It has been a fantastic year for equity investors as Donald Trump pressured Federal Reserve to reduce interest rates and finalized the first leg of a trade deal with China. If you were a passive index fund investor, you had seen gains of 31% in your equity portfolio in 2019. However, if you were an active investor putting your money into hedge funds’ favorite stocks, you had seen gains of more than 41%. In this article we are going to take a look at how hedge funds feel about a stock like International Game Technology PLC (NYSE:IGT) and compare its performance against hedge funds’ favorite stocks.

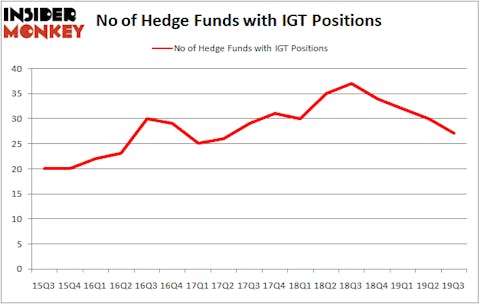

Is International Game Technology PLC (NYSE:IGT) the right investment to pursue these days? Hedge funds are selling. The number of long hedge fund bets retreated by 3 in recent months. Our calculations also showed that IGT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings). IGT was in 27 hedge funds’ portfolios at the end of the third quarter of 2019. There were 30 hedge funds in our database with IGT positions at the end of the previous quarter.

In the financial world there are several gauges shareholders use to analyze their holdings. A duo of the most underrated gauges are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the top money managers can trounce the broader indices by a superb margin (see the details here).

Paul Reeder of PAR Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Now let’s take a glance at the key hedge fund action surrounding International Game Technology PLC (NYSE:IGT).

How have hedgies been trading International Game Technology PLC (NYSE:IGT)?

Heading into the fourth quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -10% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards IGT over the last 17 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

Among these funds, Samlyn Capital held the most valuable stake in International Game Technology PLC (NYSE:IGT), which was worth $68.9 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $35.3 million worth of shares. PAR Capital Management, AQR Capital Management, and Lonestar Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Covalent Capital Partners allocated the biggest weight to International Game Technology PLC (NYSE:IGT), around 8.47% of its 13F portfolio. Lonestar Capital Management is also relatively very bullish on the stock, designating 4.71 percent of its 13F equity portfolio to IGT.

Because International Game Technology PLC (NYSE:IGT) has faced falling interest from the entirety of the hedge funds we track, it’s easy to see that there was a specific group of hedge funds that decided to sell off their entire stakes last quarter. At the top of the heap, Parag Vora’s HG Vora Capital Management said goodbye to the largest stake of the 750 funds tracked by Insider Monkey, comprising an estimated $48 million in stock. Steve Cohen’s fund, Point72 Asset Management, also dropped its stock, about $11.7 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest fell by 3 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to International Game Technology PLC (NYSE:IGT). These stocks are TC Pipelines, LP (NYSE:TCP), Advanced Disposal Services, Inc. (NYSE:ADSW), Magnolia Oil & Gas Corporation (NYSE:MGY), and BlackBerry Limited (NYSE:BB). This group of stocks’ market valuations are similar to IGT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TCP | 5 | 17286 | 0 |

| ADSW | 24 | 668160 | -2 |

| MGY | 17 | 132628 | -2 |

| BB | 28 | 401792 | 3 |

| Average | 18.5 | 304967 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.5 hedge funds with bullish positions and the average amount invested in these stocks was $305 million. That figure was $234 million in IGT’s case. BlackBerry Limited (NYSE:BB) is the most popular stock in this table. On the other hand TC Pipelines, LP (NYSE:TCP) is the least popular one with only 5 bullish hedge fund positions. International Game Technology PLC (NYSE:IGT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately IGT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on IGT were disappointed as the stock returned 8.6% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.