As AI continues to redefine the workforce, companies such as DeepSeek are at the forefront of this revolution. The R1 model, in particular, has made investors realize how AI models can be developed with lower costs and less advanced software. Nevertheless, AI enablers continue to create AI-specific semiconductor chips, build out compute power, and develop platforms that foundation models can use to operate.

READ ALSO: 10 Buzzing AI Stocks Dominating Headlines and 10 AI Stocks Worth Watching Today

“On one hand, the DeepSeek approach showed that you can optimize your model building process so that you require much lower compute power. That has a negative impact on Nvidia. However, the obvious thing is now you’ll find a lot of people building foundation models. Foundation models are not going to be just for the top five companies or so that have hundreds of millions of dollars to build the infrastructure.”

-Mohamed Elgendy, co-founder and CEO of enterprise AI platform Kolena.

The gist of it all remains that even though DeepSeek marks a shift toward accessible AI development, powerful computational resources are still going to be needed as AI adoption scales. However, AI’s impact extends beyond the tech world, also disrupting the way people are going to work in the evolving landscape.

Generative artificial intelligence isn’t just another invention, Aneesh Raman, chief economic opportunity officer at LinkedIn, recently remarked. Now that it is disrupting entire industries and economies, it may also hold the power to set up an entire economy in motion.

“But [generative AI] isn’t just another invention. It’s a turning point, forcing us to rethink not just what work is, but what it means to be human at work.”

-Aneesh Raman, chief economic opportunity officer at LinkedIn.

That’s right, artificial intelligence is pushing us into a new work era.

“For centuries, work was about our physical abilities on farms, and then again in the factories. It’s only been the past couple decades that work has been about our intellectual abilities…

“The knowledge economy is on the way out, and a new economy is on the way for us humans at work…I’m calling it the innovation economy.”

According to Raman, physical tasks are now being handled by automation, and intellectual ones are being taken over by AI. This leaves humans to be defined by their social abilities, he said. He further noted that in this era, human innovation and unique human skills, such as social and emotional intelligence, are going to be key determinants.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds. The hedge fund data is as of Q4 2024.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

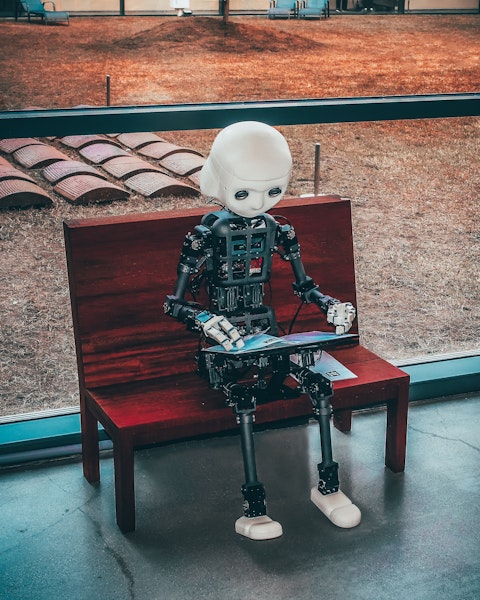

Photo by Andrea De Santis on Unsplash

10. International Business Machines Corporation (NYSE:IBM)

Number of Hedge Fund Holders: 60

International Business Machines Corporation (NYSE:IBM) is a multinational technology company and a pioneer in artificial intelligence, offering AI consulting services and a suite of AI software products. On February 25, the company announced that it had entered into a new agreement with Riyadh Air, Saudi Arabia’s airline.

The agreement will allow the integration of Watsonx, IBM’s portfolio of AI products, and IBM Consulting AI solutions to fulfill Riyadh Air’s vision as the world’s first digital native airline. With the airline preparing for its inaugural flights in late 2025, the agreement will allow Riyadh Air to prepare an intelligent digital foundation that anticipates passenger needs, streamlines operations, and boosts efficiency and service.

“By embedding Watsonx at the core of its operations, Riyadh Air is taking an AI-first approach to redefine air travel and set new industry standards as the world’s first digital-native airline. Together we are supercharging our teams with AI to enhance traveler experiences, optimize operations, and shape the future of aviation in Saudi Arabia and beyond.”

-Mohamad Ali, Senior Vice President and Head of IBM Consulting.

9. Palantir Technologies Inc. (NASDAQ:PLTR)

Number of Hedge Fund Holders: 63

Palantir Technologies Inc. (NASDAQ:PLTR) is a leading provider of artificial intelligence systems. On February 25, Morgan Stanley analyst Sanjit Singh lifted the price target on the stock to $115 from $95 and maintained a “Buy” rating.

The firm has grown optimistic about the stock following management’s remarks at the recent ICR (Investor Communications) conference, shedding light on its upbeat outlook.

It is now confident in Palantir’s performance and upbeat outlook, anticipating revenue growth potential of more than 30% in 2025. It believes that the AI Company has a bright future owing to the growing number of government and commercial contracts.