3D Systems Corporation (NYSE:DDD) Q4 2022 Earnings Call Transcript March 1, 2023

Operator: Hello, and welcome to the 3D Systems Fourth Quarter and Full Year 2022 Conference Call and Webcast. A question-and-answer session will follow the formal presentation. As a reminder, this conference is being recorded. It’s now my pleasure to turn the call over to your host, Russell Johnson, Vice President, Treasury and Investor Relations. Please, go ahead.

Russell Johnson: Good morning, and welcome to 3D Systems’ fourth quarter 2022 conference call. With me on today’s call are Dr. Jeffrey Graves, President and Chief Executive Officer; Michael Turner, Executive Vice President and Chief Financial Officer; and Andrew Johnson, Executive Vice President and Chief Legal Officer. The webcast portion of this call contains a slide presentation that we will refer to during the call. Those following along on the phone who wish to access the slide portion of this presentation may do so on the Investor Relations section of our website. For those who have access to streaming portion of the webcast, please be aware that there may be a few seconds delay and that you will not be able to post questions via the web.

The following discussions and responses to your questions reflect management views as of today only and will include forward-looking statements as described on this slide. Actual results may differ materially. Additional information about factors that could potentially impact our financial results is included in last night’s press release and our filings with the SEC, including our most recent Annual Report on Form 10-K and quarterly reports on Form 10-Q. During this call, we will discuss certain non-GAAP financial measures. In our press release and slides accompanying this webcast, which are both available on our Investor Relations website, you will find additional disclosures regarding these non-GAAP measures, including reconciliations of these measures with comparable GAAP measures.

Finally, unless otherwise stated, all comparisons in this call will be against our results for the comparable period of 2021. With that, I’ll turn the call over to our CEO, Jeff Graves, for opening remarks.

Jeffrey Graves: Thank you, Russell, and good morning, everyone. I’ll begin this morning with some comments on 3D Systems’ performance and achievements during 2022, and then I’ll share my thoughts on the company’s outlook for 2023 and what we’ll be focusing on in the year ahead. After that, I’ll hand the call over to our CFO, Michael Turner, for a more detailed discussion of fourth quarter and full year 2022 financial results as well as our guidance for 2023. So with that, let me turn to slide five and start with a quick recap of last year. I’ll say upfront that while we came in short of our original financial goals set at the beginning of the year, I’m very proud of what our company ultimately achieved, particularly given the headwinds that we encountered during the year, a few of which were common to many companies and one of which was unique to ours.

It’s important that we be as clear as possible about these factors, as they directly relate to our view of the year ahead and actions we’re taking in response to them. First, while COVID driven supply chain issues were nagging problems throughout the year, they were no worse than what we had anticipated and they continued to improve throughout the year as expected. Much more impactful, however, was the rapid rise in inflation, which reduced consumer demand for a variety of elective medical procedures. At 3D Systems, we felt this most acutely as a significant slowdown in our dental orthodontic business, which declined significantly as consumers shifted their spending to more basic necessities such as groceries, clothing and energy for their homes and cars.

This inflation also manifested itself in higher labor and material costs in our products, which created challenges in gross profit margins as our pricing opportunities at times lagged the cost trends. Second, economic uncertainty and recession fears at some of our customers, particularly in the industrial manufacturing space to become more cautious and defer new investments in equipment and inventory. Third, while the COVID situation improved in the United States, economic activity in parts of Asia continue to be disrupted by factory shutdowns and restrictions on daily life. And finally, the tragic war in Ukraine not only led us to halt sales into Russia, but also dampened demand for key European markets in general. Baking into these factors, we updated our external financial guidance and took a number of concrete steps to control costs and drive near-term operational efficiencies.

I want to commend to our entire global 3D Systems team for staying nimble and working hard to manage, you will prove to be a very challenging year. Thanks to their efforts. We had a solid second half of 2022, delivering well on our key customer commitments. One of the most important things to emphasize with regard to 2022 was that it proved to be an extraordinarily productive and strategic year for our company when you consider the foundation we put in place for our company’s future. Last year, we made it clear that 2022 would be an investment year for 3D Systems. And indeed, we invested during the year in a number of key areas, refreshing our product portfolio, continuing to build a world-class regenerative medicine business and improving our corporate and regulatory infrastructure such that it can be leveraged to support future growth.

I’m pleased to say that we’re already harvesting the benefits of some of these investments in the form of important new technologies, new customers and new sources of revenue. Capitalizing on these early wins will be a key focus for us in 2023, and I’ll speak more about that in a moment. It’s also important to note that we invested heavily during 2022 in the highly attractive emerging businesses, such as regenerative medicine. While these efforts are largely pre-commercial today, their future impact will become increasingly apparent over the next two years. And while this investment spending impacted our 2022 results, I’m committed to stay the course in 2023 and beyond, prudently balancing these expenses with efficiency initiatives that are needed in order to assure customers of our ability to support their growth needs over the long-term.

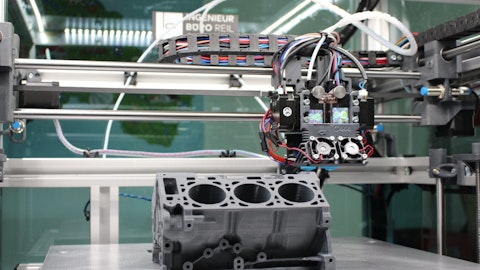

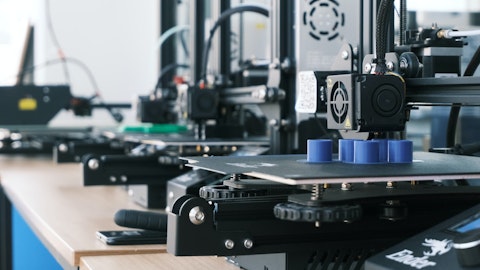

These investments are absolutely the right strategic decision for 3D Systems, given the continued acceleration of additive manufacturing and production environments and the opening of entirely new markets as the cost of adoption continue to fall. We’re at the forefront of this dynamic and well positioned to deliver the value of promises for all of our stakeholders. Moving to Slide 6. During 2022, a crucially important investment focus for us was updating and expanding our industry-leading product portfolio, including hardware, materials and software. In particular, our hardware teams undertook a comprehensive effort to refresh our most critical printer platforms and they’ve already achieved several important milestones on this front. Last year, we launched the SLA 750 and SLA 750 Dual, our fastest-ever stereolithography printer that’s ideal for large format, high-volume polymer applications.

This all-new platform is the largest, fastest and most precise SLA printer on the market, and has enjoyed an enthusiastic reception from our industrial, aerospace and automotive customers. Just last week, we announced the BWT Alpine F1 team has purchased four of our new SLA 750 printing systems after having extensively tested the product during its beta phase. The Alpine F1 team is currently producing 25,000 additively manufactured parts per year using 3D Systems equipment and materials. The team will use our SLA 750 to accelerate their bills of complex aerodynamic parts, for wind tunnel testing as well as small composite tools and high-temperature bonding jigs. The SLA 750 evolution is a perfect illustration of the strategic capability we’re building at 3D systems, the ability to drive growth, through rapid innovation by accelerating new products from the design lab to the customer market.

And two weeks ago, we introduced a major upgrade to our industry-leading jetting printer, the MJP 2500W Plus, which is ideally suited for jewelry and other small precision casting applications. This upgraded platform is specifically designed to produce complex, high-quality pure wax 3D printed jewelry patterns with new levels of speed and precision. It was developed in close collaboration with end users and responded directly to the needs of our customers operating in mass customization production environments. As I noted earlier, a key focus for 2023 will be to harvest the near-term benefits of these technology investments. The SLA 750 and refreshed MJP 2500 are two early examples of the investments we’re making in rapid customer-focused innovation.

We’ll accelerate the cycle of performance upgrades during 2023 with a number of new platforms scheduled for launch throughout the year. Now moving to slide seven. In addition to these organic investments, in our legacy print platforms, in 2022, we further accelerated the expansion of our hardware offerings by acquiring three early-stage production printing platforms, Titan, Kumovis and DP Polar, each of which offer unique advantages in specific markets. We’re very optimistic about the potential for each of these new systems. While still in the early stages of launch, we’re already seeing exciting signs of what these revolutionary technologies can accomplish. Let me take a minute to share one example with you. Just last week, we witnessed the achievement of a major milestone for our Healthcare Solutions Group, when a surgical team at Austria’s University Hospital in Salzburg, executed the first clinical implantation of a 3D printed cranial plate manufactured from medical-grade PEEK polymeric materials using a Kumovis printer.

This printer was specifically developed for precision printing of medical grade high-performance polymers, such as Polyetheretherketone or PEEK. Using Kumovis printer installed at the point of care inside the hospital, the surgical team customized and printed a cranial implant to precisely match the patient’s specific anatomical profile and related physiological needs. In this incident, it was critically important to not only create a suitable scale plate for protection of the brain. But given the size of the replacement section needed to also lightweight the unusually large cranial plate by 3D printing with a porous honeycomb internal structure, an outcome that would have been impossible using traditional manufacturing techniques. This type of personalized patient-specific point-of-care implant application, which takes advantage of the performance and biocompatible properties on PEEK material, is exactly why we acquired Kumovis and are integrating their platform into our overall portfolio.

As this technology now comes online, we’re uniquely positioned to provide surgeons a full spectrum of printed solution options ranging from titanium and cobalt chrome for joint and bone replacement to advance medical-grade polymeric for spinal, cranial and other targeted orthopedic applications, each of which is customized to precisely match the patient needs using the digital tools and processes that we’ve pioneered over the last decade in our health care business. These solutions provide better, faster and lower cost outcomes to patients in a rapidly growing range of orthopedic applications, which will drive sustained long-term growth in our existing health care business. When combined with our Oqton software platform, which is now in process, the ability to standardize and automate orthopedic workflows will further accelerate the application of this technology for patients around the world.

I’m proud to say we’re the leader in this market, and we’re making the key investments required to remain so. As we move forward with these and other investments in our product portfolio, our goal is clear. 3D Systems will continue to offer the most complete innovative lineup of 3D Print solutions in the industry and we’ll remain the partner of choice for customers wishing to unlock the vast potential of true serial scale additive manufacturing. Moving now to Slide 8. Another strategically important area of investment focus during 2022 was regenerative medicine. As I’ve shared with you previously, I believe that regenerative medicine is the next frontier for additive manufacturing. Moreover, I’m convinced that 3D Systems is uniquely positioned to lead this emerging growth industry.

We combine a set of attributes that no other company can claim, including a 30-year-plus track record of developing high-resolution 3D printing applications, deep propensity in material science, a strong foundation of quality and regulatory expertise to draw upon and hands-on experience in human tissue engineering, gained through both strategic acquisitions and through our multiyear organ partnership with United Therapeutics. Over the last 12 months, our regenerative medicine program has achieved remarkable milestones that offer a preview into the extraordinary growth potential of this emerging business. In 2023 systems in our long-time biotech development partner, United Therapeutics, publicly unveiled a 3D printed lung scaffold that represents the most complex 3D printed object ever manufactured.

This extraordinary engineering achievement has already demonstrated functional gas exchange in animal models. Based upon progress made last year, we believe that our 3D printed lungs could enter human transplantation trials within five years, a significantly accelerated time frame to what we just envisioned back in 2021. Also in 2022, we announced the formation of Systemic Bio, a wholly owned startup company with leveraging our expertise in vascularized tissue printing to develop and manufacture a unique organ-on-a-chip technology called HVIOS for use in drug discovery and development by the pharmaceutical industry. I want to remind everyone that Systemic Bio will not be a traditional vendor of 3D printers and materials instead Systemic Bio will partner directly with major pharmaceutical companies to jointly develop HVIOS chips tailored to a specific organ and disease functions, when marketers ships directly to pharmaceutical and biotech companies engaged in drug discovery.

I’m sure you can all appreciate the substantial increase to our company’s baseline profitability that we would drive by becoming a major supplier of customized high-value biotech products for the pharmaceutical industry as well as the re-rating of our company’s valuation multiple that could result from this change. As we speak, our Systemic Bio team is actively engaged in commercial discussions with potential partners and customers. I look forward to having more news to share with you on this front in the near future. And just two weeks ago, we announced we had another milestone, a new regenerative tissue program that’s a direct outcome of the success we’ve achieved in 3D printing human organs scaffolds. This internal research and development effort is combining bioprinting technology, biocompatible 3D printing materials and patient-derived cells to manufacture vascularized hydrogel scaffolds, the mimic a patient’s anatomy and physiology and can deliver improved outcomes in a variety of surgical applications.

The first 3D printed product that we have under development is regenerative breast tissue. This breakthrough application could offer dramatically improved implant-based reconstruction option for millions of women diagnosed with cancer each year. It could also open up a significant new market opportunity to 3D Systems is uniquely positioned to address. A key point regarding our ongoing investment initiatives is we’re only pursuing R&D programs and new additions to our product portfolio that we believe offer attractive returns and are consistent with our company’s mission to provide application-focused solutions to high-value, high-growth industrial, and health care markets. Given its strategic importance, we maintained our heavy investment focus during 2022 despite macroeconomic and geopolitical headwinds as well as greater-than-expected softness in our key orthodontic market.

Doing so requires us to target our investment spending very carefully, control our operating costs, and utilize our strong balance sheet. I remain convinced that the programs we supported during 2012 and will continue to fund in 2023 are building a solid foundation for future growth and profitability that we’ll be able to leverage for many years to come. Moving now to slide nine. I’d like to highlight several recent internal activities that have already provided us with important performance benefits, and we’ll continue to do so as we move through 2023. Last year, we achieved meaningful success in better aligning our manufacturing and supply chain operations with our company’s operating profile and emerging product portfolio. During the second half of 2022, we completed a major step in this process by in-sourcing a significant amount of our polymer printing platforms into our South Carolina manufacturing operations.

This transition required us to incur some one-time costs as well as to take inventory onto our books ahead of need, which in part explains our elevated inventory levels at the end of the year. The change has already improved our gross margins and positively impacted delivery reliability and product quality for our customers. In 2023, as we accelerate the pace of new product releases that track to our financial performance targets, you have my commitment that we will be laser-focused on driving operational excellence and cost efficiency. Yesterday, we announced an important step in this process, a restructuring initiative that will improve our 2023 profit profile by better aligning our European engineering and manufacturing operations for our three metals platforms, streamlining our software organization, which is now consolidated under often and focusing our product portfolio on platforms that bring the highest long-term value to the market.

These actions, which is the culmination of integration activities and optimization planning conducted throughout 2022 will allow us to achieve significant cost synergies in 2023 and beyond, as Michael will detail later for you. Beyond these discrete measures to maximize efficiency, during the fourth quarter of 2022, we laid groundwork for further operational improvements by undertaking a major reorganization of our operations and engineering functions. We’ve now aligned all 3D Systems engineering, design, product management, procurement, manufacturing and logistics and are a single member of my executive team, Dr. Joe Zuiker, who recently joined the company to take on this new role. Under Joe’s leadership, our operations and engineering teams will work together to drive an organization-wide focus on operational excellence.

Photo by Mahrous Houses on Unsplash

Their primary mission will be to ensure a seamless progression from product design to full-scale manufacturing for every element in our portfolio. Before handing the call over to Michael, I’d like to provide my broad perspective on our outlook for 2023. In our new full year guidance, which Michael will present to you shortly, we’re prudently assuming that the dental market slowdown that we experienced in the second half of 2022 will persist throughout 2023. Outside of Dental, we see considerable strength in virtually all other markets across our Healthcare and Industrial Solutions segments. Putting this all together, we expect to achieve consolidated revenue growth for 2023 in the mid-single digits, supported by growth rates in the mid-teens for our non-dental markets.

This growth profile plus the operational cost efficiencies that will drive throughout 2023 should allow us to generate positive adjusted EBITDA and free cash flow for the full year, excluding any one-time restructuring costs that we may incur. I want to emphasize that our 2023 guidance fully reflects continued investments in growth areas of our business, including new product development, R&D and creating a world-class regenerative medicine business. All of which are critically important activities designed to support future growth. As we enter the New Year, I’ve never been more excited and confident in our company’s leadership position in the 3D printing industry, particularly given the technology, application expertise and operational foundation we’ve worked so hard to put in place over these last few years.

In 2023, we’re committed to drive financial results in line with our leadership position. Finally, before concluding my remarks, I’d like to note one additional topic. Earlier this week, the US Department of State, Justice and Commerce announced that these agencies have settled their open investigation with 3D Systems into alleged export control violations by 3D Systems that previously took place between 2012 and 2019. We disclosed this matter in our SEC filings for some time now. Under the settlement, 3D Systems will be subject to civil monetary penalties as well as certain remedial compliance measures as a part of our three-year consent agreement. The company is pleased to have reached a settlement with the agency, remains committed to continuing to enhance its export controls program.

Looking forward, I’m very proud of the compliance culture, processes and infrastructure that we’ve now established with 3D Systems and that we’ll continue building upon. We are fully committed to not only meeting all required standards, but being a true leader in what is an essential element of all complex global businesses today. With that, I’d like to turn the call over to Michael Turner, our CFO. Michael?

Michael Turner: Thanks, Jeff. Before I start, I’d like to remind everyone that 3D Systems made three significant divestitures in 2021. The earnings release that we issued last night contained tables with non-GAAP measures relating to our full year 2021 results, from which we exclude the impacts of these divested businesses. Likewise, on today’s call, any reference that I made to our full year 2021 results will be on the same ex-divestiture basis. The point of this adjustment is to make our 2022 results comparable to our 2021 results on an organic basis. However, it’s important to note that we completed our divestiture program during the third quarter of 2021. Therefore, any tables contained in last night’s earnings release relating to our fourth quarter 2021 results — and likewise, any reference that I made to our fourth quarter 2021 results on today’s call do not reflect any adjustments for divestitures.

Turning now to slide 11. I’ll start out with a discussion of full year 2022 results for our consolidated business. As Jeff mentioned, our business encountered a variety of external challenges during 2022 that caused our full year results to come in below what we expected at the beginning of the year. These challenges include FX headwinds, high inflation, recessionary fears and the war in Ukraine. And of course, the biggest headwind we faced during the year was that inflation and economic uncertainty reduced the demand for many elective medical procedures. As a result, we experienced an unexpected and significant decline in dental market revenue during the second half of 2022. This was particularly impactful for 3D Systems because dental sales represent a large percentage of our total business.

However, after making a midyear adjustment to our 2022 revenue guidance to reflect the above factors, we were able to finish out the year by coming in quite close to our revised revenue expectations. Revenue for 2022 was $538 million, a decrease of 12.6% as compared to 2021. Excluding divestitures and the unfavorable impacts of FX, revenue increased by 3.3% compared to the prior year. This top line growth, despite a very challenging operating environment, reflects continued solid demand in most of the end markets served by our Industrial and Healthcare Solutions segments. As previously noted, partially offsetting this growth was our exit from the Russia market in early 2022, as well as weakness in dental market revenues, predominantly in orthodontics, which declined by roughly 10% year-over-year.

Adjusting for these items, our net sales increased by lower double digits year-over-year in 2020. Moving now to quarterly revenue results, which, as noted previously, no longer reflect the impacts of 2021 divestitures on a consolidated basis, firmly for the fourth quarter of 2022, decreased by 12% to $132.7 million compared to the same period in the prior year. Excluding unfavorable impacts of FX, consolidated revenues decreased by 7.6%. The decline in revenue primarily reflects sharply lower fourth quarter dental market sales, partially offset by continued solid product and service demand across other areas of the business. Turning now to slide 12 for a review of segment revenues. For our Healthcare Solutions segment, full year 2022 revenue, excluding divestitures and the unfavorable impacts of FX, decreased 2.9% as compared to 2021 due to a decline in our dental market of approximately 10% started in mid-2022.

Outside of dental, we saw healthy growth during 2022 and some of the other major business lines within our Healthcare Solutions segment, including strong sales to customers that 3D print various types of medical devices, such as orthopedic implants and surgical guides. Additionally, our sales of virtual surgical planning and point-of-care solutions to doctors, surgeons and hospitals grew in the fourth quarter. These two areas of our healthcare business often involve medical procedures that are less elective in nature, and therefore, have been proven resilient even in times of economic uncertainty. For our Industrial Solutions segment, full year 2022 revenue, excluding divestitures and the unfavorable impacts of FX, increased by 9.7% as compared to 2021, driven by continued strength in precision microcasting applications and demand for production machines in energy and commercial space applications.

Moving now to quarterly segment results. For our Healthcare Solutions segment, fourth quarter revenue, excluding unfavorable FX impacts, declined 16.6% year-over-year due primarily to dental market headwinds, partially offset by continued strength in medical devices. For our Industrial Solutions segment, fourth quarter revenue, excluding unfavorable FX impacts, increased 1.1%. Revenue during the quarter benefited from continued strength in precision microcasting applications for jewelry customers, as well as growth in semiconductors and electronics, partially offset by relatively weaker sales to aerospace and motorsports customers, as compared to a very strong fourth quarter in the prior year for both of those end markets. Moving now to gross profit on slide 13.

Gross profit margin for the full year 2022 was 39.8% compared to 42.5% in the prior year. The decrease in margins was due to multiple factors, including 2021 divestitures of non-core assets, inflationary impacts on input costs, freight and unfavorable changes in product mix due to selling more printers and less materials in 2022 than the prior year. This year-over-year mix shift impact was particularly impactful in our key dental market vertical. For the fourth quarter of 2022, gross profit margin was 40.9% and compared to 44.1% for the same quarter last year. The factors driving the year-over-year decline in margin are largely the same as for the full year. For while our margins are down in 2022 versus 2021, we achieved sequential margin improvement in the fourth quarter with a 100 basis point increase from Q3 levels, which followed a similar increase from Q2 to Q3.

We have been able to improve margins despite challenging macroeconomic environment. through a combination of price actions and increased focus on operational excellence, which includes the benefit of bringing some of our outsourced printer production back in-house during the second half of 2022. Turning now to operating expenses on Slide 14. Operating expenses for the year — for the full year 2022 increased 11.6% to $331.3 million compared to the prior year. The higher operating expenses include spending in targeted areas to support future growth, including the expenses from acquired businesses, research and development and investments in personnel and corporate infrastructure partially offset by the assets of expenses from divested businesses.

The higher expense also includes $17.2 million in accrued expenses for legal and other settlement costs that were largely related to the export control investigation, as Jeff mentioned, just a moment ago, we have now settled with the US catering. On a non-GAAP basis, which excludes non-recurring charges and divestitures, full year 2022 operating expenses were $241.1 million, a 22.1% increase from the prior year, which primarily reflects spending to support future growth. For the fourth quarter, operating expenses increased 18% to $82.7, million compared to the same period of prior year ago. On a non-GAAP basis, fourth quarter operating expenses were $64.1 million, an 18.2% increase from the same period a year ago. The increase in non-GAAP operating expenses primarily reflects spending to support future growth, including the expenses from acquired businesses, research and development and investments in personnel and corporate infrastructure.

Moving now to Slide 15. Adjusted EBITDA, which is defined as non-GAAP operating profit plus depreciation was negative $5.8 million for the full year 2022, compared to $56.2 million for 2021. For the fourth quarter of 2022, adjusted EBITDA was negative $4.8 million, compared to $17.9 million for the same period last year. The decline in adjusted EBITDA reflects all the factors that we’ve previously discussed. One point I’d like to remind everyone of as I did on our third quarter call, 3D Systems profitability during 2022 was significantly impacted by a variety of growth investments, which includes SG&A and R&D expenses from businesses that we’ve acquired over the last 1.5 years, including Oqton, Titan, Kumovis and most recently dp polar. It also includes investments we’re making to build our regenerative medicine business, which is still largely in a pre-commercial stage.

We invested on this front in 2022 and will increase our level of investment in 2023. These acquisitions and other investments in emerging businesses are highly strategic to 3D Systems, and we expect them to contribute significantly to our revenue growth over the coming years. However, for the time being, these businesses in aggregate have yet to generate meaningful revenue for us. As such, you should expect our adjusted EBITDA to run below our natural potential for a period of time due to the near-term expense impact of recent acquisitions and investments in pre-commercial businesses. Although, as I will discuss in a moment, we are forecasting a return to breakeven or better adjusted EBITDA in 2023 after a negative year in 2022. And for EPS, full year 2022, we had fully diluted loss per share of $0.96 compared to income per share of $2.55 for 2021 excluding charges for stock-based compensation and other non-recurring items as detailed in the appendix of the earnings release.

Our 2022 non-GAAP loss per share was $0.43 compared to non-GAAP earnings per share of $0.33 in 2021. For the fourth quarter of 2020, we had a fully diluted loss per share of $0.20 as compared to a loss per share of $0.05 in the prior year quarter. On a non-GAAP basis, we had a loss per share of $0.06 in the fourth quarter of 2022 versus $0.09 earnings per share in the prior year quarter. The year-over-year EPS decline reflects all the factors we’ve previously discussed. Now turning to Slide 16 for balance sheet highlights. We ended the quarter with $568.7 million of cash and short-term investments on hand. Our cash and short-term investments declined approximately $220.9 million since the end of 2021, driven primarily by $104.3 million paid for acquisitions and equity investments, cash used in operations of $16.4 million, capital expenditures of $22.5 million and cash used for financing activities of $13.8 million.

We continue to have a strong balance sheet with a sufficient cash to support organic growth and our investments in our pre-commercial businesses. I’ll conclude my remarks on Slide 17 with a discussion of our full year 2023 guidance. We expect revenue to be in the range of $545 million to $575 million. We expect non-GAAP gross profit margin to be in the range of 40% to 42%, and we expect both adjusted EBITDA and free cash flow to be breakeven or better. I want to highlight several points related to this new guidance. First, we are not providing 2023 guidance for non-GAAP operating expenses as we did for 2022. However, we have added 2023 guidance for both adjusted EBITDA and free cash flow. We made this change because we believe that these two metrics, one which addresses profitability and the other, which addresses cash generation are most consistent with how investors will evaluate our overall performance going forward.

Given that we are now guiding to new metrics, I want to make sure that we have a common understanding on definitions. For purposes of this guidance, I define free cash flow as adjusted EBITDA plus changes in trade working capital, less capital expenditures. Also €“ both adjusted EBITDA and free cash flow are meant to exclude any restructuring and/or one-time charges that we may incur during 2023. And lastly, I want to note that our 2023 guidance fully incorporates two known headwinds. It includes increased operating expenses associated with our continued investment in our pre-commercial regenerative medicine business, which we expect to be approximately $9 million higher than in 2022. And it also assumes that our dental orthodontic demand will be down roughly 35% versus 2022, primarily driven by customer supply chain, inventory reduction initiatives.

Offsetting these headwinds are the favorable impacts of the restructuring that Jeff spoke to you earlier and strong growth in our core non-dental markets. The key takeaway here is our guidance for 2023, anticipates breakeven to positive adjusted EBITDA and free cash flow after fully incorporating these own headwinds, which demonstrates that the fundamentals of our core business are sufficiently robust to drive solid overall performance for the company. Finally, although we are not providing quarterly guidance for 2023, I want to make a comment about seasonality. In the past, it’s been difficult for 3D Systems to begin each year with a relatively weaker first quarter and then go through a somewhat higher second and third quarter and then end the year with a strong Q4, as customers stops their annual budgets and stock up on inventories for the coming year.

2022 do not follow the same pattern, leads to the decline in our dental markets in the second half of the year, as well as other macroeconomic challenges. Based on the current forecast upon which our 2023 guidance is based, we are expecting to return to normal seasonal trends, as I just described, which should result in a quarterly split of revenue similar to what we experienced in 2021. That concludes my remarks. Operator, we are now ready to open the line for questions.

See also Top 10 Drug Companies in USA and 12 Most Promising Growth Stocks To Buy.

Q&A Session

Follow 3D Systems Corp (NYSE:DDD)

Follow 3D Systems Corp (NYSE:DDD)

Receive real-time insider trading and news alerts

Operator: Thank you. We’ll now be conducting a question-and-answer session. Our first question today is coming from Troy Jensen from Lake Street Capital. Your line is now live.

Troy Jensen: Hey John, thanks for the time here. Congrats on results that I thought were better than feared for the most part. But quick — just for you. To start, Michael, a point of clarification. In your prepared remarks, you right at the end, did you say that health care was down 35%, or are you expecting that to be down in ’23 at that level?

Michael Turner: We expect 2023 dental — our dental markets to be down 35% year-over-year in ’23.

Troy Jensen: Okay, cool. I got you. And then just thoughts on like share loss. Is that just customer adoption stall that much, or just share is obviously an important topic for this customer. So just your thoughts on that, please?

Michael Turner: For that market, specifically, Troy,

Troy Jensen: Yes, yes, obviously, is what

Michael Turner: No, Troy, there’s no share loss. It’s strictly a correction in the supply chain at this point. But if you watch public company announcements, that the impact on that business has kind of moderated now. It’s flattened out. They’ve just got to burn off some inventory. They had built inventory pretty aggressively as they expanded their production capability and they got hit with the consumer discretionary spending drop. So, they’re just clearing inventory. So, we’ve tried to just be very realistic in the year to say, it’s going to take — this consumption rate is going to take a while for them to do well and return to normal levels, but no share loss.

Troy Jensen: Okay. Perfect. And then, Jeff, I mean, you’ve talked historically about just the importance of profitability in this industry, especially from the leaders like you guys and additive. I guess, I was hoping to get your thoughts on what the OpEx is for like bioprinting and regenerative that isn’t generating revenues here. But as Michael pointed out, there’s a lot more than just the regenerative stuff or some of the traditional additive stuff that you brought to that’s kind of pre revenue. So — just thoughts on — I think, Michael, you’re saying was a natural potential of the margin profile. I’d love to know what you think this business could be. Where is it right now if you didn’t have all these aggressive investments?

Jeffrey Graves: Well, I’ll — and it’s a discussion we have actively in , especially coming into the year to set the budget. It’s — for companies that are viewed themselves as growth-oriented companies, it takes no great brainpower to just broad-based cut costs. What we’ve tried to do in ’23 is to really look at our markets and say, what’s really going to drive meaningful shareholder value over the next few years to make sure we funded that. And then, let’s be realistic on top line revenue. And then let’s aggressively take cost out where we can. So it’s that balance of looking out for the next few years on the adoption rate of additive in key markets that are going to drive growth, really valuable growth and balancing that off — those investments off against cutting costs and making sure that we’re profitable.

So, we just put a stake in the ground this year and said, look, we can strike a nice balance, we can have EBITDA profitability, so be profitable on adjusted EBITDA, and we can generate positive free cash flow. And remember, our balance sheet, we still have well over $0.5 billion of cash on the balance sheet. But I think customers, especially right now in uncertain times, they need to see you making money. They need to see it particularly generating cash to know that you’re going to be around and be able to support them, especially we’re selling now into relatively conservative large, older line industrial companies that are adopting additive, they’re conservative in their supply chain design. So, they want to know that we’re going to be around and making money.