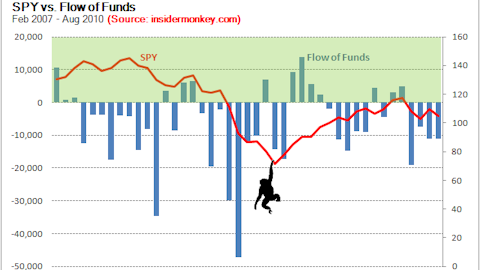

Insider Monkey published an article yesterday showing how mutual fund flows (a.k.a. dumb money) beat the index funds by more than 11% during the past 3.5 years. This is against the conventional wisdom. A recent study published at Journal of Financial Economics shows how dumb money lost an average of 1.6% per year by switching in an out of the stock market over a 25 year period. How did dumb money suddenly become so smart? Here are 3 reasons why dumb money is right this time:

1. Pure statistical results without a reasonable theoretical explanation may not always hold true. One might recall all the articles written at the end of August about the oncoming double dip recession and how September returns are going to be miserable because of the dreaded “September Effect”. Insider Monkey wrote an article disputing the September Effect. The September Effect is a statistical fluke; there is no reasonable explanation for it. Now we know that September, 2010 had the best performance since the Germans invaded Poland, when the stock market went through the roof in hopes of selling more goods to the Europeans.

Our theoretical explanation: Mutual fund investors are bipolar, swinging from one extreme to the other. When the economy is good, they think the boom is going to last forever; when we are in a recession, they think it is an epic recession. In the past 25 years, we did not really have an epic recession, so the mutual fund investors were never paid for the bets they made. But this recession was different. Bill Miller -who was the only money manager to beat the S&P 500 index for 15 years in a row- was wrong, and the average Joe was right. Dumb money essentially bought an insurance policy. It seems to us that dumb money was underperforming the market because they had been effectively paying an annual insurance premium of 1.6% to protect themselves from market crashes.

2. An analysis period of 25 years doesn’t guarantee robust results. Ten years ago, everybody was talking about how the stocks were great but that nobody could explain the equity premium puzzle. After 10 years of an amazing bond market and lackluster stock market performance, the “equity premium puzzle” is now a nonissue. Stocks have been historical winners in this country because this country has been a winner. You cannot just test your theory in this country and claim a “scientific” finding about investors, instruments, or markets. In less successful countries, like Turkey, dumb money has been investing in the bond market and beating the stock returns by an average of 5% per year for a very long time.

3. Insider Monkey assumed that we had access to September fund flow data at the beginning of October. The academic study mentioned above assumed that September data would be available at the beginning of November. If you check out the ICI announcements, you would see that on October 1st, we have data for the week ending September 22nd. It isn’t difficult to guess whether September had a positive or negative flow when you have 75% of the observations you need. There are also other paid services (Trim Tabs) that provide more current data. This means that the academic paper didn’t actually use current data. Because of that, their results paint a grim picture of dumb money’s performance. If more current data was used and the recent performance of dumb money was accounted for, we believe the real figure would be down significantly. Not 1.6%, in other words. If this analysis was repeated in a different country- where the stock market didn’t experience a boom during most of the 25 years covered by the study- then we may even see opposite results.

Warren Buffett almost lost his shirt because of his conviction that the stocks wouldn’t plummet. There are no guarantees in the stock market. If we continue to see poor economic performance and a Japanese style monetary and fiscal environment, dumb money will continue to beat the S&P 500 index.