In this article, we will take a look at the 10 penny stocks with high growth potential. If you want to skip our discussion on penny stocks and their historical performance, go directly to the 5 Penny Stocks With High Growth Potential.

Investors normally avoid going into the realm of penny stocks that trade under the $5 range as it is deemed a dangerous arena, where an investor stands to lose a significant amount of money. Penny stocks usually experience wild swings in prices due to numerous factors. The weak volumes, uncertain business fundamentals, and significant short-selling positions held by investors magnify the impact of any economic development on penny stocks. However, a Bloomberg report revealed that in 2021 a company’s performance was better when its share price was lower. Russell 3000 stocks with average share prices under $2 increased by over 13% last year, while shares under $5 rose by almost 10%. That represents an increase of over three times compared to what stocks with share values of over $100 witnessed during the same time period. Furthermore, approximately 38 billion shares had been traded in off-exchange markets in 2021, reflecting a seven times increase from the average one year prior. Meanwhile, on poorly regulated trading networks maintained by companies like OTC Markets, over 1 trillion shares were traded in December 2021.

In the last ten years, the number of penny stocks that have outperformed the broader market is much higher than stable blue-chip stocks. While most big-cap firms like Microsoft Corporation (NASDAQ:MSFT), Occidental Petroleum Corporation (NYSE:OXY), and Apple Inc. (NASDAQ:AAPL) offer security to investors through dividends, they do not offer the opportunity to earn exponential returns like penny stocks. The stock price of some corporations moves into the penny stock region of under $5 when they are forced to dilute their shareholding to raise equity to either support or grow their operations. However, it must be noted that some of the companies that use this equity wisely can ramp up their operations significantly and yield healthy shareholder returns in the long run.

Some investors may wonder that it might not be the right time to enter this speculative area of investing, with the US Federal Reserve expected to increase the benchmark interest rates by 75 basis points (bps) when it convenes later this month. This move is expected to depress the growth outlook of the stocks and put the valuation under pressure. However, many analysts believe that the stocks have already incorporated this development into their valuation as the Federal Reserve Chairman has been taking a hawkish stance on controlling inflation since the last month. The depressed valuation has made these high-growth potential companies look cheap in terms of valuations. If you think darker times are ahead, you can always employ a dollar-cost averaging strategy to build your portfolio and try to average out your position near the bottom to yield maximum return in the long run.

Image by Steve Buissinne from Pixabay

Our Methodology

We have looked at the broader themes that are expected to gain momentum in the coming decade and how these shortlisted penny stocks intend to play on these themes. Furthermore, we have analyzed the business fundamentals and growth prospects of these companies. The earnings reports and analyst ratings have also been included to provide investors with a holistic investment context. All the stocks discussed are priced under $5 as of September 9.

10 Penny Stocks With High Growth Potential

10. Wrap Technologies, Inc. (NASDAQ:WRAP)

Number of Hedge Fund Holders: 1

Wrap Technologies, Inc. (NASDAQ:WRAP) is a Tempe, Arizona-based developer of public safety technologies and services.

BolaWrap 150 is the headline product of the company that accurately throws a 7.5-foot Kevlar cord from a distance of 10 to 25 feet to restrain an individual. The individual can be in a moving or stationary position. Furthermore, Wrap Technologies, Inc. (NASDAQ:WRAP) offers Wrap Reality VR Training to law enforcement officers to handle real-world circumstances more effectively.

Following the Q2 2022 results published on August 10, the company revealed that it anticipates strong sales momentum during the second half of the year as supply chain-related challenges would ease. Furthermore, the transition from the previous model, BolaWrap 100, to the new BolaWrap 150 will be made at a faster pace. Wrap Technologies, Inc. (NASDAQ:WRAP) is on a path to achieving a cash-flow breakeven level by the end of next year and becoming profitable by 2024. The Street anticipates Wrap Technologies, Inc. (NASDAQ:WRAP) to see its revenue grow by 120% YoY to $18.06 million by the end of 2023.

9. Sunworks, Inc. (NASDAQ:SUNW)

Number of Hedge Fund Holders: 3

Sunworks, Inc. (NASDAQ:SUNW) is a Provo, Utah-based provider of solar services through its partner organizations across 15 states in the US. The company, founded in 2002, builds customized commercial and residential solar power systems.

Experts believe that Sunworks, Inc. (NASDAQ:SUNW) is one of the few solar companies that is pursuing a differentiated strategy by focusing on controlling the aspects of procurement, logistics, and installation and making it a key competitive advantage in the solar and storage space. This strategy makes the company one of the best penny stocks with high growth potential. Analysts anticipate Sunworks, Inc. (NASDAQ:SUNW) to reach a top line of $149.20 million by the end of this year. This would signify a YoY increase of 47.50%, which is further expected to increase by 18.1% in 2023 to $176.20 million.

During Q2 2022, Sunworks, Inc. (NASDAQ:SUNW) saw its revenue grow by 13.4% YoY to $36.4 million and outperformed the consensus forecast by $2.95 million. Meanwhile, gross profit grew by 11.4% YoY to $16.9 million during the same period.

8. CleanSpark, Inc. (NASDAQ:CLSK)

Number of Hedge Fund Holders: 5

CleanSpark, Inc. (NASDAQ:CLSK) is a Henderson, Nevada-based sustainable bitcoin mining company. We have included the stock in our list of penny stocks with high growth potential as it provides exposure to the world of cryptocurrencies, which has now become a mainstream theme in recent times and is expected to see manifold growth in the coming years.

Bitcoin is the biggest cryptocurrency in the world and takes up over 70% of the cryptocurrency share. In a report issued on August 10, Mike Colonnese at H.C. Wainwright gave CleanSpark, Inc. (NASDAQ:CLSK) stock a Buy rating with a target price of $6. The target price provides a potential upside of over 32% from the closing price as of September 9. The analyst highlighted that CleanSpark, Inc. (NASDAQ:CLSK) is showing strong signs of strategy execution despite the tough environment for bitcoin miners due to rising inflation. The company acquired 10,000 bitcoin mining machines on September 7 and mined 395 bitcoin in August 2022. CleanSpark, Inc. (NASDAQ:CLSK) has tripled its hash rate in the last 12 months.

Intrinsic Edge Capital was the leading hedge fund investor in CleanSpark, Inc. (NASDAQ:CLSK) during Q2 2022.

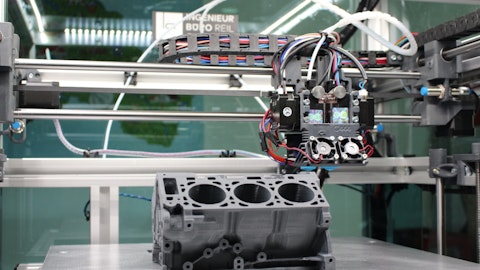

7. Nano Dimension Ltd. (NASDAQ:NNDM)

Number of Hedge Fund Holders: 8

Nano Dimension Ltd. (NASDAQ:NNDM) is a Waltham, Massachusetts-based 3D printing company that is involved in fabricating printed circuit boards (PCB) and other electronic devices.

The company, founded in 2012, has made the bold move of taking a stake of just over 12% in Stratasys Ltd. (NASDAQ:SSYS). The Rehovot, Israel-based Stratasys is one of the oldest and leading 3D printing companies in the world and is a known brand on the polymer side of the 3D printing industry. Nano Dimension Ltd. (NASDAQ:NNDM) has made this move to gain a market leadership position in the industry and provide its shareholders with a flavor of the blue ocean strategy. The company is already undergoing accelerated growth, and the exposure in Stratasys is expected to provide a presence in the stable and mature side of the 3D printing industry. Nano Dimension Ltd. (NASDAQ:NNDM) has seen its revenue increase by four times in the last 12 months and by a factor of 10 in the last two years.

Citadel Investment Group increased its stake in Nano Dimension Ltd. (NASDAQ:NNDM) by 136% during Q2 2022.

6. Safe Bulkers, Inc. (NYSE:SB)

Number of Hedge Fund Holders: 9

Safe Bulkers, Inc. (NYSE:SB) is a Greek provider of marine dry bulk transportation services and has handled cargoes of coal, grain, and iron ore on some of the renowned shipping routes of the world since 1958.

The company has 42 vessels under its ownership with an average age of 10.4 years as opposed to an average age of nearly 11 years for dry bulk carriers. On July 20, Omar Nokta at Jefferies initiated coverage on Safe Bulkers, Inc. (NYSE:SB) stock with a Buy rating and a target price of $5. The analyst anticipates the company to capture higher earnings in the future due to its relatively new fleet. Nokta added that Safe Bulkers, Inc. (NYSE:SB) is an under-the-radar dry bulk company with a rich history and a strong fleet. Since the start of the conflict between Russia and Ukraine, marine dry bulk companies have gained prominence as Europe is facing energy-related challenges due to its strained relationship with Russia. These factors make Safe Bulkers, Inc. (NYSE:SB) a penny stock with high growth potential.

Besides popular firms like Microsoft Corporation (NASDAQ:MSFT), Occidental Petroleum Corporation (NYSE:OXY), and Apple Inc. (NASDAQ:AAPL), penny stocks such as Safe Bulkers, Inc. (NYSE:SB) are also attracting hedge fund investment now. Of the 895 hedge funds tracked by Insider Monkey at the end of Q2 2022, Safe Bulkers, Inc. (NYSE:SB) was held by 9 hedge funds.

Click to continue reading and see 5 Penny Stocks With High Growth Potential.

Suggested Articles:

- Best Artificial Intelligence Stocks To Buy Now

- Top 7 Best Stocks To Buy According to Stephen Feinberg’s Cerberus Capital Management

- Top 8 Stock Picks of Jeff Ubben’s Inclusive Capital

Disclose. None. 10 Penny Stocks With High Growth Potential is originally published on Insider Monkey.