U.S. e-commerce sales hit a record this year on the unofficial shopping holiday, and artificial intelligence has played a starring role. According to Adobe Analytics, online spending has hit $10.8 billion in the US, and Generative AI chatbots drove a 1,800% surge in retail site traffic compared to 2023. These tools helped bargain hunters find deals, compare products, and check out more quickly.

READ NOW: 15 AI News Investors Shouldn’t Miss and 15 Buzzing AI Stocks Making Headlines

Similarly, Salesforce revealed that the use of AI-enabled online chat services grew 31% year-on-year on Black Friday, with U.S. Black Friday online sales reaching $17.5 billion, up 7% year-over-year. Digital retailers using generative AI and agents in their customer service experiences saw a 9% higher conversion rate compared to those who did not.

In other news, OpenAI’s chief financial officer, Sarah Friar, told the Financial Times that the company is considering introducing ads on its platform. She further revealed that the company had recently hired Kevin Weil, an executive from Instagram, who was well-suited to the task.

“The good news with Kevin Weil at the wheel with product is that he came from Instagram. He knows how this [introducing ads] works”.

– Sarah Friar, OpenAI’s chief financial officer.

However, a later statement issued by Friar reveals that while OpenAI may be open to the possibility, they currently don’t have any active plans for the same.

“While we’re open to exploring other revenue streams in the future, we have no active plans to pursue advertising.”

A Bloomberg Opinion column by Dave Lee reveals that such an apparent change in statements could be because the AI Company realized that advertisements tend to signal “troubling trends”. The shift may send doubts about the profitability of its subscription-based model, raising concerns about potential “enshittification”, as tech commentator and activist Cory Doctorow famously terms it, where user-focused features are compromised for advertiser-driven engagement and time optimization.

Moreover, OpenAI’s endeavors are so huge that its revenues don’t manage to cover them. The development of advanced AI models would require even greater spending, which is why advertising could be seen as an avenue to help bridge the gap. However, its risks undermine ChatGPT’s appeal as an alternative to Google search, potentially disrupting its user experience, Lee noted.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

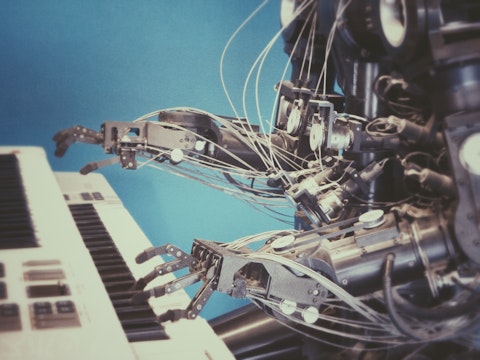

Photo by Possessed Photography on Unsplash

15. Rubrik, Inc. (NYSE:RBRK)

Number of Hedge Fund Holders: 23

Rubrik, Inc. (NYSE:RBRK) provides data security solutions to individuals and businesses worldwide and is heavily utilizing artificial intelligence and machine learning to monitor threats and provide advanced data recovery capabilities. On December 3rd, Rubrik, Inc. (NYSE:RBRK) announced that it has expanded its leading cyber protection capabilities for cloud data that runs on AWS. The new capabilities will enable joint customers to accelerate identification and response to hidden threats, as well as help them recover faster from cyber-attacks. A key feature is the Rubrik Cloud Vault (RCV), a secure and fully managed backup system. The company is also offering expanded features for AWS, including Anomaly Detection, Threat Monitoring, Threat Hunting, and Data Discovery & Classification.

“Surviving a cyberattack is not as simple as just restoring from a backup. IT and security teams must also rapidly pinpoint when the attack occurred, identify what was compromised, and determine if sensitive data was impacted — all while trying to find a clean, safe recovery point. This is no small task, but we believe the power of Rubrik and AWS makes it simple for organizations to bounce back quickly and safely while minimizing the risk of reinfection. Together we will continue to bring our partnership to new heights to better protect organizations and join them on their journey to cyber resilience.”

-Anneka Gupta, Chief Product Officer at Rubrik.

14. Upstart Holdings, Inc. (NASDAQ:UPST)

Number of Hedge Fund Holders: 29

Upstart Holdings, Inc. (NASDAQ:UPST) operates a cloud-based artificial intelligence (AI) lending platform in the United States. On December 2, JP Morgan downgraded the company’s stock to “Underweight” from Neutral but lifted the price target to $57 from $45. According to the firm, the company’s artificial intelligence platform is nice but it is struggling with a valuation that reflects the higher originations seen in 2022. The firm said it would take at least a few quarters to reach that level.