Sovereign AI: a new concept gaining traction in the realm of artificial intelligence. As reported by CNBC, tech giants are developing “sovereign” artificial intelligence models to boost their competitiveness. Last month, Denmark revealed its very own artificial intelligence supercomputer, becoming one of many sovereign AI initiatives that have the ability to “codify” a country’s culture, history, and collective intelligence.

READ ALSO: 10 AI Headlines Making Waves Today and 15 AI News You Must Read Today

That said, many of the biggest large language models today, such as OpenAI’s ChatGPT and Anthropic’s Claude, have US-based data centers for storing data and processing requests from the cloud. Several politicians and regulators hailing from Europe are beginning to raise concern over this, who believe that dependence on US technology is harmful to their continent’s competitiveness and technological resilience.

Filippo Sanesi, global head of marketing and operations at OVHCloud, noted that the French cloud firm is experiencing lots of demand for its European-located infrastructure, as they “understand the value of having their data in Europe, which are subject to European legislation.”

“As this concept of data sovereignty becomes more mature and people understand what it means, we see more and more companies understanding the importance of having your data locally and under a specific jurisdiction and governance. We have a lot of data. This data is sovereign in specific countries, under specific regulations.”

– Filippo Sanesi told CNBC.

While AI sovereignty is not yet a regulatory mandate, European countries are increasingly investing in AI technologies that are reflective of their own societal norms.

Latest Advancements in AI

In recent news, more than 3,000 companies from around the world participated in Lisbon’s Web Summit 2024. The theme for Europe’s largest technology event was artificial intelligence, with startups showcasing machines that could think and learn, and even solve many of the world’s problems, such as deforestation. One such startup at the summit was Woodchat, an artificial intelligence system identifying lumber types to combat the use of illegal wood.

“WoodChat is an artificial intelligence system that identifies lumber types, and the whole thing is done via WhatsApp. Our technology is an API verified by Meta. In Brazil, our recognition system is used to fill out forestry documents. The process helps loggers to fill it out so that the wood passes through the federal system with authorised certification”.

– Fernanda Onofre, founder of WoodChat.

Other fields with interesting startups at the summit were robotics, finance, and also air travel.

In other AI news, OpenAI, an American artificial intelligence research organization, is preparing to launch a new artificial intelligence operator codenamed “Operator”, Bloomberg reports. The company is reportedly set to launch the tool as a research preview in January, allowing a computer to take action on a human’s behalf, such as writing code or booking travel. The planned release is part of a wider industry movement towards agents—AI software capable of performing multi-step tasks for users with minimal oversight.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

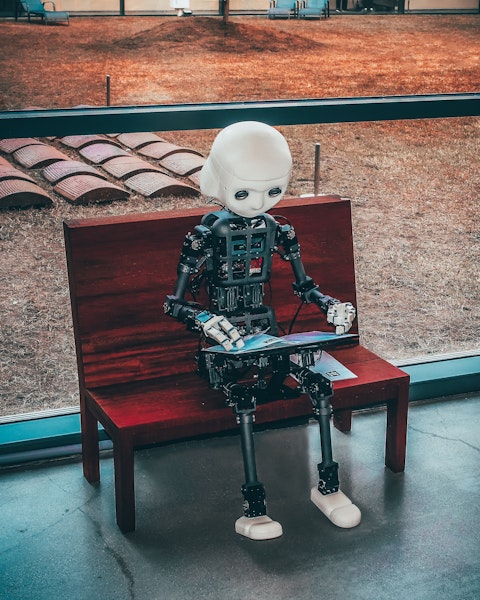

Photo by Andrea De Santis on Unsplash

10. CCC Intelligent Solutions Holdings Inc. (NASDAQ:CCCS)

Market Capitalization: $7.34 billion

CCC Intelligent Solutions Holdings Inc. (NASDAQ:CCCS) is a provider of cloud, mobile, AI, telematics, hyperscale technologies and applications for the property and casualty insurance economy.

On November 13, Morgan Stanley analyst Josh Baer upgraded shares of CCC Intelligent Solutions Holdings Inc. (NASDAQ:CCCS) to “Overweight” from an Equal Weight rating, lifting the price target to $15 from $14. According to Baer, Wall Street is “underpricing the value” of the company’s portfolio of artificial intelligence products. Even though the company offers a compelling suite of AI products with a “durable” core offering and “best in class operational efficiency” that support growth, sentiments towards the stock are sore. The analyst also notes that the stock provides a compelling entry point and an attractive valuation discount considering its shares have underperformed those of its peers.

“CCCS is a market share leader, positioned to capture value digitizing and automating the [property and casualty] Insurance industry. Established solutions, ramping emerging solutions and AI help to sustain high-single-digit growth.”

-Morgan Stanley analyst Josh Baer

9. Pure Storage, Inc. (NYSE:PSTG)

Market Capitalization: $16.37 billion

Pure Storage, Inc. (NYSE:PSTG) is an American technology company engaged in the provision of data storage and management technologies, products, and services. It is a Top Goldman Sachs AI stock, offering high-performance data storage solutions designed to support AI workloads.

One of the biggest analyst calls on Wednesday, November 13, was about Pure Storage, Inc. (NYSE:PSTG). Oppenheimer initiated Pure Storage, Inc. (NYSE:PSTG) as “Outperform” with a price target of $70. The data storage company is best positioned for share gains, notes Oppenheimer, considering it is a key beneficiary of the growing demand for unstructured data storage solutions used in AI applications.

“Our bullish stance is predicated upon our view that Pure Storage is: (1) a beneficiary of rising creation and storage of unstructured data that is used to build and deliver AI applications; (2) a long-term share gainer in the all-flash array (AFA) market, where it has a technological advantage”.

-Oppenheimer

8. Snowflake Inc. (NYSE:SNOW)

Market Capitalization: $41.40 billion

Snowflake Inc. (NYSE:SNOW) is an American cloud-based data storage company. The company capitalizes on the AI boom as data warehouses are a critical component in making AI useful for enterprises.

On November 12, Snowflake Inc. (NYSE:SNOW) announced the latest innovations that make it easier for enterprises to develop and deploy artificial intelligence solutions. Announced at the BUILD 2024 conference, the updates will streamline “reliable” app development for enterprises, optimize natural language processing timelines, and accelerate machine learning using GPU-powered containers. These advancements are driven by the need for reliable and trustworthy AI that in turn leads to effective decision-making in organizations.

“For enterprises, AI hallucinations are simply unacceptable. Today’s organizations require accurate, trustworthy AI in order to drive effective decision-making, and this starts with access to high-quality data from diverse sources to power AI models. The latest innovations to Snowflake Cortex AI and Snowflake ML enable data teams and developers to accelerate the path to delivering trusted AI with their enterprise data, so they can build chatbots faster, improve the cost and performance of their AI initiatives, and accelerate ML development”.

– Baris Gultekin, Head of AI, Snowflake Inc. (NYSE:SNOW).

7. Autodesk, Inc. (NASDAQ:ADSK)

Market Capitalization: $66.46 billion

Autodesk, Inc. (NASDAQ:ADSK) is a global leader in design and make technology, offering 3D design, engineering, and entertainment technology solutions worldwide. It is one of the leading providers of AI design tools that help cut costs and save time.

On November 12, Autodesk, Inc. (NASDAQ:ADSK) and Trane Technologies (NYSE:TT), a global climate innovator, entered into a strategic collaboration to improve the design of commercial buildings by leveraging artificial intelligence, with a key focus on sustainability. By integrating Trane’s TRACE® software with Autodesk Revit for engineers, engineers will be able to more efficiently design and size complex HVAC systems, reducing building emissions and improving energy and economic outcomes. Meanwhile, AI-assisted designs will simplify workflows and enhance MEP design process efficiency. The solutions will initially be available in high-BIM adoption regions like the United States and Canada.

“Our strategic work with Trane Technologies underscores our commitment to addressing the critical workflow gaps faced by engineers today, while leveraging AI and machine learning to enhance the extensibility of Autodesk’s platforms. By integrating Trane’s trusted capabilities into Revit, we provide engineers with tools that deliver reliable performance, while empowering them to tackle today’s greatest industry challenges. Together, we’re bridging the digital and physical, and unlocking data to create more efficient, sustainable buildings.”

– Nicolas Mangon, VP, AEC Industry Strategy at Autodesk.

6. Micron Technology, Inc. (NASDAQ:MU)

Market Capitalization: $115.42 billion

Micron Technology, Inc. (NASDAQ:MU) is a US-based innovative memory and storage solutions provider. Its solutions support the development of artificial intelligence and generative AI applications.

On November 13, Harsh Kumar from Piper Sandler maintained a “Buy” rating on Micron Technology, Inc. (NASDAQ:MU) with a price target of $150.00. The firm says it is bullish on the stock after a series of meetings with the company’s management. The company is poised for growth in its high-bandwidth memory products due to substantial data center demand.

“We feel the company continues to be well-positioned with its HBM [high bandwidth memory] product offering and roadmap. Incremental growth drivers in the near-term continue to be outsized orders from the data center end market while longer-term, automotive as well as a return to growth from handsets and PCs could provide tailwinds in our view.”

5. Palantir Technologies Inc. (NYSE:PLTR)

Market Capitalization: $135.96 billion

Palantir Technologies Inc. (NYSE:PLTR) is an American company that builds agile solutions for data-driven operations and decision-making. The company’s Artificial Intelligence Platform, AIP, has transformed its business, which is used to test, debug code, and evaluate AI-related scenarios.

On November 13, Palantir Technologies Inc. (NYSE:PLTR) renewed its multi-year enterprise agreement with the Rio Tinto Group, a leading mining and metals group. The agreement extends the enterprise agreement between the two companies, securing Rio Tinto’s access to the Palantir Artificial Intelligence Platform for an additional four years. As an early user of Palantir Foundry, Rio has already developed a digital twin “Ontology” that acts as a unified data framework for essential operations.

“We have high expectations for Rio Tinto’s utilization of Palantir’s AI Platform (AIP) based on what they have already achieved with Foundry and their ambition for secure use of AI. The Ontology created by Rio Tinto’s team in Foundry over the past three years enables fast deployment of AI solutions to some of Rio Tinto’s most pressing challenges and ensures best and safe operator practice in areas like risk identification, asset management, and supply chain order and fulfilment processes”.

-Ted Mabrey, Palantir’s Head of Commercial.

4. Alibaba Group Holding Limited (NYSE:BABA)

Market Capitalization: $213.37 billion

Alibaba Group Holding Limited (NYSE:BABA) is a multinational technology company specializing in e-commerce, retail, Internet, and technology. It heavily leverages artificial intelligence in its business and recently launched more than a hundred new AI models as part of its AI push.

On November 11, Alibaba Group Holding Limited (NYSE:BABA)’s subsidiary, Alibaba Cloud, announced the new version of the open foundation Qwen model— Qwen2.5-Coder-32B-Instruct. The new AI coding assistant, which helps developers write, analyze, and understand code, has coding abilities matching those of GPT-4o. According to Alibaba Cloud, the Qwen2.5-Coder has delivered significantly improved performance in core tasks such as code generation, code reasoning, and code repair.

3. ServiceNow, Inc. (NYSE:NOW)

Market Capitalization: $215.95 billion

ServiceNow, Inc. (NYSE:NOW) is a cloud-based AI-driven platform that engages in the provision of enterprise cloud computing solutions.

On November 13, ServiceNow, Inc. (NYSE:NOW) and Five9 (NASDAQ:FIVN), provider of the Intelligent CX Platform, announced an expanded partnership to enhance employee and customer experiences. The turnkey AI-powered solution will integrate ServiceNow’s Customer Service Management (CSM) with Five9’s platform for streamlined self‑service and assisted service operations as well as unified customer support processes; leveraging solutions such as reducing operational costs, increasing agent efficiency, improving customer satisfaction, and simplifying contact center operations.

“Organizations know they need to deliver seamless customer experiences. But most CRM solutions only focus on capturing customer requests, not fulfilling or resolving them. As a result, human middleware ties manual processes and siloed technologies together. ServiceNow Customer Service Management is different. We focus on driving great customer service experiences with workflows, automation, and GenAI that enable seamless self‑service and assisted service across voice and digital channels. Our expanded partnership with Five9 takes this even further, combining the best of both platforms to streamline and unify contact center operations with a turnkey solution that’s fast to deploy and delivers fast ROI.”

-John Ball, senior vice president, Customer and Industry Workflows at ServiceNow.

2. Salesforce Inc (NYSE:CRM)

Market Capitalization: $319.73 billion

Salesforce Inc (NYSE:CRM) is a cloud-based CRM software. It is one of the best stocks in the AI, Growth, and Low Rates Era, integrating artificial intelligence as a core component in its business operations.

Bank of America Securities analyst Bradley Sills reiterated a “Buy” rating on Salesforce Inc (NYSE:CRM), boosting the price target to $390.00 from $325. The analyst considers Salesforce Inc (NYSE:CRM) as a top pick, noting the company’s strong potential for future growth, notably in key areas such as Sales/Marketing and Service Clouds. The company’s new AI-powered platform, Agentforce, is also garnering interest and is expected to boost data cloud deals and contribute to long-term growth. Sills also anticipates that the platform will enhance subscription growth in the coming years, reaffirming the buy rating.

“A round of calls with partners suggests largely in-line deal activity, consistent with Q2. Key takeaways: 1) steady growth in Sales/Marketing Clouds & Service Cloud, 2) health care/life sciences, financial services & government verticals continued to outperform.”

1. Apple Inc. (NASDAQ:AAPL)

Market Capitalization: $3.39 trillion

Apple Inc. (NASDAQ:AAPL) designs, manufactures, and markets smartphones, tablets, personal computers (PCs), and portable and wearable devices. Investing heavily in artificial intelligence technology, it recently revealed Apple Intelligence, its personal artificial intelligence system.

On November 13, Apple Inc. (NASDAQ:AAPL) took a step forward in video editing by unveiling Final Cut Pro 11. The video editing application comes loaded with intelligent new features, along with powerful updates to Final Cut Pro for iPad, Final Cut Camera, and Logic Pro. Final Cut Pro 11 is available as of November 13 as a free update for existing users and for $299.99 (U.S.) for new users on the Mac App Store.

“Our creative apps give artists, producers, directors, and editors around the world the tools they need to express themselves and realize their artistic vision. With the power of Apple silicon and state-of-the-art machine learning capabilities, Final Cut Pro and Logic Pro are faster and more intelligent than ever. These latest updates give creative professionals more stylistic interpretations to explore — whether that’s with fine-tuned masking for color grading or amazing sound processing — and greater versatility and efficiency in their workflows.”

– Brent Chiu-Watson, Apple’s senior director of Worldwide Product Marketing for Apps.

While we acknowledge the potential of AAPL as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than AAPL but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.