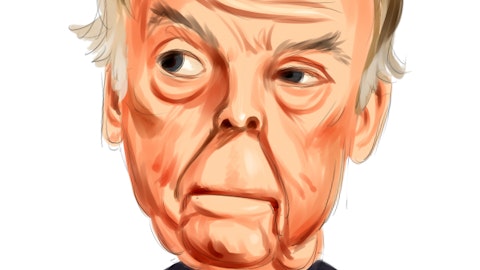

Legendary investor Jim Rogers is extremely bullish about commodities. Previously Insider Monkey, your source for free insider trading data, covered Ray Dalio’s CNBC interview. Ray Dalio was insanely bullish about emerging markets’ currencies, bonds, and equities. Dalio believes the US dollar is on its way to lose its reserve currency status and emerging countries will have to revalue their currencies to counter the dollar induced inflation. Dalio thinks gold is underowned and undervalued too. It’s clear that Ray Dalio and Jim Rogers agree on the future of commodities.

Recently Jim Rogers was on Bloomberg. He’s still extremely bullish about oil, gold, silver, and agriculture. Here is what he said:

“The world is running out of known reserves of oil. It’s a simple fact.”

“Saudi Arabia has been lying about their (oil) reserves for decades,” said Rogers. “The reason oil is going up is the world is running out of known reserves of oil.”

“In bull markets things go to prices which nobody can conceive of. I’m the bull, and I’m telling you, at one point I’m going to sellout and then they’re going double again. In the bull market in stocks, who would’ve thought that CISCO would have gone up a hundred times. It did. That’s what happens at the end of a bull market and that’s what’s going to happen at the end of the bull market in commodities. It’s still several years away.”

“Gold will go to $2000 in this decade. It’s pretty simple as far as I’m concerned.”

“Silver will certainly go over $50. The old high on silver was $50. Silver will go to new highs again. All these prices are going to go to absurd levels by the end of the decade, by the end of the bull market.”

“Huge bull market in agriculture. Agriculture prices are still extremely depressed on a historic basis. You know, the price of sugar has gone up 600% in the last 6 years, 5 years. It is still 50% below its all time high. 50% below its all time high. The scope for price increases in agriculture is staggering.”

“In a bull market I don’t want to be short or to avoid anything when a secular bull market is taking place. I will hedge myself by shorting something. I’m short emerging markets, for instance, right now. I’m short NASDAQ stocks, for instance, right now. So in the bull market you dont want to avoid. You want to own everything, even the ones you think are bad, because that’s where the great gains are, and you hedge yourself by shorting or selling something else.”

“I don’t know what’s going to happen to the world economy. I know if the economy gets better, I’m going to make money in commodities. If it doesn’t get better, I’m going to make money in commodities because they’re going to print money, print huge amounts of money. But I need a hedge and that’s why BBVA and Citic and I have come up with this new index.”

“You see what’s happening to agricultural prices. You see what’s happening to oil prices. You see what’s happening with metals prices. This has got a long way to go and that’s the major shift that’s taking place.”

“I own some dollars now because there was a big panic, a huge drop in the dollar, and I stepped in and I bought some more dollars. I do sometimes like to buy things when they collapse. Sometimes I get it right. Sometimes I don’t. Sometimes I lose money. But at the moment I own some dollars.”