In this article, we discuss the 10 3D printing companies to watch in 2022. If you want to skip our detailed analysis of these companies, go directly to 5 3D Printing Companies to Watch in 2022.

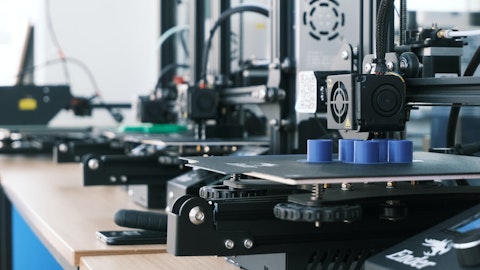

Thought of as something straight from a science fiction novel up until a few decades ago, 3D printing has now become a prevalent phenomenon around the globe with the power to transform billion dollar industries. Also known as additive manufacturing, 3D printing technology works by applying thin layers of material in the form of powdered plastic, liquid, metal or cement, and then fusing those layers together to form an object based on a digital design. Even though this technology is some time away from mass manufacturing, this technique is a game-changer for the manufacturing logistics and inventory management industries.

Imagine a complex machine part breaking down in a high-powered factory. Instead of waiting for repair or replacement, the factory can quickly churn out the missing part from a 3D printer located at the factory. Ultimately, experts believe that additive manufacturing will have the capacity to mass produce anything, from automotive parts to medical equipment, to airline components and much more. By 2026, the 3D printing industry is predicted to reach $34.8 billion in value, up from $12.6 billion in 2021. This growth is expected to take place at 22.5% CAGR over the next five years.

In March 2020, HP Inc. (NYSE:HPQ) CEO Enrique Lores talked about how the supply chain issues caused by the COVID-19 pandemic have shown how crucial it is to be able to manufacture products onsite during critical times. He said:

It is really highlighting how 3-D printing has the potential of transforming the manufacturing industry, this is a great example of its capabilities.

Industries around the world are adopting 3D printing technology, although some factors that need to be addressed include high cost of materials, lack of standard process controls, and the threat of copyright infringement. But as these problems are addressed and the industry picks up pace, 3D companies will present some of the most exciting investment opportunities in the near to long-term future. Some of the most notable 3D companies include Desktop Metal, Inc. (NYSE:DM), 3D Systems Corporation (NYSE:DDD) and HP Inc. (NYSE:HPQ), among others discussed in detail below.

Pixabay/Public Domain

Our Methodology

Let’s take a look at the 10 3D printing companies to watch in 2022. These companies below were selected on the basis of hedge fund sentiment, analysts’ ratings, fundamentals, and growth potential based on core business strengths.

10 3D Printing Companies to Watch in 2022

10. Straumann Holding AG (SAUHY)

Number of Hedge Fund Holders: N/A

Straumann Holding AG (SAUHY) starts off our list of the 10 3D companies to watch in 2022. The firm is based in Switzerland and provides regenerative dentistry solutions around the globe. Its list of products and services include dental implant systems, biomaterials, clear aligner systems, and various materials for dental applications.

On December 21st, Bernstein analyst Lisa Bedell Clive upgraded Straumann Holding AG (SAUHY) to ‘Outperform’ from ‘Market Perform’, setting a CHF 2,150 price target. The firm’s analyst noted that the company has transformed itself in the last 10 years to become a global leader in dentistry implants, and has expanded into several segments of the “digital dentistry” ecosystem. Straumann Holding AG (SAUHY) has increased its addressable market to CHF 18 billion in 2021, as compared to CHF 4 billion in 2012.

Straumann Holding AG (SAUHY) is expected to grow at an average organic growth rate of 10% per annum over the next decade, and could also exceed these expectations given its dominant position in the market. The company has recently launched new products and expanded its footprint around the globe, which will ensure increase in market share for the foreseeable future.

In addition to Desktop Metal, Inc. (NYSE:DM), 3D Systems Corporation (NYSE:DDD) and HP Inc. (NYSE:HPQ), Straumann Holding AG (SAUHY) is a top 3D company to watch in 2022.

9. Organovo Holdings, Inc. (NASDAQ:ONVO)

Number of Hedge Fund Holders: 3

Organovo Holdings, Inc. (NASDAQ:ONVO) is based in California, and deals in the development of 3D human tissues using 3D bioprinting technology. The company’s proprietary NovoGen Bioprinters enable the fabrication of mammalian cells by using 3D living tissues. Organovo Holdings, Inc. (NASDAQ:ONVO)’s products including ExVive human liver tissue and ExVive human kidney tissue, are used for predictive preclinical testing of drug compounds.

For the third quarter of 2021, Organovo Holdings, Inc. (NASDAQ:ONVO) posted an EPS of -$0.95, beating estimates by $0.05. Quarterly revenue of $1.23 million was above analysts’ forecasts by $438,000. In November, Organovo Holdings, Inc. (NASDAQ:ONVO) announced that it was on track to establish its first 3D tissue disease models for inflammatory bowel disease (IBD) in 2022.

Out of all the hedge funds tracked by Insider Monkey, 3 reported ownership of stakes in Organovo Holdings, Inc. (NASDAQ:ONVO) at the end of the third quarter, with combined holdings worth $3.51 million. This is an upward trend from last quarter, where 2 hedge funds held stakes in the firm.

8. Nano Dimension Ltd. (NASDAQ:NNDM)

Number of Hedge Fund Holders: 10

Nano Dimension Ltd. (NASDAQ:NNDM) deals in the provision of additive electronics, with its flagship product being the DragonFly lights-out digital manufacturing (LDM) system, which is a precision system capable of producing professional multilayer circuit boards, sensors, RF antennas and molded connected devices for prototyping. The Israel-based company also offers conductive and insulating inks for printed electronics, as well as optimized multi-material design of complex electronics.

At the end of the third quarter, Nano Dimension Ltd. (NASDAQ:NNDM) was reported in the portfolio of 10 hedge funds, with combined holdings worth $112.88 million. This is down from 11 hedge funds holding $173.99 million in the second quarter of 2021.

Nano Dimension Ltd. (NASDAQ:NNDM) aims to deliver high ROI products in the fast-evolving 3D manufacturing segment, and currently sits on a neat $1.4 billion cash on hand. In November, the firm announced the acquisition of Essemtec AG, maker of equipment for assembling electronics equipment on circuit boards, for around $24.8 million.

In December, Nano Dimension Ltd. (NASDAQ:NNDM) announced that it had acquired ISO 9001:2015 certification, which is a high criteria for quality management systems, fulfilled by over one million organizations and companies in 170 countries around the world.

7. Materialise NV (NASDAQ:MTLS)

Number of Hedge Fund Holders: 9

Materialise NV (NASDAQ:MTLS) is a 3D company based in Belgium, and deals in the provision of 3D printing technology and services, medical software solutions and additive manufacturing software solutions through its segments: Materialise Software, Materialise Medical, and Materialise Manufacturing. The company looks set to benefit from the sector growth in 3D manufacturing, making strategic acquisitions in its highly profitable software department.

In November, Materialise NV (NASDAQ:MTLS) announced the acquisition of 100% equity interests in Link3D, a digital manufacturing software company, for $33.5 million. This deal will help Materialise NV (NASDAQ:MTLS) boost the development of its software platform for additive manufacturing. As of the third quarter, Materialise NV (NASDAQ:MTLS) posted an EPS of $0.18, beating consensus estimates by $0.16. Quarterly revenue of $60.98 million was above analysts’ forecasts by $2 million.

Out of all the hedge funds tracked by Insider Monkey, 9 held long positions in Materialise NV (NASDAQ:MTLS) at the end of the third quarter, down from 14 in the preceding quarter.

On October 20, JPMorgan analyst Paul Chung initiated coverage of Materialise NV (NASDAQ:MTLS) with an ‘Overweight’ rating and a $28 price target, noting that the stock is a core holding in the additive manufacturing growth-market, given that the company scales with overall industry activity without the risk associated with specific print materials and printers.

6. Stratasys Ltd. (NASDAQ:SSYS)

Number of Hedge Fund Holders: 21

Stratasys Ltd. (NASDAQ:SSYS) is a US-based company that offers 3D printing systems and materials, and runs Thingiverse.com, which is an online platform for sharing downloadable digital 3D printing designs. The company provides its products and services to the automotive, aerospace, education, medical, dental and consumer goods markets around the world. Stratasys Ltd. (NASDAQ:SSYS) boasts nearly 1,600 granted and pending additive technology patents.

Stratasys Ltd. (NASDAQ:SSYS) had a strong Q3 result, beating consensus on the top line and the bottom line. The firm posted an EPS of $0.01, which was above estimates by $0.07. Quarterly revenue of $159.01 million outperformed estimates by $8.93 million. Several big names like General Motors, BAE Systems, and Boeing are currently working with Stratasys Ltd. (NASDAQ:SSYS).

On November 8, Loop Capital analyst Ananda Baruah raised the firm’s price target on Stratasys Ltd. (NASDAQ:SSYS) stock to $35 from $19, while maintaining a ‘Hold’ rating. The analyst noted that after a strong Q3, the firm has made strategic decisions which will allow it to capitalize on any surge in the adoption of 3D printing in response to global supply chain pressures.

21 hedge funds were bullish on Stratasys Ltd. (NASDAQ:SSYS) at the end of the third quarter, holding a combined value of $270.21 million. The same number of hedge funds held stakes in the firm a quarter earlier as well.

Investment firm Alger Spectra Fund mentioned Stratasys Ltd. (NASDAQ:SSYS) in its Q3 investor letter. Here’s what the fund said:

“Short position Stratasys also contributed to performance. Stratasys is one of the larger 3D printing companies. While additive manufacturing (3D printing) is a revolutionary concept, it has only seen its primary adoption for manufacturing prototypes and test parts, not high-volume end-use parts. Unfortunately for incumbents like Stratasys, additive manufacturing has continued to attract capital and dozens of new entrants have emerged with new technologies targeting specific applications. Industry pioneers like Stratasys have seen key patents expire and have lost market share to new competition. As a result of these factors, Stratasys has not grown for five years. Some industry participants believe that Stratasys’ plastic extrusion technology is simply too slow to be an acceptable solution for higher volume manufacturing. The short position contributed to portfolio returns when Stratasys’ shares declined due to year-over-year revenue contraction, continuing market share losses, a talent exodus, the issuance of new shares via a secondary offering, and no significant progress on developing new opportunities in promising additive verticals like metal and dental.”

Along with Desktop Metal, Inc. (NYSE:DM), 3D Systems Corporation (NYSE:DDD) and HP Inc. (NYSE:HPQ), Stratasys Ltd. (NASDAQ:SSYS) is a 3D company attracting investors in 2022.

Click to continue reading and see 5 3D Printing Companies to Watch in 2022.

Suggested articles:

- 15 Very High Yield Dividend Stocks Worth Checking Out

- 15 Best Micro-Cap Stocks To Buy Now

- 10 Emerging Energy Technologies You Can Invest In Today

Disclosure: None. 10 3D Printing Companies to Watch in 2022 is originally published on Insider Monkey.