In this article, we will take a look at the 13 Best Forever Stocks to Buy Right Now.

State of The Market in The Wake of The CPI Report

The first month of 2025 was an interesting one, with inflation rising faster than expected, giving another motivation for the Federal Reserve to keep interest rates unchanged. The consumer price index, a comprehensive measure of expenses in goods and services throughout the US economy, increased by a seasonally adjusted 0.5% for January, bringing the annual inflation rate to 3%. Excluding volatile food and energy costs, the CPI increased 0.4%, bringing the 12-month inflation rate to 3.3%, higher than the projections of 0.3% and 3.1%, respectively. According to Josh Jamner, investment strategy analyst at ClearBridge Investments, the report spells the end of the Fed’s rate-cutting cycles:

“The ‘wait and see’ Fed is going to be waiting longer than anticipated after a red-hot January CPI inflation report. This report puts the final nail in the coffin for the rate cut cycle, which we believe is over.”

In addition, policymakers are also keeping a watch on the White House in the wake of President Donald Trump’s advocacy for high tariffs, which might boost prices and make it more difficult for the Fed to reach its goal. Speaking on this, James Knightley, chief international economist at ING, said the following:

“There is no getting away from the fact that this is a hot report and with the sense that potential tariffs run upside risk for inflation the market is understandably of the view the Federal Reserve is going to find it challenging to justify rate cuts in the near future,”

While the consumer price index release is a widely cited inflation gauge, it isn’t the principal metric the Federal Reserve uses. Rather, the Fed’s preferred inflation measure is the personal consumption expenditures price index, which the Bureau of Economic Analysis will publish later this month, although it also monitors the CPI and other comparable pricing indices. In his remarks before the House Financial Services Committee on February 12, Fed Chair Jerome Powell acknowledged the Fed’s increased emphasis on the PCE measure but acknowledged that “we’re not quite there yet” on inflation, despite the “great progress” that has been done so far.

In such a macroeconomic environment, the notion of acquiring the best “forever stocks” might appear challenging. That said, although investors may gravitate toward riskier options with bigger potential returns, it is crucial to recognize that long-term stock investments have their worth and importance. With this in mind, let’s take a look at some potential forever stocks.

Our Methodology

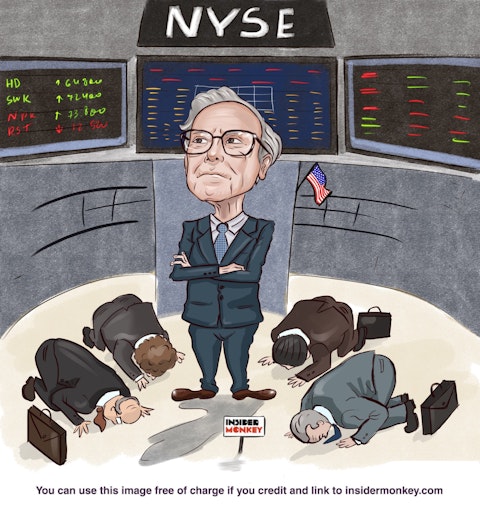

When it comes to long-term investing, who better to emulate than Warren Buffett, arguably the most well-known investor on Wall Street? To come up with our list of the best forever stocks, we began by evaluating Buffett’s stock portfolio, focusing on stock holdings that had been in his portfolio for at least 5 years. Next, we looked at the number of hedge fund investors linked with each stock using Insider Monkey’s database of 900 funds in the third quarter of 2024. The following names are ranked according to hedge fund sentiments around them.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

13. The Kraft Heinz Company (NASDAQ:KHC)

Number of Hedge Fund Holders: 38

The Kraft Heinz Company (NASDAQ:KHC) is a global leader in food and beverage production that was founded in 2015 by the merger of Kraft Foods and Heinz. The company makes a variety of items, including dairy, meat, sauces, drinks, and other commodities.

On February 13, Stifel revised its outlook for The Kraft Heinz Company (NASDAQ:KHC), lowering the price target from $32 to $31 while maintaining a Hold rating on the company’s stock. The correction comes after Kraft Heinz reported its fourth-quarter profits, which revealed that Kraft Heinz’s organic sales fell by 3.1%, including a 4.1% loss in volume, albeit this was somewhat offset by a 1% rise due to price. The profits per share for the quarter were $0.84, representing an 8% increase and surpassing Stifel’s expectation by $0.05, aided by a $0.06 benefit from below-the-line items, such as a reduced tax rate.

12. VeriSign, Inc. (NASDAQ:VRSN)

Number of Hedge Fund Holders: 39

VeriSign, Inc. (NASDAQ:VRSN), is a multinational software infrastructure company that provides domain name registry services and internet infrastructure, allowing users to navigate the internet using globally recognized domain names. The company acts as the exclusive registry for the .com and .net domains.

On February 10, Citi analyst Ygal Arounian raised the price target for VeriSign, Inc. (NASDAQ:VRSN) to $260 from $250, while keeping a Buy rating on the company. The adjustment follows VeriSign’s fourth-quarter performance, which Arounian deemed positive. Verisign recorded a considerable year-over-year increase rate in the fourth quarter, with 9.5 million gross new registrations. The company also maintained notable gross profit margins of 87.7% and had a 4.3% sales increase in the previous year. Arounian stated that these findings support the idea that the company’s volume difficulties are cyclical rather than structural.

11. DaVita Inc. (NYSE:DVA)

Number of Hedge Fund Holders: 39

DaVita Inc. (NYSE:DVA) provides renal dialysis treatments to individuals suffering from chronic kidney failure in the United States. The firm runs renal dialysis clinics and offers associated lab services at outpatient dialysis centers. It also provides outpatient, hospital inpatient, and home-based hemodialysis services and manages clinical laboratories that conduct standard laboratory testing for dialysis.

In the third quarter of 2024, the company recorded consolidated revenues of $3.2 billion. Furthermore, operating income was $535 million, demonstrating the company’s capacity to profit from its core businesses while eliminating non-operational costs such as taxes and interest. Additionally, diluted profits per share was $2.50, while adjusted diluted earnings per share was $2.59. With 2028 as the nearest maturity date, DaVita Inc. (NYSE:DVA) has properly controlled its debt, and its leverage is within acceptable limits.

DaVita Inc. (NYSE:DVA) managed recent operational challenges well, reducing the impact of storms and maintaining labor and medical cost management. The company anticipates supply chain circumstances to return to normal by early 2025 as it prepares for a regulatory move involving oral-only pharmaceuticals into Medicare Part B, which may increase patient access and efficiency.

10. The Kroger Co. (NYSE:KR)

Number of Hedge Fund Holders: 39

The Kroger Co. (NYSE:KR) is an American retail firm that runs supermarkets and multi-department shops across the United States. The Kroger Co. (NYSE:KR), is one of the world’s leading food retailers, with over 2,700 supermarkets and multi-department shops scattered throughout 35 states in the United States.

On January 24, Citi analysts restored coverage of KR shares with a Neutral rating and a $61 price target. The decision comes after a pause owing to a possible merger between The Kroger Co. (NYSE:KR) and Albertsons Companies Inc., which has since been halted. Citi analysts praised the company’s many outstanding qualities while also highlighting many issues and obstacles that might affect its performance.

During the third quarter of 2024, The Kroger Co. (NYSE:KR) grew its client base by providing outstanding value through competitive pricing, personalized promotions, and high-quality private-label items, all within a seamless shopping experience. The company’s quarterly sales were $33.63 billion, down 0.95% from the same period last year.

9. Charter Communications, Inc. (NASDAQ:CHTR)

Number of Hedge Fund Holders: 61

Charter Communications, Inc. (NASDAQ:CHTR) is a renowned cable and internet company that serves both residential and commercial clients. The company offers services such as voice, television, and the internet.

Charter Communications, Inc. (NASDAQ:CHTR) posted impressive results for the third quarter of 2024 in most categories, including revenue, EBITDA, and free cash flow. Specifically, mobile service income increased by 37.9%, while advertising revenues rose by 17.7%. The company’s free cash flow (FCF) in particular has been a topic of discussion. Following a fall in 2023, FCF is predicted to rebound significantly by 2026. Some experts predict that Charter’s FCF will reach approximately $8.0 billion by 2027, up from less than $3.0 billion in 2024.

Charter Communications, Inc. (NASDAQ:CHTR) also intends to acquire Liberty Broadband in an all-stock deal, an acquisition that is expected to boost liquidity and direct ownership for Liberty Broadband stockholders. The deal is scheduled to finalize in late June 2027.

Brennan Asset Management stated the following regarding Charter Communications, Inc. (NASDAQ:CHTR) in its Q4 2024 investor letter:

“Charter Communications, Inc. (NASDAQ:CHTR): Still Hated…But Progress Continues and CHTR/Liberty Broadband (LBRDK) Terms Finalized: We discussed Charter (CHTR) in our 2024 Q1 letter and then reviewed CHTR’s offer to repurchase Liberty Broadband shares in our Q3 2024 letter. CHTR continues to show operational progress. While there is likely to be some continued Affordable Connectivity Program (ACP) noise during the early part of 2025, CHTR has done an admirable job in retaining customers, and total losses are far lower than originally feared. While the stock (frustratingly) will bounce around with small changes in quarterly broadband additions/losses versus expectations, we still believe that CHTR’s ultimate success will come down to whether they can create packages that encourage customers to jointly consider broadband and cell phone prices rather than mentally segregating the two bills. As we previously discussed, we are cautiously optimistic that CHTR’s more aggressive broadband/bundling packages can do just that. We also believe that CHTR’s streaming aggregation product could be another positive differentiator. During its third quarter conference call, CHTR announced that it did not expect to be a meaningful participant in the Broadband Equity, Access, and Deployment (BEAD) program. This cutback in expansionary capex after 2025 likely means a more rapid return to aggressive share repurchases, especially once the company’s network investments are completed in 2027.

Separately, CHTR and LBRDK came to terms with the merger proposal that we discussed in our third quarter letter. The final deal was probably viewed somewhat disappointingly by LBRDK investors, considering that the exchange ratio was closer to CHTR’s original proposal — 0.236 shares of CHTR for each LBRDK share with GCI Communications (GCI) not included versus LBRDK’s proposal for 0.29 CHTR/LBRDK including GCI. That said, the part that most frustrated some was disclosure that the LBRDK/CHTR deal will not close until June 2027. This later closing was designed so LBRDK could sell down CHTR and deleverage prior to the merger, but this also means that LBRDK likely will trade at a discount until closer to deal closing. While we understand the criticisms, CHTR was the only likely buyer for LBRDK, and this deal will simplify CHTR’s capital structure and ultimately allow a collapse of the LBRDK discount.”

8. American Express Company (NYSE:AXP)

Number of Hedge Fund Holders: 62

American Express Company (NYSE:AXP) is a major bank holding company that offers a full digital payments network, including credit cards, charge cards, and financing alternatives. One key reason for its position as an industry leader is its premium brand. Late last year, AXP bought UBS’s 50% investment in Swisscard, becoming the sole owner of the credit card issuer. This transaction helped the company to establish a stronger base in the Swiss market.

On January 27, RBC Capital increased its price target for American Express Company (NYSE:AXP) from $330 to $350 and reaffirmed its Outperform rating on the company. According to the firm’s research, American Express had strong core results, with revenue up 9.3% yearly to $60.76 billion, reflecting favorable spending patterns. This was placed against a backdrop of rising costs, which RBC’s experts considered reasonable. In addition, American Express Company (NYSE:AXP) also posted strong results for the fourth quarter of 2024, with EPS of $3.04, slightly higher than the average expectation of $3.03.

7. Moody’s Corporation (NYSE:MCO)

Number of Hedge Fund Holders: 67

Moody’s Corporation (NYSE:MCO) is an integrated risk assessment company that offers credit research, credit models, analytics, and economic data as part of its risk management services.

Citi resumed coverage of Moody’s Corporation (NYSE:MCO) on December 19, with a $565 price target and a Buy rating. The firm recognized many variables that may contribute to a favorable credit issuance cycle and expressed optimism about the company’s prospects, including the Federal Reserve’s policy easing, tight credit spreads, and a large number of imminent debt maturities. Through 2027, the company expects EPS to expand at a compound annual rate in the low teens.

Moody’s Corporation (NYSE:MCO) posted solid financial results for the third quarter of 2024, including a 32% rise in adjusted diluted profits per share and a 23% increase in revenue to $1.8 billion. This expansion was mostly driven by the ratings sector, notably investment-grade issuance, which experienced a 70% rise in transaction income. In addition, Moody’s Corporation (NYSE:MCO) recently announced an agreement to acquire CAPE Analytics, a geospatial AI business that specializes in property evaluation. This acquisition is intended to improve Moody’s data and analytics for the insurance market.

6. The Coca-Cola Company (NYSE:KO)

Number of Hedge Fund Holders: 69

The Coca-Cola Company (NYSE:KO) is a global beverage industry leader best known for its famous brand, Coca-Cola. Aside from its flagship product, the company produces, sells, and distributes a wide variety of non-alcoholic beverages, including syrups, concentrates, and more recently, alcoholic beverages.

On February 11, Citi analyst Filippo Falorni reiterated his Buy rating and price target for The Coca-Cola Company (NYSE:KO) at $85 per share. Falorni’s judgment is based on the company’s Q4 2024 performance and projected profits for 2025. Due to pricing that was 9% higher than expected (5.9%), the company’s organic sales growth came in 14% higher than the consensus expectation of 7%. Furthermore, concentrate sales climbed by 5% rather than the expected 1%, surpassing predictions.

5. Johnson & Johnson (NYSE:JNJ)

Number of Hedge Fund Holders: 81

Johnson & Johnson (NYSE:JNJ) is a leading player in the healthcare sector, including sub-sectors such as medicines, Medtech equipment, and consumer health goods. The company is renowned for creating medications to treat a variety of ailments and diseases, including cancer, diabetes, and HIV/AIDS. Johnson & Johnson (NYSE:JNJ) also has several other potential development prospects, including the robotic-assisted surgical business.

On February 3, Guggenheim increased its price target for Johnson & Johnson (NYSE:JNJ) from $162 to $166 while reaffirming its Neutral rating on the company’s shares. The adjustment followed JNJ’s Q4 2024 results, which showed $22.5 billion in revenue and $2.04 in profits per share. Guggenheim praised Johnson & Johnson’s performance, including the initial forecast for 2025, despite increased competition from Stelara biosimilars in the US market. The recent acquisition of ITCI is also intended to increase Johnson & Johnson’s foothold in the mental health industry, with the transaction slated to be completed in the second quarter of 2025.

On January 13, Johnson & Johnson (NYSE:JNJ) announced the $14.6 billion acquisition of IntraCellular, a neurological pharmaceutical. This acquisition will provide JNJ with access to Caplyta, an oral medication used to treat bipolar disorder and schizophrenia.

4. Mastercard Incorporated (NYSE:MA)

Number of Hedge Fund Holders: 131

Mastercard Incorporated (NYSE:MA) is the world’s second-largest payment processing firm. The firm provides its customers with a wide range of payment processing and related services, such as credit and debit cards, data analytics, settlements, payment deferrals, and more.

For the fourth quarter of 2024, Mastercard Incorporated (NYSE:MA) reported sales of $7.5 billion, a 14% rise over the same time the year before. Compared to the previous year, the company’s net income increased to $3.5 billion during the quarter. In addition, Mastercard Incorporated (NYSE:MA) has provided its customers with 3.5 billion MasterCard and Maestro-branded cards by the end of Q4.

Following MasterCard’s fourth-quarter results, Raymond James maintained an Outperform rating on the stock and raised its price target from $614 to $640. The firm emphasized MasterCard’s sustained performance, noting that while the first guidance may result in lower projections, this is mostly due to foreign exchange changes and transaction-related operational expenditures.

Qualivian Investment Partners stated the following regarding Mastercard Incorporated (NYSE:MA) in its Q3 2024 investor letter:

“Mastercard Incorporated (NYSE:MA): Q2 2024 revenues and EPS beat consensus expectations, growing 11% (+13% on a constant currency, CC, basis) and 24% (+27% on a CC basis) respectively. Overall payments volume increased 9%, with highly profitable cross-border volumes growing 17%. Management qualified their expectations for a solid FY2024 anchored around continued stable consumer spending, while noting there is uncertainty regarding the overall macroeconomic backdrop heading into the back half of 2024 and 2025. In the event of a weakening consumer, management noted they would adjust investment priorities as well as the company’s cost structure as appropriate if trends softened further. We continue to expect that over the longer term, MA will continue to drive and benefit from the digitization of payments globally.”

3. Apple Inc. (NASDAQ:AAPL)

Number of Hedge Fund Holders: 158

Apple Inc. (NASDAQ:AAPL) is a tech behemoth known for its flagship products, such as the iPhone, Mac, and Apple Watch, as well as its varied portfolio of services, including iCloud and Apple Music.

According to Morgan Stanley, Apple Inc. (NASDAQ:AAPL)’s latest AI program, Apple Intelligence, looks to have given iPhone demand a tiny lift in the United States during the December quarter. However, the impact was limited and mostly focused on discounted older models rather than the most recent iPhone portfolio. Looking ahead, Morgan Stanley anticipates iPhone demand in emerging nations other than China to remain robust, with India leading the charge.

On February 4, JPMorgan reiterated its Overweight rating and $270 price target for Apple Inc. (NASDAQ:AAPL). The firm report was based on Sensor Tower data, which revealed that Apple’s App Store sales increased by 2.7% month-over-month in January, above the historical average growth rate of 2.3% from December to January. This expansion also aided in accelerating year-over-year sales trends, with a 17.6% rise in January compared to 13.1% in December of last year.

2. Visa Inc. (NYSE:V)

Number of Hedge Fund Holders: 165

Visa Inc. (NYSE:V) is an American multinational payment card service corporation that provides a variety of associated services and products to its customers. The company links about 4 billion account members to over 130 million merchants and 14,500 financial institutions in over 200 countries.

In Q1 2025, Visa Inc. (NYSE:V) witnessed overall payment volumes in constant dollars increase by 9%, up from 8% in the fourth quarter of 2024. This increase was mostly because of overseas markets, which jumped by 11%, surpassing the preceding quarter’s growth of 10%. In addition, payment volumes increased by 7% in the United States, above the 5% rise in the fourth quarter of 2024. Visa Inc. (NYSE:V) expects net revenue to expand at a high single-digit to low double-digit percentage rate in the second quarter, adjusted for the leap year.

Mar Vista Global Strategy stated the following regarding Visa Inc. (NYSE:V) in its Q3 2024 investor letter:

“After lagging the broader markets over the last one, three, and five years, we believe Visa Inc.’s (NYSE:V) stock now reflects a more conservative and realistic expectation for future cash flow growth. The electronic transaction toll-taker has long enjoyed a highly defensible network effect that connects global buyers and sellers and scale advantages that keep upstart competitors from disrupting the industry’s economics. At the same time, Visa directly benefits from the secular trend of replacing cash with e-payments. Penetration rates and transaction volumes in developed markets will inevitably slow over the next five years yet we expect Visa revenues to grow 8-10% over our investment horizon. Key value drivers remain global consumer spending growth, e-transaction penetration, “new flows” expansion in areas like business-to-business transactions, and lastly, value-added client service growth.

Visa’s dominant position is reflected in its nearly pristine financials: 68% operating margins, greater than 70% incremental operating margins and only 3-4% capital expenditures as a percent of sales. Awash in excess capital, Visa is one of the more aggressive purchasers of its own stock. Shares outstanding over the last fifteen years have declined by one-third and we expect the company to continue to repurchase 2-3% of shares outstanding annually. Since the 2016 acquisition of Visa Europe, total returns on capital have expanded from 25% to 50% and we expect the metric to approach 100% over the next five years as net operating profits expand roughly 60% on a flat capital base. Overall, Visa should compound per share intrinsic value at 10-13% over the next five years.”

1. Amazon.com Inc. (NASDAQ:AMZN)

Number of Hedge Fund Holders: 286

Amazon.com, Inc. (NASDAQ:AMZN) sells consumer items, advertising, and subscription services online and in physical shops in North America and overseas. The company also serves the cloud computing sector, particularly through its Amazon Web Services (AWS) division.

Amazon.com Inc. (NASDAQ:AMZN) stated on January 7 that AWS will invest around $11 billion to develop its infrastructure in Georgia. With this investment, AWS, a major income source for Amazon, is likely to improve its position as the market leader. In addition, Amazon.com Inc. (NASDAQ:AMZN) announced net revenues of $158.9 billion in fiscal Q3 2024, up 11% YoY due to AWS’s notable growth.

On February 10, New Street Research upgraded its outlook on Amazon.com (NASDAQ:AMZN) shares, with analyst Dan Salmon raising the price target to $280 from $234 and maintaining a Buy rating for the online retail giant. Salmon highlights AWS as a significant driver of Amazon’s future financial growth, with catalysts including expanded AWS partnerships, especially in artificial intelligence with Trainium 2. Other important advances include enhancements to the Nova frontier model, changes to consumer general AI apps such as Rufus, and the impact of general AI selling tools.

While we acknowledge the potential of AMZN, our conviction lies in the belief that certain AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than AMZN but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.