In this article, we will discuss: 13 Best Commodity Stocks To Buy According to Analysts.

Two major trends that are shaping commodity markets are the rising interconnection of the market and the increasing importance of power in the energy transition, as per a report. The link between necessary commodities for the energy transition, such as LNG and metals, grew to 56% in 2022-23, up from 27% in 2015-19. With the introduction of more than 100 new tankers in the previous three years, the supply of LNG is rising dramatically. By 2028, it is anticipated that there will be more LNG carriers than oil carriers. Flexible contracts and increased competition between Europe and Asia are the main causes of this change.

Moreover, estimates suggest that power will play a larger part in the energy transition by 2040, contributing between $1.3 trillion and $2.4 trillion, expanding at a rate of up to 5% annually. Since renewable energy is predicted to account for the majority of the power mix between 2030 and 2050, significant investments in transmission networks, flexible power assets, and renewable energy sources will be required to meet net-zero targets. Up to 50% of the steel, copper, and aluminum needed for production will come from wind turbines alone.

Meanwhile, it is becoming more difficult to reduce inflation as global commodity prices level off, according to the World Bank’s April 2024 Commodity Markets Outlook. The price decline from mid-2022 to mid-2023 was 40%, but it has since stabilized. However, since the middle of 2023, indices of commodities prices has largely not altered. The World Bank projects that global commodity prices will fall by 3% in 2024 and 4% in 2025, assuming that geopolitical tensions do not flare up again. Inflation will continue to rise above central bank targets despite this modest decline as per the report World Bank.

Oil prices are still high as the world economy is going down; Brent crude is expected to average $84 a barrel by 2024, as per the World Bank. Prices might rise above $100 in the event of global upheaval, providing investors in oil substantial profits. Secondly, due to geopolitical uncertainty and the robust demand from central banks in developing countries, gold is predicted to reach record highs in 2024. This confirms gold’s reputation as a “safe haven” asset in times of market volatility.

Moreover, the demand for metals like copper and aluminum is being driven by investments in green technologies. Already at a two-year high, copper prices are predicted to grow by 5% in 2024, while aluminum prices are forecasted to rise by 2% due to rising demand for renewable energy infrastructure and electric vehicles.

On the other hand, a report from a large US bank stated that, in May, commodity prices reached all-time highs, driven by increases of 74% in only 1.5 months for U.S. natural gas, copper, gold, and cocoa. A retreat in June was brought on by profit-taking and worries about the U.S. economic slowdown. By year’s end, Natasha Kaneva projects a 10% growth in the commodity market, citing weather-related supply chain disruptions and favorable fundamentals that might raise the price of gas, oil, and agricultural products. Energy transition commodities may see more gains from China’s decarbonization initiatives, and gold prices may reach $2,600/oz by 2025 as a result of Fed rate cuts and central bank easing.

With that said, here are the 13 Best Commodity Stocks To Buy According to Analysts.

A drilling rig in the middle of an industrial mining site, surrounded by rugged terrain.

Methodology:

We sifted through holdings of commodity ETFs to form an initial list of 20 commodity stocks. Then we selected the 13 stocks that had the highest upside potential based on analysts’ consensus. We have only included stocks in our list with an upside potential of 30% or higher. The stocks are ranked in ascending order of the upside potential.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points. (see more details here)

13. Chevron Corporation (NYSE:CVX)

Upside potential: 30.00%

Chevron Corporation (NYSE:CVX) is a global energy business that conducts operations in exploration, production, and refining. It is the second-largest oil company in the United States, producing 3.1 million barrels of oil equivalent per day, which includes 7.7 million cubic feet of natural gas and 1.8 million barrels of liquids per day. Production occurs throughout Europe, Africa, Asia, Australia, and South and North America.

Its refineries can process 1.8 million barrels of oil per day and are located in the US and Asia. Estimated reserves at the end of 2023 totaled 11.1 billion barrels of oil equivalent, comprising 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas.

The company’s oil-leveraged portfolio and the company’s next phase of growth, which is concentrated on expanding its huge, advantageous Permian Basin position, should help it generate greater returns and expand its margin as per analysts.

CVX stated that reduced refining margins were a major factor in the company’s second-quarter 2024 adjusted earnings, which dropped to $4.7 billion from $5.8 billion the YoY. Management blamed operational problems and discrete items as the reason that earnings did not meet market expectations. However, production rose to 3,292 thousand barrels of oil equivalent per day (mboe/d) from 2,959 mboe/d YoY, mostly as a result of PDC Energy’s acquisition and the Permian’s ongoing development, which more than compensated Australia’s downtime.

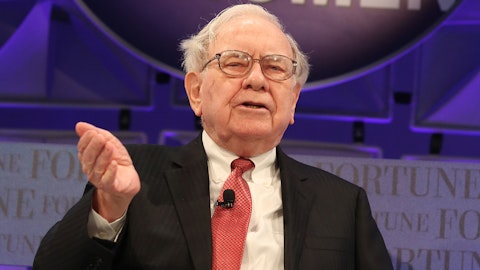

In the second quarter of 2024, Chevron Corporation (NYSE:CVX) appeared in 64 hedge fund portfolios, an increase from 62 in the previous quarter. Warren Buffett’s Berkshire Hathaway is the largest shareholder in the company, with 118,610,534 shares worth $18.55 million.

12. Valero Energy Corporation (NYSE:VLO)

Upside potential: 30.51%

Valero Energy Corporation (NYSE:VLO) is among the largest independent refiners in the United States. It runs fifteen refineries in the US, Canada, and the UK, with a combined daily output capacity of 3.2 million barrels. In addition, the firm owns a 50% share in Diamond Green Diesel, which has the ability to produce 1.2 billion gallons of renewable fuel annually, and 12 ethanol plants with a combined capacity of 1.6 billion gallons yearly.

Valero’s advanced refining capabilities and geographic location, which provide it with more feedstock flexibility, allow it to be well-positioned for nearly any market condition. The company has always had an advantage over rivals because of its more efficient system of fifteen refineries, which enables it to turn low-quality feedstock into high-value products. When domestic light oil discounts started to appear, it changed its focus to processing larger volumes of high-quality discounted domestic petroleum by building more light crude processing facilities, investing in transportation infrastructure, and replacing imported crude with domestic.

Valero Energy Corporation (NYSE:VLO) announced reasonable financial performance in the second quarter of 2024. The main source of revenue during the quarter was the refinery division. Despite the decline from $1.7 billion in Q1 of 2024, sales volume held steady at 3 million barrels per day on average.

Overall, Valero has a cost advantage due to its proximity to cost-effective light crude oil, capacity to process cheap heavy sour crude, and low operating costs due to lower local natural gas prices.

11. Rio Tinto Group (NYSE:RIO)

Upside Potential: 31.09%

Rio Tinto Group (NYSE:RIO) is a prominent global mining firm that engages in the mining of iron ore, copper, aluminum (including alumina and bauxite), and minerals (diamonds, sands, borates, and salt).

The multinational mining company’s current business, was established through the dual-listed structure of the 1995 merger of RTZ and CRA. Each company’s shareholders have equal economic and voting rights, and the two function as a single business entity. Key holdings included the iron ore operations in the Pilbara area, a 30% share in the Escondida copper mine, a 66% ownership in the Oyu Tolgoi copper mine in Mongolia, the bauxite mines of Gove and Weipa in Australia, and six hydroelectric aluminum smelters in Canada.

Demand for commodities is correlated with economic growth worldwide, particularly in China. Rio Tinto has profited handsomely over the last twenty years from its growth in China. China is by far the company’s biggest client, making up almost 60% of sales in 2023.

It is progressing with the $20 billion Simandou iron ore project in Guinea, which, following a 27-year delay, is expected to produce 60 million tons of iron ore annually by 2028. The project, which is in collaboration with Chinese companies and the government of Guinea, intends to ship its first cargo of iron ore in 2025, with the possibility of providing 5% of the world market for seaborne iron ore.

Bank of America Securities’ Jason Fairclough has maintained his buy rating on Rio Tinto, highlighting the company’s dedication to decarbonization through its joint venture Elysis and the promising future of the aluminum market. Rio Tinto Group (NYSE:RIO)’s low-carbon aluminum production and favorable Canadian mining operations are among its strategic advantages.

10. Freeport-McMoRan Inc. (NYSE:FCX)

Upside Potential: 31.86%

Mining company Freeport-McMoRan Inc. operates globally. Four main divisions comprise its mining operations: Molybdenum mines, South American mining, Indonesian mining, and North American copper mines. The Morenci, Cerro Verde, and Grasberg copper mines in Indonesia, the Rod & Refining operations, and Atlantic Copper Smelting and Refining are its segments. Copper sales provide the majority of its revenue.

Freeport-McMoRan Inc. (NYSE:FCX), one of the biggest producers of copper in the United States, has a considerable competitive advantage. This is because increasing production in the mining industry usually necessitates a major capital investment, which makes it difficult for rivals to catch up in the near run. Yet as evidenced by the declining demand in China, this also leaves the stock open to economic downturns. Conversely, a recovery in the economy generally results in higher stock prices, especially when it comes to a reduction in interest rates. This was illustrated in July 2024 when revised payroll figures for May indicated that the Fed might decrease rates, which caused a spike in the firm’s shares of more than 1%.

Given that its Grasberg mine is among the biggest in the world, the firm will have a major edge in satisfying growing demand. The mining industry’s high setup costs and extended lead times allow Freeport-McMoRan to develop significant industrial alliances ahead of possible competitors.

The company was upgraded by UBS from Neutral to Buy with a $55 from $54 price target, noting its improved position following Q3 price corrections and a strong copper outlook. Despite short-term uncertainties, the upgrade displays confidence in the company’s de-risked investment case and views current levels as a positive medium-term entry point.

There are 11 analysts bullish on the stock with a “buy” rating. The average target price set by analysts is $53.27, which is an upside of 31.86%.

9. Antero Resources Corporation (NYSE:AR)

Upside Potential: 34.09%

The Denver-based company Antero Resources Corporation (NYSE:AR) searches for and produces natural gas and natural gas liquids across North America and Canada. The company stated that it has proven reserves of 18.1 trillion cubic feet of natural gas equivalent at the end of 2023. In 2023, production was roughly 3,483 million cubic feet equivalent per day on average, with 63% natural gas and 37% liquids.

The Marcellus and Utica shales in West Virginia and Ohio are used by the company to produce natural gas. It focuses on locations with a comparatively high liquid content; around 35% of its production is made up of natural gas liquids and condensate. This suggests that the company is in a good position to profit from growing butane, propane, and ethane prices. Strong international demand exists for these petrochemical feedstocks, and Antero stands to gain significantly from its position as an anchor shipper on the Mariner East 2 pipeline, which provides direct access to export facilities on the East Coast.

Antero reported earnings per share that were in line with PitchBook consensus, while revenue was below expectations due to lower natural gas prices. Antero has been struggling with prolonged weakness in gas prices, just like the majority of natural gas players. Nonetheless, it has improved its financial performance by shifting development toward natural gas liquids, or NGLs. Despite this, the lower commodity prices have caused the Morningstar analyst Stephen Ellis to nearly completely reduce the fair value from $25 to $24.

Nonetheless, Antero Resources Corporation (NYSE:AR)’s midstream contracts provide it priority access to LNG export markets, allowing it to capitalize on rising global demand for US natural gas.

8. ConocoPhillips (NYSE:COP)

Upside Potential: 35.62%

Independent exploration and production company ConocoPhillips (NYSE:COP) is situated in the US. It generated 3.1 billion cubic feet of natural gas per day and 1.2 million barrels of oil and natural gas liquids per day in 2023, mostly from Norway in Europe, different countries in Asia-Pacific, and the Middle East, as well as Alaska and the Lower 48 states in the United States. As of the end of 2023, proven reserves amounted to 6.8 billion oil-equivalent barrels.

The company has set forth a 10-year plan for cautious investment, stable growth, better returns, and, above all, returning capital to shareholders to set itself apart from competitors both large and small. Its strategy, combined with its dedication to capital constraints and transparent cash return to shareholders policy, makes it a very attractive alternative in the energy market, as per analysts. Its low-cost portfolio allows it to develop high-return investment opportunities in a climate of rising prices, and its sound financial position protects the dividend during a downturn.

ConocoPhillips (NYSE:COP) reported $2.3 billion in adjusted earnings for the strong Q2 2024, up 4.55% YoY due to increased production and price realizations. The full-year production estimate was reduced by the company to 1.93-1.94 mboe/d, while the capital expenditure estimate was raised to $11.5 billion as a result of the Willow project’s advancement and increased activity in the Lower 48. The company’s estimated $112 fair worth is anticipated to hold steady despite growing expenses, as per Morningstar analysts.

It is one of the Best Commodity Stocks To Buy According to Analysts. There are 14 analysts who are bullish on the stock with a “buy” rating. The average target price set by analysts is $143.21, which is a 35.62% increase from the current price.

7. Occidental Petroleum Corporation (NYSE:OXY)

Upside Potential: 36.76%

Occidental Petroleum Corporation (NYSE:OXY) is among the biggest independent producers of gas and oil in the world. Its upstream activities are spread throughout North Africa, the Middle East, and the US. The company claimed to have net proven reserves of around 4 billion barrels of oil equivalent at the end of 2023. In 2023, net production reached 1,234 thousand barrels of oil equivalent per day on average, with around 50% of the output coming from natural gas and 50% from oil and gas liquids.

One of the biggest producers of oil and gas (O&G) in the US, Occidental Petroleum Corporation (NYSE:OXY) also runs subsidiaries in the chemical and renewable energy industries.

It owns a majority equity stake in Western Midstream and operates a consolidated midstream business that offers gathering, processing, and transport services to the upstream segment. The portfolio also consists of a chemical company that manufactures PVC and caustic soda. The latter segment’s profitability is dependent on the health of the overall economy, although it enjoys lower energy and ethylene costs.

The company achieved a strong Q2 2024 performance. An increase in hydrocarbon output beyond analyst forecasts was recorded, totaling 1,258 thousand barrels of oil equivalent per day, or mboe/d. The strong production by Oxy was cost-effective.

Morningstar analysts boosted their fair value estimate for the firm by 7% to $62, noting the impact from Oxy’s midstream business benefiting from lower crude oil and transportation costs from the Permian to the Gulf Coast. The company estimates that these rate reductions will result in annualized savings of $300 million to $400 million, with 40% of the savings beginning in 2025 and the remaining amount achieved in 2026.

With a “Buy” rating, the average 12-month price objective for OXY stock, as estimated by 14 analysts, is $71.36. The average target suggests a 36.76% rise from the current price.

6. The Mosaic Company (NYSE:MOS)

Upside Potential: 37.27%

One of the biggest manufacturers of phosphate and potash fertilizers globally, The Mosaic Company (NYSE:MOS) was established in 2004 from the merger of IMC Global and Cargill’s fertilizer division. The company’s businesses include potash mines in Saskatchewan, New Mexico, and Brazil, as well as phosphate rock mines in Florida, Brazil, and Peru. Moreover, Mosaic operates a sizable fertilizer distribution network in Brazil through Mosiac Fertilizantes, a firm it purchased from Vale in 2018.

Phosphates made up around 33% and potash about 57% of its overall gross revenues in 2023. The remaining funds come from the fertilizer segment in Brazil. The US phosphate rock mines owned by the company and its potash properties in Canada give the company an ongoing source of raw materials for its products. Mosaic should eventually profit from the rising demand for fertilizer around the world.

The historical flooding problems at the firm’s K3 Esterhazy potash mine have been resolved, and this will bring its potash production costs closer to those of its low-cost Canpotex competitor as per analysts.

The Mosaic Company (NYSE:MOS)’s Q2 2024 results highlighted reduced fertilizer prices, particularly potash, as companywide operating earnings fell 37% YoY.

Adam Samuelson, an analyst at Goldman Sachs, kept his Buy rating on the company due to internal efficiency improvements and positive developments in the phosphate market. Future growth is anticipated to be driven by the company’s proactive strategy along with favorable market conditions.

Ariel Focus Fund stated the following regarding The Mosaic Company (NYSE:MOS) in its first quarter 2024 investor letter:

“There were a few notable performance detractors in the quarter. Shares of producer and marketer of crop nutrients, The Mosaic Company (NYSE:MOS), declined in the period, as weaker than expected phosphates and fertilizer volumes as well as higher raw material and production costs weighed on the bottom-line. Management reiterated expectations for tight global grain and oilseed markets in 2024 and believe growers will continue to be incentivized to maximize yields by applying fertilizers. Meanwhile, MOS is focused on cost discipline, free cash flow generation and paying down debt, while continuing to return significant capital to shareholders through buybacks. Given management’s disciplined approach towards capital allocation, we continue to believe the company is well positioned from a risk/reward standpoint.”

MOS is one of the Best Commodity Stocks To Buy According to Analysts since it has promising growth potential, as seen by 14 analysts. It has a consensus Buy rating with an average price target of $33.33 with upside potential of 37.27% from the current stock price.

5. Devon Energy Corporation (NYSE:DVN)

Upside Potential: 41.62%

Devon Energy Corporation (NYSE:DVN) is a gas and oil firm that owns land in a number of the top US shale plays. Its production is primarily derived from the Permian Basin, but it is also significantly present in the Bakken, Anadarko, and Eagle Ford basins. Devon reported net proven reserves of 1.8 billion barrels of oil equivalent at the end of 2023. In 2023, net production was approximately 658,000 barrels of oil equivalent per day on average, with 27% being natural gas and 73% being oil and natural gas liquids.

Following a series of effective capital allocation decisions in 2018, Devon sold its investment in Enlink Midstream, sold off its Canadian heavy oil and Barnett Shale businesses, and merged with WPX. Following these clever moves, the firm was able to recycle cash by selling off noncore or higher-cost businesses. It made a significant turn toward the Delaware and gained fresh exposure in the Bakken through recycled funds. Its production was previously 40%-50% comprised of Barnett Shale and Canadian heavy oil.

Devon has strategically placed properties in the heart of the basins in which it operates. Competitive supply costs and above-average performance are correlated with attractive acreage.

DVN is also one of the “10 Stocks That Have Jim Cramer’s Attention”. In a recent commentary, Jim Cramer stated the following regarding DVN:

“I like Devon Energy, especially considering its strategic acquisitions. However, with natural gas prices low and oil prices struggling to stay above $60, don’t get overly excited about the stock’s immediate prospects.”

The firm had a successful second quarter of 2024 due to record oil production and efficient cost control. A record 335,000 barrels of oil were produced every day, with the Delaware Basin accounting for 66% of the total volume produced in Q2 2024. Devon Energy Corporation (NYSE:DVN) also increased its output estimate for the entire year from 655,000 to 675,000 barrels of oil equivalent per day (boepd) to 677,000-688,000 boepd.

Hence, there are 16 analysts who have collectively rated the stock as a “buy.” The average price objective of $58.63 indicates a possible gain of 41.62% from the current stock price.

4. Teck Resources Limited (NYSE:TECK)

Upside Potential: 41.78%

Teck Resources Limited (NYSE:TECK) is a base metals miner that operates in Chile, Peru, the United States, and Canada for copper and zinc. Following the sale of its metallurgical coal division, copper now accounts for the majority of its EBITDA contribution, with zinc following. Teck ranks third among zinc miners. China is the largest customer of everything Teck Resources extracts from the ground, including copper, zinc, and lead.

The company’s overall copper production is expected to expand by around 75% as a result of its significant new copper mine in Chile at the majority-owned Quebrada Blanca 2, which it operates together with Sumitomo. Rebalancing its portfolio to include low-carbon metals like copper is Teck’s goal, along with several other copper growth prospects. Early in 2023, it sold its oil sands company, and in mid-2024, it sold its coal company.

It is significantly boosting its production of copper in order to capitalize on the growing demand brought about by trends like electrification and decarbonization.

Based on an all-time high in copper pricing and output, the mining company reported a strong second quarter of 2024 with a record $1.7 billion in Adjusted EBITDA. The company is shifting its focus to energy transition metals, specifically copper, after selling its steelmaking coal business strategically for US$7.3 billion. The sale proceeds will be utilized to reduce debt, encourage the growth of copper, and give shareholders a sizable cash return.

Teck Resources Limited (NYSE:TECK) was upgraded from Neutral to Buy by UBS analyst Myles Allsop, who raised the price target from C$76 to C$78. Following the consolidation of commodity prices, the analyst tells investors in a research note that the stock’s risk/reward ratio has improved.

It is one of the Best Commodity Stocks To Buy since it has received a “strong buy” recommendation from 7 analysts. It has an average Wall Street analyst price target of $62.71, indicating an upside potential of 41.78% from the company’s current price.

3. Cleveland-Cliffs Inc. (NYSE:CLF)

Upside Potential: 46.54%

North America’s Cleveland-Cliffs Inc. (NYSE:CLF) is a producer of iron ore pellets and flat-rolled steel. Although it functions through a single reportable market, steelmaking, it is divided into four operating segments based on varied products: tubular, tooling and stamping, steelmaking, and European operations. From extracted raw materials, direct reduced iron, and ferrous scrap to primary steelmaking and subsequent finishing, stamping, tooling, and tubing, it is vertically integrated. Given the wide range of flat-rolled steel products it offers, it caters to a variety of other markets. Geographically, it works in the US, Canada, and other countries. The United States accounts for the majority of revenue. It provides steel to North America’s automotive industry.

Trillions of dollars have been allocated for infrastructure improvements and the establishment of sizable chip manufacturing facilities in the United States by President Biden’s Inflation Reduction Act, the Bipartisan Infrastructure Act, and the CHIPS and Science Act. These will create substantial long-term tailwinds for the revenue of the company. US hot roll steel prices dropped from $775 per ton in May to $745 in June, which can cause issues later on. However, the company has also disclosed plans to pay $2.5 billion to acquire Canadian steelmaker Stelco, which might increase its revenue base.

A positive shift in supply-side adjustments in the steel market led Seaport Global Securities to raise Cleveland-Cliffs Inc. (NYSE:CLF) from Neutral to Buy, with a $16.50 price objective suggested. Despite decreased third-quarter 2024 EBITDA expectations, the company believes that stabilizing steel prices will help the stock.

It is one of the Best Commodity Stocks since 7 analysts have given an average price target of $15.60 with an upside potential of 46.54% from the current stock price.

2. Albemarle Corporation (NYSE:ALB)

Upside Potential: 49.45%

Albemarle Corporation (NYSE:ALB) is among the biggest producers of lithium worldwide. Most of the demand for lithium in the industry originates from batteries, which employ lithium as an energy storage material, especially in electric vehicles. It is a manufacturer of lithium, accounting for the majority of its total revenue. Its upstream resources consist of two joint venture hard rock mines in Australia and salt brine deposits in the US and Chile. The firm runs lithium refining facilities in China, Australia, the US, and Chile. When it comes to producing bromine, which is used in flame retardants, Albemarle is a world leader. It also produces a significant amount of catalysts for oil refinement.

Through two joint venture stakes in Australian mines, Talison (Greenbushes) and Wodgina, as well as its own salt brine assets in Chile and the United States, it produces lithium. One of the most affordable sources of lithium in the world is the Chilean operation. Since spodumene can be immediately turned into hydroxide, talison is one of the best spodumene resources in the world, enabling Albemarle to be one of the most affordable producers of lithium hydroxide. The company also possesses a third sizable resource in the form of Wodgina, a high-grade spodumene asset that is more expensive than Talison.

The fall in lithium prices was reflected in Albemarle’s Q2 2024 results, as adjusted EBITDA for the entire firm fell by 70% YoY. In reaction to declining lithium prices, management announced more reductions in capital expenditures and cost-cutting measures. Most significantly, the company announced that it would cease work on phase three of the Kemerton lithium hydroxide processing facility and place phase two under care and maintenance. Additionally, it will further reduce capital investment in 2025 and beyond and lower unit production costs to increase profits in the aftermath of lower lithium prices.

Nonetheless, being one of the most affordable sources of lithium production in the world, Albemarle Corporation (NYSE:ALB)’s brine operations in Chile and spodumene hard-rock activities in Western Australia provide it with superior lithium assets. Hence, the average price objective of $117.18 indicates a possible gain of 49.45% from the current stock price.

1. Vale S.A. (NYSE:VALE)

Upside Potential: 63.31%

Iron ore and pellets are produced worldwide by Vale S.A. (NYSE:VALE), a sizable mining company. To focus on iron ore, nickel, and copper, the company sold off noncore assets including its steel, coal, and fertilizer businesses in recent years. The bulk materials division, which mainly sells iron ore and iron ore pellets, accounts for the majority of earnings. The relatively smaller base metals category consists of copper mines that produce copper in concentrate and nickel mines and smelters. It has decided to sell a minority 13% ownership in energy transition metals, its base metals business, which is slated to go into effect in 2024 and is likely the first step in separating base metals from iron ore.

The Q2 2024 performance of Vale met analysts’ expectations. The primary driver of earnings, iron ore sales volumes, jumped by 25% from the previous quarter and by 7% YoY. Although first-half sales volumes of 144 million metric tons are 10% higher YoY, Vale maintained its guidance for 2024 output of 310 million to 320 million metric tons. Analysts believe 2024 sales volumes are likely to be lower than production, as has generally been the case in recent years, despite the strong first half and sales generally being greater in the second half due to seasonal factors. Therefore, Morningstar analysts have kept the 2024 iron ore sales prediction at 305 million metric tons, which is unchanged from 2023. The quarter’s average iron ore fines prices of roughly $98 per metric ton and the half-year average of $99 are in line with its full-year assumption of roughly $101.

With record iron ore output and advancements on significant expansion projects adding 30 million tonnes of capacity, Vale S.A. (NYSE:VALE) recently reported good operational performance. Most crucially, Vale’s reduced unit costs in comparison to producers in India and China, as well as high-cost producers like Anglo American, enable it to remain profitable even in low-price conditions. There are 9 analysts who have collectively rated the stock as a “buy”, with an upside of 63%.

While we acknowledge the potential of commodity stocks, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than NVDA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: $30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure: None. 13 Best Commodity Stocks To Buy According to Analysts is originally published on Insider Monkey. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.