The performance of the semiconductor industry is commonly measured by the Philadelphia Semiconductor Index (SOX), a capitalization-weighted index comprising 30 of the largest U.S.-traded semiconductor companies. These firms play a critical role in designing, manufacturing, distributing, and selling semiconductors. Year-to-date (YTD), the SOX has delivered a solid return of 5.7%. However, when compared to other S&P 500 sector indices, it ranks seventh in performance, as of February 19. Still, the sector continues to outperform the broader S&P 500 Index, which has posted a 4.5% gain so far in 2025. This moderate growth comes on the heels of an impressive 19% surge in 2024.

The semiconductor industry has shown resilience in 2025, navigating economic uncertainty, rapid technological advancements, and shifting geopolitical dynamics. Demand remains strong across key sectors, including consumer electronics, automotive, and industrial applications. Semiconductor innovation continues to drive transformative technologies, fuelling advancements in artificial intelligence (AI), autonomous vehicles, electric mobility, and next-generation wireless networks. As innovation accelerates, semiconductors will remain at the heart of technological progress, shaping a smarter, greener, and more connected future.

Growth Momentum Expected to Continue

The long-term outlook for the semiconductor industry remains robust, bolstered by policy support and investment in domestic chip manufacturing. According to the Semiconductor Industry Association (SIA)’s 2024 ‘State of the U.S. Semiconductor Industry’ report, U.S. semiconductor manufacturing capacity is projected to more than triple between 2022 and 2032—making it the fastest-growing region in the world during this period. This growth is largely attributed to the CHIPS Act, which has incentivized investment in domestic production. The report further projects that by 2032, the U.S. will hold a 28% share of advanced semiconductor (sub-10nm) manufacturing capacity and capture 28% of global capital expenditures (capex) in the sector. Without the CHIPS Act, the U.S. would have secured only 9% of global capex.

The industry’s upward trajectory is reflected in its financial performance. SIA’s latest report, published on February 7, 2025, revealed that global semiconductor sales reached $627.6 billion in 2024—a 19% increase from the previous year. This momentum is expected to persist, with double-digit growth anticipated for 2025.

Challenges and Potential Risks

Despite strong growth prospects, the semiconductor industry is not without challenges. Geopolitical tensions, supply chain disruptions, and U.S. trade policies, including recently proposed tariffs, could pose risks. However, industry experts believe the direct impact of tariffs on semiconductors may be limited. In a recent CNBC interview, Stacy Rasgon, senior semiconductor analyst at Bernstein Research, noted that while the U.S. imports a substantial volume of semiconductors, only a small fraction originates from countries targeted by tariffs, such as China, Mexico, and Canada. As a result, the direct impact on semiconductor manufacturers is expected to be minimal. However, indirect effects—such as higher costs for consumer electronics and industrial products that incorporate semiconductors—could lead to weaker demand in some markets.

For investors, the semiconductor sector continues to offer compelling opportunities, given its role in driving technological innovation. A strategic and well-researched approach is key to navigating market volatility while capitalizing on long-term growth. With that in mind, let’s take a closer look at 10 of the best-performing semiconductor stocks in 2025.

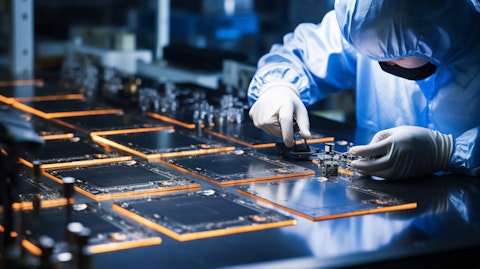

A worker assembling metal oxide semiconductor field effect transistors (MOSFETs) on a conveyer belt.

Our Methodology

To identify the 10 best-performing semiconductor stocks year-to-date, we first screened all U.S.-listed semiconductor companies with a market price above $10 to exclude penny stocks. We then filtered these stocks based on their YTD returns and ranked the top 10 in ascending order, placing the best-performing stocks at the top. Additionally, we included data on hedge fund holdings in these companies as of Q4 2024 to provide further insight into investor interest.

Note: All pricing data is as of market close on February 18.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 363.5% since May 2014, beating its benchmark by 208 percentage points (see more details here).

10 Best Performing Semiconductor Stocks So Far in 2025

10. KLA Corp. (NASDAQ:KLAC)

YTD Returns: 20%

Number of Hedge Fund Holders: 58

KLA Corp. (NASDAQ:KLAC) is a prominent supplier of process control and yield management systems for the semiconductor industry. The company’s comprehensive portfolio includes inspection, metrology, and data analysis solutions that assist semiconductor manufacturers in achieving optimal productivity and high-quality output.

KLA Corp. (NASDAQ:KLAC)’s share price has rallied around 20% so far in 2025. Share price was supported by the strong Q2 FY 2025 results where revenue of $3.08 billion rose 23.7% year-over-year and came in at the upper end of the company’s guidance. Adjusted EPS came in at $8.2, up 33% year-over-year. Analysts remained positive on the stock with overall growth driven by the AI-led demand. On January 31, an analyst from Needham raised the price target on the company to $830 from $800 and reiterated a Buy rating on the shares. The analyst was encouraged by the strong results but believed that guidance was conservative as it reflected revenue growth of 11% in 2025. He still saw the guidance as strong in comparison to the wafer fabrication market growth expectation of only the mid-single-digit.

9. Allegro MicroSystems Inc. (NASDAQ:ALGM)

YTD Returns: 23%

Number of Hedge Fund Holders: 27

Allegro MicroSystems Inc. (NASDAQ:ALGM) is a designer and manufacturer of power and sensing semiconductor solutions for motion control and energy efficient systems. The company’s products are widely used in automotive, industrial, and consumer applications, providing critical sensing and power solutions.

Allegro MicroSystems Inc. (NASDAQ:ALGM)’s share price has continued its upward trend since the start of the year with YTD returns of around 23%. About 12% of this return came after the company reported its Q3 2025 results (FY ending March) on January 30. Quarterly results were mixed but still considered healthy given the weakness from inventory correction in the industry. The company reported quarterly revenue and EPS which were in line to slightly positive versus expectations. While the semiconductor industry continues to face issues of inventory build-up in its end markets, the company is focusing on reducing inventory and product development in the coming months. Allegro MicroSystems Inc. (NASDAQ:ALGM)’s share price also benefitted from overall improving sentiment in the semiconductor industry.

Allegro MicroSystems Inc. (NASDAQ:ALGM) is well-positioned to capitalize on the EV revolution, with its magnetic sensing and power ICs playing a key role in battery management, ADAS, and electrified powertrains. Allegro is also seeing strong demand from factory automation and renewable energy markets, driving long-term secular growth. Analysts remained broadly positive after the results. Analysts from Evercore ISI and Wells Fargo reiterated their Buy rating on the shares with a price target of $29 and $27, respectively. While maintaining their Buy rating, TD Cowen also raised their price target on Allegro MicroSystems Inc. (NASDAQ:ALGM) to $28 from $25 earlier.

8. Silicon Laboratories Inc. (NASDAQ:SLAB)

YTD Returns: 24%

Number of Hedge Fund Holders: 22

Silicon Laboratories Inc. (NASDAQ:SLAB) is a fabless IoT semiconductor company specializing in wireless connectivity solutions for smart homes, industrial automation, and medical devices. The company’s products are used across various industries, including smart home, industrial automation, and automotive sectors.

On February 4, Silicon Laboratories Inc. (NASDAQ:SLAB) reported impressive Q4 2024 results, with revenue reaching $166 million, reflecting a 91% year-over-year growth, although sequential growth remained flat. Management attributed this growth to improvements in excess customer inventory, increased bookings, and market share gains across both of its business units. The 2025 growth outlook is supported by design wins in areas such as connected healthcare, smart metering, commercial retail, and other applications now ramping into production.

Shares of Silicon Laboratories Inc. (NASDAQ:SLAB) have surged 24% year-to-date. This strong performance is partly due to the solid results and a broader upswing in the semiconductor industry. The company was also less impacted by the DeepSeek saga and experienced only a slight decline during the January 27-28 sell-off.

Positive analyst activity post-results also boosted sentiment. Following the robust results, an analyst from Benchmark upgraded Silicon Laboratories Inc. (NASDAQ:SLAB) to Buy from Hold, setting a $160 price target. The analyst’s positive outlook is based on the resolution of industry and customer inventory issues, which enabled the company to deliver an in-line December quarter with flat sequential sales, consistent with company guidance. The analyst believes that improving company fundamentals will lead to upward estimate revisions and sees a positive outlook through the next industry upcycle, potentially extending through fiscal 2026.

7. Micron Technology Inc. (NASDAQ:MU)

YTD Returns: 27%

Number of hedge funds: 94

Micron Technology Inc. (NASDAQ:MU) designs, develops, manufactures, and markets memory and storage products, including dynamic random-access memory (DRAM), flash memory (NAND), solid-state drives (SSDs), and High Bandwidth Memory (HBM) globally. The company is well-positioned to capitalize on technological advancements in AI, 5G, autonomous vehicles, and data centers.

Micron Technology Inc. (NASDAQ:MU)’s stock has gained 27% year-to-date (YTD), reflecting investor optimism about AI-led demand. Despite a 12% drop during the DeepSeek-driven sell-off, shares have fully recovered.

Notably, on February 18, the stock surged 7% after the company unveiled its Micron 4600 PCIe Gen5 NVMe SSD, which allows large language models (LLMs) to load from SSD to DRAM in under a second, significantly enhancing AI PC performance. That is 62% faster than the Gen4 performance SSDs and would speed up faster deployment of LLMs and other AI workloads. In addition, the new product also boasts up to 107% better energy efficiency (MB/s per watt) compared to its predecessor thus increasing battery life and system efficiency. The announcement reinforced Micron Technology Inc. (NASDAQ:MU)’s position as a key player in the next-generation computing.

6. Rambus Inc. (NASDAQ:RMBS)

YTD Returns: 30%

Number of Hedge Funds: 34

Rambus Inc. (NASDAQ:RMBS) is a semiconductor and technology solutions company specializing in high-performance memory, security, and interface solutions. The company develops advanced memory architectures, cryptographic security products, and chip-to-chip interface technologies used in data centers, AI workloads, and high-performance computing. Rambus collaborates with major semiconductor manufacturers and cloud service providers to enhance data security and processing efficiency.

Rambus Inc. (NASDAQ:RMBS) shares have surged a strong 30% this year so far led by optimistic street expectations. Analysts have reaffirmed their positive view of the company after it reported impressive Q4 2024 results on February 3. While its total revenue surged 32% YoY in the quarter, Product revenue rose 37%. Interestingly, the company also extended a patent license agreement with Micron Technology Inc. (NASDAQ:MU) through 2029 which is a testimony to the strength of its innovation and patent portfolio. For Q1 2025, the company guided for revenue between $156 million and $162 million which reflects a robust 19% YoY topline growth. On the strong results, CEO Luc Seraphin highlighted the company’s strong positioning and said:

“We expanded our addressable market with a record number of new product introductions throughout the year and gained share through continued product leadership. As AI continues to accelerate performance demands across the computing landscape, we are well positioned to deliver long-term growth and continued stockholder return”.

5. Arm Holdings Plc. (NASDAQ:ARM)

YTD Returns: 30%

Number of Hedge Fund Holders: 42

Arm Holdings Plc. (NASDAQ:ARM) is a UK-based company specializing in semiconductor and software design. Renowned for its energy-efficient processor architectures, Arm licenses its intellectual property to a broad range of partners. Arm-based chips are widely used in various devices, such as smartphones, tablets, and wearables, and are increasingly found in data centers and automotive applications. The company also offers software development tools, systems and platforms, system-on-a-chip (SoC) infrastructure, and software. Softbank Group holds the majority ownership of Arm Holdings Plc. (NASDAQ:ARM).

There are reports suggesting that Arm Holdings Plc. (NASDAQ:ARM) is planning to launch its own chips this year, with Meta Platforms (NASDAQ:META) rumored to be one of its initial customers. If these reports are accurate, it would increase competition for both Advanced Micro Devices Inc. (NASDAQ:AMD) and Intel Corp. (NASDAQ:INTC). However, this development should benefit Arm Holdings Plc. (NASDAQ:ARM) in the long run by diversifying its revenue streams and reducing its dependency on licensing its intellectual property to other companies.

Currently, Arm Holdings Plc. (NASDAQ:ARM) shares are trading at $160.3, reflecting a 30% increase year-to-date. The stock has also reached a peak of $179.9 during 2025. The company remains well-positioned within the global semiconductor ecosystem, licensing its energy-efficient chip architecture to nearly all leading semiconductor companies, including Apple, Qualcomm, and Nvidia. The company’s push into the automotive sector and AI-powered IoT solutions is expanding its total addressable market.

4. Himax Technologies Inc. (NASDAQ:HIMX)

YTD Returns: 34%

Number of Hedge Fund Holders: 13

Himax Technologies Inc. (NASDAQ:HIMX) is a fabless semiconductor company based out of Taiwan. The company is a leading provider of display imaging processing technologies, offering a wide array of products including display driver ICs, timing controllers, touch sensor controllers, and CMOS image sensors. Its solutions are integral to devices such as TVs, laptops, monitors, smartphones, tablets, and augmented reality (AR) equipment.

Himax Technologies Inc. (NASDAQ:HIMX) shares have surged 34% year-to-date, and as of February 19, the stock has increased by an additional 8% in ongoing trading. The key driver of this impressive rally is the recently reported strong Q4 2024 results, where the company exceeded its own revenue guidance. This growth was fuelled by strong order momentum, robust performance in automotive displays, and an improved product mix. Following the results, the company’s stock surged by as much as 13%. Himax Technologies Inc. (NASDAQ:HIMX) has been capitalizing on the growing demand for AMOLED, OLED, and automotive display solutions, with its advanced driver ICs being integrated into high-end automotive infotainment and ADAS systems. With a strong product pipeline and increasing adoption of automotive semiconductors, the company is well-positioned for future growth.

3. Intel Corp. (NASDAQ:INTC)

YTD Returns: 37%

Number of Hedge Fund Holders: 83

Intel Corp. (NASDAQ:INTC) is a global leader in the design and manufacturing of microprocessors and semiconductor components. The company’s products power a wide range of computing devices, from personal computers to data centers and Internet of Things (IoT) applications. Intel is renowned for its innovation in CPU architecture and process technology.

With a 37% rise in share price YTD, the year 2025 has been quite good so far for the company. However, Intel Corp. (NASDAQ:INTC) is currently navigating a challenging period, with substantial investments in the foundries business yet to yield significant results and continuing market share losses, particularly to Advanced Micro Devices Inc. (NASDAQ:AMD). The company’s shares dropped by around 60% in 2024, which appeared to be the result of a series of execution failures in launching new and advanced products over the past five years.

As a direct consequence of the declining share price and investor confidence, CEO Pat Gelsinger was forced to step down, and the company is now run by two Co-CEOs. Over the last couple of months, Intel Inc. (NASDAQ:INTC) has seen various speculations circulating, including the possibility of selling or spinning off parts of its business, being acquired by another semiconductor leader, or private equity firms taking stakes in the company. In response to reports of a potential split, a Cantor Fitzgerald analyst recently commented that, although it would be a complex deal, Taiwan Semiconductor Manufacturing Company (NYSE:TSM) might agree to participate under favorable conditions. The analyst raised his price target on Intel Inc. (NASDAQ:INTC) from $22 to $29 on February 18, while maintaining a Neutral rating.

2. Nova Ltd. (NASDAQ:NVMI)

YTD Returns: 39%

Number of Hedge Fund Holders: 26

Nova Ltd. (NASDAQ:NVMI) is an Israel-based company specializing in metrology solutions for advanced process control in semiconductor manufacturing. The company provides a range of metrology devices and services that enable semiconductor manufacturers to monitor and control critical dimensions and material properties during fabrication. Their innovative technologies support the production of advanced nodes and complex 3D structures, ensuring high yield and performance.

At the end of January, the company announced the doubling of its chemical metrology production capacity and the opening of a new manufacturing facility in Germany with the aim of enhancing its global presence. In addition, the company acquired the Germany-based company Sentronics Metrology GmbH, which is a provider of wafer metrology tools for backend semiconductor fabrication.

On February 13, 2025, the company reported strong financial Q4 2024 with a 45% year-over-year revenue growth in revenue of $210 million. On the next day, an analyst from Benchmark raised Nova Ltd. (NASDAQ:NVMI)’s price target to $295 from $245 while maintaining a Buy rating. The analyst believes that the company’s recent quarterly results were strong and guidance for the March quarter also bodes well for growth. He expects adjusted earnings to grow 34% year-over-year in 2025. The analyst upgrade cycle started in early January when the analyst from Citi upgraded the stock to Buy from Neutral, raising his target price to $240 from $226.

All these factors have led to a strong performance from the stock with around 39% gains YTD.

1. ACM Research Inc. (NASDAQ:ACMR)

YTD Returns: 60%

Number of Hedge Funds: 23

ACM Research Inc. (NASDAQ:ACMR) is a provider of advanced semiconductor equipment, specializing in wet processing technology and products for the semiconductor manufacturing industry. The company’s product portfolio includes equipment for critical processes such as cleaning, etching, and surface treatment, which are essential for producing high-performance chips.

ACM Research Inc. (NASDAQ:ACMR) has seen its stock surge 60% year-to-date, with an additional 9% increase as of February 19. The stock’s upward momentum is largely attributed to the company’s robust financial performance and heightened demand for its cleaning solutions, which are essential in logic and memory chip manufacturing. The company recently introduced its 2025 revenue guidance where it anticipated revenue in the range of $850 million to $950 million, reflecting an estimated 25% year-over-year growth. The company continues to innovate its tools while aiming to expand into markets beyond mainland China, anticipating greater global growth. ACM Research Inc. (NASDAQ:ACMR) is expected to report its Q4 2024 results on February 26.

While we acknowledge the potential of ACMR to grow, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than ACMR but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap.

Disclosure. None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and investors. Please subscribe to our daily free newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.