U.S. e-commerce sales hit a record this year on the unofficial shopping holiday, and artificial intelligence has played a starring role. According to Adobe Analytics, online spending has hit $10.8 billion in the US, and Generative AI chatbots drove a 1,800% surge in retail site traffic compared to 2023. These tools helped bargain hunters find deals, compare products, and check out more quickly.

READ NOW: 15 AI News Investors Shouldn’t Miss and 15 Buzzing AI Stocks Making Headlines

Similarly, Salesforce revealed that the use of AI-enabled online chat services grew 31% year-on-year on Black Friday, with U.S. Black Friday online sales reaching $17.5 billion, up 7% year-over-year. Digital retailers using generative AI and agents in their customer service experiences saw a 9% higher conversion rate compared to those who did not.

In other news, OpenAI’s chief financial officer, Sarah Friar, told the Financial Times that the company is considering introducing ads on its platform. She further revealed that the company had recently hired Kevin Weil, an executive from Instagram, who was well-suited to the task.

“The good news with Kevin Weil at the wheel with product is that he came from Instagram. He knows how this [introducing ads] works”.

– Sarah Friar, OpenAI’s chief financial officer.

However, a later statement issued by Friar reveals that while OpenAI may be open to the possibility, they currently don’t have any active plans for the same.

“While we’re open to exploring other revenue streams in the future, we have no active plans to pursue advertising.”

A Bloomberg Opinion column by Dave Lee reveals that such an apparent change in statements could be because the AI Company realized that advertisements tend to signal “troubling trends”. The shift may send doubts about the profitability of its subscription-based model, raising concerns about potential “enshittification”, as tech commentator and activist Cory Doctorow famously terms it, where user-focused features are compromised for advertiser-driven engagement and time optimization.

Moreover, OpenAI’s endeavors are so huge that its revenues don’t manage to cover them. The development of advanced AI models would require even greater spending, which is why advertising could be seen as an avenue to help bridge the gap. However, its risks undermine ChatGPT’s appeal as an alternative to Google search, potentially disrupting its user experience, Lee noted.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

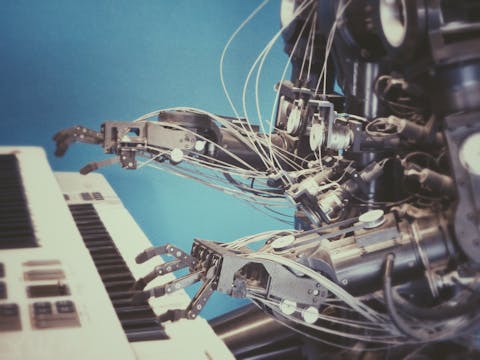

Photo by Possessed Photography on Unsplash

15. Rubrik, Inc. (NYSE:RBRK)

Number of Hedge Fund Holders: 23

Rubrik, Inc. (NYSE:RBRK) provides data security solutions to individuals and businesses worldwide and is heavily utilizing artificial intelligence and machine learning to monitor threats and provide advanced data recovery capabilities. On December 3rd, Rubrik, Inc. (NYSE:RBRK) announced that it has expanded its leading cyber protection capabilities for cloud data that runs on AWS. The new capabilities will enable joint customers to accelerate identification and response to hidden threats, as well as help them recover faster from cyber-attacks. A key feature is the Rubrik Cloud Vault (RCV), a secure and fully managed backup system. The company is also offering expanded features for AWS, including Anomaly Detection, Threat Monitoring, Threat Hunting, and Data Discovery & Classification.

“Surviving a cyberattack is not as simple as just restoring from a backup. IT and security teams must also rapidly pinpoint when the attack occurred, identify what was compromised, and determine if sensitive data was impacted — all while trying to find a clean, safe recovery point. This is no small task, but we believe the power of Rubrik and AWS makes it simple for organizations to bounce back quickly and safely while minimizing the risk of reinfection. Together we will continue to bring our partnership to new heights to better protect organizations and join them on their journey to cyber resilience.”

-Anneka Gupta, Chief Product Officer at Rubrik.

14. Upstart Holdings, Inc. (NASDAQ:UPST)

Number of Hedge Fund Holders: 29

Upstart Holdings, Inc. (NASDAQ:UPST) operates a cloud-based artificial intelligence (AI) lending platform in the United States. On December 2, JP Morgan downgraded the company’s stock to “Underweight” from Neutral but lifted the price target to $57 from $45. According to the firm, the company’s artificial intelligence platform is nice but it is struggling with a valuation that reflects the higher originations seen in 2022. The firm said it would take at least a few quarters to reach that level.

13. SAP SE (NYSE:SAP)

Number of Hedge Fund Holders: 36

SAP SE (NYSE:SAP) is a leader in ERP software that leverages artificial intelligence to enhance its enterprise resource planning (ERP) solutions. On December 3rd, SAP SE (NYSE:SAP) and Amazon announced the launch of GROW with SAP on AWS, a comprehensive cloud ERP solution that will enable customers to rapidly deploy SAP’s enterprise resource planning (ERP) solution while leveraging the reliability, security, and scalability of the most widely adopted cloud. The solution will integrate SAP’s enterprise resource planning (ERP) expertise with AWS’s robust cloud infrastructure, allowing organizations to modernize their operations and unlock new business opportunities. The integrated solution simplifies ERP adoption by cutting costs and deployment time so that businesses can set up in months without upfront expenses. It also integrates AWS’s generative AI tools like Amazon Bedrock and SAP’s Joule for smarter, AI-powered operations.

“Our collaboration with AWS will provide customers of all sizes a simplified path to deploy cloud ERP with powerful automation and insights via Joule embedded across our business applications. Today’s announcement will allow customers to transform in the cloud more easily with the proven security, reliability, and availability of AWS. By using Amazon Bedrock via the generative AI Hub from SAP, customers can unlock even more business AI innovation”.

– Muhammad Alam, member of the executive board of SAP SE, SAP Product Engineering.

12. NetApp, Inc. (NASDAQ:NTAP)

Number of Hedge Fund Holders: 38

NetApp, Inc. (NASDAQ:NTAP) is an intelligent data infrastructure company and a top Goldman Sachs Phase 2 AI stock, catering to the needs of the cloud computing and data center industries. On December 1, the company announced a new integrated solution that simplifies the use of NetApp block storage with AWS Outposts. AWS Outposts is a family of fully managed solutions that deliver AWS infrastructure and services to any on-premises or edge location. Through the solution, hybrid cloud deployments are simplified by combining NetApp’s unified data storage and intelligent services with the powerful cloud infrastructure offered by AWS Outpost. Ultimately, it helps customers optimize cloud deployments on-premises and at the edge.

“Whether customers are looking to use hybrid cloud infrastructure to increase resiliency or improve compliance, leveraging NetApp storage in AWS Outposts can help customers run applications securely and efficiently at the edge. This solution makes it simpler for customers to leverage NetApp intelligent data infrastructure to manage their data in AWS Outposts deployments. By automating volume attachments, IT teams can now tap into the efficiency and power of NetApp on-premises storage arrays to power critical workloads.”

-Jonsi Stefansson, Senior Vice President and Chief Technology Officer at NetApp.

11. HP Inc. (NYSE:HPQ)

Number of Hedge Fund Holders: 42

HP Inc. (NYSE:HPQ), a technology company, specializes in personal computing and printing solutions. On December 3, DBS analyst Jim Hin Kwong Au initiated a new “Buy” rating on HP (HPQ) and a $44 price target. Looking at the company’s current and future prospects, the analyst highlighted that the company has shown a modest revenue increase due to a recovering PC market, and also holds a significant market share in both global PC shipments and hardcopy peripherals.

Moreover, AI-powered PCs, including the company’s collaboration with Microsoft’s Copilot+ and AMD’s Ryzen AI chips, are further expected to strengthen its competitive position and capture a larger market share as AI penetration in PCs is poised to grow. The company is also switching to a subscription-based model which is expected to drive higher margins and more predictable revenue. The move aligns with broader industry trends and also strives to leverage emerging technologies like generative AI. The stock is also undervalued when it comes to its peers.

10. Palantir Technologies Inc. (NASDAQ:PLTR)

Number of Hedge Fund Holders: 43

Palantir Technologies Inc. (NASDAQ:PLTR) is a leading provider of artificial intelligence systems. On December 3, Palantir Technologies Inc. (NASDAQ:PLTR) announced that it has received the FedRAMP High Authorization for Palantir Federal Cloud Service (PFCS) and Palantir Federal Cloud Service – Supporting Services (PFCS-SS). The FedRAMP authorization is a government-wide program that encourages the use of secure cloud services across government agencies. This is done by offering a unified framework that assesses security and manages risk associated with cloud technologies.

The new authorization allows Palantir to handle sensitive US government workloads and will be covering the complete range of Palantir’s product offerings and programs—including AIP, Apollo, Foundry, Gotham, FedStart, and Mission Manager. The company’s high authorization builds on Palantir’s previous FedRAMP Moderate and DoD IL5 and IL6 authorizations, enabling the U.S. government to process the most sensitive unclassified workloads in Palantir’s cloud offering.

“We’re proud to have achieved the FedRAMP High milestone for our full product suite, including our award-winning AI Platform (AIP), which is transforming the speed, scale, and efficiency with which the US Government can operate across civilian, defense, and intelligence agencies. With the addition of the PFCS-SS FedRAMP High offering, Palantir is excited to accelerate our work with other technology partners—big and small, government or commercial—to enable their technology to be securely operated on behalf of USG missions. This milestone is an affirmation of our ongoing commitment to upholding the highest security standards and being trusted to handle our government partners’ most sensitive data and workloads, as well as our commitment to enabling the entire American technology base to support critical government needs.”

-Akash Jain, CTO and President of Palantir USG.

9. Axon Enterprise, Inc. (NASDAQ:AXON)

Number of Hedge Fund Holders: 46

Axon Enterprise, Inc. (NASDAQ:AXON) develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand and boasts a strong suite of AI-powered products such as Axon Auto-Transcribe and Draft One. On December 3, Morgan Stanley analyst Meta Marshall upgraded Axon Enterprise, Inc. (NASDAQ:AXON) to “Overweight” from Equal Weight with a price target of $700, up from $500.

The firm is positive about Axon’s strong growth driven by expanding its software portfolio and adoption of artificial intelligence solutions. The company’s 25-30% revenue growth is becoming more durable over the long term considering the adoption of its higher-priced software bundles, and new offerings like drones and license plate readers. The company’s total addressable market (TAM) of $77 billion remains largely untapped, with Axon’s AI product, Draft One, raking in a $100 million pipeline just three months after its launch.

“We are more willing to ascribe value to AI portfolio pulling through other products, which could lead to additional valuation upside”.

-Morgan Stanley

8. Elastic N.V. (NYSE:ESTC)

Number of Hedge Fund Holders: 47

Elastic N.V. (NYSE:ESTC) is a search AI company offering cloud-based solutions. On December 3, the company announced new capabilities on Elastic Security, designed to help organizations detect, investigate, and respond to security incidents and threats. The expanded cloud detection and response (CDR) capabilities, together with features such as agentless ingestion, cloud asset inventory, extended protections, and graph view, eliminate the need for a separate cloud detection and response tool altogether. The company is the first to integrate the CDR capabilities directly into an AI-driven security analytics solution.

“Over the past two years, Elastic has integrated cloud security and CDR capabilities directly into its AI-driven security analytics solution to enhance how modern organizations detect and respond to threats more effectively. Our comprehensive approach maximizes efficiency, lowers the total cost of ownership (TCO), and alleviates the burden on security teams. Ultimately, Elastic Security ensures organizations stay ahead of evolving threats while leveraging the full benefits of CDR.”

-Santosh Krishnan, general manager of Security at Elastic.

7. Twilio Inc. (NYSE:TWLO)

Number of Hedge Fund Holders: 52

Twilio Inc. (NYSE:TWLO) is a leading cloud communications platform-as-a-service (CPaaS) company that’s integrating artificial intelligence via tools like Twilio Segment and Twilio Flex for enhancing customer engagement and data insights. On December 2nd, Twilio Inc. (NYSE:TWLO) announced the public beta availability of Linked Audiences in the Twilio Segment for Amazon Redshift. Linked Audiences assists marketers in creating targeted audiences without the need for SQL knowledge or team support.

The integration between AWS and Twilio will allow customers to build audiences, enhance their customer profiles, and grow personalization at scale. Marketers will be able to access customer data in Redshift without coding skills, helping them create targeted campaigns easily and effectively.

“With Linked Audiences, Amazon Redshift users can now create dynamic, context rich audiences that will drive effective personalized marketing campaigns that can increase engagement. This builds on our existing Segment and AWS product integrations and enables data teams the ability to link Segment unified profiles to critical business entity data that lives in the Redshift warehouse. Our data graph provides technical marketers with a rich view of the customer that can be used to send dynamic audience payloads that power impactful personalized campaigns in downstream systems.”

– Thomas Wyatt, President of Twilio Segment.

6. CrowdStrike Holdings, Inc. (NASDAQ:CRWD)

Number of Hedge Fund Holders: 74

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) specializes in AI-driven endpoint and cloud workload protection products. On December 3, CrowdStrike Holdings, Inc. (NASDAQ:CRWD) announced that it was named the AWS 2024 Global Security Partner of the Year, AWS North America Marketplace Partner of the Year, and AWS LATAM Public Sector Technology Partner of the Year during the Partner Awards Gala at AWS re: Invent 2024.

The awards highlight the critical role Crowdstrike has been playing in helping customers secure innovation built on Amazon Web Services (AWS). AWS uses CrowdStrike’s AI-powered Falcon platform to protect its infrastructure and customers. Last year, the company became the first cybersecurity ISV founded for the cloud to exceed $1 billion in software sales through the AWS marketplace.

“CrowdStrike’s partnership with AWS has defined how companies build and secure their businesses in the cloud. Last fall, we became the first for the cloud to exceed $1 billion of software sales through AWS Marketplace, AWS consolidates its own cybersecurity on the Falcon platform, and we protect AWS customers of all sizes, from all industries and sectors, all over the world, against advanced threats. We look forward to continuing and expanding our relationship with AWS, jointly securing the cloud, and stopping breaches together”.

-Daniel Bernard, chief business officer, CrowdStrike

5. ServiceNow, Inc. (NYSE:NOW)

Number of Hedge Fund Holders: 78

ServiceNow, Inc. (NYSE:NOW) provides a cloud-based and AI-driven platform that enables enterprises to automate multiple management workflows. On December 3, ServiceNow (NYSE: NOW) and Amazon Web Services (AWS) announced an expanded strategic collaboration with new capabilities to drive AI-powered transformation throughout every aspect of the business. A key update in this collaboration involves a connector that seamlessly integrates multimodal models developed and trained on Amazon Bedrock into GenAI-powered workflows on the Now Platform. Additional automation solutions are available on the AWS marketplace, and there are also plans for expanding services to Canada and Europe in 2025.

“Our partnership with AWS is accelerating business transformation for our joint customers. More than ever before, organizations demand integrated, end-to-end solutions that enhance user experiences and optimize technology investments. Together, ServiceNow’s GenAI workflows and AWS’s next-gen cloud capabilities deliver on that promise.”

– Paul Fipps, president of Strategic Accounts at ServiceNow.

4. Alibaba Group Holding Limited (NYSE:BABA)

Number of Hedge Fund Holders: 115

Alibaba Group Holding Limited (NYSE:BABA) is an online retailer that leverages AI in its e-commerce business. On December 3rd, the South China Morning Post revealed that the cloud computing and artificial intelligence (AI) arm of Alibaba Group Holding is collaborating with local partners to expand its services in Indonesia, Thailand, and Japan. The move comes as the company prioritizes markets in East and Southeast Asia in an overseas push.

The “Alibaba Cloud Partner Rainforest Plan” aims to work with 100 ecosystem partners next year to develop and provide cutting-edge AI and cloud computing solutions for businesses across various industries around the world. Alibaba Cloud has launched three programs under the plan: an AI Alliance Accelerator to build a robust partner ecosystem, a Service Partner Program for partner upskilling, and an Incentive Program to drive revenue growth.

Under these projects, Alibaba Cloud plans to build an AI partner ecosystem through collaboration with “50 AI technology partners and 50 channel partners” in 2025, focuses on upskilling existing service partners with targeted training, and helps partners grow revenue.

“We are committed to supporting our global partners to jointly reap the benefits of the AI era and meet the diverse business demand of global customers”.

-Selina Yuan, president of international business at Alibaba Cloud, at the company’s partner summit held in Bali, Indonesia on Tuesday

3. Salesforce, Inc. (NYSE:CRM)

Number of Hedge Fund Holders: 116

Salesforce Inc (NYSE:CRM) is a cloud-based CRM company that has gained popularity after the launch of its AI-powered platform called Agentforce. On December 3rd, the company posted third-quarter results and fell short of earnings estimates but exceeded revenue expectations. Adjusted earnings for the third quarter were $2.41 per share, below expectations of $2.44 per share, as reported by FactSet. Revenue for the quarter was $9.44 billion, compared to the anticipated $9.35 billion.

The company said it now anticipates fiscal 2025 revenue to be between $37.8 billion to $38 billion. It revealed its AI-powered platform Agentforce in September and officially launched it in late October, allowing customers to use AI agents to handle tasks and accelerate productivity.

“Agentforce, our complete AI system for enterprises built into the Salesforce Platform, is at the heart of a groundbreaking transformation. The rise of autonomous AI agents is revolutionizing global labor, reshaping how industries operate and scale.”

-CEO Marc Benioff said in the company’s earnings release.

2. Adobe Inc. (NASDAQ:ADBE)

Number of Hedge Fund Holders: 123

Adobe Inc. (NASDAQ:ADBE) is a strong AI player with two prominent AI products: Sensei and Firefly. On December 3rd, Adobe Inc. (NASDAQ:ADBE) announced that it is expanding its partnership with Amazon Web Services (AWS) to make Adobe Experience Platform (AEP) available on AWS. The platform will help businesses deliver highly personalized customer experiences, with AI-driven insights through the AEP that help ensure customer experiences are timely and relevant to individual tastes.

Through the AEP, brands can use AWS can tap into a suite of applications powered by AEP including Adobe Real-Time CDP, Adobe Journey Optimizer, and Adobe Customer Journey Analytics.

“Delivering one-to-one personalization across a myriad of digital channels is quickly becoming table stakes for brands. Our collaboration with AWS expands access to Adobe Experience Platform, powering an integrated set of applications that enable timely customer experiences based on deep insights. Brands will have greater flexibility in where they deploy customer data and manage tools and workflows, while leveraging a generative AI assistant to improve productivity and deliver greater ROI for marketing teams.”

– Anjul Bhambhri, senior vice president, Adobe Experience Cloud.

1. Apple Inc. (NASDAQ:AAPL)

Number of Hedge Fund Holders: 158

Apple Inc. (NASDAQ:AAPL) is a technology company that has risen in prominence within the AI investment sphere after the debut of Apple Intelligence, its AI-powered personal intelligence system. On December 2, UBS kept a “Neutral” rating on Apple (AAPL) with a $236 price target. The firm performed a recent survey of over 7,500 smartphone users in the U.S., UK, China, Germany, and Japan, revealing that iPhone demand is soft considering the interest surrounding artificial intelligence “remains muted.”

The firm further noted that the 12-month global iPhone purchase intent was unchanged in the U.S., and AI-related responses were unchanged as well. Pricing remained the top concern among 51% of participants. Despite the muted demand for iPhones and weak interest in GenAI applications, the firm slightly raised its 2024 and 2025 global ‘smartphone’ sell-in estimates from 1.20B and 1.22B units to 1.21B and 1.24B respectively.

While we acknowledge the potential of AAPL as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than AAPL but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.