In this article, we will discuss the 10 best 3D printing stocks to buy now. If you want to skip our discussion on the 3D printing industry’s growth prospects, go directly to the 5 Best 3D Printing Stocks To Buy Now.

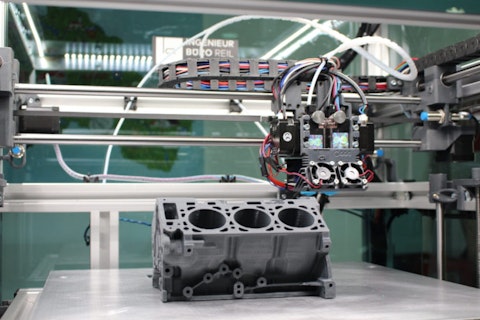

According to Fortune Business Insights, the market for 3D printing was estimated to be worth $15.10 billion in 2021. The industry is predicted to expand by 24.3% CAGR from $18.33 billion in 2022 to $83.90 billion in 2029. Researchers estimate that the demand for online 3D printing for simulation purposes will increase as a result of rapidly increasing digitization and the boosting deployment of progressive technologies like Machine Learning (ML).

Hardware has been developed by companies like Sigma Labs and Additive Assurance to oversee the compartments of metal 3D printers and identify problems. These techniques will support active feedback, allowing the printers to swiftly address problems as they arise. The machinery can recognize errors made in the past and make corrections when coupled with MES software and 3D printing simulation. Together, these fields are developing at phenomenal rates as manufacturers realize the benefits of being able to create products from digital files whenever they are needed. Large corporations like Ford Motor Company (NYSE:F), General Electric Company (NYSE:GE), and Microsoft Corporation (NASDAQ:MSFT) are pushing the additive industry to adapt to their requirements as they turn to 3D printing to generate high-quality end parts.

In the 3D printing market, North America’s revenue share was the highest due to the technology’s faster and higher adoption rate in the region in 2021. The United States is expected to experience sustained growth as more metal 3D printers are adopted by the healthcare, automotive, and consumer electronics industries. These industries are expected to adopt metal 3D printing as a result of the rapid urbanization, which stimulates the need for infrastructure development. This is especially true in nations like China, Japan, and South Korea.

The growth and importance of the 3D Printing Industry can be gauged by the fact that Cathie Wood’s Ark Investment Management has a dedicated 3D Printing ETF. The ETF has a weighted average market cap of $89 billion and has 54 holdings as of Q2 2022. The Net Asset Value returns for 2020 stood at 39.52%. However, the returns in the last year have been dismal as high-potential growth companies took a beating due to rising inflation, interest rate hikes, and fears of a recession.

Our Methodology

Keeping in view the overall bullish outlook on the 3D printing industry’s future, we will take a look at the 10 best 3D printing stocks to buy now. We have looked into the business fundamentals and positive catalysts for these stocks that would allow them to generate strong returns for investors in the long run. The hedge fund sentiment, based on the 912 elite funds in Insider Monkey’s database as of Q1 2022, has also been discussed to provide additional investment context.

10 Best 3D Printing Stocks to Buy Now

10. Materialise NV (NASDAQ:MTLS)

Number of Hedge Fund Holders: 7

Stock Price as of July 29: $14.04

Materialise NV (NASDAQ:MTLS) is a Leuven, Belgium-based innovator in the 3D Printing Industry with an experience of over three decades. The company is involved in the provision of a wide range of software and 3D Printing services for aerospace, automotive, arts, and the healthcare industry.

Materialise NV (NASDAQ:MTLS) posted its Q2 2022 result on July 28. The company reported revenue of $60.32 million, increasing by 14.5% YoY and beating the consensus estimate of $58.48 million. Meanwhile, the GAAP EPS was posted at two cents, in line with the consensus estimates. Materialise NV (NASDAQ:MTLS) anticipates revenue for 2022 to be 10% higher than the 2021 level. This would amount to around $256 million as opposed to the analysts’ estimates of $239.32 million. Meanwhile, the company is anticipating a consolidated EBITDA of €20 million to €25 million.

Citing a bullish outlook on the future of 3D printing technology, Noelle Dilts at Stifel gave Materialise NV (NASDAQ:MTLS) a Buy rating in May.

As of Q2 2022, ARK Investment Management was the leading hedge fund investor in Materialise NV (NASDAQ:MTLS), with a cumulative stake worth over $90.7 million.

9. Nano Dimension Ltd. (NASDAQ:NNDM)

Number of Hedge Fund Holders: 10

Stock Price as of July 29: $3.29

Nano Dimension Ltd. (NASDAQ:NNDM) is a Waltham, Massachusetts-based 3D Printing company that is focused on manufacturing circuit boards through 3D printing.

The company has been in the news for acquiring a 12% stake in Stratasys Ltd. (NASDAQ:SSYS). Industry experts think that Nano Dimension Ltd. (NASDAQ:NNDM) has made this move to diversify into the polymer side of the 3D printing industry and wants to include one of the oldest 3D printing companies in its portfolio. However, Stratasys Ltd. (NASDAQ:SSYS) has adopted a poison bill to stop the further acquisition of its shares.

In the last 18 months, Nano Dimension Ltd. (NASDAQ:NNDM) has acquired three notable 3D printing entities. On July 27, preliminary revenue for Q2 2022 was reported at $11 million, reflecting a 5.5% increase on a sequential basis. Nano Dimension Ltd. (NASDAQ:NNDM) finished the first half of 2022 with total revenue of $21.5 million. This shows a significant increase of 1,244% YoY.

At the end of Q1 2022, 10 hedge funds held a cumulative stake worth over $100.3 million in Nano Dimension Ltd. (NASDAQ:NNDM).

8. Desktop Metal, Inc. (NYSE:DM)

Number of Hedge Fund Holders: 12

Stock Price as of July 29: $2.13

Desktop Metal, Inc. (NYSE:DM) is a Burlington, Massachusetts-based 3D printing corporation that is a leader in the production of components for the jet engine. The company has domestic and international engineering facilities. Furthermore, it has a distribution network that covers 65 countries around the world through more than 200 partners.

Desktop Metal, Inc. (NYSE:DM) is focused on making 3D printing a part of its mainstream manufacturing process. The company is working on coming up with a next-gen 3D printer that could disrupt the industry. To combat the tough macroeconomic environment, Desktop Metal, Inc. (NYSE:DM) announced a strategic integration and cost optimization plan in June 2022. The plan intends to save at least $100 million in the next two years.

On July 28, Desktop Metal, Inc. (NYSE:DM) revealed that it had qualified the use of IN625, nickel alloy, for its metal 3D printing platform, Studio System. The platform allows users to print premium quality metal parts in low volumes.

Desktop Metal, Inc. (NYSE:DM) was held by 12 hedge funds at the end of Q1 2022.

7. FARO Technologies, Inc. (NASDAQ:FARO)

Number of Hedge Fund Holders: 12

Stock Price as of July 29: $32.52

FARO Technologies, Inc. (NASDAQ:FARO) is a Lake May, Florida-based company in the rising 3D measurement and imaging segment. The 3D measurement and imaging services come into play in the field of architecture, engineering, maintenance, new construction, and public safety.

FARO Technologies, Inc. (NASDAQ:FARO) is ramping up its efforts to come up with effective 4D digital reality solutions. To reduce cost, the company has outsourced its production to a facility in Thailand and has the products shipped through its logistics center in Shanghai. FARO Technologies, Inc. (NASDAQ:FARO) is scheduled to release its Q2 2022 results on August 8. The analysts anticipate the company to report revenue of $79.47 million. In the last eight quarters, FARO Technologies, Inc. (NASDAQ:FARO) has outperformed revenue and earnings estimates on five occasions.

According to James Ricchiuti at Needham, the company will experience the benefits of rebooting its go-to-market (GTM) strategy and manage to lower costs in the next two years. The analyst has given FARO Technologies, Inc. (NASDAQ:FARO) stock a Buy rating with a target price of $50 in a research note issued on April 28.

Paradice Investment Management increased its stake in FARO Technologies, Inc. (NASDAQ:FARO) by 15% during Q2 2022.

6. 3D Systems Corporation (NYSE:DDD)

Number of Hedge Fund Holders: 14

Stock Price as of July 29: $11.44

3D Systems Corporation (NYSE:DDD) is a Rock Hill, South Carolina-based 3D printing company. The company provides a wide range of 3D products such as printers, scanners, and medical goods.

3D Systems Corporation (NYSE:DDD) underwent a strategic restructuring in mid-2020 to increase the efficiency level of the company’s operations. The company finished 2021 with higher revenue and a better bottom line compared to the previous period, but inflationary pressure halted its progress.

3D Systems Corporation (NYSE:DDD) has refocused its efforts on the two most profitable industries, namely healthcare and industrials. Under the new strategy, the company is working on reducing its annual operating costs by $100 million. 3D Systems Corporation (NYSE:DDD) is expected to have a bright future as the market size for 3D printing of medical devices is expected to grow annually by 17.5% to $6.6 billion by 2028.

ARK Investment Management holds a stake worth over $39.7 million in 3D Systems Corporation (NYSE:DDD) as of Q2 2022.

Apart from the hedge funds, popular companies also appear to be bullish on 3D printing stocks owing to the industry’s bright growth prospects. Notable companies like Ford Motor Company (NYSE:F), General Electric Company (NYSE:GE), and Microsoft Corporation (NASDAQ:MSFT) have also invested in 3D printing companies to aid the expansion of the industry.

Click to continue reading and see the 5 Best 3D Printing Stocks To Buy Now.

Suggested Articles:

- Top 8 Stock Picks of Jeff Ubben’s Inclusive Capital

- Top 7 Best Stocks To Buy According to Stephen Feinberg’s Cerberus Capital Management

- 10 Stocks To Buy According to William Von Mueffling’s Cantillon Capital Management

Disclose. None. 10 Best 3D Printing Stocks To Buy Now is originally published on Insider Monkey