In this article, we will look at the 10 Worst 3D Printing and Additive Manufacturing Stocks To Buy.

The Global 3D Printing & Additive Manufacturing Market

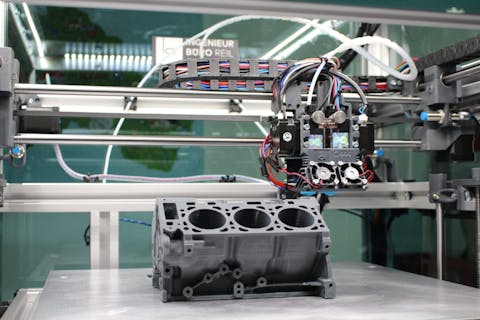

3D printing and additive manufacturing (AM) is a technology that creates three-dimensional objects by layering materials. This technology offers a range of benefits, including the ability to use various materials such as plastics, metals, and biomaterials. It has diverse applications across engineering, healthcare, and entertainment industries and employs different processes like stereolithography and digital light processing. Notably, 3D printing enables the production of parts with high precision and reliability and allows for the creation of customized parts with intricate geometric structures.

According to a report by Precedence Research, the global 3D printing market was valued at $24.61 billion in 2024 and is expected to reach $117.78 billion by 2033, expanding at a CAGR of 19%. North America accounts for over 34% of revenue share, whereas the European market experienced the fastest growth in 2023. Europe is poised to emerge as a hub for additive manufacturing, driven by the presence of numerous industry players who possess in-depth technical expertise in additive manufacturing techniques. In terms of printer type, industrial printers led the way, generating more than 77% of total revenues. Stereolithography technology, which uses ultraviolet (UV) light to create objects from liquid resin, played a significant role, contributing over 11% of total revenues.

The 3D printing market revealed a strong presence of prototyping applications, which emerged as the largest segment, accounting for over 55% of total revenues. This indicates that the technology is being widely adopted to create prototypes, which is a critical stage in the product development process. The prototyping segment’s dominance can be attributed to the ability of 3D printing to rapidly produce complex designs, test, and iterate on them, and refine the final product. This has led to increased adoption in various industries, with the automotive sector being a prime example. The automotive vertical was the leading industry, capturing over 25% of revenue share, as 3D printing is being used to create complex car parts, tooling, and prototypes. Furthermore, the market also saw a significant contribution from metal materials, which dominated the market, accounting for over 53% of global revenue.

ARK Invest Forecasts 40% Annual Growth for 3D Printing Industry

According to Tasha Keen, Director of Investment Analysis and Institutional Strategies at ARK Invest, 3D printing will scale at a 40% annually to reach $180 billion by 2030. With its potential to disrupt industries worth over $4 trillion in revenue, Keen is confident that 3D printing will become a transformative technology that revolutionizes how industries manufacture and produce goods.

According to Keen, 3D printing is already being used extensively in prototyping, tooling, and production, with the latter being the largest addressable opportunity. The automotive industry, in particular, is embracing 3D printing, with companies such as Tesla experimenting with printing entire vehicle underbodies. The technology has the potential to simplify supply chains, reduce labour costs, and improve product strength by eliminating joints. Moreover, 3D printing can significantly reduce automotive development time and design validation costs.

Beyond automotive, 3D printing is also transforming the medical industry, enabling breakthroughs in surgeries and improving patient outcomes. Using patient-specific 3D printed tools and moulds has improved surgical accuracy and results by 40-50% and reduced operating time by 30%. While the 3D printing industry itself has grown slower than expected, Keen believes that software-enabled 3D printers will be a game-changer. These machines, equipped with sensors, can collect data on each print and send it back to manufacturers, enabling them to improve the print process over time. Keen forecasts that this could lead to higher margins for printer manufacturers and create a more sustainable business model.

The 3D printing market is poised for significant growth, driven by its diverse applications across various industries, including engineering, healthcare, and entertainment. The technology’s ability to produce parts with high precision and reliability, as well as its capacity to create customized parts with geometric structures, has made it an attractive solution for companies looking to innovate and improve their product development processes. With that in context, let’s take a look at the 10 worst 3d printing and additive manufacturing stocks to buy.

Our Methodology

For this article, we used online rankings and ETFs to find 15 prominent companies in 3D printing and additive manufacturing. From that list, we shortlisted companies with the highest short interest. The list is sorted in ascending order of their short interest. We have also added the hedge fund sentiment around each stock, as of Q2 2024.

Why do we care about what hedge funds do? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

10 Worst 3D Printing and Additive Manufacturing Stocks To Buy

10. Carpenter Technology (NYSE:CRS)

Short % of Float: 3.07%

Number of Hedge Fund Investors in Q2 2024: 50

Carpenter Technology (NYSE:CRS) is a global leader in high-performance alloy-based materials and process solutions. It serves industries such as aerospace, transportation, defence, energy, industrial, medical, and consumer electronics. The company’s product portfolio includes over 500 specialty alloys, end-to-end manufacturing capabilities, distributed alloys, and value-added services. Carpenter Technology (NYSE:CRS) offers a variety of 3D printing and additive manufacturing services and has an additive manufacturing facility in Alabama.

Carpenter Technology’s (NYSE:CRS) BioDur 108 is an FDA-approved nickel and cobalt-free stainless steel alloy used as an alternative to other stainless steel options. It is ideal for medical implants and other applications where nickel sensitivity is a concern. The alloy is also strong and corrosion-resistant, with a non-magnetic, austenitic phase structure maintained by manganese and a relatively high nitrogen content. This structure provides significant advantages compared to traditional stainless steel, including improved corrosion resistance and strength.

Carpenter Technology’s (NYSE:CRS) titanium alloys, particularly Ti64 ELI Grade 23, is widely used in biomedical applications due to their high strength, excellent corrosion resistance, and biocompatibility. The company has developed Ti64 Grade 23+, an innovative additive manufacturing solution that combines controlled powder chemistry with lower oxygen content and optimized print parameters. This solution provides a 15-20% improvement in mechanical properties, delivers consistent, high-quality results, and enables state-of-the-art device designs through improved mechanical properties and topology optimization.

Carpenter Technology’s (NYSE:CRS) innovative materials and additive manufacturing solutions, such as BioDur 108 and Ti64 Grade 23+, are revolutionizing the medical device industry with their unique properties and capabilities. These materials enable the creation of complex, high-performance devices that meet the most stringent requirements. Despite 3.07% of shares being shorted, 50 hedge funds showed a bullish stance on the stock as of the second quarter and own stocks worth $498.70 million. Hawk Ridge Management is the largest shareholder in the company, holding $65.91 million worth of stock as of June 30.

9. HP (NYSE:HPQ)

Short % of Float: 3.17%

Number of Hedge Fund Investors in Q2 2024: 41

HP (NYSE:HPQ) is a global technology company known for printing, personal computing, and imaging solutions. Although the company is widely recognised for traditional printers, it has also invested significantly in 3D printing technologies.

HP’s (NYSE:HPQ) 3D printing business is a key growth driver for the company. Its Multi Jet Fusion (MJF) technology offers up to 50% faster print speeds and significantly lower costs than traditional 3D printing methods. With its advanced 3D printing solutions, HP (NYSE:HPQ) enables companies to produce customised products with minimal waste and energy consumption.

One key driver of HP’s success in the 3D printing market is its partnership with leading companies in the industry. For example, HP has partnered with Materialise, a leading 3D printing software and services provider, to develop innovative solutions for the aerospace and defence industries. The company has also partnered with Autodesk, a leading design and engineering software provider, to develop integrated solutions for the 3D printing market.

In March, HP introduced a new material, HP 3D HR PA 12 S, for its industrial 3D polymer solutions. This new material sets a new benchmark for surface finish while reducing customer costs using HP’s Jet Fusion 5200 Series 3D printing solutions. Due to its cost-effectiveness, this new material offers a supreme surface finish and is ideal for producing aesthetic parts.

Several customers, including Accel Digital Solutions, Decathlon, Erpro Group, and Materialise, have already adopted the new material. They use it to produce aesthetic parts with enhanced surface finishes and lower production costs. These customers have reported significant benefits from using the new material, including improved print quality, reduced part roughness, and increased productivity.

With its advanced 3D printing solutions, HP enables companies to produce complex products with unprecedented speed and accuracy, opening up new opportunities for innovation and growth. Despite 3.17% of shares being shorted, 41 hedge funds showed a bullish stance on the stock as of the second quarter and own stocks worth $654.99 million. AQR Capital Management is the largest shareholder in the company, holding $186.92 million worth of stock as of June 30.

8. Stratasys (NASDAQ:SSYS)

Short % of Float: 3.62%

Number of Hedge Fund Investors in Q2 2024: 13

Stratasys (NASDAQ:SSYS) is one of the largest and most established 3D printing companies and offers various additive manufacturing solutions. Stratasys (NASDAQ:SSYS) provides 3D printers, materials, and software for prototyping and production, serving healthcare, automotive, aerospace, eyewear, art and design, wearables, and consumer goods. The company’s continued innovation in 3D printing technology has made it a global leader in additive manufacturing.

In March, Stratasys (NASDAQ:SSYS) launched the F3300, a new industrial 3D printer that sets a new standard in fused deposition modelling technology. The F3300 boasts up to twice the speed and throughput of standard 3D printers, making it an ideal solution for manufacturing applications in various industries, including automotive, aerospace, rail, general manufacturing, and medical.

On September 10, the company reported securing over 30 orders for its advanced F3300 industrial 3D printer shortly after its launch. Notable customers include BAE, Sikorsky, the US Department of Defense, and the US Department of Energy. The F3300 industrial 3D printer is designed to meet the needs of performance-oriented organisations and helps overcome manufacturing challenges such as supply chain disruptions, distributed manufacturing, and sustainability regulations.

On September 9, Stratasys (NASDAQ:SSYS), in collaboration with Materialise, announced the launch of the Stratasys Neo Build Processor for Investment Casting, a new solution designed to accelerate the production of high-quality investment casting master patterns. This innovative build processor, developed for Stratasys Neo 450 and Neo 800 stereolithography (SLA) 3D printers, offers up to 50% faster file processing and significantly enhanced print speeds, which result in up to 75% time savings compared to traditional methods.

Stratasys’ (NASDAQ:SSYS) advanced F3300 industrial 3D printer and the Stratasys Neo Build Processor for Investment Casting have set a new standard in fused deposition modelling technology by offering up to twice the speed and throughput of standard 3D printers. As a global leader in additive manufacturing, Stratasys (NASDAQ:SSYS) is well-positioned to continue driving innovation and growth in the industry. Despite 3.62% of shares being shorted, 13 hedge funds showed a bullish stance on the stock as of the second quarter and own stocks worth $70.59 million. Rubric Capital Management is the largest shareholder in the company, holding $50.07 million worth of stock as of June 30.

7. Align Technology (NASDAQ:ALGN)

Short % of Float: 3.93%

Number of Hedge Fund Investors in Q2 2024: 47

Align Technology (NASDAQ:ALGN) is a medical device company that specializes in designing, manufacturing, and marketing 3D digital dentistry products and services. The company uses 3D scanning and digital technology to design and produce its custom aligners and is is best known for its Invisalign product, a clear aligner system used for orthodontic treatment.

Align Technology (NASDAQ:ALGN) has invested heavily in research and development and has launched several innovative products. The company recently launched the Palatal Expander system, a 3D-printed orthodontic device that addresses the need for widening the upper arch in growing patients. The system has received positive feedback from doctors and patients and is expected to be a significant growth driver for the company.

Align Technology (NASDAQ:ALGN) is expanding its presence in international markets, particularly in Asia Pacific, with a large and growing demand for clear aligners. In Q1, the company reported that international shipments grew 17.5% year-over-year, driven by strong demand in Asia Pacific. The company is well-positioned to capitalize on this growth, with a strong distribution network and partnerships with local dental professionals.

The demand for clear aligners is growing rapidly, driven by increasing awareness and adoption of orthodontic treatment among consumers. According to a report by Fortune Business Insights, the global clear aligners market was valued at $4.66 billion in 2024 and is forecasted to reach $28.15 billion by 2032, exhibiting a CAGR of 25.2%. Align Technology (NASDAQ:ALGN) is well-positioned to capitalize on this growth, with its Invisalign product being the market leader in the clear aligner market. Despite 3.93% of shares being shorted, 47 hedge funds showed a bullish stance on the stock as of the second quarter and own stocks worth $1.11 billion. Citadel Investment Group is the largest shareholder in the company, holding $21.47 million worth of stock as of June 30.

6. Jabil (NYSE:JBL)

Short % of Float: 4.04%

Number of Hedge Fund Investors in Q2 2024: 51

Jabil (NYSE:JBL) offers additive manufacturing services as part of its broader advanced manufacturing capabilities. The company works with industries such as healthcare, aerospace, and automotive, delivering innovative solutions that include both traditional and additive manufacturing technologies. The company is revolutionizing the manufacturing industry through services, including material development, 3D printing, and digital parts production, to help customers design, make, and deliver products more efficiently.

The company’s additive manufacturing services offer 3D printing from prototype to production, with expertise in manufacturing rigours to ensure parts perform as expected. The digital parts and services division enables customers to shift from conventional design to innovative Design for Additive Manufacturability (DfAM), increasing efficiencies and design flexibility.

On September 10, 2024, Jabil Inc. (NYSE:JBL) announced that it had signed a Memorandum of Understanding (MoU) with the Tamil Nadu state government in India to establish a new facility in Tiruchirappalli, Tamil Nadu/ This move is seen as a strategic step by Jabil to tap into India’s growing manufacturing sector and complement its existing facility in Pune, Maharashtra, which has been operational since 2003. Commenting on the occasion, Matt Crowley, Executive Vice President of Global Business Units at Jabil (NYSE:JBL), said:

“India is emerging as a key manufacturing hub, and our expansion in India will enable us to meet and grow with the future needs of our customers.”

While 4.04% of the company’s shares are shorted, 51 hedge funds have maintained a bullish sentiment on the stock, with stakes worth $1.05 billion as of the second quarter. Alyeska Investment Group is the largest shareholder in the company, holding $165.87 million worth of stock as of June 30.

5. Nano Dimension (NASDAQ:NNDM)

Short % of Float: 7.06%

Number of Hedge Fund Investors in Q2 2024: 8

Nano Dimension (NASDAQ:NNDM) is an Israeli company that designs and manufactures Additive Electronics and Additive Manufacturing 3D printing machines. The company specializes in advanced 3D printing technologies, particularly printed circuit boards (PCBs) for electronics. Its innovative technology allows for the rapid prototyping and production of electronic components, integrating conductive materials and circuits. The company serves the defence, aerospace, and automotive industries.

One of the most significant opportunities for Nano Dimension (NASDAQ:NNDM) is its ability to make strategic acquisitions in the additive manufacturing market. The company has previously stated that it has 3-5 acquisition opportunities ahead of it, with two of those being very large companies. Potential acquisition targets include companies such as Velo3D, Desktop Metal, and Markforged, which could provide the company with access to new technologies, markets, and customers.

On July 2, Nano Dimension (NASDAQ:NNDM) announced the acquisition of 2. Desktop Metal (NYSE:DM) in an all-cash transaction. The acquisition is valued at $183 million, or $5.50 per share, although the price may be adjusted downward to $4.07 per share, depending on certain conditions. The acquisition combines two companies with complementary product portfolios in the additive manufacturing (AM) industry. Nano Dimension (NASDAQ:NNDM) is a leader in 3D-printed electronics and high-performance polymer, ceramic, and metal applications, while Desktop Metal (NYSE:DM) has platforms focused on industrial-volume scale applications of metal and polymer with proprietary materials, software, and sintering solutions. The combined company will is expected to generate significant synergies and cost savings opportunities. The acquisition is expected to accelerate the industry’s transition to mass production and create a leader in the industry. The company will also have a diversified customer base, including blue-chip customers such as Amazon, Caterpillar, and Tesla, and will serve a range of industry verticals, including automotive, aerospace, defence, industrial, medical industries and R&D.

Nano Dimension (NASDAQ:NNDM) is implementing cost-cutting measures, which should move it closer to breakeven over the next 1-2 years. With a negative enterprise value, the company is well-positioned to capitalize on the weakness in the additive manufacturing market and make strategic acquisitions to drive growth and profitability. Despite 7.06% of shares being shorted, 8 hedge funds showed a bullish stance on the stock as of the second quarter and own stocks worth $60.35 million. Anson Investments is the largest shareholder in the company, holding $45.38 million worth of stock as of June 30.

4. DENTSPLY SIRONA (NASDAQ:XRAY)

Short % of Float: 8.69%

Number of Hedge Fund Investors in Q2 2024: 27

DENTSPLY SIRONA (NASDAQ:XRAY) provides 3D printing solutions for dental applications. The company uses digital and 3D technology for dental treatments, such as creating dental prosthetics and crowns.

DENTSPLY SIRONA’s (NASDAQ:XRAY) Lucitone Digital Print Denture System is a revolutionary 3D printing solution that enables dental practices and labs to produce high-quality dentures in-house. The system uses a combination of three resins, including Lucitone Digital Print 3D Denture Base, Lucitone Digital IPN 3D Premium Tooth, and Lucitone Digital Value Trial Placement, which are provided in a convenient Primeprint cartridge system. This allows for safe and clean usage, and the automated and software-supported workflow requires fewer manual steps than traditional denture production techniques.

The company recently acquired FDA and CE clearance Lucitone Digital Print Denture System. This clearance is expected to increase sales for the company, as more dental practices and labs adopt the technology. Additionally, the system’s ease of use and convenience will attract new customers to the company, including those who may not have previously considered 3D printing technology.

The Lucitone Digital Print Denture System enables DENTSPLY SIRONA (NASDAQ:XRAY) to expand its customer base, increase sales, and maintain its market leadership in the dental 3D printing market. Furthermore, the system’s ability to simplify the workflow and reduce the amount of manual labour needed to clean and cure dentures will make it an attractive option for dental professionals looking to streamline their operations.

While 8.69% of the company’s shares are shorted, 27 hedge funds have maintained a bullish sentiment on the stock, with stakes worth $205.67 million as of the second quarter. First Eagle Investment Management is the largest shareholder in the company, holding $325.57 million worth of stock as of June 30.

3. FARO Technologies (NASDAQ:FARO)

Short % of Float: 8.80%

Number of Hedge Fund Investors in Q2 2024: 20

FARO Technologies (NASDAQ:FARO) is an information technology company specializing in software-driven 3D measurement, imaging, and realization solutions. The company has established itself as a strong competitor in 3D printing and expanded its reach through strategic acquisitions.

FARO Technologies’ (NASDAQ:FARO) cloud-based Sphere platform has the potential to drive growth and increase profitability. The company’s recent launch of Sphere XG, a unified cloud platform that enables users to view and analyze 3D data, is a significant step forward in this strategy. Sphere XG allows users to combine 360° photos, 3D point clouds, and building information models (BIM) in one platform to provide a comprehensive solution for customers. The potential for Sphere XG to drive growth is significant. The market for 3D capture and virtual management tools is growing rapidly, driven by the increasing adoption of digital technologies in industrial sectors.

The company’s cost-cutting efforts have been successful, with non-GAAP operating expenses down 10% year-over-year (YoY) in Q4. This reduction in costs has helped to offset the decline in revenue, resulting in an adjusted EBITDA margin of 13.3%, a 2% YoY increase. The company’s free cash flow margin was approximately 15% in Q4, significantly improving from previous quarters. This increase in free cash flow results from the company’s focus on working capital efficiency the company expects to be cash flow positive in 2024, which will provide it with the flexibility to invest in growth initiatives and pursue strategic opportunities.

FARO Technologies (NASDAQ:FARO) is well-positioned to capitalize on the growing demand for 3D capture and virtual management tools. While 8.8% of the company’s shares are shorted, 20 hedge funds have maintained a bullish sentiment on the stock, with stakes worth $10.346 million as of the second quarter. Divisar Capital is the largest shareholder in the company, holding $29.42 million worth of stock as of June 30.

2. 3D Systems (NYSE:DDD)

Short % of Float: 12.15%

Number of Hedge Fund Investors in Q2 2024: 15

3D Systems (NYSE:DDD) is one of the pioneers in the 3D printing industry and offers a range of products and services to various industries, including healthcare, aerospace, and defence.

3D Systems (NYSE:DDD) has a strong position in the orthopedic market, focusing on end-to-end solutions for custom implants. The company has also received FDA clearance for its 3D-PEEK cranial implants and has a growing presence in the dental market. These opportunities, combined with its expertise in 3D printing technology, position 3D Systems for long-term growth and success.

3D Systems (NYSE:DDD) has faced significant challenges recently, including low demand for printer hardware and intense competition from Chinese manufacturers. However, the company has been engaged in a restructuring effort since Q4 2023, closing and consolidating 15 sites globally and reducing its workforce. These efforts will result in significant cost savings, with operating expenses targeted at under $60 million in the fourth quarter.

3D Systems (NYSE:DDD) has reported sequential growth in the second quarter, and management expects this trend to continue throughout the year. The company’s guidance for 2024 revenue is $450-460 million, representing a return to year-over-year growth in the fourth quarter. With a strong pipeline and increasing demand for consumables and services, 3D Systems (NYSE:DDD) is well-positioned to achieve its revenue targets. Despite 12.15% of shares being shorted, 15 hedge funds showed a bullish stance on the stock as of the second quarter and own stocks worth $18.18 million. ARK Investment Management is the largest shareholder in the company, holding $9.45 million worth of stock as of June 30.

1. Xometry (NASDAQ:XMTR)

Short % of Float: 14.86%

Number of Hedge Fund Investors in Q2 2024: 9

Xometry (NASDAQ:XMTR) is an on-demand manufacturing marketplace that connects customers with suppliers for custom manufacturing services, including 3D printing, CNC machining, and injection moulding. The company’s platform offers rapid prototyping and production across multiple industries, such as aerospace, automotive, and healthcare. Xometry (NASDAQ:XMTR) uses advanced technologies to provide cost-effective and quick-turnaround solutions for businesses of all sizes.

In Q2, Xometry’s (NASDAQ:XMTR) revenue increased 19% year-over-year (YoY) to $133 million. This growth was driven by the company’s international segment, which grew 31% YoY. The company’s Q2 2024 marketplace gross margin was 33.5%, which is impressive considering the competitive nature of the on-demand manufacturing industry. Moreover, management reaffirmed guidance of 20% revenue growth and exiting 2024 with a marketplace gross margin of approximately 35%.

The company’s growth in the international segment demonstrates its potential for growth outside the competitive US market. With fewer direct competitors in global markets, Xometry (NASDAQ:XMTR) can increase its margins and establish itself as a leading player in the on-demand manufacturing industry. The company’s expansion plans outside the US will increase operating expenses in the short term and help achieve a positive EBITDA for the company.

The company is also trying to scale its supplier network and increase its marketplace revenue which will lead to higher gross margins and improved profitability. A higher gross margin will contribute to improved profitability and increase Xometry’s competitiveness in the market.

While we acknowledge the potential of Xometry (NASDAQ:XMTR) to grow, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than XMTR but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: $30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure. None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and investors. Please subscribe to our daily free newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.