It has been a fantastic year for equity investors as Donald Trump pressured Federal Reserve to reduce interest rates and finalized the first leg of a trade deal with China. If you were a passive index fund investor, you had seen gains of 31% in your equity portfolio in 2019. However, if you were an active investor putting your money into hedge funds’ favorite stocks, you had seen gains of more than 41%. In this article we are going to take a look at how hedge funds feel about a stock like Carnival Corporation & Plc (NYSE:CCL) and compare its performance against hedge funds’ favorite stocks.

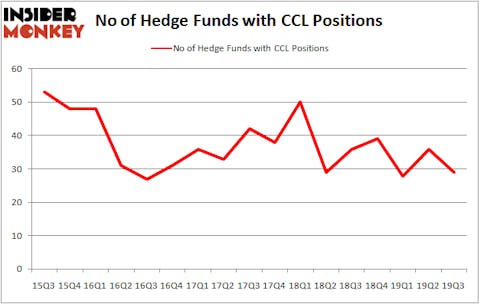

Is Carnival Corporation & Plc (NYSE:CCL) a healthy stock for your portfolio? The best stock pickers are getting less optimistic. The number of bullish hedge fund positions went down by 7 recently. Our calculations also showed that CCL isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In the 21st century investor’s toolkit there are a lot of metrics investors can use to assess their stock investments. A couple of the less known metrics are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the elite money managers can beat their index-focused peers by a superb amount (see the details here).

John Overdeck of Two Sigma Advisors

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Now we’re going to analyze the recent hedge fund action regarding Carnival Corporation & Plc (NYSE:CCL).

How have hedgies been trading Carnival Corporation & Plc (NYSE:CCL)?

At the end of the third quarter, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -19% from the previous quarter. On the other hand, there were a total of 36 hedge funds with a bullish position in CCL a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, holds the most valuable position in Carnival Corporation & Plc (NYSE:CCL). Arrowstreet Capital has a $192.4 million position in the stock, comprising 0.4% of its 13F portfolio. On Arrowstreet Capital’s heels is Two Sigma Advisors, led by John Overdeck and David Siegel, holding a $122.6 million position; 0.3% of its 13F portfolio is allocated to the company. Remaining peers that are bullish encompass Renaissance Technologies, Brian Ashford-Russell and Tim Woolley’s Polar Capital and Cliff Asness’s AQR Capital Management. In terms of the portfolio weights assigned to each position MD Sass allocated the biggest weight to Carnival Corporation & Plc (NYSE:CCL), around 1.97% of its 13F portfolio. Omega Advisors is also relatively very bullish on the stock, designating 1.6 percent of its 13F equity portfolio to CCL.

Seeing as Carnival Corporation & Plc (NYSE:CCL) has faced falling interest from the aggregate hedge fund industry, we can see that there were a few fund managers that decided to sell off their full holdings by the end of the third quarter. It’s worth mentioning that Parag Vora’s HG Vora Capital Management sold off the largest stake of the 750 funds followed by Insider Monkey, comprising close to $58.2 million in stock, and John Khoury’s Long Pond Capital was right behind this move, as the fund sold off about $25.8 million worth. These moves are important to note, as aggregate hedge fund interest was cut by 7 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Carnival Corporation & Plc (NYSE:CCL) but similarly valued. These stocks are Fortive Corporation (NYSE:FTV), Archer Daniels Midland Company (NYSE:ADM), PPL Corporation (NYSE:PPL), and United Airlines Holdings, Inc. (NASDAQ:UAL). This group of stocks’ market caps are similar to CCL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FTV | 34 | 803239 | 6 |

| ADM | 21 | 511939 | -5 |

| PPL | 24 | 516405 | 4 |

| UAL | 46 | 7090686 | -1 |

| Average | 31.25 | 2230567 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.25 hedge funds with bullish positions and the average amount invested in these stocks was $2231 million. That figure was $589 million in CCL’s case. United Airlines Holdings, Inc. (NASDAQ:UAL) is the most popular stock in this table. On the other hand Archer Daniels Midland Company (NYSE:ADM) is the least popular one with only 21 bullish hedge fund positions. Carnival Corporation & Plc (NYSE:CCL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately CCL wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); CCL investors were disappointed as the stock returned 7.4% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 65 percent of these stocks already outperformed the market in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.