In this article, we’re going to talk about the 10 best QQQ stocks to buy according to analysts.

Navigating High Valuations and Stock Opportunities

Several recent discussions have focused solely on the implications of the Fed’s recent rate cut for the market. Analysts have noted that smaller interest rate reductions are expected as the Fed adopts a long-term perspective on monetary policy. Despite earlier recession predictions, there is a bullish outlook for the market now.

Economic data indicates strong growth. The current environment is characterized as stable, suggesting that additional quarter-point cuts could be beneficial. Just as October began, Richard Fisher, Jefferies’ senior advisor, joined CNBC to make a discussion on the concerns about whether current rates are too restrictive, with arguments that financial conditions remain supportive. We covered this in detail in our 10 Most Undervalued Quality Stocks To Buy According To Analysts article, here’s an excerpt from it:

“He highlighted the significance of recent economic data, particularly from the Atlanta Fed, which indicates strong growth above 3%. Fisher characterized the current economic environment as experiencing neither a soft landing nor a hard landing, but rather a smooth glide path. He believes that two more quarter-point cuts would be appropriate to maintain this trajectory. When discussing concerns about whether current rates are too restrictive relative to inflation, Fisher disagreed with the argument and pointed out that financial conditions remain accommodative, citing narrow spreads and strong private lending activity. He argued that with another two cuts, the Fed would not be overly restrictive.”

Analysts caution against declaring victory regarding economic stability too soon. The ongoing evaluation of monetary policy will continue until 2026. Under a similar discussion, Michael Kantrowitz, chief investment officer at Piper Sandler, joined CNBC on October 14 to discuss the outlooks on overvalued markets, as he thinks that over-valuation is no reason to get bearish.

The financial markets marked the second anniversary of the ongoing bull market, which has seen stock prices rise at the second-fastest pace since 1950. Michael Kantrowitz noted that while markets may appear expensive, this does not necessarily warrant a bearish outlook unless new risks emerge. Kantrowitz emphasized that many valuation models have indicated that the market has been expensive for some time, but he believes it is essential to understand the catalysts driving these valuations.

He explained that the significant rise in market multiples over the last two years can largely be attributed to the pricing out of risks that were prevalent two years ago, such as inflation and high interest rates. Kantrowitz stated that these concerns have largely been factored into equity prices, which is why the market is where it is today. He argued that an expensive market alone is not a reason to adopt a bearish stance; instead, potential spikes in interest rates or renewed inflation fears could trigger such a sentiment. Currently, however, he sees no immediate threats on the horizon.

When discussing sector performance, Kantrowitz clarified that his focus is less on broad sectors and more on individual stocks with strong earnings momentum. He acknowledged that while sectors like technology may appear expensive overall, there are still individual stocks within those sectors that continue to show earnings growth. He stressed the importance of earnings revisions as a key factor in stock selection and portfolio construction.

Addressing concerns about rising bond yields, Kantrowitz acknowledged that higher yields could pose challenges for equity markets. He recalled how earlier in the year when ten-year Treasury yields rose from around 3.80% to approximately 4.30%, equity markets initially remained stable but began to feel pressure as rate-sensitive stocks started underperforming. He noted that utilities and real estate sectors had benefited from lower rates but were now facing challenges as rates increased.

Kantrowitz also commented on various economic indicators suggesting mixed signals in the market. For instance, he mentioned metrics like rail freight carloads and corporate misery indices indicating weak demand. However, he cautioned against overreacting to these indicators, noting that downward earnings revisions are common as companies adjust their forecasts throughout the year. Historically, Q4 tends to see significant downward revisions as companies align their expectations with actual performance.

In the current economic climate, characterized by uncertainty and mixed signals, the importance of quality stocks cannot be overstated. Quality stocks, those with strong earnings momentum and resilient business models, are particularly well-positioned to navigate these turbulent times. As concerns about rising interest rates and inflation persist, investors may find that high-quality companies with solid balance sheets and consistent profitability can offer a buffer against volatility. That being said, we’re here with a list of the 10 best QQQ stocks to buy according to analysts.

Methodology

We first sifted through the Invesco QQQ exchange-traded fund (ETF) holdings to find the ones with an upside potential of over 25% as of October 14, 2024. We then selected 10 stocks with the highest upside potentials that were also the most popular among elite hedge funds and that analysts were bullish on. The stocks are ranked in ascending order of their analysts’ upside potential.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

10 Best QQQ Stocks to Buy According to Analysts

10. CoStar Group Inc. (NASDAQ:CSGP)

Average Upside Potential: 27.84%

Number of Hedge Fund Holders: 42

CoStar Group Inc. (NASDAQ:CSGP) provides commercial real estate information, analytics, and online marketplaces for real estate transactions, with research services that include online services and research for the rental home and hotel industry. Its extensive network and deep industry expertise have made it a trusted source for real estate professionals worldwide.

The company has a portfolio of 27+ internationally recognized brands, including industry-leading names like Apartments.com, attracting over 100 million unique monthly visitors, and Homes.com. 95% of the revenue is derived from subscriptions and there’s an impressive 90% renewal rate for contracts exceeding one year.

During the second quarter of 2024, revenue was up 11.87% year-over-year. It hit the milestone of a record 183 million monthly average unique visitors. The commercial information and marketplace businesses delivered 41% profit margins in the quarter.

Apartments.com revenue increased 18%, with unaided brand awareness up 74% and average monthly unique visitors up 3%. Lender product net new sales surged by 47%, and the number of banks and lending institutions on the platform increased by 50%. Revenue from benchmarking and subscriptions grew 28% year-over-year. The subscriber overall base grew by 19%.

Other than that, LoopNet revenue increased by 7%. Real Estate Manager revenue was up 9% due to strong renewal rates. Land.com revenue increased by 5% due to signature ads and diamond ads. sales grew significantly. BizBuySell revenue rose by 6% as franchise directory and listing leads grew.

While the company’s core business is exposed to the cyclical nature of the commercial real estate market, CoStar Group Inc. (NASDAQ:CSGP) has a strong balance sheet and a high-margin business model that can drive consistent value creation. Its competitive edge in commercial real estate makes it an attractive choice for investors.

Weitz Investment Management Partners III Opportunity Fund stated the following regarding CoStar Group, Inc. (NASDAQ:CSGP) in its Q2 2024 investor letter:

“Liberty Media Corp.-Liberty SiriusXM (LSXMK) (83% owner of Sirius XM Holdings, Inc. (SIRI)) and CoStar Group, Inc. (NASDAQ:CSGP) were also top detractors for the quarterly and year-to-date periods. At CoStar, the recently launched residential real estate portal (Homes.com) generated strong initial sales results and drove healthy stock price appreciation in the first quarter. Recent reports, however, suggest the pace of real estate agents buying memberships to their site may have slowed, causing shares to give back prior quarter gains and then some. Progress for this new business vertical will likely continue in fits and starts, but importantly, our investment thesis is principally underwritten by CoStar’s existing and dominant commercial real estate and multifamily rental marketplace businesses. From current prices, eventual success at Homes.com represents potential upside optionality.”

9. ASML Holding (NASDAQ:ASML)

Average Upside Potential: 27.99%

Number of Hedge Fund Holders: 81

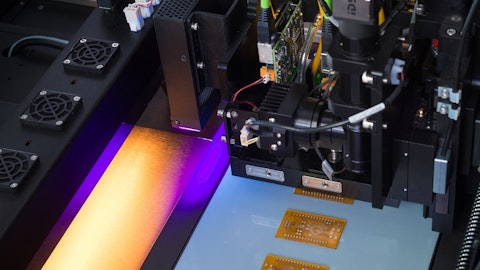

ASML Holding (NASDAQ:ASML) is a leading manufacturer of chip-making equipment, designing and manufacturing lithography machines, an essential component in chip manufacturing. Its innovative technology and advanced manufacturing capabilities have made it a dominant player in the semiconductor industry with products used by major chip manufacturers worldwide to produce cutting-edge microchips for various applications, including smartphones, computers, and data centers.

Despite a strong track record of 18.42% average annual revenue growth over the past decade, the company is facing challenges in 2024 due to cautious customer spending, supply chain disruptions, and economic uncertainties. For this reason, the revenue dropped 11.69% year-over-year. Logic and Memory improvements and better inventory management were the main drivers of the remaining revenue. Earnings per share for the quarter stood at $4.39.

The company enjoys a unique position as the exclusive provider of EUV and high NA EUV lithography machines, essential for producing advanced 5nm, 3nm, and 2nm chips. This technological monopoly gives it a significant competitive advantage. Its innovative lithography systems are critical for the production of advanced microchips, powering the growth of AI and other cutting-edge technologies. The recent breakthroughs in EUV technology, combined with strong demand across various industries, position it for continued success in the semiconductor market.

While 2024 is a transitional year with no expected revenue growth, the company is gearing up for a record-breaking 2025, projecting revenue between $33.17 billion and $44.2 billion. This forecast seems reasonable considering the company’s impressive historical growth, averaging 19% top-line and 24% bottom-line growth over the past 5 years.

Baird Chautauqua International and Global Growth Fund stated the following regarding ASML Holding N.V. (NASDAQ:ASML) in its Q3 2024 investor letter:

“ASML Holding N.V. (NASDAQ:ASML): After a 35% price appreciation in 1H24 and a beat in 2Q24 numbers, investors are apprehensive about Intel capex cuts, potential memory weakness, and a less clear cyclical recovery pace in 3Q24 and potentially 2025. We remain positive on long-term demand for ASML’s products due to industry supply/demand factors for computing power.”