In this article, we will take a look at the 10 Best 3D Printing Stocks To Buy Right Now.

3D printing, sometimes known as additive manufacturing, is the process of layering materials to create three-dimensional objects and structures using computer-aided design (CAD) technology. Unlike traditional manufacturing procedures, additive manufacturing builds 3D objects layer by layer using a range of materials such as metal, plastic, concrete, and paper. Although the technology has been around for a few years, the industry has expanded massively in recent years due to its limitless applications in commercial manufacturing and large-scale projects.

According to Proto Labs’ 2024 3D Printing Trend Report, the 3D printing market was valued at $22.14 billion on average in 2023, an increase of 26.8% from $17.46 billion in 2022. This was 10% more than the company’s previous forecast, which predicted a $19.9 billion market size in 2023 with a 17% compound annual growth rate (CAGR). The research also suggests a CAGR of 21%, with the market reaching $24.8 billion by the end of 2024 and $57.1 billion by 2028. This rapid market growth rate was also highlighted in replies to the 2024 edition of Proto Labs Network’s annual survey of over 700 members of its worldwide engineering community. Around 70% of the survey’s respondents reported printing more components in 2023 than in 2022.

Artificial intelligence is another potential boon for 3D printing. AI’s development has been so broad and disruptive in practically every area that it’s almost a guarantee it will have an influence on 3D printing as well. AI’s revolutionary prospects, such as spotting faults during construction, creating elaborate designs, and even optimizing material qualities, are unquestionably fascinating. However, Adam Hecht, co-founder and head of Additive Manufacturing at DIVE, feels that artificial intelligence will be most useful in hardware devices. He said the following:

“Right now, we have a lot of smart printers that are very dumb. They will say something is wrong without specifying what it is. That’s very frustrating for a lot of consumers and companies. But as the systems get smarter, they can actually help users to self-diagnose, or dial in new materials, for example—I think that’s where we’re going to see a lot more adoption.”

3D Printing in Healthcare

As an additive technology, 3D printing has made its way into most, if not all, industries, but it has proven to be most effective in the healthcare industry, due to its applications in the manufacture of precise prosthetics for amputees, fitted perfectly to the individual’s requirements. Another key advantage of 3D printing, especially with regard to medical device development, is its capacity to facilitate rapid prototyping and iterative design. Historically, bringing novel medical equipment to market has required long design versions, tooling techniques, and testing stages. However, 3D printing accelerates the process by allowing designers to quickly construct prototypes and revise concepts in response to feedback and testing results. Given this, it’s no wonder that the usage of 3D printing in healthcare is gradually increasing. According to Grand View Research, the healthcare 3D printing market was valued at $8.52 billion in 2023 and is expected to increase at a CAGR of 18.5% between 2024 and 2030.

Our Methodology

For our list of the 10 best 3D printing stocks to buy, we used financial media reports and ETFs to narrow down on companies involved in 3D printing, additive manufacturing, or technologies related to 3D printing operations. The names on this list are ranked in ascending order according to the hedge fund sentiments surrounding them, using data from Insider Monkey’s Q4 2024 database.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

10. Xometry, Inc. (NASDAQ:XMTR)

Number of Hedge Fund Holders: 14

Xometry, Inc. (NASDAQ:XMTR) is a major online marketplace for manufacturing services that connects customers to a global network of providers. The company offers a wide range of manufacturing services, such as 3D printing, CNC machining, injection molding, and metal fabrication.

In Q4 2024, Xometry, Inc. (NASDAQ:XMTR) reported $135 million in marketplace revenues, up 20% year on year. The number of active purchasers increased by 23%, reaching 68,267 at the end of the year. Meanwhile, accounts spending more than $50,000 in the past 12 months increased by 12% to 1,495. For the full year 2024, Xometry, Inc. (NASDAQ:XMTR) hit $486 million in marketplace revenues, a 23% increase from 2023.

On February 15, MP Securities confirmed its Market Outperform rating on Xometry, Inc. (NASDAQ:XMTR), with a price objective of $42. The firm provided insight into the company’s future potential, stating that if Xometry can increase its active buyers to over 400,000 and achieve a 30% adjusted EBITDA margin—matching the upper end of its long-term goals—within the next two decades, the stock could reach $75.

Alger Small Cap Growth Fund stated the following regarding Xometry, Inc. (NASDAQ:XMTR) in its Q4 2024 investor letter:

“Xometry, Inc. (NASDAQ:XMTR) is a leading two-sided marketplace for on-demand manufacturing services. The company provides real-time access to global manufacturing demand and capacity, with sourcing and pricing available across a network of buyers and sellers. In our view, this marketplace enables buyers (e.g., engineers and product designers) to efficiently source manufacturing processes and sellers of manufacturing services to grow their businesses. Xometry’s AI-enabled technology platform is powered by proprietary machine learning algorithms, resulting in a sophisticated marketplace for manufacturing. During the quarter, shares contributed to performance after delivering strong fiscal third quarter results, along with management raising fiscal fourth guidance that signaled continued revenue growth and earnings-before-interest-taxes-depreciation-amortization (EBITDA) break-even. Further, we believe last few quarters have demonstrated consistency in execution which is driving investor confidence.”

9. Proto Labs, Inc. (NYSE:PRLB)

Number of Hedge Fund Holders: 18

Proto Labs, Inc. (NYSE:PRLB) is an e-commerce company that creates custom prototypes and on-demand manufacturing components. The company provides injection molding, CNC machining, three-dimensional printing, and sheet metal fabrication products for developers and engineers who utilize 3D computer-aided design tools to create products for a variety of end markets.

Proto Labs, Inc. (NYSE:PRLB) recently announced Q4 2024 results that surpassed analysts’ predictions, despite a small year-over-year revenue decline. The company posted adjusted earnings per share of $0.38, surpassing analysts’ forecasts of $0.29. In addition, revenue for the quarter was $121.8 million, which was above the average projection of $120.01 million but represented a 2.6% decrease from $125.0 million in the fourth quarter of 2023.

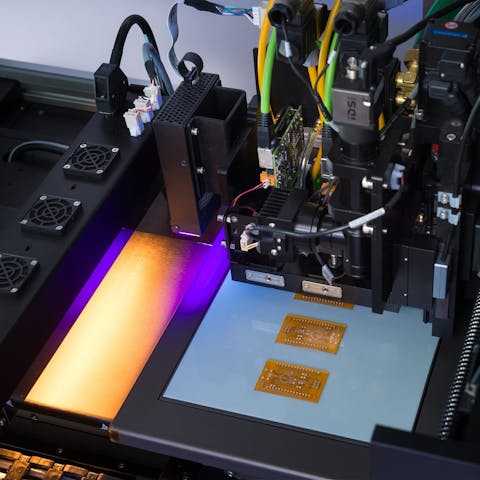

Proto Labs, Inc. (NYSE:PRLB) raised its 3D printing capabilities back in September 2024 by introducing advanced photopolymer technology. The company’s Axtra3D Hybrid PhotoSynthesis (HPS) produces highly repeatable and finely detailed 3D printed items at high rates by making use of a dual 3D printing method that overcomes existing restrictions in traditional 3D printing.