In this article, we will take a look at the 10 Best 3D Printing Stocks To Buy Right Now.

3D printing, sometimes known as additive manufacturing, is the process of layering materials to create three-dimensional objects and structures using computer-aided design (CAD) technology. Unlike traditional manufacturing procedures, additive manufacturing builds 3D objects layer by layer using a range of materials such as metal, plastic, concrete, and paper. Although the technology has been around for a few years, the industry has expanded massively in recent years due to its limitless applications in commercial manufacturing and large-scale projects.

According to Proto Labs’ 2024 3D Printing Trend Report, the 3D printing market was valued at $22.14 billion on average in 2023, an increase of 26.8% from $17.46 billion in 2022. This was 10% more than the company’s previous forecast, which predicted a $19.9 billion market size in 2023 with a 17% compound annual growth rate (CAGR). The research also suggests a CAGR of 21%, with the market reaching $24.8 billion by the end of 2024 and $57.1 billion by 2028. This rapid market growth rate was also highlighted in replies to the 2024 edition of Proto Labs Network’s annual survey of over 700 members of its worldwide engineering community. Around 70% of the survey’s respondents reported printing more components in 2023 than in 2022.

Artificial intelligence is another potential boon for 3D printing. AI’s development has been so broad and disruptive in practically every area that it’s almost a guarantee it will have an influence on 3D printing as well. AI’s revolutionary prospects, such as spotting faults during construction, creating elaborate designs, and even optimizing material qualities, are unquestionably fascinating. However, Adam Hecht, co-founder and head of Additive Manufacturing at DIVE, feels that artificial intelligence will be most useful in hardware devices. He said the following:

“Right now, we have a lot of smart printers that are very dumb. They will say something is wrong without specifying what it is. That’s very frustrating for a lot of consumers and companies. But as the systems get smarter, they can actually help users to self-diagnose, or dial in new materials, for example—I think that’s where we’re going to see a lot more adoption.”

3D Printing in Healthcare

As an additive technology, 3D printing has made its way into most, if not all, industries, but it has proven to be most effective in the healthcare industry, due to its applications in the manufacture of precise prosthetics for amputees, fitted perfectly to the individual’s requirements. Another key advantage of 3D printing, especially with regard to medical device development, is its capacity to facilitate rapid prototyping and iterative design. Historically, bringing novel medical equipment to market has required long design versions, tooling techniques, and testing stages. However, 3D printing accelerates the process by allowing designers to quickly construct prototypes and revise concepts in response to feedback and testing results. Given this, it’s no wonder that the usage of 3D printing in healthcare is gradually increasing. According to Grand View Research, the healthcare 3D printing market was valued at $8.52 billion in 2023 and is expected to increase at a CAGR of 18.5% between 2024 and 2030.

Our Methodology

For our list of the 10 best 3D printing stocks to buy, we used financial media reports and ETFs to narrow down on companies involved in 3D printing, additive manufacturing, or technologies related to 3D printing operations. The names on this list are ranked in ascending order according to the hedge fund sentiments surrounding them, using data from Insider Monkey’s Q4 2024 database.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

10. Xometry, Inc. (NASDAQ:XMTR)

Number of Hedge Fund Holders: 14

Xometry, Inc. (NASDAQ:XMTR) is a major online marketplace for manufacturing services that connects customers to a global network of providers. The company offers a wide range of manufacturing services, such as 3D printing, CNC machining, injection molding, and metal fabrication.

In Q4 2024, Xometry, Inc. (NASDAQ:XMTR) reported $135 million in marketplace revenues, up 20% year on year. The number of active purchasers increased by 23%, reaching 68,267 at the end of the year. Meanwhile, accounts spending more than $50,000 in the past 12 months increased by 12% to 1,495. For the full year 2024, Xometry, Inc. (NASDAQ:XMTR) hit $486 million in marketplace revenues, a 23% increase from 2023.

On February 15, MP Securities confirmed its Market Outperform rating on Xometry, Inc. (NASDAQ:XMTR), with a price objective of $42. The firm provided insight into the company’s future potential, stating that if Xometry can increase its active buyers to over 400,000 and achieve a 30% adjusted EBITDA margin—matching the upper end of its long-term goals—within the next two decades, the stock could reach $75.

Alger Small Cap Growth Fund stated the following regarding Xometry, Inc. (NASDAQ:XMTR) in its Q4 2024 investor letter:

“Xometry, Inc. (NASDAQ:XMTR) is a leading two-sided marketplace for on-demand manufacturing services. The company provides real-time access to global manufacturing demand and capacity, with sourcing and pricing available across a network of buyers and sellers. In our view, this marketplace enables buyers (e.g., engineers and product designers) to efficiently source manufacturing processes and sellers of manufacturing services to grow their businesses. Xometry’s AI-enabled technology platform is powered by proprietary machine learning algorithms, resulting in a sophisticated marketplace for manufacturing. During the quarter, shares contributed to performance after delivering strong fiscal third quarter results, along with management raising fiscal fourth guidance that signaled continued revenue growth and earnings-before-interest-taxes-depreciation-amortization (EBITDA) break-even. Further, we believe last few quarters have demonstrated consistency in execution which is driving investor confidence.”

9. Proto Labs, Inc. (NYSE:PRLB)

Number of Hedge Fund Holders: 18

Proto Labs, Inc. (NYSE:PRLB) is an e-commerce company that creates custom prototypes and on-demand manufacturing components. The company provides injection molding, CNC machining, three-dimensional printing, and sheet metal fabrication products for developers and engineers who utilize 3D computer-aided design tools to create products for a variety of end markets.

Proto Labs, Inc. (NYSE:PRLB) recently announced Q4 2024 results that surpassed analysts’ predictions, despite a small year-over-year revenue decline. The company posted adjusted earnings per share of $0.38, surpassing analysts’ forecasts of $0.29. In addition, revenue for the quarter was $121.8 million, which was above the average projection of $120.01 million but represented a 2.6% decrease from $125.0 million in the fourth quarter of 2023.

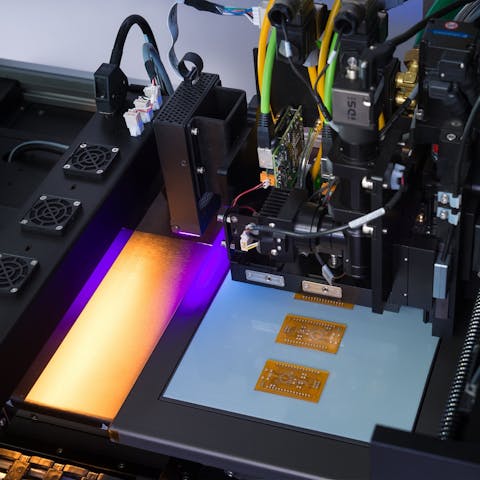

Proto Labs, Inc. (NYSE:PRLB) raised its 3D printing capabilities back in September 2024 by introducing advanced photopolymer technology. The company’s Axtra3D Hybrid PhotoSynthesis (HPS) produces highly repeatable and finely detailed 3D printed items at high rates by making use of a dual 3D printing method that overcomes existing restrictions in traditional 3D printing.

8. 3D Systems Corp (NYSE:DDD)

Number of Hedge Fund Holders: 20

3D Systems Corporation (NYSE:DDD) offers 3D printing and digital manufacturing services, such as stereolithography, selective laser sintering, direct metal printing, and multi-jet printing. The company has made a number of advancements in its divisions, such as printing high-purity copper and introducing the PSLA 270, a faster photopolymer 3D printing platform.

On February 11, Cantor Fitzgerald analyst Troy Jensen reaffirmed his Overweight rating on 3D Systems Corporation (NYSE:DDD) shares, with a price target of $5.75. According to Jensen, the company’s revenue should be in line with FactSet consensus projections, indicating a combination of low system demand and strong consumable sales. The analyst’s estimates also included the different businesses inside 3D Systems, where system sales were hampered by external economic worries but consumable demand remained strong.

Furthermore, 3D Systems Corporation (NYSE:DDD) and Daimler recently formed a partnership to decentralize spare part manufacture utilizing 3D printing technology. This partnership is intended to cut time to components in hand by up to 75% while minimizing vehicle downtime due to maintenance.

7. Stratasys Ltd. (NASDAQ:SSYS)

Number of Hedge Fund Holders: 20

Stratasys Ltd. (NASDAQ:SSYS), founded in Minnesota and headquartered in Israel, manufactures 3D printers and 3D production systems for office-based fast prototyping and direct digital manufacturing solutions. The company services a wide range of businesses, including aerospace and automotive components manufacturers, medical and dentistry enterprises, and producers of simple consumer goods.

The 3D printing company announced preliminary adjusted net income in the fourth quarter of $8.1 million to $8.6 million, above the consensus expectation of $7.02 million. This follows Fortissimo’s purchase of 11,650,485 freshly issued ordinary shares, increasing its ownership to approximately 15.5% of Stratasys’ issued and outstanding ordinary shares.

On February 11, Cantor Fitzgerald maintained its Overweight rating on Stratasys Ltd. (NASDAQ:SSYS), with a price target of $12. According to the firm, Stratasys anticipates a sequential increase in hardware revenue, but consumable sales will be lower than in the third quarter of 2024. Based on current revenues of $578 million, Stratasys Ltd. (NASDAQ:SSYS) expects an adjusted EBITDA margin of 8%.

6. HP Inc. (NYSE:HPQ)

Number of Hedge Fund Holders: 48

HP Inc. (NYSE:HPQ) is a global technology company that makes personal computers, various access devices, imaging, and printing products. Since its initial venture into 3D printing back in 2016, the company has released multiple polymer 3D printing systems and debuted Metal Jet technology.

HP Inc. (NYSE:HPQ) recently entered into a formal agreement to buy artificial intelligence assets from the technology startup Humane. The $116 million transaction includes the AI-powered platform Cosmos, a staff of highly trained engineers, and a portfolio of over 300 patents and applications. The agreement will bring Humane’s team under the HP umbrella, effectively launching HP IQ, a new AI innovation lab.

Similarly, on February 5, HP Inc. (NYSE:HPQ) entered into a software license arrangement with Structure, a producer of 3D scanning devices and software. According to the agreement, HP will use the AI-powered Structure Software Development Kit (SDK) to deliver 3D scanning application development services targeted to the demands of its Additive Manufacturing customers. The partnership is stated to be part of HP’s commitment to deliver end-to-end 3D scanning and additive manufacturing services to its clients, hence driving adoption across a wide range of applications.

5. L3Harris Technologies Inc. (NYSE:LHX)

Number of Hedge Fund Holders: 48

L3Harris Technologies, Inc. (NYSE:LHX) is a major American technology company noted for its expertise in surveillance systems, microwave weapons, and electronic warfare. The firm uses metal 3D printing to develop and manufacture metal alloy additive manufacturing parts for aerospace and defense propulsion and power systems.

L3Harris Technologies, Inc. (NYSE:LHX) posted fourth quarter revenues of $5.5 billion, in line with market forecasts, while adjusted profits per share came in at $3.47, higher than the average estimate of $3.42. However, despite beating forecasts, Citi analysts decreased the company’s price target to $285 but maintained a buy rating. Meanwhile, Bernstein analysts reiterated an Outperform rating and a $267 price target.

Late last year, L3Harris Technologies, Inc. (NYSE:LHX) delivered the first RL10 engine with an additively built copper thrust chamber to United Launch Alliance (ULA), a testament to the company’s capabilities in 3D printing and additive manufacturing. The most recent iteration, the RL10E-1, employs Additive Manufacturing to reduce the number of components in the thrust chamber by 98%. The engine will be used on a ULA Vulcan rocket this year.

4. Carpenter Technology Corporation (NYSE:CRS)

Number of Hedge Fund Holders: 55

Carpenter Technology Corporation (NYSE:CRS) develops, produces, and sells stainless steel and corrosion-resistant nickel, copper, and titanium alloys, as well as powered alloys for 3D additive printing in the aerospace, defense, and medical sectors.

Carpenter Technology (NYSE:CRS) posted strong financial results for the second quarter of FY2025, with a record operating income of $118.9 million, up 70% year on year. CRS also reported $1.66 profits per diluted share and $67.9 million in operational cash flow. Its Specialty Alloys Operations segment outperformed expectations with $135.6 million in operating income and an adjusted operating margin of 28.3%, up from 20% the previous year.

On January 21, TD Cowen analysts raised the price target on Carpenter Technology (NYSE:CRS) shares to $220 from $200, keeping a Buy rating on the company’s shares. The firm’s analysts emphasized the company’s strong execution and the breadth of its backlog, which provide it the flexibility to overcome any reduced demand from Boeing’s original equipment manufacturer (OE). The analysts stated that Carpenter Technology’s additional benefits from price and operational leverage are projected to result in higher EBIT increases compared to its rivals.

3. Align Technology, Inc. (NASDAQ:ALGN)

Number of Hedge Fund Holders: 58

Align Technology, Inc. (NASDAQ:ALGN), recognized as a leader in 3D-printed dental treatments, is a prominent medical device company that employs 3D printing to manufacture Invisalign systems, which straighten teeth with removable and custom-made aligners.

On February 14, Wells Fargo started coverage of Align Technology, Inc. (NASDAQ:ALGN), with an Overweight rating and a $255 price target. The firm’s analyst, Vik Chopra, emphasizes the company’s strong competitive moat, comparing its Invisalign brand to notable names such as Kleenex in their respective markets, and notes that Align Technology controls roughly two-thirds of the clear aligner market.

Align Technology, Inc. (NASDAQ:ALGN) stated in January of this year that it had finalized the acquisition of privately held Cubicure GmbH, a pioneer in direct 3D printing solutions for polymer additive manufacturing. The purchase of Cubicure will help Align support and grow its strategic innovation agenda, as well as improve the Align Digital Platform. Cubicure will also help Align expand and scale its printing, material, and manufacturing capabilities for its 3D printed product portfolio, which already includes the Invisalign Palatal Expander system, the company’s first direct 3D printed orthodontic device.

2. ANSYS, Inc. (NASDAQ:ANSS)

Number of Hedge Fund Holders: 74

ANSYS, Inc. (NASDAQ:ANSS) is a software company located in Pennsylvania that develops and markets Multiphysics engineering simulation products. The firm’s Ansys Additive Solutions software allows for additive manufacturing designs and simulations of the metal additive manufacturing process, saving product development time.

ANSYS, Inc. (NASDAQ:ANSS) reported Q4 2024 revenues of $882.2 million, which came above the average estimate of $863.49 million. This is a 10% increase in reported currency and an 11% increase in constant currency compared to the same quarter of 2023. The company’s GAAP diluted EPS stood at $3.21, lower than the predicted $3.39, while its non-GAAP diluted EPS increased to $4.44, greatly above forecasts.

On February 20, Rosenblatt Securities raised its price target for the ANSS stock to $340 from $335, while keeping a Neutral rating. The change comes after ANSYS, Inc. (NASDAQ:ANSS) announced a strong fourth-quarter result that exceeded expectations. ANSYS reported a 10% year-over-year growth in revenues, hitting $882.2 million, slightly above Rosenblatt’s projection of $872.6 million. The company also announced operating margins of 53%, which came above the expected 51%.

Conestoga Capital Advisors stated the following regarding ANSYS, Inc. (NASDAQ:ANSS) in its Q4 2024 investor letter:

“ANSYS, Inc. (NASDAQ:ANSS) is a market leader in selling computer-aided engineering (CAE) software that allows engineers to simulate how product designs will behave in real world environments before they are manufactured. Despite its pending acquisition by Synopsys (SNPS), the company’s stock reacted favorably to a surprisingly healthy quarter.”

1. Autodesk, Inc. (NASDAQ:ADSK)

Number of Hedge Fund Holders: 74

Autodesk, Inc. (NASDAQ:ADSK) is a top software provider for designers, engineers, and builders. Its technology covers architecture, engineering, building, product design, and production. The most popular of its products is AutoCAD, a 3D software tool. That said, many users consider the company’s Fusion to be a superior tool, with its built-in features for 3D modeling, collaboration, simulation, and documentation.

On February 20, KeyBanc Capital Markets reiterated its confidence in Autodesk, Inc. (NASDAQ:ADSK), keeping an Overweight rating and a $330 price target. KeyBanc analyst Jason Celino presented insights following the firm’s conclusion of quarter-end evaluations, which predicted an “average” fiscal fourth-quarter performance from the software company. Celino expects Autodesk’s fiscal year 2025 sales prediction to increase by 12-13%, expanding on the company’s existing 11.5% revenue growth, with operating margin and free cash flow projections in line with previous forecasts.

Polen Focus Growth Strategy stated the following regarding Autodesk, Inc. (NASDAQ:ADSK) in its Q2 2024 investor letter:

“Autodesk, Inc. (NASDAQ:ADSK) and Accenture were also notable absolute detractors in the quarter. With Autodesk, most of the stock’s price weakness came in April. The company announced that it would delay the release of its earnings and 10-K filing as it launches an internal investigation regarding its practices on some non-GAAP financial metrics. Upon further analysis, we were encouraged to hear that they were taking this very seriously and being very comprehensive in their investigation. Ultimately, Accenture announced it was closing the investigation and that no re-statements would be required. As discussed in the following section, we chose to exit the position in favor of a more attractive investment.

While we acknowledge the potential of ADSK as an investment, our conviction lies in the belief that certain AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than ADSK but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.