One of the most overlooked parts of daily financial commentary is a key component to beating the market: dividends.

Letting your stocks pay you back

Even including two of the best bull markets of our lifetime, nearly half of the S&P 500’s total return over the past 25 years has been the payment of dividends. Day by day, week by week, this takes a little bit of value out of the market cap of a company or the value of an index and puts it into investors’ pockets. What most people don’t realize is that the point change quoted on the news every night doesn’t include dividends, and over time they really do matter.

The chart below shows just how big a role dividends play in long-term profits for investors. If we included dividends, we would have been discussing the market’s record highs last year instead of this spring.

On a business basis, the effect can be even stronger. Take a look at 3M Co (NYSE:MMM)‘s stock price return since the early 1970s versus its total return.

MMM Total Return Price data by YCharts

Without dividends, an investment in this conglomerate at that time would yield 10.7 times your money, but with dividends it’s 24.4 times your money.

Dividends can play a big role in retirement

One major advantage for retirees is that dividends often increase year after year. For retirees, that’s like getting an annual raise.

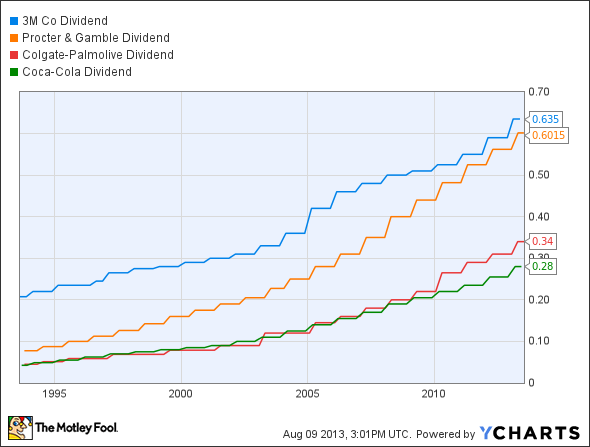

Look at the table below with dividends from 3M Co (NYSE:MMM), The Procter & Gamble Company (NYSE:PG), Colgate-Palmolive, and The Coca-Cola Company (NYSE:KO). These are all rock-solid companies with diverse businesses, and they’ve all increased their dividend payments to investors for over 50 years.

MMM Dividend data by YCharts

If you start with a portfolio of dividend stocks that generate a livable income, odds are you can make more and more each year during retirement. Not a bad way to grow income if you ask me.

Foolish bottom line

Dividends play a big part in long-term investment success. In retirement they can play an even more important role, providing a growing income source after you’re done with the day-to-day grind of work life. It’s a great way corporate America can pay you back for saving all of these years.

The article The Huge Role Dividends Play in Your Retirement Plans originally appeared on Fool.com and is written by Travis Hoium.

Fool contributor Travis Hoium has no position in any stocks mentioned. The Motley Fool recommends 3M, Coca-Cola, and Procter & Gamble.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.