In this article, we will take a look at the 15 best lumber stocks to buy now.

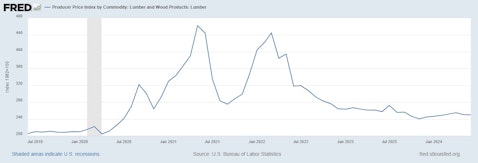

The lumber market has faced considerable volatility in recent years, driven by a confluence of dynamic and interconnected factors. In 2021, lumber prices surged to unprecedented levels due to the COVID-19 pandemic disrupting supply chains, a surge in home construction boosting demand, and logistical challenges further straining the market. However, this peak was followed by a dramatic price correction as these extraordinary conditions began to stabilize. Currently, lumber prices have plummeted 75% from their May 2021 record high of $1,514 per thousand board feet to just $366, closely matching pre-pandemic levels. The futures market has mirrored this decline, with contract prices for July falling 28% to $466. The following chart by U.S. Bureau of Labor Statistics clearly depicts the change in lumber prices over a five year horizon.

The sharp drop in lumber prices reflects a slowdown in both new home construction and renovations, largely due to high home prices and elevated mortgage rates that have reduced housing affordability. This has led to decreased demand for lumber, with a notable 52% year-over-year plunge in multi-family housing starts and a 2% decline in single-family starts as of May, reported by Fortune. Furthermore, the home renovation market, which had previously supported high lumber prices, is now also weakening. Retailers like Home Depot are seeing declines in sales, particularly for larger projects.

On the supply side, the lumber industry expanded production capacity during the boom years, expecting continued high demand. However, this new supply is now coming to market at a time when demand is low, exacerbating the oversupply situation. Experts predict that lumber prices may stagnate near current levels through the end of 2024, with a possible minor increase. Looking ahead to 2025, some sawmills might cut back production, and interest rate reductions could spur a modest recovery, potentially pushing prices between $500 and $600 per thousand board feet. Investors should be mindful of the ongoing volatility and regional price variations as they consider opportunities in the lumber market. For those looking to navigate the best lumber stocks to buy, the S&P Global Timber & Forestry (GTF) Index provides a valuable benchmark. Designed to measure the performance of companies involved in the ownership, management, or upstream supply chain of forests and timberlands, the index targets a constituent count of 100. This includes forest products companies, timber REITs, paper products firms, paper packaging companies, and agricultural businesses engaged in these sectors. As of August 1, 2024, the index has demonstrated a robust 10-year annualized return of 4.24%, currently valued at 2,012.10. This performance highlights the index’s stability and growth potential, making it a key consideration for investors in the timber and forestry sector.

According to the report from Timberland Investment Resources, investing in timberland presents several notable benefits and considerations. Timberland is a tangible asset that serves as a natural hedge against inflation. As inflation increases, the value of timberland often rises, helping to preserve purchasing power. This characteristic makes timberland an appealing option for investors seeking protection against inflationary pressures. Additionally, timberland offers substantial portfolio diversification due to its typically lower volatility compared to traditional equities. This reduced volatility can contribute to more stable long-term returns, making timberland an attractive choice for investors looking to balance risk and reward. Beyond capital appreciation, timberland investments can also generate a consistent income stream through timber harvesting. This dual benefit of income and appreciation makes timberland a valuable asset class for long-term investors.

The report also underscores the significance of sustainable management practices in timberland investments. Effective management is crucial for maintaining the health and productivity of forestlands while adhering to environmental standards and promoting ecological balance. Sustainable forestry practices, such as selective logging and reforestation, ensure that timberland remains productive and environmentally responsible over the long term. By implementing these practices, investors can mitigate negative environmental impacts and support the economic viability of their timberland assets. Sustainable management not only helps preserve the asset’s value but also aligns with growing environmental and regulatory expectations.

However, the report also identifies several risks associated with timberland investments. Timber prices can be highly variable, influenced by fluctuations in supply and demand, which can impact profitability. Additionally, timberland is vulnerable to natural disasters, such as wildfires, storms, and pest infestations, which can cause significant damage and affect returns. Regulatory changes and evolving environmental policies also pose risks, potentially impacting the operational aspects of timberland management. To effectively navigate these risks, the report emphasizes the importance of selecting well-managed timberland properties and partnering with experienced forestry professionals. Proper due diligence and active management are essential for mitigating these risks and maximizing the potential of timberland investments. Overall, while timberland offers stable growth and diversification benefits, it requires careful management and a long-term perspective to fully realize its potential.

The Food and Agriculture Organization (FAO) predicts a 37% increase in the consumption of primary processed wood products by 2050, according to their latest report. This growth includes materials such as sawnwood, plywood, and wood pulp, expected to reach 3.1 billion cubic meters. The rise is projected to be even higher, up to 23%, if modern wood products like mass timber and man-made cellulose fibers gain greater traction in replacing non-renewable materials. Wood’s renewable and versatile nature makes it a key player in efforts to replace non-renewable resources and address climate change. The FAO emphasizes the need for sustainable forest management and increased production from both naturally regenerated and planted forests to meet future demand. Investments totaling around $40 billion annually will be necessary to expand production, with an additional $25 billion for modernization. The sector might face challenges in maintaining employment levels and ensuring adequate training for a more sophisticated workforce. As demand for wood energy grows, especially in developing regions, balancing traditional fuelwood use with modern biomass energy will be crucial.

According to the National Association of Home Builders (NAHB), single-family home construction is expected to rise in 2024 despite ongoing supply-side challenges. Higher interest rates have impacted the housing market over the past two years, but with the Federal Reserve anticipated to lower rates in the latter half of 2024, mortgage rates are expected to decrease. This should stimulate homebuilding, although supply-side issues like rising prices and shortages of materials and labor will persist. The NAHB projects single-family starts to increase by 4.7% in 2024 and by 4.2% in 2025, but notes that this growth will not fully address the nation’s housing deficit of approximately 1.5 million units. Despite the forecasted increase in construction, the multifamily housing market faces challenges, with a 19.7% decline in multifamily starts anticipated for 2024 due to tight credit conditions. However, with a high volume of apartments currently under construction, rent growth is expected to slow, potentially easing inflation. Builders remain optimistic, with a majority planning to increase their activities, although they face hurdles including high regulatory costs and fluctuating land prices. The demand for housing continues to shift, with varying generational preferences influencing market dynamics. Addressing these challenges requires balancing new construction with sustainable practices and increased housing supply.

Aerial shot of a building site stocked with lumber and other building materials.

Our Methodology

We shortlisted the holdings of iShares Global Timber & Forestry ETF, ranked them by the number of hedge funds in each stock, and shared the 15 most popular timber and forestry stocks below. Basically our articles presents the best lumber and timber stocks to buy according to hedge funds.

15. Stella-Jones Inc. (OTC:STLJF)

Number of Hedge Fund Holders: 3

Stella-Jones Inc. (OTC:STLJF) produces and sells pressure-treated wood products in Canada and the U.S., operating through two segments: Pressure-Treated Wood, and Logs and Lumber. It supplies railway ties and timbers for railroad operators and wood utility poles for electrical and telecom companies. On July 8, RBC Capital downgraded Stella-Jones Inc. (OTC:STLJF) from Outperform to Sector Perform and set a price target of Cdn$94.00. The analyst acknowledged the company’s strong management and good positioning for long-term infrastructure investments but noted that the stock’s current valuation is at the high end of its five-year range, reflecting these trends. RBC Capital also expressed concerns about new pole capacity in the industry, which could challenge pricing power and impact Stella-Jones’s revenue and margins in 2025. While volume growth is a positive, it is offset by risks in pole pricing and current valuation, leading the analyst to view the risk-reward profile as balanced. In the latest quarter, Stella-Jones Inc. (OTC:STLJF) reported revenue of $564.37 million, beating expectations by $4.56 million, with a year-to-date price return of 15.46%, close to the S&P 500’s 15.81%.

During Q1, 2024 the count of hedge funds holding positions in Stella-Jones Inc. (OTC:STLJF) rose to 3 from 2 in the prior quarter, as reported by Insider Monkey’s database encompassing 920 hedge funds. These holdings collectively amount to around $0.09 million.

14. LL Flooring Holdings, Inc. (NYSE:LL)

Number of Hedge Fund Holders: 5

LL Flooring Holdings, Inc. (NYSE:LL) operates as a multi-channel specialty retailer of hard and soft surface flooring and accessories, including waterproof hybrid resilient, waterproof vinyl plank, solid and engineered hardwood, laminate, bamboo, and tile. In the latest quarter, announced on May 8, the company reported an EPS of -$1.04, missing expectations by $0.77, and a revenue of $188.49 million, falling short by $30.11 million. On July 3, it was reported that LL Flooring Holdings, Inc. (NYSE:LL) is considering filing for Chapter 11 bankruptcy due to struggles with higher interest rates and declining home renovation activity.

LL Flooring Holdings, Inc. (NYSE:LL) is also attempting to sell a distribution center in Virginia to improve cash reserves and is negotiating with banks to modify its credit agreement due to potential liquidity rule violations. In the first quarter, net sales dropped 21.7% to $188.5 million compared to the previous year, attributed to a difficult macroeconomic environment and brand awareness challenges. LL Flooring Holdings, Inc. (NYSE:LL), which has over 400 locations, changed its name from Lumber Liquidators in 2020 after settling securities fraud allegations for $33 million in 2019. In another development, on July 10, F9 Investments announced the election of all three of its nominees—Tom Sullivan, Jason Delves, and Jill Witter—to LL Flooring’s Board of Directors.

In the first quarter of 2024, there were 5 hedge funds holding positions in LL Flooring Holdings, Inc. (NYSE:LL), as compared to 6 in the previous quarter according to Insider Monkey’s database. The total value of these holdings is approximately $2.13 million. D. E. Shaw held the largest stake among these hedge funds during this period.

O’keefe Stevens Advisory stated the following regarding LL Flooring Holdings, Inc. (NYSE:LL) in its fourth quarter 2023 investor letter:

“LL Flooring Holdings, Inc. (NYSE:LL) – We initiated and closed our position in LL Flooring (LL) during the quarter. This is an unusually short holding period for us, though it was the intention when we initiated the position. LL received an all-cash takeover offer of $5.85 from Live Ventures (LIVE). LL was and continues to be in a precarious position with a troubled balance sheet and a market share donor. The offer acted as a lifeline that we believed management could not deny, as the business is headed for bankruptcy, barring a dramatic rebound in repair and remodel spend. After writing a letter to the board and speaking with Charles Tyson (CEO), management is unwilling to “fire” themselves, regardless of whether it’s in the best interest of shareholders. Management went on about how they will weather the downturn and invest in the future, even when there isn’t one. On the one hand, we were unlucky to establish the position shortly before the Bleeker Street short report. However, we were able to break even on the trade.”

13. Mercer International Inc. (NASDAQ:MERC)

Number of Hedge Fund Holders: 11

Mercer International Inc. (NASDAQ:MERC), together with its subsidiaries, manufactures and sells northern bleached softwood kraft (NBSK) and northern bleached hardwood kraft (NBHK) pulp worldwide, operating through two segments: Pulp and Solid Wood. The company also produces and distributes pulp, electricity, and chemicals through its pulp mills. In the latest quarter, announced on May 9, Mercer International Inc. (NASDAQ:MERC) reported normalized EPS of $0.01, beating expectations by $0.12, and revenue of $553.43 million, surpassing estimates by $45.51 million. The company’s forward dividend yield is 3.91%, with an annual payout of $0.30. On July 18, CIBC analyst Hamir Patel maintained a hold rating on Mercer International Inc. (NASDAQ:MERC) and adjusted the target price from $11 to $10. The number of hedge funds in Insider Monkey’s database owning stakes in Mercer International Inc. (NASDAQ:MERC) remain at 11 in Q1 2024, as similar to the preceding quarter. The consolidated value of these stakes is nearly $43.40 million.

12. PotlatchDeltic Corporation (NASDAQ:PCH)

Number of Hedge Fund Holders: 14

PotlatchDeltic Corporation (NASDAQ:PCH) is a leading REIT owning nearly 2.2 million acres of timberlands across seven states and operating six sawmills, a plywood mill, a real estate development business, and a timberland sales program. In Q2, PotlatchDeltic Corporation (NASDAQ:PCH) reported an EPS of $0.17, beating estimates by $0.08, and revenue of $320.7 million, surpassing the consensus of $305.82 million. The stock closed at $43.18 on August 1, up 10.63% over the past month but down 17.69% over the past year. It has a forward dividend yield of 4.06%, with an annual payout of $1.80 and a payout ratio of 580.65%. The dividend has grown at a 2.38% rate over five years and has increased for four years. On July 31, RBC Capital raised its price target for PotlatchDeltic Corporation (NASDAQ:PCH) to $50 from $46, maintaining an Outperform rating, citing the company’s exposure to a tightening lumber market and potential growth from solar and other NCS businesses.

In the first quarter of 2024, there were 14 hedge funds holding positions in PotlatchDeltic Corporation (NASDAQ:PCH), as compared to 12 in the previous quarter according to Insider Monkey’s database. The total value of these holdings is approximately $101.01 million. Mason Hawkins’s Southeastern Asset Management held the largest stake among these hedge funds during this period.

Longleaf Partners Small-Cap Fund stated the following regarding PotlatchDeltic Corporation (NASDAQ:PCH) in its Q2 2024 investor letter:

“PotlatchDeltic Corporation (NASDAQ:PCH) – Timberland and mill company PotlatchDeltic was a detractor after we initiated a position in the first quarter. We have owned this company in various forms over the years, including Potlatch in the late 2000s/early 2010s, Deltic twice before and post-merger PotlatchDeltic in the late 2010s/early 2020s. We have the opportunity to invest again because the stock market is overly focused on the challenging near-term housing market. This most impacts the lumber mill segment, which is less than 20% of our appraisal. The company’s mills are currently operating at break-even, which is commendable in such a tough environment, demonstrating cost efficiency relative to peers. Long-term value will be driven by the vast majority of the value that comes from high-quality timberlands in the southern US and Idaho. While log prices are depressed currently, timberland has a long history of growing value and alternative use development that is not currently recognized in the stock price. For example, the growing solar market is driving developers to pay $10,000 to $15,000 per acre for land we previously valued at $1,500 to $2,000 per acre. Additionally, PotlatchDeltic has a strong management team that we know well, with a proven history and the ability to buy back stock at a significant discount to the private market net asset value. Meanwhile, we benefit from a solid, tax-efficient dividend.”

11. Clearwater Paper Corporation (NYSE:CLW)

Number of Hedge Fund Holders: 15

Clearwater Paper Corporation (NYSE:CLW) manufactures and supplies bleached paperboards and consumer tissues globally. It operates in two segments: Pulp and Paperboard, and Consumer Products. The Pulp and Paperboard segment produces and markets bleached paperboard used for folding cartons, liquid packaging, and other items, along with hardwood and softwood pulp, offering custom sheeting, slitting, and cutting services.

On July 22, Clearwater Paper Corporation (NYSE:CLW) agreed to sell its tissue business to Sofidel America Corporation for $1.06 billion. The sale is part of Clearwater’s strategy to become a leading paperboard supplier in North America. The transaction is valued at six times the Adjusted EBITDA of the tissue segment for the year ending March 31, 2024. Clearwater expects net proceeds of approximately $850 million, which will be used to reduce debt and invest in growth. The deal is expected to close in late 2024, pending customary conditions.

In the latest quarter, announced on April 29, Clearwater Paper Corporation (NYSE:CLW) reported normalized EPS of $1.43, beating estimates by $0.32, with revenue of $496.2 million, missing by $11.8 million. The stock has gained 48.95% YTD, outperforming the S&P 500’s 14.19% increase.

The number of hedge funds in Insider Monkey’s database owning stakes in Clearwater Paper Corporation (NYSE:CLW) grew to 15 in Q1 2024, as compared to 12 in the preceding quarter. The consolidated value of these stakes is nearly $32.72 million. Among these hedge funds, D. E. Shaw was the company’s leading stakeholder in Q1.

Wasatch Micro Cap Value Strategy stated the following regarding Clearwater Paper Corporation (NYSE:CLW) in its first quarter 2024 investor letter:

“As for our sells, we exited the RMR Group, Inc. (RMR) and Clearwater Paper Corporation (NYSE:CLW). RMR owns, develops and manages real-estate properties with a focus on senior-living communities, hotels, resorts, cruise ships and full-service travel centers. Clearwater Paper manufactures consumer tissue, bleached paperboard and wood products. We had invested in both companies when we thought they were inexpensive. After their stock prices rose to the point where we saw less upside, we decided to sell.”

10. Koppers Holdings Inc. (NYSE:KOP)

Number of Hedge Fund Holders: 16

Koppers Holdings Inc. (NYSE:KOP) is a global supplier of treated wood products, wood preservation chemicals, and carbon compounds, with operations in the United States, Australasia, and Europe. The company is divided into three segments: Railroad and Utility Products and Services (RUPS), Performance Chemicals (PC), and Carbon Materials and Chemicals (CMC). The forward dividend yield for Koppers Holdings Inc. (NYSE:KOP) is 0.69%, with an annual payout of $0.28 and a payout ratio of 6.46%. This relatively low yield suggests that Koppers prioritizes reinvestment over high dividend payouts, focusing on growth and operational needs. In the latest quarter, announced on May 3, Koppers Holdings Inc. (NYSE:KOP) reported a normalized EPS of $0.62, beating estimates by $0.07. These results indicate strong operational performance and efficient cost management. However, the company’s revenue for the quarter was $497.6 million, missing estimates by $7.4 million.

Despite these positive earnings figures, Koppers Holdings Inc. (NYSE:KOP) stock price has declined by 25.01% year-to-date, significantly underperforming the S&P 500’s 14.19% increase. In the first quarter of 2024, the number of hedge funds with stakes in Koppers Holdings Inc. (NYSE:KOP) increased to 16 from 14 in the previous quarter, according to Insider Monkey’s database. The combined value of these stakes is approximately $91.72 million. David Rosen’s Rubric Capital Management emerged as the largest stakeholder among these hedge funds during this period.

09. Sylvamo Corporation (NYSE:SLVM)

Number of Hedge Fund Holders: 16

Sylvamo Corporation (NYSE:SLVM) produces and markets uncoated freesheet for cutsize, offset paper, and pulp across Latin America, Europe, and North America, operating through segments in these regions. Recently, Memphis-based Sylvamo Corporation (NYSE:SLVM) completed a series of refinancing actions on July 31, 2024, to extend debt maturity and optimize liquidity. The restructuring included amending existing credit facilities, issuing a new term loan, and redeeming senior notes. The company reduced its revolving credit facility from $450 million to $400 million, extended the maturity to 2029, and rolled $36 million of Term Loan A into a new $235 million Term Loan F-2 Facility due in 2031. Sylvamo also used part of this new loan to redeem $90.1 million of its 7% 2029 Notes. The Accounts Receivable Finance Facility was extended to 2027 and reduced to $110 million.

Sylvamo Corporation (NYSE:SLVM) offers a forward dividend yield of 2.44%, with an annual payout of $1.80 and a payout ratio of 21.70%. This indicates a solid dividend policy, reflecting the company’s ability to distribute a portion of its earnings to shareholders while retaining a majority for reinvestment and operational needs. Year-to-date, Sylvamo Corporation (NYSE:SLVM) stock has performed exceptionally well, delivering a price return of 46.55%, significantly outperforming the S&P 500’s 14.19% increase. This strong performance underscores investor confidence in the company’s strategic financial decisions and overall business stability.

During Q1, 2024 the count of hedge funds holding positions in Sylvamo Corporation (NYSE:SLVM) grew to 16 from 13 in the prior quarter, as reported by Insider Monkey’s database encompassing 920 hedge funds. These holdings collectively amount to around $84.62 million. Chuck Royce’s Royce & Associates emerged as the leading shareholder among these hedge funds during this timeframe.

08. West Fraser Timber Co. Ltd. (NYSE:WFG)

Number of Hedge Fund Holders: 18

West Fraser Timber Co. Ltd. (NYSE:WFG), a diversified wood products company, manufactures and distributes lumber, engineered wood products, pulp, newsprint, and renewable energy. It markets its products to major retail chains, contractor supply yards, wholesalers, and industrial customers for further processing or as components for other goods across Canada, the United States, the United Kingdom, Europe, and globally. Established in 1955, the company is headquartered in Vancouver, Canada. On July 29, CIBC analyst Hamir Patel raised the firm’s price target for West Fraser Timber Co. Ltd. (NYSE:WFG) to C$138 from C$125, while maintaining an Outperform rating, reflecting confidence in the company’s future performance. In the latest quarter, announced on July 24, West Fraser Timber Co. Ltd. (NYSE:WFG) reported a normalized EPS of $1.34, surpassing estimates by $0.18. The company also beat revenue estimates with $1.70 billion, surpassing forecasts by $124.06 million. The company offers a forward dividend yield of 1.44% with an annual payout of $1.28 and a payout ratio of 49.94%. The dividend has grown at an impressive 16.66% over the past five years and has been increasing for three years. This indicates a stable return for investors and a strong commitment to rewarding shareholders.

In the first quarter of 2024, the number of hedge funds with stakes in West Fraser Timber Co. Ltd. (NYSE:WFG) increased to 18 from 16 in the previous quarter, according to Insider Monkey’s database. The combined value of these stakes is approximately $138.42 million. Israel Englander’s Millennium Management emerged as the largest stakeholder among these hedge funds during this period.

07. Simpson Manufacturing Co., Inc. (NYSE:SSD)

Number of Hedge Fund Holders: 21

Simpson Manufacturing Co., Inc. (NYSE:SSD) designs, engineers, manufactures, and sells structural solutions for wood, concrete, and steel connections. The company offers wood construction products such as connectors, truss plates, fastening systems, fasteners, shearwalls, and pre-fabricated lateral systems for light-frame construction. In the latest earnings report announced on July 22, the company reported a normalized EPS of $2.33, missing expectations by $0.11. This slight shortfall indicates challenges in meeting profit forecasts. Revenue was $596.98 million, falling short by $7.68 million, suggesting lower-than-expected sales or operational inefficiencies.

Simpson Manufacturing Co., Inc. (NYSE:SSD) forward dividend yield stands at 0.58%, which is relatively modest, providing some income to investors but not a major draw for those focused on dividends. The annual payout of $1.12 reflects a steady commitment to returning value to shareholders. With a payout ratio of 13.09%, the company retains most of its earnings for reinvestment, indicating potential for future growth. Over the past five years, the dividend growth rate has been 4.14%, showing steady but moderate growth, while nine consecutive years of dividend increases highlight a solid track record of rewarding shareholders.

The forward P/E ratio (Non-GAAP) of 23.76 suggests the stock is reasonably valued, reflecting market expectations of continued profitability. However, the year-to-date price return is -3.45%, indicating that the stock has underperformed and possibly due to missed earnings and revenue targets. Compared to the S&P 500’s robust 14.54% year-to-date return, Simpson Manufacturing Co., Inc. (NYSE:SSD) performance highlights investor concerns or broader industry challenges.

In Q1 2024, the count of hedge funds holding stakes in Simpson Manufacturing Co., Inc. (NYSE:SSD) rose to 21 from 19 in the previous quarter, based on Insider Monkey’s database of 920 hedge funds. These stakes collectively amount to around $273.61 million in value. John W. Rogers’s Ariel Investments emerged as the largest stakeholder among these hedge funds during this period.

Conestoga Capital Advisors Small Cap Strategy stated the following regarding Simpson Manufacturing Co., Inc. (NYSE:SSD) in its fourth quarter 2023 investor letter:

“Simpson Manufacturing Co., Inc. (NYSE:SSD): SSD designs and manufactures connectors, fasteners, and anchors used in residential and commercial construction. The company’s 3Q results continued to demonstrate its very strong business model. The company slightly exceeded revenue and earnings expectations for 3Q. It also modestly raised operating margin guidance. In addition to the strong fundamental results, the stock certainly benefited from lower interest rates during the quarter, which improved market sentiment for housing-related stocks.”

06. UFP Industries, Inc. (NASDAQ:UFPI)

Number of Hedge Fund Holders: 21

UFP Industries, Inc. (NASDAQ:UFPI), along with its subsidiaries, designs, manufactures, and markets wood and non-wood composites, as well as other materials across North America, Europe, Asia, and Australia. The company operates through three segments: Retail, Packaging, and Construction. UFP Industries, Inc. (NASDAQ:UFPI) offers a forward dividend yield of 1.02% with an annual payout of $1.32, and maintains a payout ratio of 14.68%. Over the past five years, the dividend growth rate has been 28.47%, with 11 consecutive years of dividend growth. The forward P/E ratio (Non-GAAP) stands at 16.86. Year-to-date, the company has achieved a price return of 1.20%, compared to the S&P 500’s 14.54%.

Over the past five years, UFP Industries, Inc. (NASDAQ:UFPI) experienced significant revenue growth from $4,416.0 million in 2019 to $9,626.7 million in 2022. However, revenue dropped by 25.0% to $7,218.4 million in 2023 due to lower selling prices and reduced organic unit sales, particularly in the construction segment, which saw a 31% decline. Despite the 2023 downturn, the company showed strong growth from 2019 to 2022. In the latest earnings report announced on April 30, UFP Industries, Inc. (NASDAQ:UFPI) reported normalized and GAAP earnings per share of $1.96, surpassing expectations by $0.30. The company achieved actual revenue of $1.64 billion, though this figure missed projections by $68.20 million.

In Q1 2024, the count of hedge funds holding stakes in UFP Industries, Inc. (NASDAQ:UFPI) grew to 21 from 18 in the previous quarter, based on Insider Monkey’s database of 920 hedge funds. These stakes collectively amount to around $255.62 million in value.

05. Boise Cascade Company (NYSE:BCC)

Number of Hedge Fund Holders: 24

Boise Cascade Company (NYSE:BCC) manufactures wood products and distributes building materials across the U.S. and Canada, operating through the Wood Products and Building Materials Distribution segments. The Wood Products segment specializes in laminated veneer lumber and beams. In the latest earnings report from May 6, Boise Cascade Company (NYSE:BCC) reported a normalized EPS of $2.61, surpassing expectations by $0.33. Revenue reached $1.65 billion, beating projections by $82.00 million. The company’s forward dividend yield is 4.11%, with an annual payout of $5.80 and a payout ratio of 6.10%. Over the past five years, the dividend growth rate has been 18.66%, and the company has consistently grown its dividend for six years.

In the first quarter of 2024, the number of hedge funds with stakes in Boise Cascade Company (NYSE:BCC) stood same at 24 as in the previous quarter, according to Insider Monkey’s database. The combined value of these stakes is approximately $176.46 million. Steve Cohen’s Point72 Asset Management emerged as the largest stakeholder among these hedge funds during this period.

Miller Value Partners Income Strategy stated the following regarding Boise Cascade Company (NYSE:BCC) in its fourth quarter 2023 investor letter:

“During the fourth quarter, we eliminated two positions comprising approximately 6% of the portfolio where new information suggested that our investment thesis was wrong. As active managers, we are able to proactively make adjustments in the portfolio, a key difference from strategies that are rebalanced to a benchmark on a set frequency. Two new additions included a starter position in wood products maker Boise Cascade Company (NYSE:BCC) as well as the debt of Gray Television, a top operator of local television stations. We think Boise Cascade is a good business trading at a compelling valuation with a fortress balance sheet, while we believe markets are too pessimistic on Gray Television’s staying power.”

04. Rayonier Inc. (NYSE:RYN)

Number of Hedge Fund Holders: 27

Rayonier Inc. (NYSE:RYN), a prominent timberland real estate investment trust, operates in highly productive softwood timber regions across the United States and New Zealand. On July 16, Truist analyst Michael Roxland revised the company’s price target to $31 from $34 while maintaining a Hold rating. This adjustment comes as part of a broader review of Q2 results in the paper and packaging sector. The analyst described the quarter as a “mixed paper bag” for paper and forest products, noting stronger demand and pricing for containerboard and stable boxboard performance, but weaker demand and pricing for wood products. The reduced price target reflects ongoing concerns about global economic growth, persistently low global manufacturing activity, and decreased market multiples.

Rayonier Inc. (NYSE:RYN) offers a forward dividend yield of 3.76%, with an annual payout of $1.14. The high payout ratio of 285% indicates that the company is paying out a significant portion of its earnings in dividends. Over the past five years, the dividend has grown at a modest rate of 1.09% and has been increasing for the last two years. On July 22, the company declared a third-quarter dividend of $0.285 per share, scheduled for payment on September 30, to shareholders of record as of September 16. This dividend announcement underscores Rayonier Inc. (NYSE:RYN) commitment to returning value to its shareholders despite the mixed performance in its core sectors.

In the first quarter of 2024, the number of hedge funds with stakes in Rayonier Inc. (NYSE:RYN) increased to 27 from 21 in the previous quarter, according to Insider Monkey’s database. The combined value of these stakes is approximately $304.23 million. Ian Simm’s Impax Asset Management emerged as the largest stakeholder among these hedge funds during this period.

Third Avenue Real Estate Value Fund stated the following regarding Rayonier Inc. (NYSE:RYN) in its fourth quarter 2023 investor letter:

“Asset Sales: Rayonier Inc. (NYSE:RYN) (a U.S.-based Timber Real Estate Investment Trust or “REIT”) announced the disposition of 55k acres of timberlands in Oregon for $242 million, implying $4.4k per acre, or more than two times the implied value per acre for Rayonier’s portfolio based upon the recent stock price. Rayonier’s management team has also indicated that it plans to sell another $750 million of timberlands within the next 18 months to further reduce debt levels and return excess capital to shareholders given the price-to-value discrepancy.”

03. Weyerhaeuser Company (NYSE:WY)

Number of Hedge Fund Holders: 32

Weyerhaeuser Company (NYSE:WY), one of the largest private owners of timberlands, has been operating since 1900. The company owns or controls approximately 11 million acres of timberlands in the U.S. and manages additional timberlands under long-term licenses in Canada. In the latest earnings report announced on July 25, Weyerhaeuser Company (NYSE:WY) reported a normalized FFO (Funds from Operations) of $0.44, beating expectations by $0.03. The GAAP EPS was $0.24, also exceeding forecasts by $0.03. Revenue totaled $1.94 billion but missed projections by $34.06 million.

In Q1 2024, the count of hedge funds holding stakes in Weyerhaeuser Company (NYSE:WY) rose to 32 from 30 in the previous quarter, based on Insider Monkey’s database of 920 hedge funds. These stakes collectively amount to around $239.32 million in value. Jean-Marie Eveillard’s First Eagle Investment Management emerged as the largest stakeholder among these hedge funds during this period.

02. International Paper Company (NYSE:IP)

Number of Hedge Fund Holders: 37

International Paper Company (NYSE:IP) produces and sells renewable fiber-based packaging and pulp products across North America, Latin America, Europe, and North Africa. It operates through two segments: Industrial Packaging and Global Cellulose Fibers. In the latest earnings report announced on July 24, International Paper Company (NYSE:IP) reported a normalized EPS of $0.55, exceeding expectations by $0.13, while the GAAP EPS was $1.41, surpassing forecasts by $1.00. Revenue reached $4.73 billion but missed projections by $31.67 million. The company’s forward dividend yield is 3.94%, with an annual payout of $1.85. The last announced dividend is $0.46, with an ex-dividend date of August 15, 2024, and a payout date of September 16, 2024. The forward P/E ratio is 29.18, indicating a higher valuation relative to earnings.

In the first quarter of 2024, the number of hedge funds with positions in International Paper Company (NYSE:IP) rose to 37 from 31, according to Insider Monkey’s database, which tracks 920 hedge funds. The combined value of these holdings is approximately $756.33 million. During this period, Edgar Wachenheim’s Greenhaven Associates became the largest shareholder among these hedge funds.

01. Louisiana-Pacific Corporation (NYSE:LPX)

Number of Hedge Fund Holders: 48

Louisiana-Pacific Corporation (NYSE:LPX), along with its subsidiaries, provides building solutions for new home construction, repair, remodeling, and outdoor structures. The company operates through the Siding, Oriented Strand Board, LP South America, and Other segments. In the latest earnings report announced on May 8, Louisiana-Pacific Corporation (NYSE:LPX) reported a normalized EPS of $1.53, beating expectations by $0.41. Revenue was $724.00 million, surpassing projections by $37.16 million. The company’s forward dividend yield is 1.07%, with an annual payout of $1.04 and a payout ratio of 22.22%. The five-year dividend growth rate is 13.54%, and the dividend has grown consistently for five years. The forward P/E ratio is 17.88, suggesting a reasonable valuation. Year-to-date, the stock has returned 37.07%, significantly outperforming the S&P 500’s 14.54% return.

In the first quarter of 2024, the number of hedge funds with stakes in Louisiana-Pacific Corporation (NYSE:LPX) increased to 48 from 41 in the previous quarter, according to Insider Monkey’s database of 920 hedge funds. The combined value of these stakes is approximately $1396.27 million. Warren Buffett’s Berkshire Hathaway emerged as the largest stakeholder among these hedge funds during this period.

Cooper Investors Global Equities Fund stated the following regarding Louisiana-Pacific Corporation (NYSE:LPX) in its first quarter 2024 investor letter:

“Highlights are often the private site tours we undertake with portfolio companies, two worth discussing on this trip were with Louisiana-Pacific Corporation (NYSE:LPX) and Eurofins Scientific (Eurofins). LP is a business we invested in mid-2023 and represents a Low-Risk Turnaround where the proposition is a commodity-to-specialty transformation story. The company is a leading manufacturer of wood-based building materials produced from its 24 mills and finishing plants, comprising ~4bn sq. ft of Oriented Strand Board (OSB) capacity and ~2bn sq. ft of siding capacity. Historically, OSB was the core output of LP but is a commoditised product in which LP is a price-taker. Group profits and losses swung around and led to highly volatile earnings over the years for a business at the whim of the underlying OSB price.

Siding on the other hand is a genuinely differentiated product that gives LP pricing power and generates consistent incremental margins of 25-30%. Made in the same mills as OSB using engineered wood flake and embossed with a grain finish (a processing marvel we’ve witnessed first-hand at a Source: Company Disclosures, Redburn Atlantic mill in Upper Michigan), LP ‘Smartside’ is a sustainable way to wrap homes in an attractive durable substrate that is gaining popularity among small and medium builders…” (Click here to read the full text)

LPX tops our list of best consulting stocks. However, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than LPX but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Analyst Sees a New $25 Billion “Opportunity” for NVIDIA and Jim Cramer is Recommending These 10 Stocks in June.

Disclosure: None.