The tech world was already spooked when it got to know AI models could be developed more cheaply and efficiently. However, the landscape is shifting even further now that DeepSeek has revealed some cost and revenue data related to its V3 and R1 models.

Its potential for massive profit margins — up to 545% in ideal conditions — highlights just how effective AI models can be. The new information from DeepSeek reveals the profit margins from less computationally intensive “inference” tasks. This is the stage after training that involves trained AI models making predictions or performing tasks, such as through chatbots.

READ ALSO: 10 Buzzing AI Stocks Dominating Headlines and 10 AI Stocks Gaining Momentum Right Now

In a GitHub post published on Saturday, DeepSeek revealed that if we assume that the cost of renting one H800 chip is $2 per hour, the total daily inference cost for its V3 and R1 models is $87,072.

In comparison, the theoretical daily revenue generated by these models is $562,027, leading to a cost-profit ratio of 545%. In a year, this would add up to just over $200 million in revenue.

However, DeepSeek has cautioned that its “actual revenue is substantially lower” because the cost of using its V3 model is lower than the R1 model. Moreover, only some services are monetized as web and app access is free and developers pay less during off-peak hours.

DeepSeek’s AI models are notably a product of what is known as “distillation”. Distillation, now a buzz word in the tech world, is a technique used to make cheaper and more efficient AI models. This process involves taking a large AI model, called the ‘teacher,’ and allowing it to train a smaller, more efficient ‘student’ model.

Eventually, this helps companies transfer knowledge from big AI systems into smaller, faster, and cheaper versions. Companies such as OpenAI, Microsoft, and even Meta are joining in on the bandwagon to develop such models. Thanks to this model, AI models can be made cheaply and efficiently, allowing businesses to save money while keeping their AI performances high.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds. The hedge fund data is as of Q4 2024.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

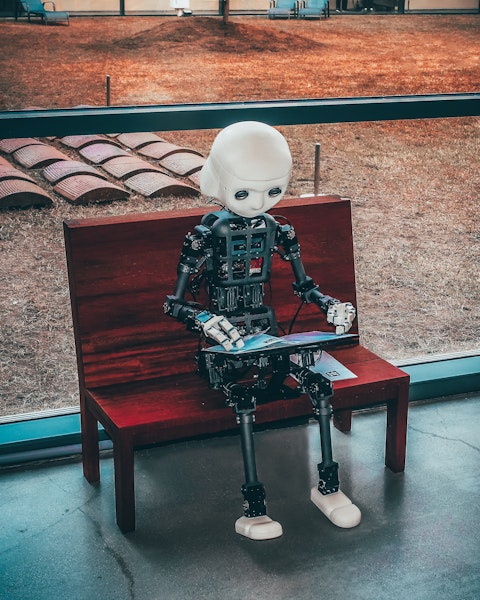

Photo by Andrea De Santis on Unsplash

10. SoundHound AI (NASDAQ:SOUN)

Number of Hedge Fund Holders: 11

SoundHound AI (NASDAQ:SOUN) is a voice artificial intelligence company offering voice AI solutions to businesses. On February 25, the company unveiled its next-generation voice AI platform for restaurants, enhancing its Dynamic Drive-Thru solution with seamless Omni channel ordering. The platform is now capable of going beyond drive-thru to incorporate Call-to-Order, Text-to-Order, Scan-to-Order, and In-Car Voice Ordering. Key features of SoundHound’s Dynamic Drive-Thru include an advanced speech recognition model, AI-powered ordering, fully autonomous voice generative AI, AI-driven upselling, smart lane technology, and multilingual support with AI-driven language adaptability.

“AI in restaurants is no longer optional – it’s the new standard. The future is omnichannel, and our advanced platform gives restaurants the flexibility to integrate automation across every customer touchpoint. With over two decades of AI expertise and data, SoundHound has developed the most advanced and comprehensive solution that not only works for the drive-thru but seamlessly integrates across all ordering channels.”

-James Hom, Chief Product Officer at SoundHound AI.

9. CrowdStrike Holdings, Inc. (NASDAQ:CRWD)

Number of Hedge Fund Holders: 77

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is a leader in AI-driven endpoint and cloud workload protection. On February 28, JPMorgan raised the firm’s price target on the stock to $450 from $418 and kept an “Overweight” rating on the shares. The firm updated targets in security software as part of an earnings preview.

Previously, Barclays raised the firm’s price target on the stock to $506 from $372 and kept an “Overweight” rating on the shares. The rating was issued ahead of the Q4 report on March 4, reflecting the firm’s expectation of potential upside to annual recurring revenue estimates. Other analysts are also optimistic about CrowdStrike based on its ability to sustain momentum as a strategic platform vendor, largely due to its AI-powered security solutions.