The list of the most successful penny stocks that made it big ranks some of the biggest companies today that were selling their shares as penny stocks in the first phases of their business development. Today, penny stocks are known as one of the most volatile market options you can buy. The reason for this is the high number of fraud schemes that involve the stocks traded over-the-counter.

Fraudulent brokers often intentionally purchase a large batch of penny stocks and create an artificial hype, in order to sell their shares at a higher price. This scheme is called ‘pump and dump,’ and there’s also another (opposite) variant of this scam called ‘short and distort.’ In addition to these common frauds, some penny stocks have purposely entered the market so that they can be extensively sold. The companies that stand behind them don’t have any funds, business operation or plan and they completely rely on the market hype.

Copyright: rawpixel / 123RF Stock Photo

Still, some penny stocks are the shares of real and ambitious small and medium-sized businesses. These can be small companies that are just developing their business idea and don’t satisfy all the criteria required for the major exchange listings. On the penny stock market, you can also find companies that have experienced financial problems and possible liquidation, so they can’t be listed on the major exchange anymore.

There are no uniformed criteria that you can use for determining, which penny stock will make it big. If you want to invest money in the OTC market, you should conduct an elaborate research for every stock you plan to buy. Unlike major exchanges, over-the-counter ones don’t offer comprehensive information about the stock’s history and prospects. In most cases, you will need to find the information about each company online. Sometimes this can be tricky because many small companies don’t have their websites and you won’t be able to find them on the most popular business listings.

If you want to find out which penny stock is the most perspective one, you will need to conduct four different analysis. These include:

Checking the stock’s fundamentals – includes checking company’s financial statements and parameters like revenue, liability, profits, assets, net worth, and expenses;

Conducting a life cycle’s analysis – helps you to determine the development phase, company is in;

Industry check– is very important because some industries like biotech or resource filed are common ground for penny stock frauds;

Management check – gives you information about the company’s management and helps you to determine whether they will upgrade company’s business, or ruin it completely;

When buying penny stocks, you should only stick to the options for which you can successfully conduct all these analyses and find all the data you need.

There are many articles that list the most successful penny stocks that made it big, so we didn’t have problems with finding our sources. As our main sources, we have taken the two articles about penny stocks, we have found on Benzinga and Balance. We used these two articles to craft our list, and then we ranked our contestants by checking their current net worth. We found this data on Google, but if you want to make a more detailed analysis, you should find more data on broker and exchange website. While searching for this information, the Insider Monkey’s article that lists the Largest Stock Exchanges in the World can be very helpful.

10. Plug Power Inc. (PLUG)

Price: $2.25;

As a company that produces and sells hydrogen cells, the PLUG stock’s price is growing together with the ecological awareness in the United States. For some time this company has been selling its shares for less than $1, and today their price has risen to the modest $2.25. Although this still seems quite small, many experts have stated that the Plug Power Inc. will continue to grow in the years to come. Hydrogen cells are becoming more popular in the recent years, especially after the companies like Mercedes, Hyundai, and Honda released their first fuel cell prototypes.

Copyright: welcomia / 123RF Stock Photo

9. Pier 1 Imports (PIR)

Price: $4.55;

Many of the companies you will find on this list don’t have the dreamy story most people expect from fast rising stocks. The number 9 on our list of most successful penny stocks that made it big is Pier 1 Imports that was once a solid company with a large set of products that included everything from large furniture pieces to gifts and various decorative accessories. PIR reached its all-time high share price in 2003, and since then the company has been facing a constant decline for more than seven years. This was propelled by the growing competition and the 2008 Economic crisis. Since then the company has made drastic changes and now this stock is facing a solid growth. At the moment the Pier 1 Imports shares can be purchased for $4.55 a piece.

Rawpixel.com/Shutterstock.com

8. American Axle and Manufacturing (AXL)

Price: $14.29;

Another highly popular company have sold their shares over-the-counter, after disastrous collapse of the American auto industry in 2008. Back then, almost all partners of the American Axle Manufacturing, one of the most successful penny stocks that made it big, have filed for bankruptcy including huge conglomerates like General Motors and Chrysler. In 2009 the AXL shares were sold for only 40 cents, and the company faced several huge strikes that further deteriorated their business operation. After the US government has bailed out the biggest car manufacturers, the American Axle and Manufacturing managed to stand on its feet. Since then the AXL recorded a solid growth of more than 5,000 percent. This stock continues to grow, together with the AAM’s revenue.

Vadim Ratnikov/Shutterstock.com

7. Quality Systems (QSII)

Price: $16.13;

We are continuing our list of most successful penny stocks that made it big with Quality Systems’s shares that were sold over the counter for more than 20 years. Their success story starts after the year 2001 when their medical systems and software solutions became increasingly popular in both public and private medical clinics. They are one of the companies that used the fast technological advancement and turned it into a market gain. Quality Systems stock reached its all-time high in 2011 when their shares were sold for $48. Today, the price of one share is $16.13, which is still a huge growth comparing to the companies all-time low of only 11 cents in 1988. Currently, the market cap for this stock is well over $1 billion.

Image Point Fr/Shutterstock.com

6. General Growth Properties (GGP)

Price: $22.19;

The 2008 Economic crisis crushed many real estate companies. The General Growth Properties has suffered huge losses, which devolved their shares and sent them to the OTC boards. Before the crisis, the GGP was a fast rising stock. The company owned a significant number of both residential and commercial properties, and it was leasing them to tenants. The GGP’s all-time high was well above any share price we listed here. In 2007 their shares reached incredible $64. The fall started in 2008 when both real estate and credit market had fallen to their lowest points. The company filed for bankruptcy, and during the last seven years, they are gradually recovering. Today their shares are sold for $22.19. Bill Ackman, a widely known stocks trader, has made a fortune on this stock since their all-time low worth in 2009 was only 59 cents.

Andrey_Popov/Shutterstock.com

5. Axon Enterprise Inc. (AAXN)

Price: $25.39;

The Axon Enterprise is another popular company on our list of the most successful penny stocks that made it big. Jack Cover, the ex-NASA researcher, has founded several companies in the sixties and seventies while trying to sell stun guns and other security devices and systems. The shares of several of his companies have been sold over-the-counter, until 2001 when the company TASER International made a public offering on NASDAQ. The law enforcement and security agencies finally realized the practicality of non-lethal stun guns and the company soon reached $25 million in net sales. Today, the TASER International is called the Axon Enterprise, and their shares are sold for $24.39.

Nonwarit/Shutterstock.com

4. Xerox (XRX)

Price: $32.2;

Next in line on our list of most successful penny stocks that made it big is Xerox, an internationally-known company that sells photocopy machines and other plain paper document solutions and services. This company was huge few decades ago, and then the latest technology initiated its quick downfall. Xerox was trading its shares on the penny stock market for some time. Today, their shares are worth a solid $32.2, and last years they announced that their Computer Service Branch would turn into another publicly-shared company, that won’t work under the Xerox name.

Copyright: smileus / 123RF Stock Photo

3. Mylan Labs (MYL)

Price: $32.92;

There’s been a lot of time since this pharmaceutical company was selling its shares in the stock market. In 1976 they entered the market at the price of $0.75 per share. Since then the Mylan Labs, one of the most successful penny stocks that made it big, has split four times, and today it is a successful company with headquarters in the Netherlands and offices in the United Kingdom and Pennsylvania. Their shares are sold for $32.92 per piece, so people who owned them in 1976 could sell them for twelve times more money, taking in consideration all the split adjustments.

wavebreakmedia/Shutterstock.com

2. BJ’s Restaurants (BJRI)

Price: $33.55;

Currently, the market capitalization of BJRI is more than $1 billion. The story of this company sounds like the real ‘American dream.’ The first BJ’s Restaurant was opened in 1996 in San Diego, CA. Just a year after that they have made a public offering and started selling their shares for $1. Soon, the investors have recognized the potential of this establishment and have poured in large sums of money. The overall growth of BJRI is more than 28,000 percent, and at the moment their shares are sold of $33.55. In time, the BJ’s Restaurants turned into a chain with more than 192 eateries that include standard casual restaurants, grills and brew houses.

Copyright: stockbroker / 123RF Stock Photo

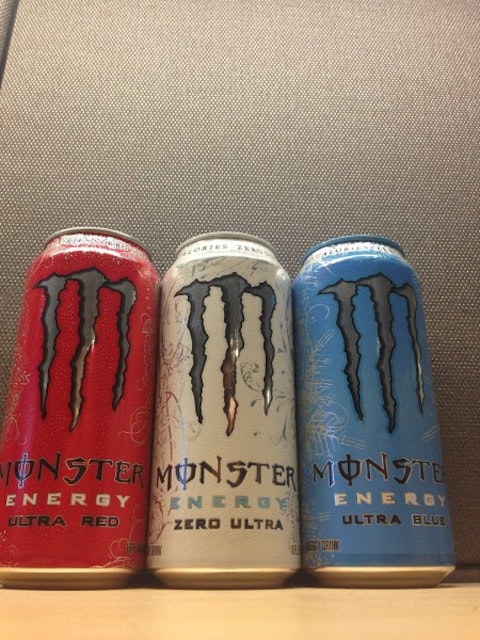

1. Monster Beverage (MNST)

Price: $52.71;

This popular energy drink is the winner of our list of the most successful penny stocks that made it big. Today Monster beverage is widely popular among teenagers and young adults. They have managed to create a strong brand name with the help of consistent branding, UFC events sponsorships, and the recent energy drink hype. The company that produces Monster was also known as Hansen Natural. They have been manufacturing refreshing beverages since the sixties. During the nineties, Hanson Naturals’ shares were sold for a little bit more than 50 cents, and current Monster shares are traded for $52.71, with the market cap that’s bigger than $10 billion. There are also rumors that Coca Cola might be interested in taking over this popular beverage, which can drastically increase the MNST’s price.

Pixabay/Public Domain