In this piece, we will take a look at the 15 best artificial intelligence stocks to buy according to hedge funds. For more top AI stocks, head on over to 5 Best Artificial Intelligence (AI) Stocks To Buy According to Hedge Funds.

The hottest trend in technology right now is artificial intelligence. This is simply due to the fact that for the general consumer, artificial intelligence is mostly associated with sci-fi grade technology with the potential to create entities with human like intelligence and response. However, until most of 2022, such technologies were not available to captivate the public attention. Most chatbots were rather rudimentary and lacked the ability to provide detailed responses.

However, all this changed with the release of ChatGPT, a conversational assistant trained on vast amounts of data and capable of generating human like responses to queries. ChatGPT set the internet on fire, and within days and weeks after its initial and public release, all tech and non tech publications were simply gushing about the assistant. As is the case with hype, it often goes far beyond what logic might suggest, and soon we were being warned that professionals such as lawyers might have to switch careers as a virtual assistant can provide better services.

All this hype has made everyone forget what artificial intelligence really is. Simply put, AI is the use of complex mathematical techniques to use a set of inputs, plug them in an equation, and then determine the most likely set of outcomes. So, if you ask ChatGPT about companies with reusable rockets, it will sift through its data to determine which are the most likely matches and likely give you an answer that includes SpaceX.

This utility of using large scale data analysis to generate a likely set of outputs provides artificial intelligence with far more utility than a simple chatbot. One of the best use cases of artificial intelligence that does not involve talking is autonomous driving. This involves feeding a computer in a car data through a variety of sensors such as LiDAR sensors, and programming it in such a way that it is able to make decisions that mimic human behavior like knowing when to stop and when to turn. Building on this, the consulting firm McKinsey takes a look at other sectors that can use AI. Its report for the 2022 use cases for AI shows that a variety of sectors such as robotic process automation, knowledge graphs, facial recognition, and recommender systems are using artificial intelligence as well. Functionally speaking, McKinsey reports that the largest users of artificial intelligence are service operators, customer service analytics, and customer generation and lead generation platforms.

One firm that leads in the customer services arena is Salesforce, Inc. (NYSE:CRM). It provides customer engagement and analytics platforms. During its earnings call for the fourth quarter of the fiscal year 2023, its executives shared the inside scoop on Salesforce’s Einstein GPT – the world’s first generative language artificial intelligence platform for customer relationship management and details for other plans to integrate AI into the overall business.

During the event, they shared:

EinsteinGPT will be integrated into all of our clouds as well as Tableau, MuleSoft and Slack. And then there’s another way we’re opening the door to use AI for our future and for all of our customers’, as we have begun working with the rapidly expanding AI ecosystem in our industry, I’ve been really impressed with how companies like Anthropic, a leading provider of generative AI, are using Slack as their user interface for generative AI assistance. The relevance of Slack as an incredible enterprise productivity platform, user interface and critical data set for these new AI systems, while it’s inspiring all kinds of new use cases, I couldn’t be more excited about the future. To wrap it up, our transformation is happening now. We’re making Salesforce one of the most profitable software companies in the world with one of the highest cash flows and one of the very largest as well.

Given these explosive use cases, it’s important to look at a wide list of firms currently developing and deploying the AI technology. Some topics AI picks from hedge funds include Amazon.com, Inc. (NASDAQ:AMZN), Microsoft Corporation (NASDAQ:MSFT), and Alphabet Inc. (NASDAQ:GOOGL).

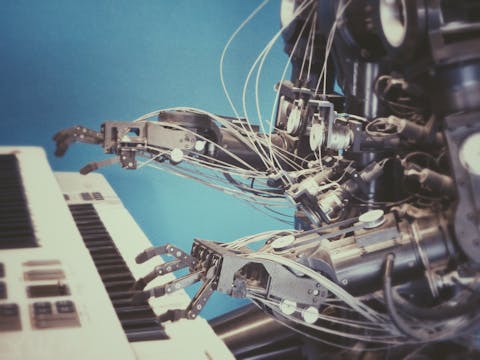

Photo by Possessed Photography on Unsplash

Our Methodology

To compile our list of the best AI stocks, we first made a list of all firms that are developing and have deployed the technology. Then, the number of hedge fund investors in their stocks was determined through Insider Monkey’s database for the first quarter of this year. The companies were ranked accordingly, and the top fifteen artificial intelligence stocks that hedge funds are piling into are listed below.

Best Artificial Intelligence (AI) Stocks To Buy According to Hedge Funds

15. SAP SE (NYSE:SAP)

Number of Hedge Fund Investors In Q1 2023: 14

SAP SE (NYSE:SAP) is an enterprise technology company based in Walldorf, Germany. The firm enables its customers to integrate artificial intelligence into their business platforms and train the models on their own datasets.

Insider Monkey took a look at 943 hedge fund portfolios for their first quarter of 2023 investments and found out that 14 had held a stake in SAP SE (NYSE:SAP). Out of these, the firm’s largest shareholder is Ken Fisher’s Fisher Asset Management since it owns 6.2 million shares that are worth $792 million.

Along with Microsoft Corporation (NASDAQ:MSFT), Amazon.com, Inc. (NASDAQ:AMZN), and Alphabet Inc. (NASDAQ:GOOGL), SAP SE (NYSE:SAP) is an artificial intelligence stock hedge funds are piling into.

14. SentinelOne, Inc. (NYSE:S)

Number of Hedge Fund Investors In Q1 2023: 34

SentinelOne, Inc. (NYSE:S) is a technology company based in Mountain View, California. It uses artificial intelligence to enable customers to manage, detect, and respond to threats to their databases and cloud platforms.

After digging through 943 hedge funds and their portfolios, Insider Monkey discovered that 34 had bought the software company’s shares. SentinelOne, Inc. (NYSE:S)’s largest investor in our database is Daniel Patrick Gibson’s Sylebra Capital Management with a $171 million stake that comes via 10 million shares.

13. UiPath Inc. (NYSE:PATH)

Number of Hedge Fund Investors In Q1 2023: 36

UiPath Inc. (NYSE:PATH) is an American software firm headquartered in New York, New York. The company provides its customers with robotic process automation (RPA) services by using artificial intelligence. The platform is based on computer vision, robotics, and cognitive software services.

36 of the 943 hedge funds part of Insider Monkey’s database had bought the firm’s shares as of March 2023. UiPath Inc. (NYSE:PATH)’s largest hedge fund investor is Catherine D. Wood’s ARK Investment Management through owning 44 million shares that are worth $788 million.

12. ANSYS, Inc. (NASDAQ:ANSS)

Number of Hedge Fund Investors In Q1 2023: 36

ANSYS, Inc. (NASDAQ:ANSS) is a software company based in Canonsburg, Pennsylvania. The firm’s products use machine learning and artificial intelligence to determine adequate parameters for production and other processes.

Insider Monkey’s first quarter of 2023 survey of 943 hedge funds revealed that 36 had invested in ANSYS, Inc. (NASDAQ:ANSS). The firm’s largest shareholder is Robert Joseph Caruso’s Select Equity Group with a $421 million stake.

11. Verisk Analytics, Inc. (NASDAQ:VRSK)

Number of Hedge Fund Investors In Q1 2023: 37

Verisk Analytics, Inc. (NASDAQ:VRSK) is a consulting company based in Jersey City, New Jersey. It offers artificial intelligence services to customers under the Smart Objects platform that enables them to ‘plug in’ AI into business processes such as fraud detection.

By the end of this year’s first quarter, 37 of the 943 hedge funds profiled by Insider Monkey had held a stake in Verisk Analytics, Inc. (NASDAQ:VRSK). Out of these, Ken Griffin’s Citadel Investment Group is the largest shareholder with a $332 million investment.

10. International Business Machines Corporation (NYSE:IBM)

Number of Hedge Fund Investors In Q1 2023: 49

International Business Machines Corporation (NYSE:IBM) is one of the largest and oldest technology companies in the world. It allows customers to augment their decision making and business processes with artificial intelligence.

49 of the 943 hedge funds part of Insider Monkey’s database had bought the firm’s shares by the end of March 2023. International Business Machines Corporation (NYSE:IBM)’s largest shareholder in our database is Peter Rathjens, Bruce Clarke, and John Campbell’s Arrowstreet Capital with a $673 million investment.

9. Autodesk, Inc. (NASDAQ:ADSK)

Number of Hedge Fund Investors In Q1 2023: 57

Autodesk, Inc. (NASDAQ:ADSK) is an engineering and design software provider. Its architecture design software uses artificial intelligence to sift through designs and evaluate structural issues.

After digging through 943 hedge funds for their first quarter of 2023 investments, Insider Monkey discovered that 57 had invested in the firm. Autodesk, Inc. (NASDAQ:ADSK)’s largest hedge fund investor is Ian Simm’s Impax Asset Management with a $253 million stake.

8. Accenture plc (NYSE:ACN)

Number of Hedge Fund Investors In Q1 2023: 60

Accenture plc (NYSE:ACN) is an information technology consulting firm based in Dublin, Ireland. It provides businesses and customers with services to use and scale artificial intelligence in their businesses.

As of March 2023, 60 of the 943 hedge funds part of Insider Monkey’s database had bought Accenture plc (NYSE:ACN)’s shares. Out of these, the largest shareholder is Nicolai Tangen’s Ako Capital since it owns 1.8 million shares that are worth $534 million.

7. Oracle Corporation (NYSE:ORCL)

Number of Hedge Fund Investors In Q1 2023: 67

Oracle Corporation (NYSE:ORCL) is an enterprise software provider. Its software enables firms to deploy artificial intelligence in their business processes and use their own data for training.

67 of the 943 hedge funds surveyed by Insider Monkey had invested in the firm as of Q1 2023. Oracle Corporation (NYSE:ORCL)’s largest hedge fund investor in our database is Jean-Marie Eveillard’s First Eagle Investment Management with a $1.9 billion stake.

6. Advanced Micro Devices, Inc. (NASDAQ:AMD)

Number of Hedge Fund Investors In Q1 2023: 91

Advanced Micro Devices, Inc. (NASDAQ:AMD) designs and sells semiconductor products. Its CPUs and GPUs are designed to handle artificial intelligence workloads.

By the end 2023’s first quarter, 91 of the 943 hedge funds surveyed by Insider Monkey had held a stake in Advanced Micro Devices, Inc. (NASDAQ:AMD). Out of these, the largest investor is Ken Fisher’s Fisher Asset Management which owns a $2.5 billion stake.

Amazon.com, Inc. (NASDAQ:AMZN), Advanced Micro Devices, Inc. (NASDAQ:AMD), Microsoft Corporation (NASDAQ:MSFT), and Alphabet Inc. (NASDAQ:GOOGL) are some top artificial intelligence hedge fund stock picks.

Click to continue reading and see the 5 Best Artificial Intelligence (AI) Stocks To Buy According to Hedge Funds.

Suggested Articles:

- 11 Stocks with Heavy Insider Buying

- Top 20 Most Popular Consumer Electronics Brands

- 25 Most Technologically Advanced Cities in the World

Disclosure: None. 15 Best Artificial Intelligence (AI) Stocks To Buy According to Hedge Funds is posted on Insider Monkey.