While taxes are essential to the development of any country, the same cannot be said of the 10 countries with the lowest tax rates for the rich. Taxes are extremely integral towards the economy of a country. These taxes enable the country’s government to establish or start projects which that would be beneficial to the public. These programs can include healthcare, the building of necessary infrastructures such as roads and bridges, and funding the military of the country to protect from any foreign threats.

Rawpixel/Shutterstock.com

Taxes are also necessary for the government to fund education systems and establish a proper method of public transport. Meanwhile, taxes help fund the salaries of government employees such as the police as well as hospitals run by the government while additionally providing funding which can be used to provide unemployment benefits to those who fail to hold a job.

Most countries employ a progressive tax bracket. This means that the people with the lowest incomes are either exempt from tax or face low tax, while the people with higher incomes face a higher rate of tax. This is because richer people have more disposable income, and hence they can afford the higher tax rates. On the other hand, some countries are already so rich, they don’t even need taxes from their people, as can be seen in 10 countries with the lowest tax rates in the world. Hence, it is safe to say that the 10 countries with the lowest tax rates for the rich are the countries which don’t charge income tax on any bracket. According to a study conducted by the firm KPMG, the following countries didn’t see the need to charge any income tax on its citizens including the extremely rich ones.

10. Bahamas

Located in North America, the Bahamas is one of the richest countries on the continent, according to the gross domestic product per capita. Tourism is the main reason behind the wealth of the country and due to the revenue generated by tourism and banking and finance, the country does not levy any income tax on its citizens, no matter what their wealth.

9. United Arab Emirates

The United Arab Emirates is one of the richest countries in the Middle East, mainly due to its vast reserves of oil. In fact, it can be honestly said that the country’s economy is greatly dependent on its oil reserves, with the exception of Dubai which has a much more diversified economy. Hence, the country does not have any need to charge income tax on its citizens, which means its rich can get richer without worrying about the increase in taxes.

8. Oman

The country is host to a prestigious past and while it may not be at the level it once was, it is still a force to be reckoned with. While the country’s economy is mainly dependent on oil, it has attempted to diversify its economy to moderate success. With riches from oil exports, the country has found no need to levy taxes on its citizens, no matter what their income bracket.

7. Qatar

With some of the largest oil and gas reserves in the world, Qatar is the richest country in the world in terms of per capita income. While Qatar was a poor nation before the discovery of oil, once it was discovered in 1940, the lives of its citizens changed dramatically, with the country abolishing the income tax.

Shahin Olakara/Shutterstock.com

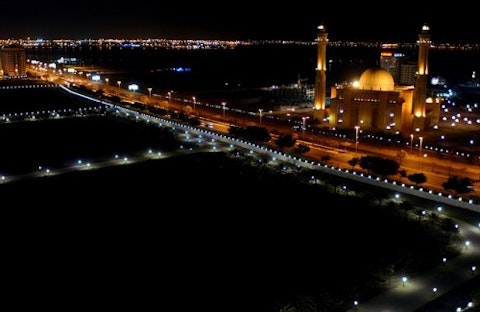

6. Bahrain

Another Middle Eastern country features on the list of countries with the lowest tax rates for the rich. Bahrain has the fastest growing economy in the Middle East, an economy which is mainly driven by the nation’s oil reserves. Due to its economy, the country saw no reason to introduce income tax legislation on its citizens.

5. Bermuda

Another North American country makes the list in the form of Bermuda. The country is famous as an offshore financial center, due to its nonexistent income tax rates. However, the country does impose a consumption tax rate which is significantly high and is utilized by the government to carry out its projects such as building the necessary infrastructure.

4. Kuwait

With the highest valued currency in the world, Kuwait has been an economic powerhouse ever since the discovery of oil reserves. While oil reserves have made the nation extremely rich, the economy is still not diversified due to political tensions in the country. However, the strong economy has meant that the country does not impose any income tax on its citizens, whether they earn minimum wage or millions of dollars.

Arlo Magicman/Shutterstock.com

3. Cayman Islands

The Cayman Islands are globally famous for their status as an offshore tax haven for the rich people in the world. The government earns it revenue through indirect taxes such as those levied on imports, since the territory does not impose any sort of tax on its citizens directly, which in turn has encouraged foreigners to transfer their money there.

2. Brunei

Located in Southeast Asia, the reason behind this country’s wealth also lies in its oil and gas reserves. While there are no taxes levied in the country, Brunei’s citizens are forced to pay 5% of their salary to a state-owned provident fund, which has to be matched by the employers as well.

1. Saudi Arabia

Saudia Arabia is the world’s largest oil producer, which is why it comes as no surprise that it does not impose any tax on its citizens, allowing it to claim a place in the 9 countries with the lowest tax rates for the rich list. Furthermore, the nation earns a lot of revenue each year during the performing of Hajj, an Islamic ritual where millions of Muslims make the journey to Makkah in order to perform the required rituals.

Fedor Selivanov/Shutterstock.com