The US continues to strive towards energy independence, and the Bakken shale figures prominently in that goal. Investing in the Bakken shale by no means guarantees returns. Drilling in this shale is expensive and not all exploration companies turn a profit. Below are examples of success and struggle in Bakken shale energy production and an alternative, safer investment in the Bakken play.

Revenues, earnings and capital gains, I like it

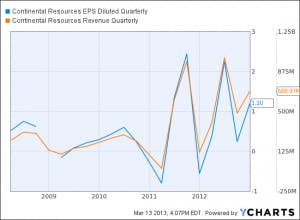

Continental Resources Inc. (NYSE:CLR) represents an easily understandable energy exploration and production company. They make money and, as the chart below shows, Continental’s earnings follow revenues. This makes sense.

The latest earnings report brings good news on both revenues and earnings. In particular, 2012 earnings improved 72% over 2011.This easily exceeded analysts estimates. Q4 2012 saw record production with 2013 production likely to exceed that. Production costs for existing wells declined and will likely continue declining. 122 wells currently await completion, compared to 62 at the end of 2011. Proved reserves increased 54% over 2011 inventory.

Best of all, Continental Resources Inc. (NYSE:CLR) sees continued improvement in profit per barrel courtesy of improved rail transportation. Continental ships more than 70% of its Bakken crude via rail to coastal refineries and derives superior prices for its product compared to pipeline transit. The “cherry on top” may be a new oil play in southern Oklahoma that delivered promising initial results. Continental looks solid.

Revenues, some earnings but no capital gains, I’ll pass

On the other hand, Kodiak Oil & Gas Corp (USA) (NYSE:KOG) attracts some attention, but I see something wrong. The company produces oil and gas and generates revenues, but unlike Continental, earnings fluctuate instead of paralleling revenues. Even worse, Kodiak experienced virtually no capital gains for the past year or so. The company’s latest annual earnings report sounded terrific, but despite huge increases in revenue, net income, and proven reserves, the stock barely budged.

Kodiak Oil & Gas Corp (USA) (NYSE:KOG) wants to capitalize on Bakken shale plays, but has had struggles. For example, in Q3 2012 Kodiak reported record revenues, but earnings came in at $0.01. Increased expenses derailed earnings as the company expanded its payroll. Kodiak faces relatively high costs per well (roughly $10 million compared to Continental’s $8.5 million), hefty debt, and cash depletion. Kodiak also went over its 2012 budget for drilling expenses.

Additionally, during the conference call, CEO Lynn Peterson suggested that production guidance could change as the company experiments with new production methods. If these new methods work, significant production improvement could be realized, but only in the back half of 2013. I suspect this uncertainty played a significant role in the muted stock response to a favorable earnings report.

Earnings, distributions and capital gains, tough to beat

Enterprise Products Partners L.P. (NYSE:EPD) is a Motley Fool CAPS five star stock, and the chart below shows why. Steadily increasing distributions and capital gains supported by earnings make Enterprise a showcase investment.

Enterprise provides transportation services, primarily through pipeline assets, to energy producers in the US, including those shipping Bakken oil to Cushing, OK. Fiscal year 2012 saw Enterprise achieve record net income, earnings per share, and distributable cash flow. The company completed $2.9 billion in capex that began to generate revenue and another $2.4 billion is slated for 2013, and another $4.8 billion through the middle of 2015.

Enterprise shrewdly expands or builds pipelines typically only after securing long term contracts for their use, ensuring future revenue. Expanding its Seaway pipeline from Cushing to the Gulf Coast, and its recent announcement regarding a Gulf Coast ethane pipeline, exemplify this strategy.

2013 started well, with expanded operations from Enterprise’s LPG export terminal in Texas. Export capacity almost doubled from 4 million barrels/month to 7.5 million barrels/month. Capacity could grow to 10 million barrels/month by 2015. According to the company’s Q4 conference call, this expanded export capacity should improve prices for ethane, as well as other NGLs. So while Q4 2012 weakened relative to Q4 2011, Enterprise looks well positioned to deliver increasing revenues and distributions.

Final Foolish Thoughts

The chart below puts these three companies in perspective.

Continental Resources Inc. (NYSE:CLR) and Enterprise outperformed Kodiak, particularly since 2010. Enterprise pays a growing distribution, further adding value to shareholders. Kodiak Oil & Gas Corp (USA) (NYSE:KOG) delivered returns over five years, but as a conservative investor, I recommend waiting until they post consistent earnings before investing. Otherwise, you invest in hope rather than results. Particularly for income purposes, Enterprise stands above the rest. Bakken energy will enrich many, and Enterprise shareholders will surely be among them.

The article 2 Bakken Beauties and One with Warts originally appeared on Fool.com and is written by Robert Zimmerman.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.