Danny Eggerichs: Yeah. Thanks. This is Danny Eggerichs on for Greg today. Hoping to dig a little bit more into dental here right off of that. Obviously, big year-over-year decrease expected here. I mean, is there anything that could make you more bullish something that could go right in this upcoming year, whether it’s on the systems side or the consumable side where maybe there’s that 35% is kind of a base case and there’s potential upside to that, or you just don’t have really good visibility to that?

Jeffrey Graves: Yeah. It’s a great question. It’s great to hear from everybody in the cold climate, first thing in the morning. No, it’s a great question. So we have a very intimate relationship with the leader in orthodontics today. And I think, if you look at what they state publicly in terms of their business now kind of bottoming, my interpretation, business bottoming and they’re looking at €“ I think €“ my guess is, that’s a culmination of many factors. You’ve got wars going on and inflation, but things seem to be kind of stabilizing. So I would agree. I mean, just as a consumer, I would agree that, that outlook is probably reasonable. And when you factor in the supply chain burn down of inventory that they want to accomplish with us that result’s in our revenue stream.

Is there upside on that? Certainly, I mean it’s I hope everybody looks in the mirror and says their teeth need to be straightened, right, that would be great. If there was increased demand that it would flow through to us very nicely and particularly probably the second half of the year, as inventories are brought in line. But it is really that simple. How much money will people be willing to spend on straightening their teeth, doing that correction because that’s really the driver in the market? And that I think we’ve been very reasonable in our projection right now. So there could always be a downturn in the economy again and things could soften. Inflation, I am hoping it comes under control and people have the money to spend on optional items like that.

But it is really important in people’s lives, and we’re really well positioned, if there is some upside there in demand. But I think we’ve been prudent in our projections right now.

Danny Eggerichs: Got it. And then I guess industrial and non-dental health care, I think that mid-teens growth was better than a lot of us were expecting. Are those €“ you think growing at similar rates, or is one outgrowing the other? And how has that changed in recent months?

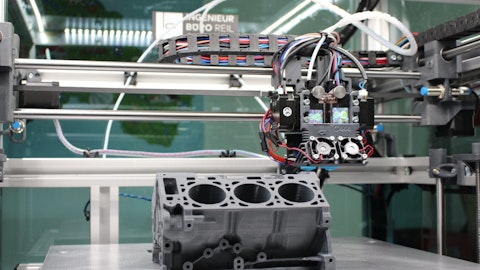

Jeffrey Graves: Yeah. Net debt is probably similar rates. I would tell you that, the non-dental half of our health care business, the orthopedics and point-of-care work, that’s fabulous. And I think we’ve gotten the technology to a point now of a broad acceptance and the costs are coming down fairly rapidly, so that orthopedic repairs to the human body are becoming the €“ as I said in the prepared remarks, better faster and cheaper. So you can now have better patient outcomes, faster turnaround times, less hospital time and all the ancillary benefits from that, you can do it at a lower cost and provide a better technology solution. And I think it’s €“ we’re really hitting our stride in orthopedic acceptance. And we work closely with the FDA on approvals of each procedure, and you got to work through that.