In this article, we will discuss the 10 Worst Affordable Tech Stocks to Buy According to Short Sellers.

The rapid advancements in Al, computing, and human-machine interaction are the critical drivers for global companies’ strong adoption of technology. Garner believes that agentic Al is expected to emerge over the next 2-3 years – with capabilities going beyond tasks such as summarizing information to taking action. While Al is being used to provide options to the users, this technology will be able to choose the option that is optimal for the user. Therefore, the most important use cases for Al in 2025 will involve the relationships between humans and machines.

The technology domain involves substantial innovation, ranging from groundbreaking Al and Machine Learning advancements to the transformative potential of blockchain and loT. Industry veterans believe that next year should be a transitional one for the generative Al as technology companies will focus on experimenting and finding applications that can help drive efficiency and productivity.

Global Growth with the Help of Cloud, Al, and Cybersecurity

The elevated interest rate environment, concerns regarding recession, and geopolitical challenges led to the slight weakening of global technology spending in 2023. Now, experts are seeing a light on the horizon.

Economists have become more optimistic about the US economy, for the tech sector specifically. Due to strong adoption trends of Cloud and Al, global analysts are now optimistic about a potential return to modest growth in 2024, with stronger prospects for 2025.

Deloitte believes that global IT investments should be aided by double-digit growth in spending for software and IT services in 2024. There are expectations that public cloud spending might see an increase of more than 20%, with stronger demand for cybersecurity. Al investment (not specifically about generative Al) should also contribute to overall spending growth. Economists continue to project that Al-related investments might touch $200 billion globally by 2025, led by the US.

Market experts believe that cybersecurity should play an important role in the comeback. Deloitte recently highlighted that analysts continue to project low double-digit growth in global spending on security and risk management from 2023 to 2024. Adoption should be fueled by the persistent threat landscape, ongoing cloud adoption, the emergence of generative Al, and data privacy and governance regulations.

On the software front, Deloitte projected that nearly all the enterprise software companies will be embedding generative Al in at least some of their products in 2024 and that the revenue uplift (for such companies and cloud providers of gen-Al processing capacity) should approach a US$10 billion run rate by the year-end. On the hardware front, Deloitte believes that the uplift for chips and servers executing generative Al should exceed US$50 billion in 2024.

Technology Trends Defining the Future

The major technology trends are expected to create opportunities, result in innovation, and become imperative to gain a competitive edge in the business world. While AI and ML continue to top the list of tech trends likely to dominate the future, experts believe that Robotic Process Automation (RPA), Blockchain Technology, Industry Cloud Platforms, and Machine Customers are also on the list.

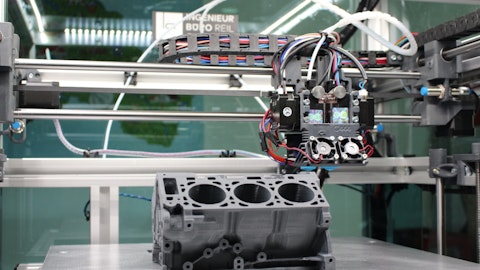

RPA helps organizations to transition to dynamic norms of automating organizational repetitive tasks with effectiveness and high precision. It revolves around employing software robots that perform tasks, like entering data and other related tasks, exactly like humans. Infosys believes that the global RPA market should touch ~$13.74 billion by 2028, reflecting a CAGR of 32.8%. With leading companies reaching the end of the learning curve, the full benefits of RPA are becoming visible. The exponential requirements for automation, a target of increased productivity, and lower operational costs should act as growth drivers.

Next, machine customers refer to AI systems that are empowered to make purchase decisions and have autonomous communication with a business. The technology leverages the options, data, and algorithms to think and transact. As per Gartner, CEOs expect that ~15% – 20% of their revenue should come from machine customers by 2030. The potential to convert billions of machines into customers offers opportunities worth trillions.

Source: Pixabay

Our methodology

To list the 10 Worst Affordable Tech Stocks to Buy According to Short Sellers, we used a Finviz screener to filter out the stocks in the technology industry and we chose the ones having high short interest. Next, we narrowed our list and chose the stocks that are trading at less than the forward earnings multiple of ~22.53x (since the broader market is trading at ~22.53x, according to WSJ). Finally, these stocks were ranked in ascending order of their short interest.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

10 Worst Affordable Tech Stocks to Buy According to Short Sellers

10) QuickLogic Corporation (NASDAQ:QUIK)

Short % of Float (As of 30 August 2024): 11.23%

Forward P/E as of 23 September 2024: 15.46x

QuickLogic Corporation (NASDAQ:QUIK) is a fabless semiconductor company in the US. It provides embedded FPGA intellectual property, low power, multicore semiconductor system-on-chips, discrete FPGAs, and AI software. The company is also engaged in providing end-to-end AI/ML solutions with accurate sensor algorithms using AI technology.

Bears believe that the stock price of QuickLogic Corporation (NASDAQ:QUIK) might come under pressure in the upcoming quarters as a result of the downturn in the broader technology sector, which continues to face challenges related to supply chain and fluctuating demand. Moreover, the company’s stock faced difficulties in the rapidly evolving industry landscape. QuickLogic Corporation (NASDAQ:QUIK)’s growth prospects might be impacted due to scheduling delays. In 2Q 2024, the company saw revenue pushouts as a result of funding delays from customers in the aerospace, defense, and industrial sectors.

On the other hand, market experts opine that QuickLogic Corporation (NASDAQ:QUIK) should be aided by expansion in its product lines and partnerships, targeting a range of sectors such as defense, industrial, and consumer electronics. QuickLogic Corporation (NASDAQ:QUIK) has been expanding its FPGA Chiplet product line and announced significant distribution agreements. The company continues to expect growth acceleration and profitability in late 2025, mainly from the storefront and chiplet opportunities.

Wall Street analysts expect that the Australis eFPGA IP Generator should enhance the company’s ability to quickly create customer-specific Hard IP. QuickLogic Corporation (NASDAQ:QUIK) expects operating expenses (OpEx) to remain flat throughout the year, hinting at controlled spending.

As per Wall Street analysts, the shares of QuickLogic Corporation (NASDAQ:QUIK) have an average price target of $12.50. Notably, 4 hedge funds held stakes in the company at the end of 2Q 2024, as per Insider Monkey’s database.

9) Lyft, Inc. (NASDAQ:LYFT)

Short % of Float (As of 30 August 2024): 13.71%

Forward P/E as of 23 September 2024: 17.18x

Lyft, Inc. (NASDAQ:LYFT) offers online ridesharing services. The company provides ride booking, payment processing, and car transportation services.

The short sellers believe that Lyft, Inc. (NASDAQ:LYFT)’s stock might decline in the remainder of 2024 as there are concerns related to the slowdown in the bookings growth. Lyft, Inc. (NASDAQ:LYFT) anticipates an increase in rider incentives, which might lead to a potential margin compression. Moreover, a competitive landscape and varying market conditions might also weigh over the broader business performance. The macroeconomic concerns about the consumer and interest in autonomous vehicles might act as headwinds for the company’s performance. The company’s nascent venture, Lyft Media, is exposed to significant risks as the company might struggle to establish a foothold and attract sustained advertiser interest.

On the other hand, Wall Street believes that Lyft, Inc. (NASDAQ:LYFT)’s growth should be supported by both ride frequency and ride conversion. The analysts are optimistic regarding the commercialization and monetization of autonomous vehicle technology. Lyft, Inc. (NASDAQ:LYFT) is expected to see enhanced user experience and driver supply as a result of new features such as price lock and improved driver incentives. The company expects positive FCF for FY 2024, with over 90% of adjusted EBITDA anticipated to convert to free cash flow for 2024.

The company’s partnership strategy, which includes a media partnership with Disney, should continue to aid its growth. Its large platform and experience with AV integration have positioned the company well for the future AV market.

Piper Sandler reiterated an “Overweight” rating on the shares of Lyft, Inc. (NASDAQ:LYFT), setting the price objective of $24.00 on 7th June. Lyft, Inc. (NASDAQ:LYFT) was part of 53 hedge funds’ portfolios in the second quarter.

8) Veeco Instruments Inc. (NASDAQ:VECO)

Short % of Float (As of 30 August 2024): 14.53%

Forward P/E as of 23 September 2024: 14.93x

Veeco Instruments Inc. (NASDAQ:VECO) is engaged in developing, manufacturing, selling, and supporting semiconductor and thin film process equipment mainly to make electronic devices in the United States and other countries. The company has developed revolutionary technology products to enable thermal annealing solutions at the most advanced technology nodes.

Bears believe that Veeco Instruments Inc. (NASDAQ:VECO) is exposed to several challenges related to managing costs and maintaining profitability amidst fluctuations in market demand. During 2Q 2024 earnings, the company highlighted that there has been a decrease in customer deposits, mainly in the data storage sector. Also, the utilization rates in the data storage industry continue to be historically low, reducing service run rate business.

Moreover, short sellers highlighted that selectivity has been increasing in the original equipment manufacturers (OEMs) and components space and the sector appears to be in the later stages of its 2nd phase. Bears are cautious about the company’s market penetration potential with ion beam deposition (IBD) technology.

On the other hand, market experts believe that Veeco Instruments Inc. (NASDAQ: VECO) should be aided by strength in its semiconductor business. The company continues to make investments in laser annealing, ion beam deposition, and compound semiconductors, with 3Q 2024 revenue expected to be $170 million to $190 million. Moreover, Wall Street believes that there are growing opportunities in laser and nano anneal technologies, and Veeco Instruments Inc. (NASDAQ:VECO) appears to be well-placed to capture those.

Wall Street remains optimistic about the company’s expanding serviceable available market (SAM) and its gains in laser annealing and nanosecond annealing. They believe that such areas should benefit from industry trends like gate-all-around (GAA) transition, backside power, and high bandwidth memory (HBM).

Oppenheimer increased their target price on shares of Veeco Instruments Inc. (NASDAQ:VECO) from $45.00 to $55.00, giving an “Outperform” rating on 27th June.

Wasatch Global Investors, an asset management company, released its second-quarter 2024 investor letter. Here is what the fund said:

“Veeco Instruments Inc. (NASDAQ:VECO) was the top contributor to strategy performance during the second quarter. The company is a global capital-equipment supplier that designs and builds processing systems used to manufacture high-tech microelectronic devices including semiconductors, photonics, display technologies and power supplies. These devices are integral to applications like advanced computing, machine learning and AI. Veeco has exhibited solid fundamentals and a reasonable valuation for a few years. Going forward, we think the bipartisan CHIPS and Science Act will create an additional tailwind for Veeco, which is one of relatively few U.S. micro-cap companies involved in semiconductor manufacturing and AI.”