Sovereign AI: a new concept gaining traction in the realm of artificial intelligence. As reported by CNBC, tech giants are developing “sovereign” artificial intelligence models to boost their competitiveness. Last month, Denmark revealed its very own artificial intelligence supercomputer, becoming one of many sovereign AI initiatives that have the ability to “codify” a country’s culture, history, and collective intelligence.

READ ALSO: 10 AI Headlines Making Waves Today and 15 AI News You Must Read Today

That said, many of the biggest large language models today, such as OpenAI’s ChatGPT and Anthropic’s Claude, have US-based data centers for storing data and processing requests from the cloud. Several politicians and regulators hailing from Europe are beginning to raise concern over this, who believe that dependence on US technology is harmful to their continent’s competitiveness and technological resilience.

Filippo Sanesi, global head of marketing and operations at OVHCloud, noted that the French cloud firm is experiencing lots of demand for its European-located infrastructure, as they “understand the value of having their data in Europe, which are subject to European legislation.”

“As this concept of data sovereignty becomes more mature and people understand what it means, we see more and more companies understanding the importance of having your data locally and under a specific jurisdiction and governance. We have a lot of data. This data is sovereign in specific countries, under specific regulations.”

– Filippo Sanesi told CNBC.

While AI sovereignty is not yet a regulatory mandate, European countries are increasingly investing in AI technologies that are reflective of their own societal norms.

Latest Advancements in AI

In recent news, more than 3,000 companies from around the world participated in Lisbon’s Web Summit 2024. The theme for Europe’s largest technology event was artificial intelligence, with startups showcasing machines that could think and learn, and even solve many of the world’s problems, such as deforestation. One such startup at the summit was Woodchat, an artificial intelligence system identifying lumber types to combat the use of illegal wood.

“WoodChat is an artificial intelligence system that identifies lumber types, and the whole thing is done via WhatsApp. Our technology is an API verified by Meta. In Brazil, our recognition system is used to fill out forestry documents. The process helps loggers to fill it out so that the wood passes through the federal system with authorised certification”.

– Fernanda Onofre, founder of WoodChat.

Other fields with interesting startups at the summit were robotics, finance, and also air travel.

In other AI news, OpenAI, an American artificial intelligence research organization, is preparing to launch a new artificial intelligence operator codenamed “Operator”, Bloomberg reports. The company is reportedly set to launch the tool as a research preview in January, allowing a computer to take action on a human’s behalf, such as writing code or booking travel. The planned release is part of a wider industry movement towards agents—AI software capable of performing multi-step tasks for users with minimal oversight.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

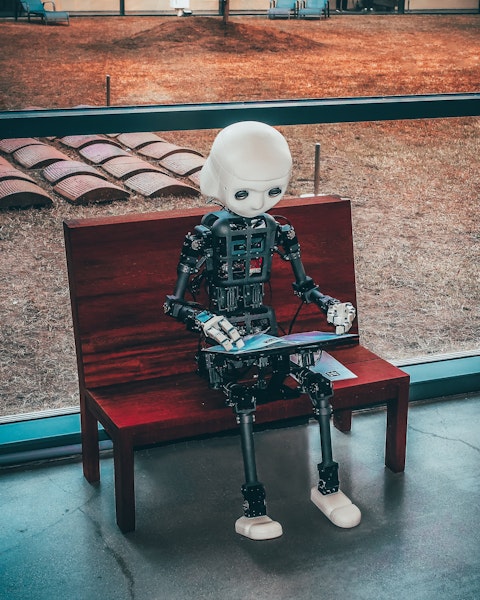

Photo by Andrea De Santis on Unsplash

10. CCC Intelligent Solutions Holdings Inc. (NASDAQ:CCCS)

Market Capitalization: $7.34 billion

CCC Intelligent Solutions Holdings Inc. (NASDAQ:CCCS) is a provider of cloud, mobile, AI, telematics, hyperscale technologies and applications for the property and casualty insurance economy.

On November 13, Morgan Stanley analyst Josh Baer upgraded shares of CCC Intelligent Solutions Holdings Inc. (NASDAQ:CCCS) to “Overweight” from an Equal Weight rating, lifting the price target to $15 from $14. According to Baer, Wall Street is “underpricing the value” of the company’s portfolio of artificial intelligence products. Even though the company offers a compelling suite of AI products with a “durable” core offering and “best in class operational efficiency” that support growth, sentiments towards the stock are sore. The analyst also notes that the stock provides a compelling entry point and an attractive valuation discount considering its shares have underperformed those of its peers.

“CCCS is a market share leader, positioned to capture value digitizing and automating the [property and casualty] Insurance industry. Established solutions, ramping emerging solutions and AI help to sustain high-single-digit growth.”

-Morgan Stanley analyst Josh Baer

9. Pure Storage, Inc. (NYSE:PSTG)

Market Capitalization: $16.37 billion

Pure Storage, Inc. (NYSE:PSTG) is an American technology company engaged in the provision of data storage and management technologies, products, and services. It is a Top Goldman Sachs AI stock, offering high-performance data storage solutions designed to support AI workloads.

One of the biggest analyst calls on Wednesday, November 13, was about Pure Storage, Inc. (NYSE:PSTG). Oppenheimer initiated Pure Storage, Inc. (NYSE:PSTG) as “Outperform” with a price target of $70. The data storage company is best positioned for share gains, notes Oppenheimer, considering it is a key beneficiary of the growing demand for unstructured data storage solutions used in AI applications.

“Our bullish stance is predicated upon our view that Pure Storage is: (1) a beneficiary of rising creation and storage of unstructured data that is used to build and deliver AI applications; (2) a long-term share gainer in the all-flash array (AFA) market, where it has a technological advantage”.

-Oppenheimer