In this article, we are going to talk about the 10 best home insurance companies. You can skip our detailed discussion about property and casualty insurance insights and go to the 5 Best Home Insurance Companies.

One of the most significant investments you will ever make is buying a home. It’s critical to safeguard your investment, and home insurance is an essential part of that. Homeowners insurance comes in handy to offset losses if your home encounters an unfortunate incident, such as a fire, tornado, or snowstorm. If you’re buying a house with a mortgage, homeowners insurance isn’t just a good idea because it’s a must-have to cover the loan.

According to McKinsey’s report, the insurance industry is one of the biggest industries in the world, generating an annual revenue of more than $5 trillion. The property and casualty (P&C) market accounts for about one-third of the insurance industry, with $1.6 trillion in premiums. The global spread of COVID-19 in 2020 has posed significant challenges around the world, and the insurance industry is not immune to the virus’s economic effects. In the first quarter of 2020, the National Association of Insurance Commissioners in the United States reported a 4.5% increase in net premiums written for the property and casualty insurance segment compared to the same period in 2019. According to the American Insurance Association, property-casualty insurers in the United States have more than $1.4 trillion invested in the economy. In 2018, the industry as a whole contributed 2.1% of global GDP.

kurhan/Shutterstock.com

Many insurers, especially those writing events cancellation and workers’ compensation, were struck by the pandemic and other disasters-related losses in the first half of 2020. According to Deloitte, the first-half annualized GAAP operating return-on-average equity for North American property-casualty insurers fell to 2.8% from 8.3% the year before, owing in part to $6.8 billion in accumulated losses related to COVID-19 and parallel declines in premium volume. Despite the challenges, the industry is expected to expand by 3% in 2021, backed by a potential 7% increase in emerging markets. Over the past twelve months, S&P’s Insurance Industry Index total return climbed 42.24%.

Should You Invest in Home Insurance Stocks?

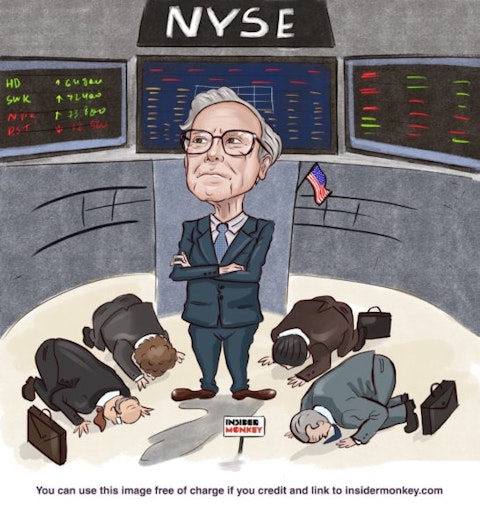

If you want to diversify your portfolio, investing in the best home insurance companies may be a good option. The insurance industry is a recession-resistant industry that can generate excellent long-term returns with less volatility. This is why Warren Buffett is so drawn to insurance and chooses it as the foundation of his empire, Berkshire Hathaway (NYSE: BRK.A).

New York-based investment management firm Davis New York Venture Fund highlighted Berkshire Hathaway (NYSE: BRK.A) in its fourth-quarter investor letter and said that:

“Our attention within the value part of the market remains steadfastly focused on finding companies that combine strength and resiliency with long-term growth, profitability, and competitive advantages. In today’s uncertain economy, we believe we have found such businesses trading at bargain prices in two sectors: industrials and financials. In the industrial space, concerns about the impact of the economic downturn on short-term profitability led to a wave of selling in a select group of leaders with durable competitive advantages, long records of profitability, and bright long-term prospects. Companies like Berkshire Hathaway is a wonderful example of an attractive investment in this sector.”

Insurers work hard to keep their growth momentum going, not to mention to improve their operating performance. While people are putting money into their premiums, the insurer will use the money to invest for a higher gain in the meantime. Given P&C’s emphasis on risk management and financial security, one would expect the industry to radically transform itself in order to meet changing demand and push the insurability boundary forward.

Best Home Insurance Companies

To give you the most accurate insights about the best home insurance companies, we ranked each insurer by its market capitalization. With this context in mind, let’s take a look at the 10 best home insurance companies to invest in.

10. Allstate Corp. (NYSE: ALL)

Market cap: $35.45 billion

We start our list of the 10 best home insurance companies with Illinois-based Allstate Corp. Founded in 1931, Allstate Corp. offers property and casualty insurance and other insurance products in the United States and Canada. Allstate’s home insurance is transparent and easily understandable, but the company stands out as one of the top homeowner’s insurance providers for its outstanding customer service. Since 2011, the property and casualty insurer has seen sales rise every year, and it has even managed to make it through 2020 with a 0.3% increase in revenue.

The company’s revenue in 2020 came in at 44.8 billion, where property and casualty premiums amounted to $37 billion. In January 2021, Allstate Corp. acquired insurance firm National General Holdings Corp for $4 billion. Shares of ALL increased 16.6% over the past twelve months. On March 30, Raymond James Financial, Inc. analysts have given Allstate a Strong Buy rating. The target price was set at $ 135. There is a 15.29% upside opportunity at the current price of $ 117.10.

9. Travelers Companies Inc. (NYSE: TRV)

Market cap: $37.8 billion

Ranking 9th in our list of the 10 best home insurance companies is New York-based Travelers Companies Inc. Founded in 1853, the company offers commercial and personal property and casualty insurance products and services. On top of that, Travelers Companies also provides automobile insurance, management liability, and risk management services.

The company’s revenue in 2020 was $31.9 billion. The current annual return dividend is $3.40, up 0.9% from the previous year. Shares of TRV jumped 37% over the past twelve months. Travelers was given a Neutral rating by Credit Suisse analysts. The target price was set at $ 153.

8. MetLife Inc. (NYSE: MET)

Market cap: $54.2 billion

Ranking 8th in our list of the 10 best home insurance companies is New York-based MetLife Inc. The company offers life and homeowners insurance and financial services to clients in the US, Europe, Latin America, Africa, the Middle East, and Asia. If you want to handle your insurance needs online or via an app, MetLife might be a good place to start your search for home insurance. Account-holders can view their policies and pay bills by credit card using the MetLife app.

The company’s revenue in 2020 came in at $42 billion. Morgan Stanley analysts have given MetLife an Overweight ranking. The target price was set at $70. Shares of MET surged 73% over the past twelve months.

7. Prudential Plc (NYSE: PUK)

Market cap: $55.8 billion

International insurance provider Prudential Plc ranks 7th on the list of the 10 best home insurance companies. Headquartered in London, United Kingdom, PRU offers property and casualty insurance, life insurance, health insurance, retirement, and asset management solutions to more than 20 million clients in the US, Asia, and Africa.

The British insurer plans to break off its U.S. business in the second quarter, following a tremendous full-year operating profit growth in Asia. Prudential, which has been pushed by activist investor Third Point to break the company in two, announced in January that it will demerge its U.S. subsidiary Jackson and raise up to $3 billion in new equity through the demerger.

In 2020, the company’s revenue came in at $55.9 billion, this reflects a dramatic drop of 40.9 % from the previous year’s revenue of $87 billion. On the other hand, Asia’s profit increased by 13% to $3.7 billion. Shares of PUK climbed 62.7% over the past twelve months. Prudential Plc. (PRU: LN) (NYSE: PUK) was upgraded from Hold to Buy by HSBC analyst Kailesh Mistry on March 23.

6. Axa SA

Market cap: $66.6 billion

Property and casualty insurer Axa SA ranks 6th on the list o the 10 best home insurance companies. The company was established in 1985 in Paris, France. AXA is one of the world’s leading insurance companies, with significant businesses in property and casualty insurance, life insurance, investments, and asset management. Axa’s P&C segment offers various products for personal and commercial clients, including vehicle, property, and general liability insurance. AXA SA made its biggest acquisition to date in 2018, when it paid $15.3 billion for XL Group.

The company’s overall revenue in 2020 was $115.3 billion. Shares of AXAHY increased 62.5% over the past twelve months.

Click to continue reading and see the 5 Best Home Insurance Companies.

Suggested articles:

- 15 Biggest Companies That Use Shopify

- 10 Best Value Stocks To Buy Now According To Howard Marks

- 15 Best Dividend Stocks Right Now

Disclosure: None. 10 Best Home Insurance Companies is originally published at Insider Monkey.