In this article, we discuss the 10 best stocks under $11 in Cathie Wood’s portfolio based on Q2 holdings of the fund. If you want to skip our detailed analysis of Wood’s history, investment philosophy, and hedge fund performance, go directly to the 5 Best Stocks Under $11 in Cathie Wood’s Portfolio.

Catherine Duddy Wood is the CEO and CIO of the US-based ARK Investment Management. She established the hedge fund in 2014. The hedge fund had $53.74 billion in assets under management as of June 2021.

Some of the notable stocks in Cathie Wood’s 13F portfolio include Amazon.com, Inc. (NASDAQ:AMZN), Microsoft Corporation (NASDAQ:MSFT), and Alphabet Inc. (NASDAQ:GOOG).

In this article, our focus would be on some of the cheap stocks in Wood’s Q2 portfolio.

Cathie Wood of ARK Investment Management

Why pay attention to Wood’s portfolio? Insider Monkey’s research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 86 percentage points since March 2017. Between March 2017 and July 2021, our monthly newsletter’s stock picks returned 186.1%, vs. 100.1% for the SPY. Our stock picks outperformed the market by more than 86 percentage points (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to. You can subscribe to our free newsletter on our homepage to receive our stories in your inbox.

With this background in mind, let’s start our list of 10 best stocks under $11 in Cathie Wood’s portfolio. We used Wood’s 13F portfolio for Q2 2021 for this analysis.

Best Stocks Under $11 in Cathie Wood’s Portfolio

10. Markforged Holding Corporation (NYSE:MKFG)

ARK Investment Management Stake Value: $21,362,000

Percentage of ARK Investment Management’s 13F Portfolio: 0.03%

Number of Hedge Fund Holders: N/A

Price per Share as of Nov. 5, 2021: $7.21

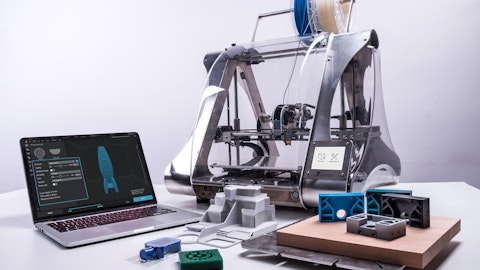

Hedge fund manager Cathie Wood is one of Markforged Holding Corporation’s (NYSE:MKFG) largest investors. ARK Investment Management holds more than 2.14 million shares of the company, worth about $21.36 million. Markforged Holding Corporation, a designer, developer, and manufacturer of industrial 3D printers, ranks tenth on the list of best stocks under $11 in Cathie Wood’s portfolio.

In August, Stifel analyst Noelle Dilts initiated coverage of Markforged, rating the stock as “Buy” and gave a price target of $13.50.

9. Surface Oncology, Inc. (NASDAQ:SURF)

ARK Investment Management Stake Value: $33,410,000

Percentage of ARK Investment Management’s 13F Portfolio: 0.06%

Number of Hedge Fund Holders: 10

Price per Share as of Nov. 5, 2021: $7.52

Surface Oncology, Inc. (NASDAQ:SURF) is a clinical-stage immuno-oncology firm based in the United States that develops cancer medicines. ARK Investment Management holds a $33.41 million stake in the firm.

The second quarter of 2021 earnings report for Surface Oncology, Inc. missed the analyst expectations. Earnings per share came in at -$0.44 below the estimates by $0.09. In addition, revenue over the period was $0.51 million, missing the analysts’ expectations by $2.45 million.

At the end of the second quarter of 2021, 10 hedge funds in the database of Insider Monkey held stakes worth $58.79 million in Surface Oncology, Inc. (NASDAQ:SURF), down from 15 the preceding quarter worth $54.75 million.

8. Desktop Metal, Inc. (NYSE:DM)

ARK Investment Management Stake Value: $21,483,000

Percentage of ARK Investment Management’s 13F Portfolio: 0.03%

Number of Hedge Fund Holders: 27

Price per Share as of Nov. 5, 2021: $8.61

Desktop Metal, Inc. (NYSE:DM) is a company that develops and distributes additive manufacturing solutions for engineers, designers, and manufacturers.

On October 7, Oppenheimer analyst Martin Yang initiated coverage of Desktop Metal with a “Perform” rating. In the second quarter of 2021, the company posted an EPS of -$0.17 missing the consensus by $0.07. In addition, revenue over the period was $19 million below the estimates by $0.18 million.

Cathie Wood’s ARK Investment Management increased its hold in Desktop Metal, Inc. (NYSE:DM) by 82% in the second quarter, ending the period with 1.87 million company shares. The fund has a $21.48 million stake in the company. Overall, 27 hedge funds in Insider Monkey’s database of 873 funds are bullish on the company.

Like Amazon.com, Inc. (NASDAQ:AMZN), Microsoft Corporation (NASDAQ:MSFT), and Alphabet Inc. (NASDAQ:GOOG), Desktop Metal, Inc. (NYSE:DM) is one of the stocks to buy according to Cathie Wood.

7. Gilat Satellite Networks Ltd. (NASDAQ:GILT)

ARK Investment Management Stake Value: $5,659,000

Percentage of ARK Investment Management’s 13F Portfolio: 0.01%

Number of Hedge Fund Holders: 7

Price per Share as of Nov. 5, 2021: $8.45

Gilat Satellite Networks Ltd. (NASDAQ:GILT), a provider of satellite-based broadband communication services and solutions, is placed seventh on the list of 10 best stocks under $11 in Cathie Wood’s portfolio. The company enhanced the 4G network of a Tier-1 Mobile Network Operator in North America for disaster recovery and ongoing operational business demands.

On the other hand, Cathie Wood has trimmed the stake in Gilat Satellite Networks Ltd. by 16% in the second quarter of 2021. She now holds 555,902 shares of the company worth $5.66 million. The company’s second-quarter revenue was $56.9 million, up 48.6% YoY.

Earlier in October, Gilat Satellite Networks Ltd. (NASDAQ:GILT) inked two-year agreements worth over $16 million to operate regional transport networks in Peru to provide broadband services. However, as of Q2 2021, 7 hedge funds have positions in the company, compared with 8 in the previous quarter.

6. Quantum-Si incorporated (NASDAQ:QSI)

ARK Investment Management Stake Value: $49,632,000

Percentage of ARK Investment Management’s 13F Portfolio: 0.09%

Number of Hedge Fund Holders: 19

Price per Share as of Nov. 5, 2021: $7.90

Quantum-Si provides next-generation protein sequencing and genomics technology for the healthcare industry and it stands sixth on the list of 10 best stocks under $11 in Cathie Wood’s portfolio.

In the second quarter of 2021, the hedge fund chaired by Cathie Wood bought close to 4.05 million shares in Quantum-Si incorporated (NASDAQ:QSI) worth over $49.63 million. It is the biggest shareholder of the company. On October 20, Canaccord analyst Kyle Mikson initiated coverage of Quantum-Si with a “Buy” rating and gave a price target of $13. Quantum-Si incorporated was in 19 hedge funds’ portfolios at the end of the second quarter of 2021.

Amazon.com, Inc. (NASDAQ:AMZN), Microsoft Corporation (NASDAQ:MSFT), and Alphabet Inc. (NASDAQ:GOOG) are some of the stocks in Cathie Wood’s 13F portfolio, just like Quantum-Si incorporated (NASDAQ:QSI).

Click to continue reading and see 5 Best Stocks Under $11 in Cathie Wood’s Portfolio.

Suggested articles:

- 10 Best Stocks Under $10 to Buy Right Now

- 10 Best Stocks Under $5 in 2021

- 10 Best Stocks Under $10 in 2021

Disclosure: None. 10 Best Stocks Under $11 in Cathie Wood’s Portfolio is originally published on Insider Monkey.