Tom Hainlin, national investment strategist at US Bank Asset Management Group, states that the two things to look for in the earnings season are consumer spending and companies’ spending on technology, particularly artificial intelligence. Recent reports from the financial sector and retailers suggest that consumers are in good financial shape, setting the stage for a promising holiday season as well as providing a solid opportunity for growth in the fourth quarter. He further states how third-quarter earnings reports show that AI-focused companies, from software to hardware and even the energy providers that power their data centers, are receiving an inordinate amount of CapEx and continue to benefit from it.

READ ALSO: 15 AI News Investors Should Not Miss and Top 10 Trending AI Stocks in Q4

Sometimes, these AI-related names are a bit overvalued and there is volatility; but the long-term thesis remains strong. In fact, these “down days” can provide a significant point of entry for investors. According to BofA Securities market analysts Ohsung Kwon and Savita Subramanian, a major “AI arms race” is happening amongst major tech companies. According to their calculations, the capital spending this year from the four major mega caps making AI bets will total $206 billion, up 40% over 2023. Meanwhile, the capital spending by the other 496 companies in the S&P 500 Index is projected to dip slightly, as per their findings.

Just like the long-term outlook for AI stocks remains strong, so is the market enthusiasm for these names. Even though it is unclear which companies are going to emerge as the long-term winners, exchange-traded funds focused on AI continue to flood the market. According to data from Morningstar, more than one-third of the ETFs that included artificial intelligence or AI in their name have launched this year alone. Several ETFs have been added to the list recently, with one that has rebranded and shifted focus from cloud computing to specifically AI. Senior analyst Daniel Sotiroff states how he isn’t surprised by recent market developments. It’s a fast-moving and fast-growing industry, he claims, and it is “easy to hope” that one could end up making a lot of money in a short period of time. The 200% plus stock gain by Nvidia over the past year, “reaffirms that confidence”.

With that said, artificial intelligence has been making its mark everywhere it goes. In its most recent development, AI startup Sierra, co-founded by Bret Taylor, Chairperson of OpenAI, has increased its valuation to $4.5 billion after a new $175 million funding round led by Greenoaks Capital. Sierra specializes in helping companies personalize and implement AI-driven customer service agents.

“We think every company in the world, whether it’s a technology company or a 150-year-old company like ADT, can benefit from AI, and the technology is ready right now. We want to enable Sierra to address that market, and that means expanding internationally and to other industries.”

-Taylor told CNBC in an interview.

In other news, Osmo, a digital olfaction company, has launched three new scent molecules through its proprietary artificial intelligence technology. While captive molecules play a significant role in fragrance development, traditional methods of captive discovery have been time-consuming and expensive. Osmo’s AI-driven approach strives to overcome these challenges, reduce costs, and speed up the process both.

“Our AI technology enables us to screen billions of molecules at a rate that would be impossible for humans. This not only speeds up the discovery process but also allows us to identify captives with desirable performance and ‘special effects’, regulatory compliance, and consumer safety.”

– Christophe Laudamiel, The Company’s Master Perfumer

Advancements such as these are, no doubt, leading us to bridge the gap towards achieving AGI- or artificial general intelligence. AGI is a type of artificial intelligence that can match or even surpass human cognitive capabilities across a wide range of cognitive tasks. However, some experts are cautious about AGI. This is what Miles Brundage, former senior advisor for OpenAI’s AGI Readiness, has to say about achieving AGI, alongside his departure from the company:

“Neither OpenAI nor any other frontier lab is ready, and the world is also not ready”.

With that, let’s take a look at the latest AI stocks that are making headlines right now.

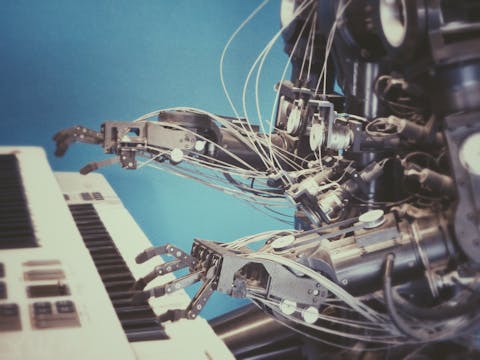

Photo by Possessed Photography on Unsplash

Our Methodology

For this article, we selected AI stocks by combing through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

10 AI News Investors Should Not Miss

10. DigitalBridge Group, Inc. (NYSE:DBRG)

Number of Hedge Fund Holders: 24

DigitalBridge Group, Inc. (NYSE:DBRG) is an infrastructure investment firm dedicated to investing in next-generation digital infrastructure and GenerativeAI. One of the primary areas of focus for the company is data centers, which play a crucial role in the AI industry.

On October 28, Business Wire reported that DigitalBridge Group, Inc. (NYSE:DBRG) has reached an agreement to acquire Yondr Group (“Yondr”), a global developer and operator of hyperscale data centers, through “DigitalBridge Fund” (its managed investment fund). Being a key player in the digital infrastructure sector, Yondr is fully capable of meeting the demand for advanced data processing capabilities fueled by the ongoing digital transformation, as well as the shift to cloud solutions and the rise of AI. This strategic investment by Digital Bridge will promote the development of advanced and sustainable data centers, supported by reliable revenue streams from investment-grade clients.

“Yondr’s assets and strong relationships with leading hyperscale clients align with DigitalBridge’s vision to support the future of digital infrastructure. Yondr enhances our existing data center portfolio and strengthens our ability to support hyperscalers. Together, we are well-positioned to capitalize on the increasing demand for hyperscale data centers – fueled by AI, cloud computing, and the ongoing digital transformation across industries.”

– Jon Mauck, Senior Managing Director at DigitalBridge.

Yondr will maintain its status as an independent entity within DigitalBridge’s portfolio, leveraging its resources, knowledge, and expertise. The deal is expected to close in early 2025, contingent upon standard closing conditions.

9. Baidu, Inc. (NASDAQ:BIDU)

Number of Hedge Fund Holders: 42

Baidu, Inc. (NASDAQ:BIDU) is a Chinese multinational technology company offering search engine services, artificial intelligence, and cloud computing in China. The company provides robotaxis and AI-powered tools, including an Ernie Bot similar to ChatGPT.

Baidu, Inc. (NASDAQ:BIDU) stock may be down 28% this year, it has attracted investor interest amid the country’s broader market rally following government stimulus measures. However, there are bears that believe Baidu’s AI-related prospects are not looking good. Jason Hsu, founder and chief investment officer of Rayliant Global Advisors, told CNBC’s Pro Talks last week that the stock may have a short-term rally, and since Baidu is a technology stock, it is naturally more volatile. Hsu is skeptical about Baidu stock as he states the search engine is a “one trick pony”.

It “doesn’t have the diversified appeal of Google which is why the two command such different price-to-earnings ratios,” he explained. Baidu is trading at 8.2 times forward price-to-earnings while Alphabet is at 21.2 times. He also believes that the company has “largely faded away from its AI capabilities,” and that many of its AI-powered services are not translating to profit streams for the company.

“Baidu was riding high for a short while but … the AI story may have sunset on Baidu and it will go back to being a one-trick pony…There’s probably a deeper issue which is, they’re in a niche space, and they really haven’t deepened capabilities beyond the search space which they dominate, and everything else is sort of based on their brand, rather than on a capability that they already have, and that brand extension without real capability supported really hasn’t panned out much”.

8. Core Scientific, Inc. (NASDAQ:CORZ)

Number of Hedge Fund Holders: 53

Core Scientific, Inc. (NASDAQ:CORZ) is a leader in artificial intelligence and Blockchain technologies, offering digital asset mining services in North America. Not only does the company offer blockchain infrastructure, software solutions, and services; and operates data center mining facilities, but also mines digital assets for its own account; and provides hosting services for other large Bitcoin miners.

On Monday, October 28, Jefferies started coverage of Core Scientific (NASDAQ:CORZ) with a “Buy” rating and a $19 price target. Analysts highlight the company’s strategic shift from solely bitcoin mining to data center hosting. Jefferies analyst Jonathan Petersen believes that the company’s extension of its 12-year hosting contract with hyperscaler CoreWeave is a major driver.

“We expect that many big tech companies will be closely watching the CoreWeave developments and successful execution will convince decision makers to sign future development leases with CORZ”.

-Petersen wrote in a letter to clients.

7. Palo Alto Networks, Inc. (NASDAQ:PANW)

Number of Hedge Fund Holders: 66

Palo Alto Networks, Inc. (NASDAQ:PANW) is an American multinational cybersecurity company offering security solutions for all apps, users, and devices. Precision AI is Palo Alto Networks’ proprietary AI system helping detect and mediate threats in an AI-first world.

On October 28, NTT Data Corporation, a global digital business and IT services leader, announced that it is expanding its partnership with Palo Alto Networks, Inc. (NASDAQ:PANW) to help enterprises advance in cyber resilience. The partnership has introduced NTT DATA’s Managed Extended Detection Response Service (MXDR), which delivers ongoing threat monitoring, detection, and rapid response capabilities. It leverages AI and machine learning to provide visibility across networks, edge, and cloud environments, helping organizations be proactive against cyber-attacks. The service is powered by Palo Alto Networks Cortex XSIAM, the industry’s leading AI-powered security operations center (SOC) platform.

“Organizations today are facing an unprecedented volume of sophisticated cyber threats, across their entire operations. With NTT DATA, we are helping organizations transform their SOC through platformization with XSIAM and expert services, delivering a unified solution that ensures customers can modernize and protect their operations with confidence.”

– Kristy Friedrichs, Chief Partnerships Officer, Palo Alto Networks.

6. Advanced Micro Devices, Inc. (NASDAQ:AMD)

Number of Hedge Fund Holders: 108

Advanced Micro Devices, Inc. (NASDAQ:AMD) is an American multinational corporation that specializes in manufacturing semiconductor devices used in computer processing. By integrating technology across CPUs, GPUs, and NPUs, it strives to create a strong ecosystem that supports the development of powerful AI applications.

Even though Advanced Micro Devices, Inc. (NASDAQ:AMD) has failed to make a significant dent in the AI chips market, Piper Sandler’s Harsh Kumar continues to view AMD as a “top large-cap pick”. On October 25, the analyst rated AMD shares as Overweight (i.e. Buy), along with a $200 price target. This indicates a potential 26% upside in the coming months. The analyst’s positivity comes from AMD’s management’s comments regarding the GPU outlook with the prospect of MI300 adoption setting the scene for “outperformance in the data center segment”. He expects the company to exceed the $5 billion annual revenue goal for its GPUs, driven by “implied GPU ramp”. The analyst states that there were also supply constraints at the beginning of the year, but the momentum is building again with the introduction of MI325.

“All in all, AMD has taken some significant steps in software/model conversion to eliminate the gap relative to competition. We feel that with the closure of the ZT Systems deal in 1H25, AMD will close another gap to NVDA in rack level performance.”

5. Alphabet Inc. (NASDAQ:GOOG)

Number of Hedge Fund Holders: 165

Alphabet Inc. (NASDAQ:GOOG) is an American multinational technology conglomerate holding company wholly owning the internet giant Google, amongst other businesses. Their subsidiary Google has been using artificial intelligence technology for years, integrating advanced AI across its products like Search, Assistant, and Cloud solutions.

Autonomous driving is one of the most exciting use cases of AI that’s gaining traction right now, and Alphabet is at the forefront of innovation in AVs. On October 25, The company’s self-driving unit Waymo reported that it had closed a $5.6 billion funding round. Despite skepticism and regulatory challenges, automakers and tech firms alike are investing in autonomous ride-hailing services to drive commercial success. Waymo revealed that existing investors including Andreessen Horowitz, Fidelity, Perry Creek, Silver Lake, Tiger Global, and T. Rowe Price have also participated in the funding round.

“With this latest investment, we will continue to welcome more riders into our Waymo One ride-hailing service in San Francisco, Phoenix, and Los Angeles, and in Austin and Atlanta through our expanded partnership with Uber,” the company said.

4. NVIDIA Corporation (NASDAQ:NVDA)

Number of Hedge Fund Holders: 179

Leading the way in AI computing, NVIDIA Corporation (NASDAQ:NVDA) is a darling AI stock. It is not only the leader in the AI chip market but has also built a robust AI ecosystem spanning graphics, computing, and networking solutions. Its GPUs are the backbone of AI innovation globally, powering everything from advanced data centers to autonomous systems.

On October 28, NVIDIA Corporation (NASDAQ:NVDA) revealed on its blog that they have developed a new NVIDIA workflow optimized for credit card transaction fraud. The new NVIDIA AI workflow for fraud detection that runs on Amazon Web Services (AWS) uses accelerated data processing and advanced algorithms to improve AI’s ability to detect and prevent credit card transaction fraud. The workflow was launched at the Money20/20 fintech conference this week, enabling financial institutions to recognize subtle patterns and anomalies in transaction data based on user behavior. The workflow will help them improve accuracy and reduce false positives compared with traditional methods, keeping customers’ money, identities, and digital accounts safe.

3. Apple Inc. (NASDAQ:AAPL)

Number of Hedge Fund Holders: 184

Apple Inc. (NASDAQ:AAPL) is an American technology company engaged in the design, manufacture, and marketing of smartphones, tablets, PCs, wearables, and accessories worldwide. Apple is considered a very important AI stock, having integrated a slew of AI capabilities into its products and services.

In September, Apple Inc. (NASDAQ:AAPL) announced that it will be launching its most important product next month. Apple Intelligence, the company’s personal intelligence system, is a suite of software tools that brings what the company describes as artificial intelligence to its devices. On October 28, the company made these artificial intelligence tools available to a select few models of the iPhone through a software update. The new AI tools are available to people with the latest devices, such as the iPhone 16 models, and the iPhone 15 Pro and Pro Max. From notification summaries and tools to assist users in writing messages, as well as a glowing new interface for virtual assistant Siri, there are a lot of exciting features. Apple Intelligence is also available on Mac computers and iPad tablets that are powered by its latest chips.

2. Microsoft Corporation (NASDAQ:MSFT)

Number of Hedge Fund Holders: 279

Microsoft Corporation (NASDAQ:MSFT) is an American multinational technology company engaged in the development and selling of software, services, and hardware. The company’s AI strategy is driven by its collaboration with OpenAI, its cloud computing infrastructure, and an ever-expanding suite of AI-driven solutions.

On October 28, an executive from Microsoft Corporation (NASDAQ:MSFT) took to their blog to reveal the forthcoming launch of a new lobby group called the Open Cloud Coalition, which includes Google and several smaller cloud providers, to gain favor with policymakers and antitrust regulators in Europe. Microsoft has learned that Nicky Stewart will lead the organization, previously authoring complaints against Microsoft and Azure Web Services in the UK Competition and Market Authority’s investigation in the cloud computing market. These “shadow campaigns” by Google are “designed to discredit Microsoft with competition authorities, and policymakers and mislead the public”. Labeling them as an “astroturf group organized by Google,” Rima Alaily – CVP, Deputy General Counsel at Microsoft alleges that Google had “gone through great lengths to obfuscate its involvement, funding, and control” by positioning smaller European cloud providers as the face of the coalition while keeping itself at the backseat.

“It seems Google has two ultimate goals in its astroturfing efforts: distract from the intense regulatory scrutiny Google is facing around the world by discrediting Microsoft and tilt the regulatory landscape in favor of its cloud services rather than competing on the merits”.

-Alaily said.

A Google spokesperson has acknowledged its membership in the coalition and stated the following:

“We and many others believe that Microsoft’s anticompetitive practices lock-in customers and create negative downstream effects that impact cybersecurity, innovation, and choice”

-Google spokesperson

1. Amazon.com Inc (NASDAQ:AMZN)

Number of Hedge Fund Holders: 308

Amazon.com Inc (NASDAQ:AMZN) is an American multinational technology company offering e-commerce, cloud computing, and other services, including digital streaming and artificial intelligence solutions. The company uses artificial intelligence for everything from reinventing shopping experiences to automated ad creatives, streamlining healthcare access, and powering the world’s most comprehensive and broadly adopted cloud platform.

On Monday, October 28, investor Ray Wang talked about Amazon.com Inc (NASDAQ:AMZN) on CNBC’s Money Movers. Even though the company may be lagging behind its peers on the AI front, the mega-cap tech titan is still a favorite for the principal analyst and founder of Constellation Research. He highlighted Amazon.com Inc.’s (NASDAQ:AMZN) advertising revenue, growing at a 20% annual rate, which is allowing the company to catch up to Google’s ad revenue numbers. Moreover, the company’s massive cloud services business, Amazon Web Services, provides it the flexibility it needs to explore AI integration across its operations. Amazon Prime Video platform is a strong competitor to Netflix as well. Despite all these positives, it is also true that the company is trailing behind its peers in AI capabilities.

“The bright side is they’re done with their big CapEx investments into their data centers, whereas Microsoft has a lot of CapEx investment to do and Google has to play a lot of catch up. So Amazon has a little bit of time to get their AI story right”.

-Investor Ray Wang

While we acknowledge the potential of AMZN as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than AMZN but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.