Angleton, Texas-based Benchmark Electronics, Inc. (NYSE:BHE) has frustrated its long-term investors for several years straight. Judging by its stock price alone, the company has consistently underperformed the market’s expectations, offering limited value for both shorts and longs.

Over the past five years, the company hit a bottom near $9 per share in late 2009, and a high just north of $22 per share in the second quarter of 2010. Since the end of the acute phase of the financial crisis, Benchmark has mostly traded in a range between $12 and $19. Its current share price of about $18.20 is near the upper end of that range.

But upon closer inspection, Benchmark Electronics, Inc. (NYSE:BHE) might still be significantly undervalued. Despite solid earnings growth, a healthy debt ratio and lots of cash on hand, the company has a price-to-book ratio of less than 0.9. This imbalance could serve as a powerful motivator for short-term or medium-term investors who wish to ride Benchmark’s upward price momentum in the coming weeks.

About Benchmark Electronics, Inc. (NYSE:BHE)

Benchmark is an electronics manufacturer that specializes in printed circuit boards and other integral components of modern computers. The company also assembles various subsystems, configures new circuit systems, and integrates its devices and systems within existing computing frameworks.

Separately, Benchmark Electronics, Inc. (NYSE:BHE) also offers an array of testing and failure analysis services to its clients. Its clients hail from North and South America as well as East Asia and Europe. Most work in the computing, medical device, and telecommunications industries.

In 2012, Benchmark earned about $56.6 million on gross revenues of $2.5 billion.

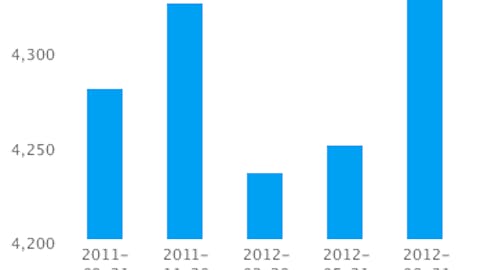

For most investors, the clear discrepancy between the company’s robust 13% quarterly growth rate and its paltry price-to-book ratio of 0.88 is the biggest sign that Benchmark may be undervalued. Most companies that exhibit impressive quarterly growth numbers have price-to-book ratios of at least 1.1. Companies that post such numbers over several consecutive quarters tend to enjoy even higher ratios.

Competitors and Long-Term Outlook

Benchmark operates in a fairly competitive industry that has faced some secular challenges of late. Its major publicly traded competitors are Singapore-based Flextronics International Ltd.(NASDAQ:FLEX) and St. Petersburg, Florida-based Jabil Circuit, Inc. (NYSE:JBL).

While JBL is a fairly strong company that enjoys decent revenue growth and solid profitability, Flextronics International Ltd. (NASDAQ:FLEX)is clearly troubled. During the same quarter in which Benchmark Electronics, Inc. (NYSE:BHE)’s revenue jumped by more than 13%, Flextronics International Ltd. (NASDAQ:FLEX)’s revenue fell by 18%. What’s more, the company has an unfavorable debt ratio and relatively dim growth prospects. Of the three major printed circuit manufacturers, Flextronics International Ltd. (NASDAQ:FLEX) is the clear laggard.