1. NVIDIA Corp. (NASDAQ:NVDA)

TTM Net Income: $53 billion

5-Year Net Income CAGR: 80.81%

Number of Hedge Fund Holders: 179

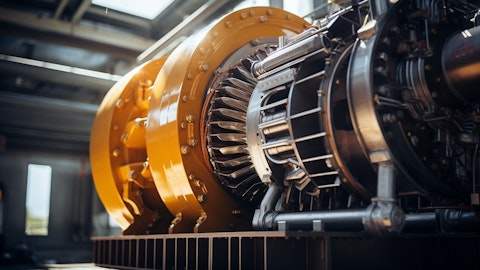

NVIDIA Corp. (NASDAQ:NVDA) specializes in graphics processing units (GPUs), which are applied in gaming, artificial intelligence, data centers, and professional visualization. It’s known for its innovative technology and its role in driving advancements in fields like machine learning and deep learning.

Impax Asset Management, a $50 billion asset manager, has increased its stake in NVIDIA Corp. (NASDAQ:NVDA) after underestimating the company’s potential. The firm believes the company is currently undervalued, considering the growing demand for its chips driven by the AI boom. Impax also sees the focus on energy efficiency as a positive factor from a climate perspective.

The company achieved significant growth in FQ2 2025, with revenue surging 122.40% from a year-ago period. The data center segment was the primary driver of this growth, with revenue increasing 54% due to strong demand for NVIDIA Hopper, GPU computing, and networking platforms. Cloud service providers accounted for a significant portion of data center revenue, contributing to the company’s impressive financial performance. Partnerships with healthcare institutions and increasing demand for AI-powered diagnostic solutions also played a role.

Its technology is used by various companies, including NetApp, which recently unveiled a new AI-powered data solution in late September. Elon Musk’s AI startup, xAI, is also utilizing NVIDIA’s H100 GPUs for its Colossal AI training system. Its focus on AI monetization and sustainability initiatives positions the company for long-term success. While the stock may seem expensive, its valuation is reasonable considering its growth prospects.

Vltava Fund stated the following regarding NVIDIA Corporation (NASDAQ:NVDA) in its Q3 2024 investor letter:

“Over the summer, we devoted a lot of time to studying the AI-related investment wave. This spans a wide range of sectors and our view could be very briefly summarised as follows: The first-tier beneficiaries are primarily companies in the semiconductor sector, NVIDIA Corporation (NASDAQ:NVDA) perhaps the most. That company is benefiting from the huge increase in investment by large technology companies to build enormous data centres. We know who NVIDIA’s customers are. They are companies like Meta, Alphabet, Amazon, and Microsoft. They are investing hundreds of billions of dollars into their AI capabilities. What is not entirely clear, however, is who are and will be the customers of NVIDIA’s customers, and, more importantly, when, and if, they will be able to come up with such huge demand for AI services that the profits from AI will justify and pay for the enormous investments all these companies have been making. The further we move away from the starting point that NVIDIA represents in our more broadly-reaching estimates, the lessreliable those estimates are.So far, we know just one thing for sure, and that is that investments in AI capabilities are ongoing and they are huge. They are not only bringing large demand to chipmakers and the semiconductor sector but to some other sectors as well. Indeed, building AI clusters also requires the construction of new semiconductor factories, new energy sources, and all the associated infrastructure. The numbers under consideration are incredibly high. It is possible that over the next decade the construction of AI centres will necessitate a 20% increase in US energy consumption. The investment required will be measured not in the hundreds of billions of dollars, but in an order of magnitude higher. Maybe two orders of magnitude.”

While we acknowledge the growth potential of NVIDIA Corp. (NASDAQ:NVDA), our conviction lies in the belief that AI stocks hold great promise for delivering high returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: $30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.