Danny Eggerichs: Got it. All right. Thanks, everyone.

Jeffrey Graves: Thanks.

Operator: The next question is coming from Shannon Cross from Credit Suisse. Your line is now live.

Shannon Cross: Thank you very much for taking my question and good morning. I wanted to ask a bit on the COGS — or actually cost side. Your restructuring program is really targeting OpEx. I’m curious about COGS. And — then, I had a, I don’t know, more of a meta-question, I guess, in terms of the biotech opportunity that you have. Could you maybe think about — I mean, you mentioned the lung has the potential to be through — I guess, into maybe human trials in five years. How should we think about the business model morphing over the next few years? I don’t want specifics, but maybe if you can talk in generalities about what kind of revenue growth projections there might be or how to think about comparable margin profiles, just because you really have sort of few separate businesses, and I think it would be really helpful for people to frame what they’re investing in. Thank you.

Jeffrey Graves: Yes. So let me — it’s — on the latter question, there’ll be a lot more that becomes public over the next two years in terms of our projections, because we have to be able to give some estimate on getting through the FDA and when — what the uptick in volumes will be. I’ll come back to that part of your question, Shannon, in just a second. But on the first one in terms of COGS and OpEx, obviously, we thought it was important this year that we really drive cost out of the business, so we drive efficiencies, there would be positive EBITDA performance and positive free cash flow. It’s important. It’s more than symbolic. It’s — because, obviously, we have a big balance sheet. So we’re fine from a stability standpoint.

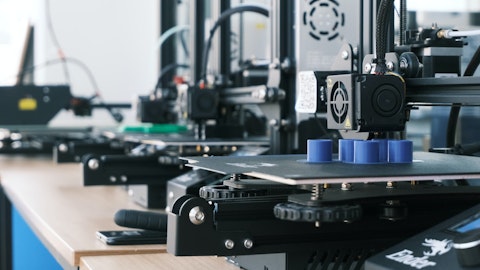

But it’s important that we show, you can make money in this business and yet still invest for long-term growth. So that was our objective. We — because we’ve insourced part of manufacturing now, that’s about 40% of our polymer platforms. We have a really nice opportunity on COGS and the supply chain is getting a little bit better. So — and as we launch new products, we’re targeting components that are more widely available, things that we can really get some better pricing on from a purchase standpoint. So we’re working COGS really hard. We’re also still working pricing very hard. So we — I know, I wish gross margins were rising faster than they are, but there in upward trend. We’re going to continue that, which is reflected in pricing and COGS.

In terms of OpEx, honestly, Shannon, we could generate a lot higher EBITDA in the short term, if all we cared about was 2023, okay? We’re spending money on refreshing our traditional platforms, because as it’s moving into factories and they want fast productive, cost-effective machinery. So we’ve got a ways to go on that. The SLA 750 is a marvelous example and this new version of our 2500 as a jetting platform, great examples. We’ve got several more to go, and you’ll hear about more of those in 2023. Those are factory grade machinery that will be good in production. We feel it’s important to complete that build-out and refresh of our product line, which will largely happen in 2023. And then on the side, we’ve got this remarkable effort in regenerative medicine.