Back in 1956, young Warren Buffett did not have a track record. Finding big investors for his brilliant investment strategy proved difficult. Initially, Buffet decided to target only those who knew him best- his friends and family. He was still just in his mid-twenties, and asking people to surrender a chunk of their earnings seemed futile. They were close to him, but they were still hesitant. So Buffett put out an offer that seemed to sweeten the deal: He would need to exceed a 4% threshold before he could collect any performance fees. Also, because he was running this operation out of his home and incurred insignificant expenses, there wouldn’t be any management fees. If his trades didn’t clear any profits after the transaction costs, that would be his problem. But all these compromises were insufficient for some of his investors. They demanded some downside protection as well.

Then, Warren Buffett came up with a brilliant scheme:

Buffett agreed to provide a 25% downside protection of his clients’ investments in exchange for a 50% performance fee above a 4% threshold. For those innocent of this arrangement, let me explain: It is a lopsided system where nearly 50% of the investors’ earnings go to Buffett. Meanwhile, Buffet takes on market exposure but only pays 25% of the losses out of pocket. Insider Monkey will show you how, for a potential investor, this arrangement is even worse than lending money at an ultralow 4%.

Alternative 1:

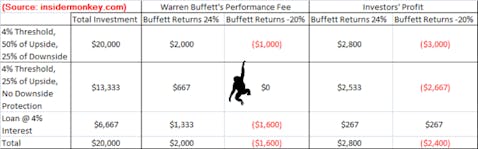

An investor feels comfortable with the downside protection arrangement and hands over $20,000 to Buffett. If Buffett returns 24% the next year, this investor will receive 4% (the threshold) plus only half of the remaining 20%. Buffett assumes 25% of the risk and gets 10% of $20,000, or $2,000, while the investor assumes 3 times as much risk, and gets 14% of the $20,000, or $2,800. Now, if Buffett loses 20% of the $20,000, he would have to pay $1,000 to the investor and the investor bears a $3,000 loss. Do you see how lopsided the agreement was?

Alternative 2:

Now suppose the investor instead gives $13,333 to Buffett. He forgoes downside protection but agrees to a 25% performance fee above a 4% threshold. Also, suppose the investor lends $6,667 to Buffett as a loan at a 4% annual interest rate. If Buffett returns 24% the next year, the investor makes 4% (the threshold) and 75% of the remaining 20%. So the investor will get 19% of $13,333, or $2,533.27, from his investments. On top of that, the investor will get 4% of the $6,667 loan as interest, which is $266.68. So the investor will receive a total of $2,799.95 from the two arrangements. Buffett, meanwhile, will pay $266.68 for the 4% interest. Since he returned 24% on that loan however, he will still pocket 20%, or $1,333.4. He will also get a 5% performance fee from the investment, which comes to $666.65. So in total, Buffett will get $2,000.05 in this arrangement. As you can see, this is the same outcome as before: the investor makes $2,800 and Buffett makes $2,000.

Let’s take a look at the downside. If Buffett loses 20% of the investor’s $13,333 and his borrowed $6,667, the investor sees a loss of $2666.6 but gets $266.68 in interest payment. So the investor’s total loss would be $2,400, or $600 less than before. Buffet, meanwhile, loses $1333.4 (20% of the $6,667 loan) and makes an interest payment of $266.68. So his total loss would be $1600 ($600 more than Alternative 1).

As you can see, Buffett’s investors would have been better protected if they had simply lent the money to Buffett instead of accepting a 50% performance fee in exchange for a 25% downside protection. Buffett probably didn’t tell the truth to these unsophisticated investors, and took advantage of them by welcoming the leverage to boost his pay.