In this article, we discuss the 12 AI news and ratings investors are watching right now.

Redefining Innovation with Next-Generation AI

At CNBC’s ‘Money Movers’, Jack Hidary, CEO of Sandbox AQ, emphasized the shift towards B2B-focused AI, positioning it as the next major evolution in artificial intelligence. While language models like those from OpenAI have excelled in consumer applications, Hidary highlighted the untapped potential of quantitative AI (QAI) in driving innovation across industries like pharmaceuticals, automotive, and energy. QAI uses fundamental equations to generate new data, which enables advancements in drug development, materials for energy storage, and aerospace.

Hidary pointed out that large quantitative models are set to transform product development by creating significant economic value, unlike large language models, which primarily reduce operational costs. He predicts that 2025 and beyond will see a growing focus on AI’s role in addressing critical challenges in B2B sectors, from building better batteries to accelerating medical breakthroughs. This evolution underscores a future where AI goes beyond text-based applications, becoming a cornerstone for innovation across various industries.

READ ALSO: 10 AI News Dominating Wall Street Today and 11 Important AI News and Ratings for Investors.

The Role of Generative AI in Transforming Sales Strategies

As per a Mckinsey report, An unconstrained future: How generative AI could reshape B2B sales, GenAI is transforming B2B sales by improving efficiency, fostering growth, and reshaping sales operations. While the core role of sellers including building trust, creating value, and minimizing friction remains unchanged, generative AI enables productivity gains through automation, personalized insights, and strategic guidance.

Companies adopting these tools report improved customer experiences, faster sales processes, and new growth opportunities. Looking ahead, AI integration is expected to redefine sales models, emphasizing customer outcomes, long-term success, and collaboration between human and AI-driven agents. To adapt, businesses must embrace agile strategies, invest in AI-driven capabilities, and align their sales approaches with evolving customer expectations.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. We listed the stocks in ascending order of their hedge fund sentiment taken from Insider Monkey’s database of 900 hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

12. Hyperscale Data, Inc. (NYSE:GPUS)

Number of Hedge Fund Holders: N/A

Hyperscale Data, Inc. (NYSE:GPUS) is transitioning from a diversified holding company focused on acquiring undervalued businesses to exclusively owning and operating data centers for high-performance computing. The company now supports AI ecosystems and other industries through colocation, hosting services, and AI-related software platforms.

On December 23, Hyperscale Data (NYSE:GPUS) entered into a Securities Purchase Agreement with Ault & Company, securing up to $25 million through the issuance of Series G Convertible Preferred Stock. The proceeds will fund the expansion of its MI data center to support infrastructure upgrades for high-performance computing, essential for powering AI solutions, along with repaying existing debt and general working capital needs. The agreement also includes a 9.5% annual dividend, with the potential to pay in common stock for the first two years, and warrants for Ault & Company to purchase up to 4.25 million shares of common stock at $5.92 per share.

11. TeraWulf Inc. (NASDAQ:WULF)

Number of Hedge Fund Holders: 35

TeraWulf is a Bitcoin mining company, which also operates sustainable data centers powered by zero-carbon energy, focusing on Bitcoin mining and expanding its capabilities in high-performance computing and AI infrastructure.

On December 23, TeraWulf signed long-term data center lease agreements with Core42, a G42 company, to provide over 70 megawatts of infrastructure for hosting AI-driven computing at its Lake Mariner facility in New York. The partnership aligns TeraWulf’s energy-efficient, zero-carbon infrastructure with Core42’s AI computing needs, expanding the company’s involvement in AI-driven solutions alongside its Bitcoin mining operations. The agreement also includes provisions for future scalability, with the potential for significant revenue growth.

10. Reddit, Inc. (NYSE:RDDT)

Number of Hedge Fund Holders: 52

Reddit, Inc. (NYSE:RDDT) uses AI to strengthen search functionality and improve user engagement by recommending relevant content and discussions. The company is also advancing its AI efforts with a new chatbot aimed at improving information retrieval and driving traffic back to its platform.

Citi analyst Ronald Josey raised Reddit’s price target to $200 from $120, maintaining a Buy rating. The increase reflects strong advertiser interest, rising engagement, and the success of new products like Reddit Answers. Citi highlighted Reddit’s expanding user base and product launches as key drivers of engagement growth. Advertiser discussions indicate increasing demand due to Reddit’s scale, with potential for more ad spending as tools like Search, Video, Dynamic Product Ads, and campaign automation gain traction. The analyst commented:

“On monetization, our conversations with advertisers suggest growing demand given Reddit’s user scale, and we believe there are multiple avenues for incremental ad spend as newer ad products like Search, Video, Dynamic Product Ads, and its planned end-to-end campaign automation tools launch and gain scale. Although our EBITDA projections go up materially, Reddit is investing across sales, search, AI/ML, and engineers. Reddit is one of our top SMID cap picks for 2025, and we reiterate our Buy rating.”

9. Equinix, Inc. (NASDAQ:EQIX)

Number of Hedge Fund Holders: 55

Equinix, Inc. (NASDAQ:EQIX) powers digital infrastructure that enables AI-driven innovations and seamless interconnections for businesses.

Equinix (NASDAQ:EQIX) has introduced a private AI solution to help businesses train AI models in public and private clouds with improved control, security, and low-latency on-premises deployment. The solution integrates the Dell AI Factory with NVIDIA, combining advanced hardware and software to support demanding AI workloads. This offering is available across Equinix’s 260+ AI-ready data centers, enabling secure and scalable connections to public clouds, private infrastructure, and colocation facilities. Lisa Miller, Senior Vice President, Platform Alliances at Equinix said:

“Our collaboration with Dell Technologies and NVIDIA enables enterprises to harness the power of generative AI while maintaining control over their data and supporting their corporate sustainability goals. This solution is designed to support the most demanding AI workloads and help ensure our customers can innovate and drive outcomes.”

8. Accenture plc (NYSE:ACN)

Number of Hedge Fund Holders: 60

Accenture plc (NYSE:ACN) provides AI-driven services such as data and AI, automation, and intelligent platforms, catering to various sectors like communications, banking, healthcare, and energy. The company also partners with Kyoto University to advance research and innovation in human-centered AI.

On December 20, Mizuho Securities analyst Dan Dolev maintained a Buy rating on Accenture driven by several positive indicators. The company reported an 8% growth in constant currency revenue for Q1 of fiscal year 2025, surpassing its 2-6% guidance. This growth was broad-based, including a notable turnaround in the Financial Services sector, which moved from a 2% decline in Q4 of fiscal year 2024 to a 4% gain in Q1 of fiscal year 2025.

Accenture also saw a rise in generative AI bookings, reaching $1.2 billion, up from $1 billion in the prior quarter. The products segment grew 10% in constant currency, while the consulting segment posted a 6% increase. A slight slowdown in bookings growth is attributed to a tough comparison with the previous quarter. Dolev has set a price target of $428 on Accenture.

7. QUALCOMM Incorporated (NASDAQ:QCOM)

Number of Hedge Fund Holders: 74

QUALCOMM Incorporated (NASDAQ:QCOM) focuses on developing technologies for wireless communication and invests in AI, 5G, and IoT across various industries.

Reuters reported on December 20 that a U.S. jury ruled that Qualcomm’s central processors are properly licensed under its agreement with Arm Holdings, allowing Qualcomm to continue selling chips created using Nuvia technology, which is key to its expansion into the laptop market. However, the jury could not decide if Nuvia breached its license with Arm, leading to a mistrial on that issue. While Qualcomm claimed the verdict supported its innovation rights, Arm expressed disappointment and plans to seek a new trial.

The case centered on royalty rates, with Arm asserting that Nuvia’s custom core designs violated its terms. For now, Qualcomm can advance its AI-focused laptop chips, a market also targeted by competitors, the report stated. The company said:

“The jury has vindicated Qualcomm’s right to innovate and affirmed that all the Qualcomm products at issue in the case are protected by Qualcomm’s contract with Arm.”

6. Micron Technology, Inc. (NASDAQ:MU)

Number of Hedge Fund Holders: 107

Micron Technology, Inc. (NASDAQ:MU) specializes in memory and storage solutions, serving markets such as data centers, automotive, and mobile devices. The company focuses on developing high-speed, low-latency memory and storage technologies, catering to industries including AI and other advanced computing applications.

On December 20, DBS analyst Jim Hin Kwong Au maintained a Buy rating on Micron with a price target of $149, citing the company’s strong position to benefit from the growing demand for AI-driven memory and storage solutions, as per TipRanks. Micron’s advancements in NAND and DRAM technology, along with its focus on next-gen nodes, give it a competitive edge. The digital transformation in data centers is also expected to drive growth, despite a slight earnings miss.

Earlier, Morgan Stanley analyst Joseph Moore Moore lowered Micron’s price target to $98 from $114, maintaining an Equal Weight rating. This adjustment follows the company’s Q2 revenue guidance falling short of expectations, driven by a decline in NAND revenue, with AI growth expected to be impacted by commodity weakness. More details in our report: 10 AI News Investors Shouldn’t Miss.

5. Advanced Micro Devices, Inc. (NASDAQ:AMD)

Number of Hedge Fund Holders: 107

Advanced Micro Devices, Inc. (NASDAQ:AMD) specializes in semiconductor solutions, offering processors and GPUs for data centers, gaming, and embedded systems. The company focuses on providing high-performance computing products for AI-driven applications.

On December 20, Morgan Stanley reduced its price target for AMD from $169 to $158, maintaining an Equal Weight rating on the stock. The firm remains positive on the semiconductors industry, highlighting the AI market’s growth, but notes that a “U-shaped bottom” is expected for other areas. Priorly, Truist had also reduced its price target for AMD from $156 to $145 with a Hold rating on the stock. The firm expressed caution about the semiconductor and AI sectors.

4. NVIDIA Corporation (NASDAQ:NVDA)

Number of Hedge Fund Holders: 193

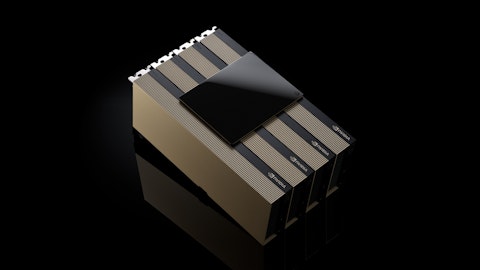

NVIDIA Corporation (NASDAQ:NVDA) is a semiconductor company that specializes in AI-driven solutions, offering advanced computing platforms, networking technologies, and software for various industries, including gaming, automotive, and data centers.

Morgan Stanley remains optimistic about Nvidia, especially when short-term data appears uncertain but long-term fundamentals remain strong. The firm also named the company its “Top Pick.” Concerns include slower demand for previous-generation Hopper products and staggered availability of Blackwell versions. The firm sees this as a natural phase-out rather than a revenue decline, given a substantial backlog expected to sustain sales for several quarters Despite these challenges, the firm expects strong demand for Blackwell to persist and continues to rate Nvidia shares as Overweight, adjusting the price target slightly to $166 from $168.

3. Alphabet Inc. (NASDAQ:GOOGL)

Number of Hedge Fund Holders: 202

Alphabet Inc. (NASDAQ:GOOGL) offers AI-powered solutions across multiple platforms, improving cloud services, enterprise collaboration tools, and consumer products. The company is also dedicated to advancing AI research.

Alphabet’s (NASDAQ:GOOGL) Google has introduced an experimental AI model called Gemini 2.0 Flash Thinking, designed to provide answers to complex questions along with a breakdown of its reasoning process. It provides stronger logical reasoning than the standard Gemini 2.0 Flash model. This mode is available through the Gemini API and Google AI Studio.

To use it via the Gemini API, the users have to specify the model code when making a call. The model generates responses with its reasoning process returned first in the content list. In Google AI Studio, the reasoning is shown in a separate Thoughts panel, which can be expanded. Some key limitations of Thinking Mode include a 32k token input limit, text and image input only, an 8k token output limit, and no integration with external tools like Search or code execution.

2. Microsoft Corporation (NASDAQ:MSFT)

Number of Hedge Fund Holders: 279

Microsoft Corporation (NASDAQ:MSFT) integrates AI into its cloud offerings, productivity software, and business solutions to boost automation, security, and user experience. The company’s AI efforts include advanced cloud services, AI-powered business applications, and cutting-edge language processing and computing capabilities.

Loop Capital analyst Yun Kim raised Microsoft’s price target from $500 to $550, maintaining a Buy rating. The firm attributes the adjustment to updated estimates for select software companies and noted that consensus projections for Microsoft are understated due to substantial capital expenditures tied to its GenAI initiatives. Despite these investments, Loop believes Microsoft’s strong position in the market justifies a significantly higher valuation premium compared to its large-cap software peers, reflecting confidence in its long-term growth potential.

1. Amazon.com, Inc. (NASDAQ:AMZN)

Number of Hedge Fund Holders: 286

Amazon.com, Inc. (NASDAQ:AMZN) is at the forefront of AI development, leveraging the technology to revolutionize shopping, entertainment, and operational processes.

On December 20, Tigress Financial analyst Ivan Feinseth increased the price target for Amazon (NASDAQ:AMZN) to $290 from $245 and maintained a Buy rating on the stock. The firm believes Amazon is benefiting from strong retail trends, its use of generative AI, and its strong fulfillment network. Additionally, the integration of AI into all parts of Amazon’s business is seen as a positive factor. The updated price target represents an upside of 28.5% for Amazon, at the time of writing on December 23.

While we acknowledge the potential of Amazon.com, Inc. (NASDAQ:AMZN) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than AMZN but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure. None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and investors. Please subscribe to our daily free newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.