So, it’s not enough to have cash on the balance sheet. We got to be adding to that cash. And yes, we still have to be investing significantly for long-term growth because truly the number of applications and production is just exploding. And not only Healthcare, but Industrial applications. So, — now not all of them can you make money at. So, you got to be careful there. But we try to pick it use carefully. So, what you see us giving in guidance is kind of the net result of that is we feel it’s really important that we’re committed to positive EBITDA and positive free cash flow this year. And we have cumulated a lot of inventory last year with the insourcing. So, we’ve got a lot of upside in terms of working capital reductions. We’ve got — we’re being prudent in our efficiency for us to make sure we deliver on those.

And then we’re spending as much as we can still on the growth initiatives, so that we end up with our results. So, — and Regenerative Medicine is taking a meaningful piece of it. But when the returns on that investment become public, I think everyone in retrospect to look back and say, they were great investments. So, we’re kind of pleased with the balance. It was a real challenge this year, particularly because of the weakness in dental is how fast will that come back. So, I think we feel very comfortable with our topline expectations at this point, and we’ll update you if we change. We’re focusing heavily on cost wherever we possibly can and we’re funding key initiatives that we think have real value in the next few years. Michael, do you want to add any more to that in terms–

Michael Turner: No, I think you covered. But yes, Troy, so the — that kind of covers it. Any questions because that’s a really thoughtful question and it’s a subjective answer. I just feel this year, it’s important to show our customers and our shareholders that we’re positive in EBITDA and that we’re going to be positive with free cash flow. And even though we’ve got a great balance sheet, we want to make sure that stays really strong.

Troy Jensen: Perfect answer. One quick question. I’ll just go out there and see the floor, but touch on Industrial, I thought the fact that your guidance for these guys to grow 15% this year, in what could be a recessionary year is to be pretty healthy, right? So, just a thought on that, Jeff, and then I’ll leave in case–

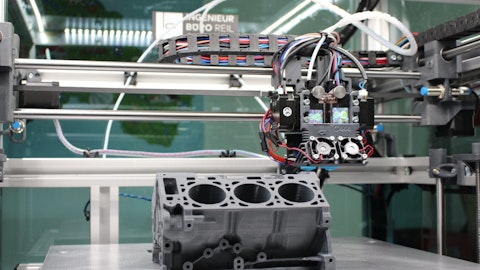

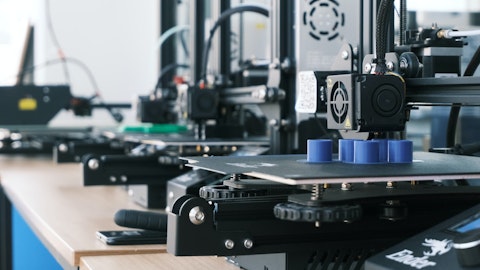

Jeffrey Graves: Yes. Troy, it’s reflective of true production applications starting to really grow. And I — it’s — we were modeling it mid-teens this year. And I think that’s going to be early days when you look over the next few years because there’s so many folks moving it into factories and factory managers are very conservative people — new companies are, but factory management particularly are promoted because they’re conservative generally, and even they’re adopting it and moving it into the floor. And be it at a moderate pace, but it’s remarkable a number of new applications that are coming on the screen every day in both polymers and metals. And customers like dealing with us because we have both and we can support them in the world wherever their needs are. So, I’m really bullish. I looked at that number to and said, well, can we deliver that? And based on our customer back analysis, Troy, it’s very doable, I believe.

Troy Jensen: Awesome. Awesome guys. Well, good luck this year and, yeah, thanks for all the time.

Jeffrey Graves: Thanks, Troy.

Michael Turner: Thanks, Troy. Stay warm.

Operator: Thank you. Your next question is coming from Greg Palm from Craig-Hallum. Your line is now live.