I’ve watched Chipotle Mexican Grill, Inc. (NYSE:CMG) for several years, and actually owned the shares for a while myself. The company reported earnings about a month ago, and the stock has risen about 15% from its short-term low. What’s ironic is, the company has three problems that investors seem to be ignoring.

There Are Two Types Of Companies

In the restaurant industry, there are two types of companies in my eyes. On the one hand, you have large companies that are established on multiple continents like McDonald’s Corporation (NYSE:MCD) and Yum! Brands, Inc. (NYSE:YUM). These two companies have over 30,000 locations each, generate huge free cash flow, and are expected to get much of their growth in the future from overseas expansion. Investors buying McDonald’s get a yield of over 3.2%, and expected earnings growth of 8.7%. YUM Brands’ investors are expecting 12% earnings growth, and collect a 2% yield.

The other type of restaurant is typified by both Chipotle and Panera Bread Co (NASDAQ:PNRA). Both of these companies have established brands and are rapidly expanding. While dividends are popular, with analysts calling for 20% EPS growth at Chipotle and 19% EPS growth at Panera, you can see the lack of a dividend isn’t a huge deal.

However, as with all growth stocks, if a company can’t meet or exceed analyst expectations, the shares can take a beating. This happened with Chipotle before when the company reported “disappointing” 8% growth in comparable store sales and investors expected more. The company actually did worse in the current quarter, but the shares went up. What’s going on here?

Expectations Are Everything

Investors who believe in Chipotle would say the company has just scratched the surface of the brand’s appeal, and the new ShopHouse concept has worldwide appeal as well. They expect Chipotle to have years of fast growth ahead, and this justifies the current price.

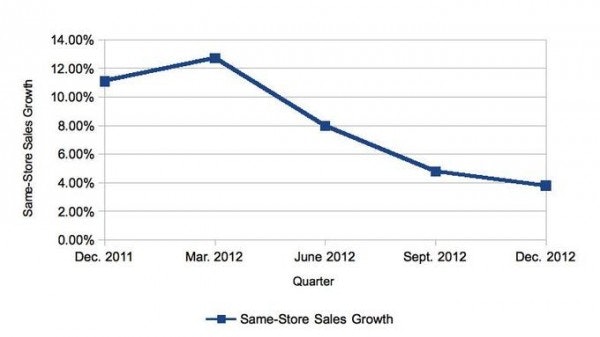

There are a few holes in this theory. First, Chipotle’s same-store sales growth seems to be in a free fall. Look at the company’s results over the last several quarters.

The problem is Chipotle pushed through a price increase last year that masked the strength of their customer traffic. Once that price increase fell off, their same-store sales growth was cut by more than half. Low single-digit same-store sales growth is expected from McDonald’s and YUM Brands. In a reversal of fortunes, Panera is now outperforming Chipotle. In the same quarter where Chipotle reported 3.8% growth, Panera reported same-store sales up 4.9%.

The second issue facing Chipotle is expectations when it comes to new store growth. For the full year 2012, Chipotle added 183 new restaurants and ended with 1,410 total locations. This level of store openings represented 14.91% new store growth. For 2013, at the most, the company expects to open 180 new stores. This means at best, the company will see 12.77% new store growth this year. This doesn’t sound like a big deal, but if the company has such a huge opportunity, why slow down new store openings?

The third issue Chipotle needs to address is their falling margins. In the current quarter, their competitor McDonald’s led most of the restaurant industry with an operating margin of 31.98%. YUM Brands performed well also, showing an 18.80% margin. Chipotle used to beat Panera on margins because of their more limited menu, and smaller staff. However, this lead has been extinguished as Panera’s operating margin of 14.5% nearly matched Chipotle’s margin of 14.6%. The fact that Chipotle’s operating margin has fallen from 16.7% at the beginning of 2012 to 14.6% shows a significant deterioration.