As AI continues to redefine the workforce, companies such as DeepSeek are at the forefront of this revolution. The R1 model, in particular, has made investors realize how AI models can be developed with lower costs and less advanced software. Nevertheless, AI enablers continue to create AI-specific semiconductor chips, build out compute power, and develop platforms that foundation models can use to operate.

READ ALSO: 10 Buzzing AI Stocks Dominating Headlines and 10 AI Stocks Worth Watching Today

“On one hand, the DeepSeek approach showed that you can optimize your model building process so that you require much lower compute power. That has a negative impact on Nvidia. However, the obvious thing is now you’ll find a lot of people building foundation models. Foundation models are not going to be just for the top five companies or so that have hundreds of millions of dollars to build the infrastructure.”

-Mohamed Elgendy, co-founder and CEO of enterprise AI platform Kolena.

The gist of it all remains that even though DeepSeek marks a shift toward accessible AI development, powerful computational resources are still going to be needed as AI adoption scales. However, AI’s impact extends beyond the tech world, also disrupting the way people are going to work in the evolving landscape.

Generative artificial intelligence isn’t just another invention, Aneesh Raman, chief economic opportunity officer at LinkedIn, recently remarked. Now that it is disrupting entire industries and economies, it may also hold the power to set up an entire economy in motion.

“But [generative AI] isn’t just another invention. It’s a turning point, forcing us to rethink not just what work is, but what it means to be human at work.”

-Aneesh Raman, chief economic opportunity officer at LinkedIn.

That’s right, artificial intelligence is pushing us into a new work era.

“For centuries, work was about our physical abilities on farms, and then again in the factories. It’s only been the past couple decades that work has been about our intellectual abilities…

“The knowledge economy is on the way out, and a new economy is on the way for us humans at work…I’m calling it the innovation economy.”

According to Raman, physical tasks are now being handled by automation, and intellectual ones are being taken over by AI. This leaves humans to be defined by their social abilities, he said. He further noted that in this era, human innovation and unique human skills, such as social and emotional intelligence, are going to be key determinants.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds. The hedge fund data is as of Q4 2024.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

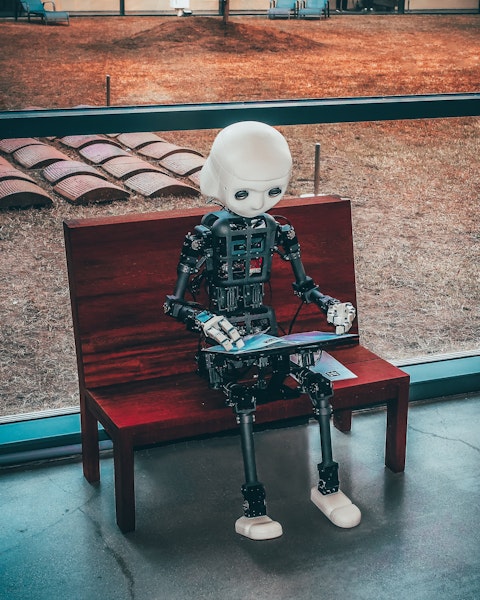

Photo by Andrea De Santis on Unsplash

10. International Business Machines Corporation (NYSE:IBM)

Number of Hedge Fund Holders: 60

International Business Machines Corporation (NYSE:IBM) is a multinational technology company and a pioneer in artificial intelligence, offering AI consulting services and a suite of AI software products. On February 25, the company announced that it had entered into a new agreement with Riyadh Air, Saudi Arabia’s airline.

The agreement will allow the integration of Watsonx, IBM’s portfolio of AI products, and IBM Consulting AI solutions to fulfill Riyadh Air’s vision as the world’s first digital native airline. With the airline preparing for its inaugural flights in late 2025, the agreement will allow Riyadh Air to prepare an intelligent digital foundation that anticipates passenger needs, streamlines operations, and boosts efficiency and service.

“By embedding Watsonx at the core of its operations, Riyadh Air is taking an AI-first approach to redefine air travel and set new industry standards as the world’s first digital-native airline. Together we are supercharging our teams with AI to enhance traveler experiences, optimize operations, and shape the future of aviation in Saudi Arabia and beyond.”

-Mohamad Ali, Senior Vice President and Head of IBM Consulting.

9. Palantir Technologies Inc. (NASDAQ:PLTR)

Number of Hedge Fund Holders: 63

Palantir Technologies Inc. (NASDAQ:PLTR) is a leading provider of artificial intelligence systems. On February 25, Morgan Stanley analyst Sanjit Singh lifted the price target on the stock to $115 from $95 and maintained a “Buy” rating.

The firm has grown optimistic about the stock following management’s remarks at the recent ICR (Investor Communications) conference, shedding light on its upbeat outlook.

It is now confident in Palantir’s performance and upbeat outlook, anticipating revenue growth potential of more than 30% in 2025. It believes that the AI Company has a bright future owing to the growing number of government and commercial contracts.

8. CrowdStrike Holdings, Inc. (NASDAQ:CRWD)

Number of Hedge Fund Holders: 77

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is a leader in AI-driven endpoint and cloud workload protection. On February 26, Bank of America Securities analyst Tal Liani reiterated a “Buy” rating on the stock and increased the price target to $420.00.

The firm noted that there are some concerns regarding contract renewals and potential pressure on free cash flow, but the company is still expected to report earnings that align with street estimates. This positive outlook is due to the anticipated growth in core modules, along with successful cross-sell and up-sell strategies for the company.

Moreover, the firm highlights how customer retention remains strong and that the July 19 outage impact has become minimal. The company has also enhanced its competitive edge by expanding its cloud security domain and addressing key security risks. CrowdStrike Holdings, specializing in AI-powered cybersecurity solutions, is expected to reveal its earnings results next week.

7. AppLovin Corporation (NASDAQ:APP)

Number of Hedge Fund Holders: 95

AppLovin Corporation (NASDAQ:APP) provides a leading marketing platform powered by AI technology. On February 26, two short sellers, namely Fuzzy Panda and Culper Research, published short reports against AppLovin Corporation, causing the stock’s trading to be briefly halted due to volatility. According to these reports, AppLovin is misrepresenting the benefits of its AI advertising platform. Instead, it is “force-feeding” app installations onto phones as a way to drive up revenue. In particular, Fuzzy Panda Research has alleged that “no one seems to know what AppLovin does”.

Research has discovered that Axon 2.0, a black-box machine-learning algorithm, is the “nexus of a House of Cards” based upon tactics often referred to as “Ad Fraud.” It further said that they have been told that AppLovin is “stealing” data from Meta in their e-commerce push. It has also been exploiting consumers and their data, which are clear violations of Google’s and Apple’s app store policies.

6. Marvell Technology, Inc. (NASDAQ:MRVL)

Number of Hedge Fund Holders: 105

Marvell Technology, Inc. (NASDAQ:MRVL) engages in the development and production of semiconductors. On February 25, Susquehanna analyst Christopher Rolland reiterated a “Buy” rating on the stock and kept the price target at $140.00. The firm is optimistic about Marvell’s promising growth prospects and market opportunities, particularly the benefit it will reap from the growing demand for AI and custom ASIC products, motivated by strong hyperscale capital expenditure plans.

Spending by major hyperscalers is also expected to increase, particularly beneficial for Marvell’s Inphi PAM4 DSPs and custom ASIC/AI products. Further growth and power advantages are also expected of the company owing to Marvell’s recent technological advancements, particularly the introduction of 5nm and 3nm DSPs. The custom silicon mix is putting pressure on gross margins, but the overall outlook on the stock remains positive.

5. Alibaba Group Holding Limited (NYSE:BABA)

Number of Hedge Fund Holders: 107

Alibaba Group Holding Limited (NYSE:BABA) is an internet giant that offers e-commerce services in China and internationally. On February 26, Analyst Fawne Jiang from Benchmark Co. maintained a “Buy” rating on the stock with a $190.00 price target.

Jiang expects Alibaba’s stock to rise in 2025 based on improvements in Alibaba’s core businesses, including e-commerce, cloud, and AIDC. In particular, the e-commerce segment is anticipated to experience growth, while AIDC is expected to achieve profitability by FY26. Earnings and stock value are also expected to boost based on the reduction of losses in other segments and the divestment of non-core assets.

Additionally, Jiang highlights how Alibaba is a key player in the AI sector, boasting competitive advantages in cloud infrastructure, proprietary models, and versatile applications across various use cases. Alibaba’s AI models flaunt robust multilingual capabilities and offer the ability to support both cloud and edge devices. The firm further noted how Alibaba’s shares are still trading at a reasonable valuation compared to global peers, offering further upside potential.

4. Broadcom Inc. (NASDAQ:AVGO)

Number of Hedge Fund Holders: 161

Broadcom Inc. (NASDAQ:AVGO) is a technology company uniquely positioned in the AI revolution owing to its custom chip offerings and networking assets. On February 25, the company announced that its end-to-end PCIe Gen 6 portfolio is now available. It will also be allowing early access to its PCIe Gen 6 Interop Development Platform (IDP), extending its multi-generational PCIe leadership.

Broadcom, in collaboration with Micron and Teledyne LeCroy, has also successfully tested its high-port switch and retimer to empower open AI infrastructure solutions. PCIe 6 switches and retimers are crucial building blocks required to power advanced AI solutions. Broadcom’s announcement marks the transition from PCIe 5 to PCIe 6 at scale, reflecting upon the need for reliable components in next-generation AI systems.

“Broadcom’s commitment to the open ecosystem has strengthened over six generations and we are now pleased to offer our new PCIe Gen 6 products to early access customers. The transition from PCIe Gen 5 to Gen 6 has been monumental given the accelerated need for trusted and reliable building blocks in next-gen AI systems. Broadcom’s PCIe Gen 6 switch, retimer and IDP will empower our partners to successfully deploy open, scalable AI clusters”.

-Jas Tremblay, vice president and general manager, Data Center Solutions Group, Broadcom.

3. Apple Inc. (NASDAQ:AAPL)

Number of Hedge Fund Holders: 166

Apple Inc. (NASDAQ:AAPL) is a technology company. On February 24, the company announced its largest-ever spending commitment, highlighting plans to spend and invest more than $500 billion in the U.S. over the next four years. The investments include an advanced manufacturing facility in Houston for artificial intelligence servers that support Apple Intelligence, a doubling of its U.S. Advanced Manufacturing Fund, and the creation of an academy in Michigan to train the next generation of U.S. manufacturers, amongst other things.

It will also add about 20,000 research and development jobs across the country in that time. According to the company, the $500 billion spending commitment includes Apple’s work with thousands of suppliers, direct employment, Apple Intelligence infrastructure and data centers, corporate facilities, and Apple TV+ productions.

“We are bullish on the future of American innovation, and we’re proud to build on our long-standing U.S. investments with this $500 billion commitment to our country’s future. From doubling our Advanced Manufacturing Fund, to building advanced technology in Texas, we’re thrilled to expand our support for American manufacturing. And we’ll keep working with people and companies across this country to help write an extraordinary new chapter in the history of American innovation.”

-Tim Cook, Apple’s CEO.

2. NVIDIA Corporation (NASDAQ:NVDA)

Number of Hedge Fund Holders: 223

NVIDIA Corporation (NASDAQ:NVDA) specializes in AI-driven solutions, offering platforms for data centers, self-driving cars, robotics, and cloud services. One of the biggest analyst calls on Tuesday, February 25, was for Nvidia Corporation. Truist Securities analyst William Stein reiterated a “Buy” rating on the stock with a $204.00 price target, stating that Nvidia is “still the AI leader and the one to own” ahead of earnings on Wednesday.

“Heading into CQ4 (Jan) results, NVDA is still the AI leader and the one to own; Lots of noise, but the data we trust most is encouraging. NVDA reports its CQ4 (Jan.) result on Weds 2/26. We expect NVDA will (1) deliver upside vs. consensus in its CQ4 (Jan) results & CQ1 (Apr) guidance, (2) highlight a narrowing of SKUs around the NVL72 configuration, (3) express confidence in CY25 owing to very robust backlog, and (4) focus on the next drivers of growth after LLMs: data processing, and physical AI. Our CY26 EPS is $5.84; PT is $204 based on 35x P/E (15x discount to hi-growth semis).

We expect NVDA will deliver modest upside relative to consensus for CQ4, and will guide CQ1 ~inline with sell side consensus of $42B. Inline with our industry contact feedback, we expect the company to discuss a consolidation of Blackwell SKUs around the NVL72 system. The capex data points bode well for NVDA’s backlog and medium-term outlook. Looking further into the future, we expect management to discuss emerging AI models & techniques including data processing and physical AI (robotics). We expect this will be a positive catalyst for the stock…and the next one will be GTC in March.”

-William Stein

1. Microsoft Corporation (NASDAQ:MSFT)

Number of Hedge Fund Holders: 317

Microsoft Corporation (NASDAQ:MSFT) provides AI-powered cloud, productivity, and business solutions, focusing on efficiency, security, and AI advancements. On February 25, Goldman Sachs analyst Kash Rangan reiterated a “Buy” rating on the stock with a $500.00 price target, stating that it is standing by the stock and that Microsoft “continues to invest in AI capacity prudently with an eye towards returns.” The rating reaffirmation comes despite recent news that Microsoft may have canceled or delayed some AI data center leases.

“We reiterate our Buy rating, $500 PT, and leave our estimates for $88bn/91bn in FY25/26 CapEx unchanged following recent reporting that Microsoft has potentially delayed or canceled some of its AI data center leases.”

While we acknowledge the potential of MSFT as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than MSFT but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stock To Buy Now and Complete List of All AI Companies Under $2 Billion Market Cap.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.