Energy and EV stocks continue to be in focus as Donald Trump signs a bunch of executive orders that will have far-reaching impacts on many industries. He even revoked an executive order related to AI, though it addresses a matter that may not directly impact a company’s sales in the near term. AI stocks are going under the radar for a few weeks but with earnings season about to get into full gear, we may not have the same opportunities in a couple of weeks that we have now.

Many of the chip stocks continue to stay undervalued. The main reason is the lack of demand in the niche industries that these companies serve. But this demand will eventually shift at some point in 2025, which is what makes them so attractive to consider at this point.

We came up with 10 stocks that we believe are undervalued, near their 52-week lows, and present good investment opportunities. To come up with the 10 undervalued chip stocks that are near 52-week lows, we only considered stocks with a market cap of between $10 billion and $200 billion that hit their 52-week lows recently.

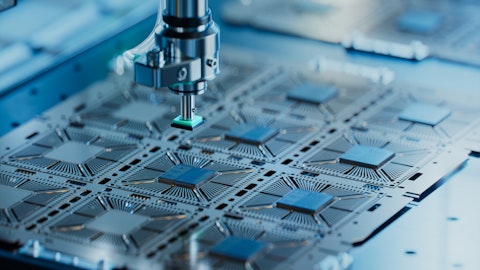

Close-up of Silicon Die are being Extracted from Semiconductor Wafer and Attached to Substrate by Pick and Place Machine. Computer Chip Manufacturing at Fab. Semiconductor Packaging Process.

10. Micron Technology Inc (NASDAQ:MU)

Micron Technology sunk on its most recent earnings report after the company gave weak guidance for the ongoing fiscal first quarter (Dec-Feb). The reason cited by the management was the weakness in consumer-centric markets, something that could also negatively impact the second quarter. As a result, Micron stock plunged 13% in after-hours trading on the day of the announcement last month.

Micron Technology’s 52-week low is $79.15, a level hit in February last year. Since then, the stock has come very close to testing this level 3 times, bunding back strongly on all occasions. This would suggest there is some inherent value in the company’s stock at these levels. After the recent plunge in stock price, the stock is already back at almost the same levels as before the announcement.

This strong surge is what gives us the confidence that Micron’s troubles are short-term and investors are willing to ignore them. Anyone who listened to Sanjay Mehrotra on the earnings call would share this sentiment:

While consumer-oriented markets are weaker in the near term, we anticipate a return to growth in the second half of our fiscal year. We continue to gain share in the highest margin and strategically important parts of the market and are exceptionally well positioned to leverage AI-driven growth to create substantial value for all stakeholders.

Semiconductors are a cyclical industry so downturns are expected. However, if the second fiscal half-year is going to bring a boom for Micron, the time to take a position in the stock is now, even if the stock is already back over 33% from its 52-week lows.

9. Texas Instruments (NASDAQ:TXN)

When the CHIPS ACT was introduced by the Biden government in Aug 2022, Texas Instruments was considered one of the biggest beneficiaries. The company doubled down on expansions on the back of this government support and built capacity it wouldn’t even need in the next 5 years. This didn’t sit well with some investors and the company even had to deal with an activist investor along the way. More than two years later, the company’s stock price stands exactly where it was when the legislation was introduced.

The stock’s returns since 2021 are dismal. The company’s management has to take part of the blame, as it prioritized expansions at the expense of shareholder value. The long-term value generated by the company’s plans is clearly not being respected by the shareholders. This could change soon though. Donald Trump’s Secretary of Commerce pick has made clear that the CHIPS ACT will continue during the Trump government. There is a concern that the scheme may be paused for reconsideration. Intel and Samsung are two companies that have fared even worse than TXN and don’t have a very optimistic outlook. So the money may be diverted to companies that can use it better.

TXN has so far received $1.6 billion under the CHIPS ACT and if that continues, the company won’t have any issue materializing its grand expansion plans. The company is building 4 fabs in Sherman Texas, the first of which will be production-ready this year. When the effects of that trickle down to the bottom line, investors will be happy to price in the next 3 fabs as well, and with it, a sizable chunk of the future growth too, making it an attractive buy at these levels.