In this article, we will be taking a look at the 10 best stocks to buy now according to billionaire Marc Lasry’s Avenue Capital. To skip our detailed analysis of Lasry’s profile, investment strategy, and 13F holdings, you can go directly to see the 5 Best Stocks to Buy Now According to Billionaire Marc Lasry’s Avenue Capital.

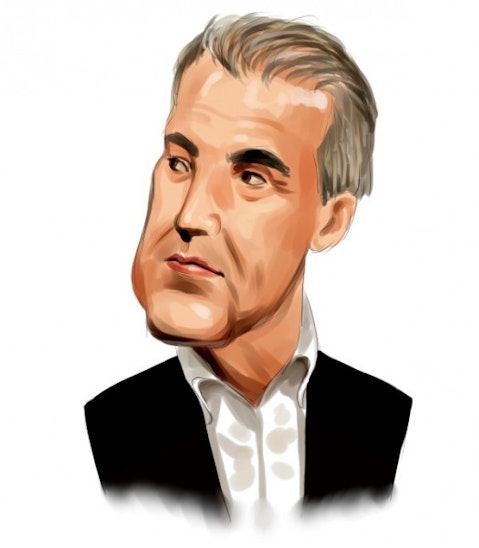

Marc Lasry, the Moroccan-American billionaire, businessman, and hedge fund manager, is the co-founder and CEO of Avenue Capital Group, a multi-strategy hedge fund. The hedge fund manages assets estimated at around $11.6 billion as of June 2022 and is focused on specialty lending, distressed debt, and other special situations investments in the US, Europe, and Asia.

On the topic of the recent market selloff, Lasry, in an interview this June with Bloomberg, commented that investors should not shy away from buying the dip. Lasry foresees that the selloff will continue till the end of 2022 and believes one should get invested while one can since the bottom cannot be timed. The billionaire also expects the US economy’s strength to cut short the market downturn. Since Lasry sees the market contraction as being short-lived in the long term, he believes that now is the time to buy the dip.

According to the billionaire, the selloff is beneficial for funds like Avenue Capital since Avenue focuses on troubled corporate debt. Lasry expects equity indices to fall by a further 5% or 10%, commenting that the downside potential is already priced in. He believes that the selloff presents many opportunities for Avenue Capital, giving the example of Exela Technologies Inc.’s (NASDAQ:XELA) debt. Lasry stated that since Avenue Capital bought Exela’s bonds at $0.35, with a yield of about 33%, it has benefited significantly from the payout, despite the risky investment. Such risk-taking has led Lasry to become one of the 25 highest-paid hedge fund managers, having brought in $280 million in annual earnings as of 2013. Now he stands at the head of Avenue Capital which boasts a portfolio valued at over $201 million. His portfolio largely comprises companies within the basic materials, services, technology, and financial sectors.

While many investors choose to invest in financially strong corporations such as Amazon.com, Inc. (NASDAQ:AMZN), Apple Inc. (NASDAQ:AAPL), and Microsoft Corporation (NASDAQ:MSFT), Marc Lasry has a reputation for making his fortune with an investment strategy focused on distressed companies in the US. Avenue Capital aims to benefit from attractive risk-adjusted returns with its focus on distressed debt and undervalued securities of American companies. Typical targets of such an investment strategy include not only distressed securities, but also bank debt, stressed high yield debt, event-driven situations, restructured and post-reorganization equities, and trade claims. This investment strategy is to be credited for Lasry’s current fortune and net worth of $1.8 billion as of 2022, according to Forbes.

We can now take a look at the 10 best stocks to buy now according to billionaire Marc Lasry’s Avenue Capital.

Our Methodology

We have picked the top ten stocks from Avenue Capital’s latest 13F holdings as of the first quarter of 2022. According to Insider Monkey’s hedge fund data for the first quarter, these stocks are also some of the most popular names among hedge funds today. We have mentioned analyst ratings and price targets for almost every stock on our list, ensuring they have mostly positive ratings and positive upside potential. The stocks are ranked based on the value of Lasry’s stake in each company, from the lowest stake value to the highest stake value.

Best Stocks to Buy Now According to Billionaire Marc Lasry’s Avenue Capital

10. Impel NeuroPharma Inc. (NASDAQ:IMPL)

Avenue Capital’s Stake Value: $2,102,000

Percentage of Avenue Capital’s 13F Portfolio: 1.04%

Number of Hedge Fund Holders: 3

Impel NeuroPharma Inc. (NASDAQ:IMPL) is a biotechnology company based in Seattle, US. The company works to develop and commercialize therapies for patients with central nervous system disease in the US. According to Avenue Capital’s latest 13F holdings, this company falls in the fund’s top ten holdings.

At the start of 2022, Impel NeuroPharma Inc. (NASDAQ:IMPL) announced that the performance of its Trudhesa since its commercial launch in October 2021 far surpassed the company’s fourth quarter of 2021 guidance. The product’s success resulted in Impel NeuroPharma Inc. (NASDAQ:IMPL) securing multiple contracts with leading pharmacy benefit managers in the US.

Three hedge funds were long Impel NeuroPharma Inc. (NASDAQ:IMPL) in the first quarter of 2022, with a total stake value of $20.7 million. Of the three, Vivo Capital was the largest stakeholder in the company, holding 2,884,789 shares worth about $18.4 million.

Like Amazon.com, Inc. (NASDAQ:AMZN), Apple Inc. (NASDAQ:AAPL), and Microsoft Corporation (NASDAQ:MSFT), Impel NeuroPharma Inc. (NASDAQ:IMPL) is a stock pick investors are eyeing today.

9. Forge Global Holdings Inc. (NYSE:FRGE)

Avenue Capital’s Stake Value: $8,095,000

Percentage of Avenue Capital’s 13F Portfolio: 4.02%

Number of Hedge Fund Holders: 17

Forge Global Holdings Inc. (NYSE:FRGE) is a financials company providing marketplace infrastructure, data services, and technology solutions for private market participants. The company allows private company shareholders to trade private company shares with accredited investors.

This May, in light of Forge Global Holdings Inc.’s (NYSE:FRGE) merger with SPAC Motive Capital, positive stock activity was reported for the company’s shares. The stock shot up by 18% that month, with company shares being up 107% since the merger. Forge Global Holdings Inc. (NYSE:FRGE) comprises over 4% of Avenue Capital’s portfolio, making it one of the best stocks to buy now according to billionaire Marc Lasry.

In the first quarter of 2022, 17 hedge funds were long Forge Global Holdings Inc. (NYSE:FRGE). Their total stake value was $36.8 million. In comparison, three hedge funds were long the stock in the previous quarter, with a total stake value of $1.8 million.

8. DISH Network Corporation (NASDAQ:DISH)

Avenue Capital’s Stake Value: $9,575,000

Percentage of Avenue Capital’s 13F Portfolio: 4.8%

Number of Hedge Fund Holders: 48

DISH Network Corporation (NASDAQ:DISH) is a communication services company offering pay-TV services in the US. The company operates in two segments, Pay-TV and Wireless. It makes up 4.8% of Avenue Capital’s portfolio according to the fund’s first quarter of 2022 13F holdings.

This June, Truist analyst Greg Miller maintained a Buy rating on DISH Network Corporation (NASDAQ:DISH) shares, alongside his price target of $60.

Miller also commented in May that he was positive about DISH Network Corporation’s (NASDAQ:DISH) spectrum holdings, discounted price points, potential enterprise partnerships, and an annual target market of $300 billion. Investors including billionaire Marc Lasry have shown an interest in the company as a result, making it one of the top holdings in Avenue Capital’s portfolio.

Out of 912 hedge funds, 48 hedge funds held stakes in DISH Network Corporation (NASDAQ:DISH) in the first quarter. Their total stake value was $1.8 billion. Boykin Curry’s Eagle Capital Management was the largest stakeholder in the company, holding 17,255,129 shares worth about $546 million.

Just like Amazon.com, Inc. (NASDAQ:AMZN), Apple Inc. (NASDAQ:AAPL), and Microsoft Corporation (NASDAQ:MSFT), DISH Network Corporation (NASDAQ:DISH) is among the most popular stock in hedge funds circles today.

7. Frontier Communications Parent Inc. (NASDAQ:FYBR)

Avenue Capital’s Stake Value: $9,891,000

Percentage of Avenue Capital’s 13F Portfolio: 4.9%

Number of Hedge Fund Holders: 48

Frontier Communications Parent Inc. (NASDAQ:FYBR) is a provider of communications services for consumer and business customers in about 25 US states. The company is a popular stock pick among over 45 hedge funds, including Lasry’s fund, making it one of the best stocks to buy now according to billionaire Marc Lasry’s Avenue Capital. It offers data and Internet, voice, video, and other services to its customers.

This May, Simon Flannery, an analyst at Morgan Stanley, upgraded Frontier Communications Parent Inc. (NASDAQ:FYBR) shares to Equal Weight. The analyst also raised his price target on the stock to $25.

In July, Citi noted that it expects solid revenue growth from its wireless and broadband stocks, believing Frontier Communications Parent Inc. (NASDAQ:FYBR) will outperform others in the sector due to its cheaper valuation and improvement prospects. Citi has a Buy rating on Frontier Communications Parent Inc. (NASDAQ:FYBR) shares.

Our hedge fund data for the first quarter of 2022 shows 48 hedge funds long Frontier Communications Parent Inc. (NASDAQ:FYBR) in that quarter. In comparison, 46 hedge funds were long the stock in the previous quarter. Their total stake values were $3.5 billion and $3.6 billion respectively.

6. Alexander’s, Inc. (NYSE:ALX)

Avenue Capital’s Stake Value: $9,903,000

Percentage of Avenue Capital’s 13F Portfolio: 4.9%

Number of Hedge Fund Holders: 7

Alexander’s, Inc. (NYSE:ALX) is a real estate investment trust based in New Jersey, US. The company has seven properties in the New York City metropolitan area and was founded in 1955.

Alexander’s, Inc. (NYSE:ALX) was among Lasry’s top holdings in the first quarter, making up almost 5% of his portfolio. The stock is also a generous dividend-payer with a yield of 7.7%, making it an attractive option for income investors. This makes it one of the best stocks to buy now according to billionaire Marc Lasry.

Seven hedge funds held stakes in Alexander’s, Inc. (NYSE:ALX) in the first quarter of 2022, with a total stake value of $59.1 million. Of these funds, Jim Simons’ Renaissance Technologies was the largest stakeholder in the company, holding 103,714 shares worth $26.6 million.

Just like Amazon.com, Inc. (NASDAQ:AMZN), Apple Inc. (NASDAQ:AAPL), and Microsoft Corporation (NASDAQ:MSFT), Alexander’s, Inc. (NYSE:ALX) is an attractive stock among investors today.

Click to continue reading and see the 5 Best Stocks to Buy Now According to Billionaire Marc Lasry’s Avenue Capital.

Suggested articles:

- 10 Best Penny Stocks To Buy Now

- 10 Best Magic Formula Stocks To Buy Now

- 12 Best Autonomous Vehicle Stocks to Buy for 2021

Disclosure: None. 10 Best Stocks to Buy Now According to Billionaire Marc Lasry’s Avenue Capital is originally published on Insider Monkey.